January 2024

December 2023

Jan 01, 2024

Please see the reporting deck linked below for full month, year, and far further back results.

I came to realize that sometimes the published results are updated after the fact, so I fully updated 2022 and 2023 monthly results in my database, not sure if it is dividend activity not captured in the month it took place or what. The changes weren’t large but I wanted to make sure I had the ‘final final’ numbers.

The fixed allocation DMS-4ETF, and I’ve got a variation of it that I think is worthwhile have been getting some of my attention, I owe info on this, I hope very soon.

Happy New Year to you, and a quick look back at the year in DMS Strategies 2023.

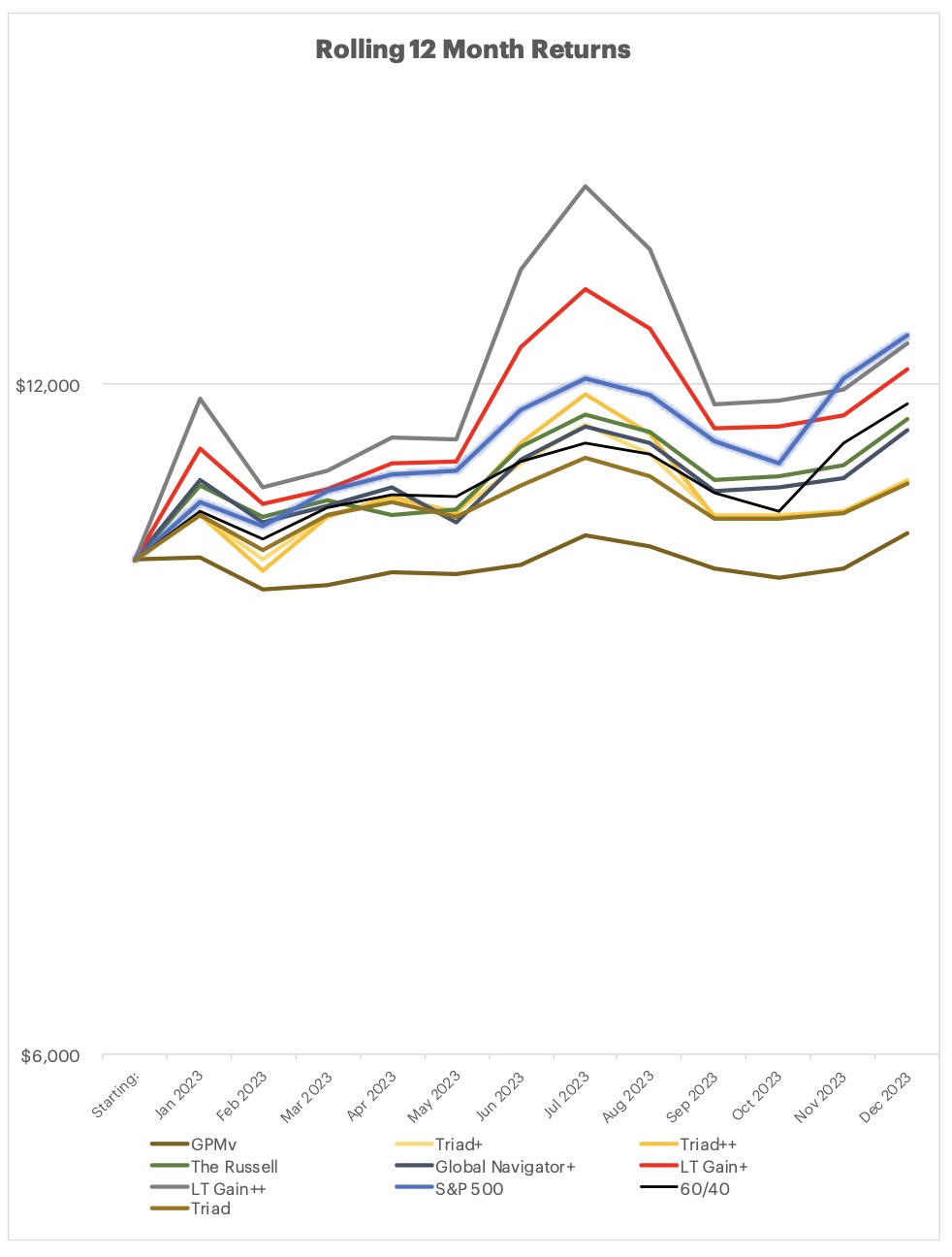

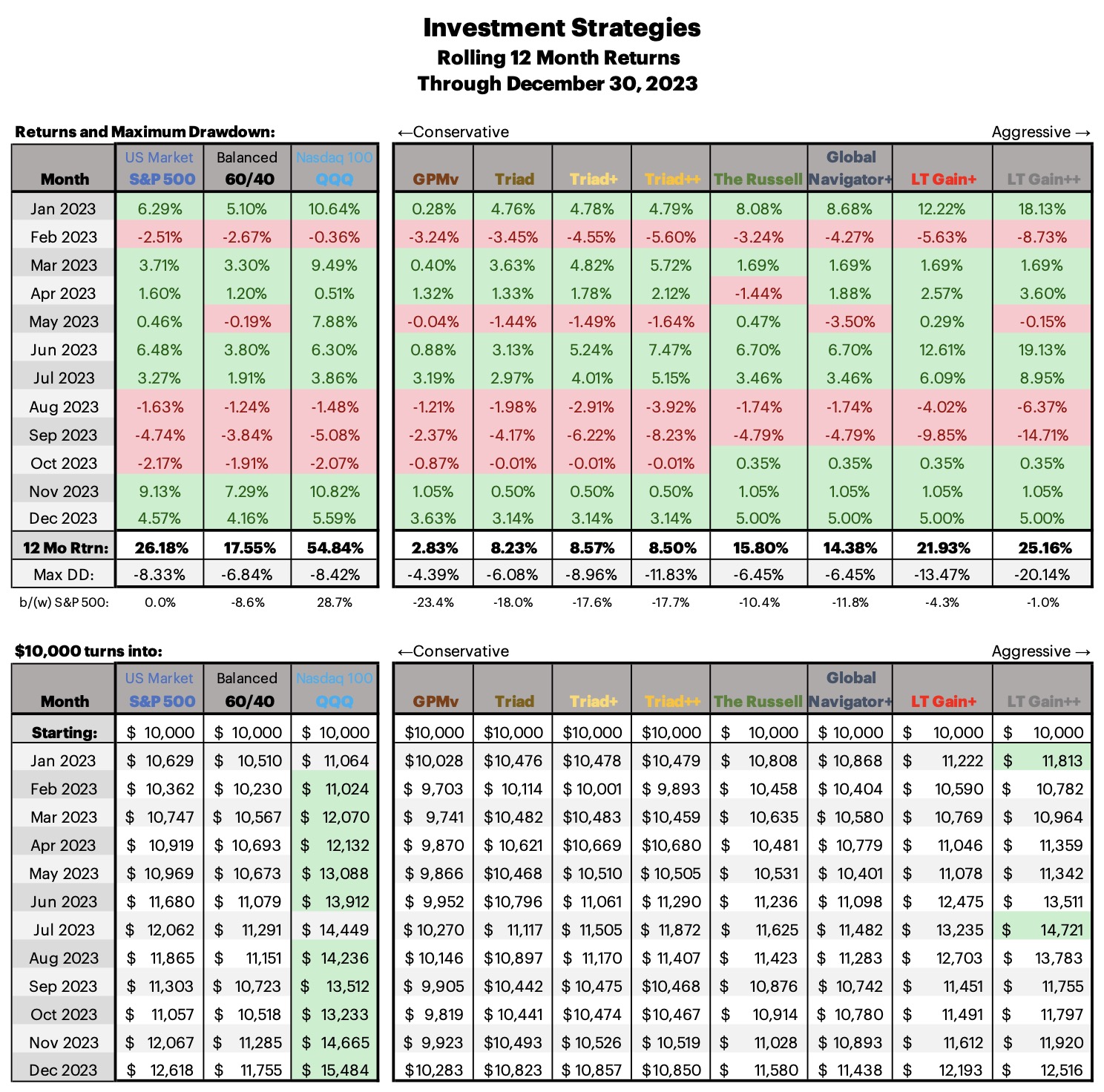

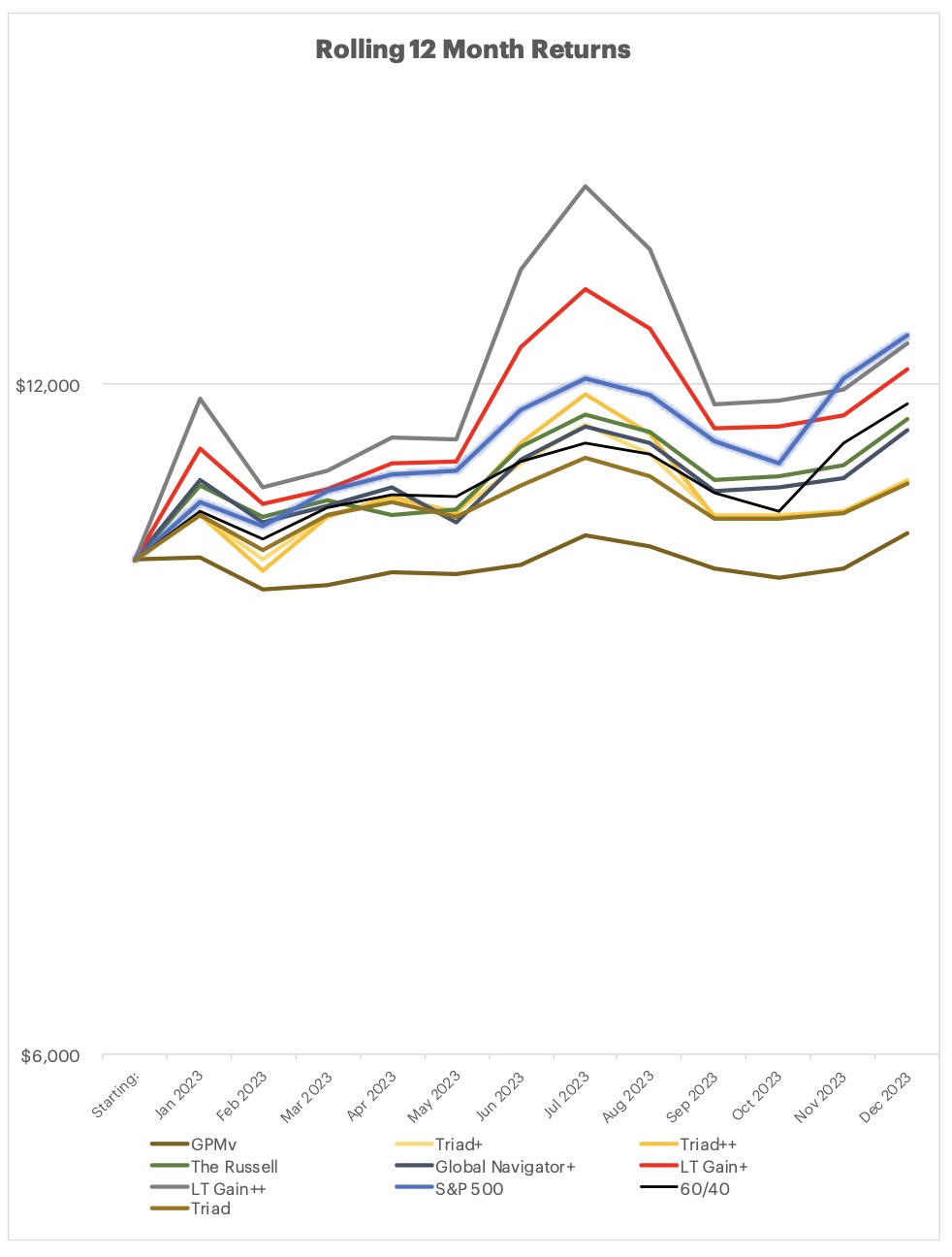

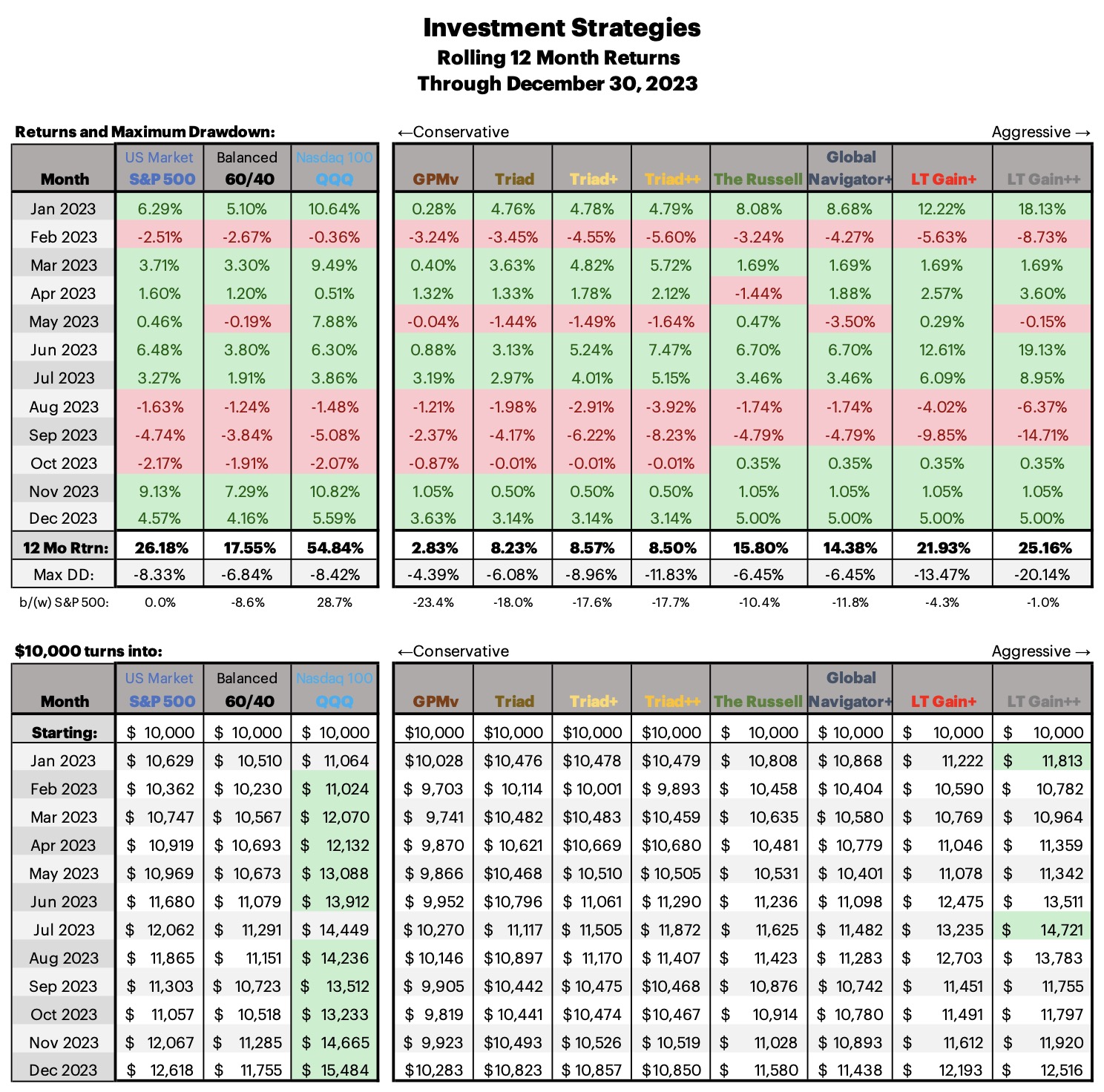

GPMv: The most conservative strategy had the lowest full year return of 2.83%. It also had the lowest drawdowns this past year, and on a percentage basis substantially lower than the 60/40 drawdown. However, compared to the 60/40 the returns for the year were paltry, knock this up to a great rebound year for bonds in 2023, and the Magnificent 7 driving the market this past year. 60/40 took advantage of both. Not that GPMv is really designed to target the 60/40, it is targeted at ultra low drawdowns and good long term gains.

Triad Strategies: These are billed as a better 60/40 for the future, but they had a misstep this year only returning roughly half what the 60/40 does. The strategy is not broken, the foundation of it is solid, it has had this sort of under performance in the past, it has a terrific long term record and is designed to be far more broad and adaptable than a 60/40 - it was not designed to take advantage of the Magnificent 7’s stellar year. Lick your wounds and continue on with Triad.

The Russell: This never leveraged strategy had a solid year coming in at just under 16% for the year with a low drawdown of just 6.45%. I still like this strategy very much.

Global Navigator+: The same 6.45% drawdown as The Russell, just slightly lower performance, this variation of GEM is still a winner, and always posed to take advantage when International equities outperform.

LT Gain Strategies: These strategies only invest in the Large Cap US when invested, as a result they both had very good years even with larger than the S&P Drawdowns.

Full reporting Deck

Allocation worksheet

I came to realize that sometimes the published results are updated after the fact, so I fully updated 2022 and 2023 monthly results in my database, not sure if it is dividend activity not captured in the month it took place or what. The changes weren’t large but I wanted to make sure I had the ‘final final’ numbers.

The fixed allocation DMS-4ETF, and I’ve got a variation of it that I think is worthwhile have been getting some of my attention, I owe info on this, I hope very soon.

Happy New Year to you, and a quick look back at the year in DMS Strategies 2023.

GPMv: The most conservative strategy had the lowest full year return of 2.83%. It also had the lowest drawdowns this past year, and on a percentage basis substantially lower than the 60/40 drawdown. However, compared to the 60/40 the returns for the year were paltry, knock this up to a great rebound year for bonds in 2023, and the Magnificent 7 driving the market this past year. 60/40 took advantage of both. Not that GPMv is really designed to target the 60/40, it is targeted at ultra low drawdowns and good long term gains.

Triad Strategies: These are billed as a better 60/40 for the future, but they had a misstep this year only returning roughly half what the 60/40 does. The strategy is not broken, the foundation of it is solid, it has had this sort of under performance in the past, it has a terrific long term record and is designed to be far more broad and adaptable than a 60/40 - it was not designed to take advantage of the Magnificent 7’s stellar year. Lick your wounds and continue on with Triad.

The Russell: This never leveraged strategy had a solid year coming in at just under 16% for the year with a low drawdown of just 6.45%. I still like this strategy very much.

Global Navigator+: The same 6.45% drawdown as The Russell, just slightly lower performance, this variation of GEM is still a winner, and always posed to take advantage when International equities outperform.

LT Gain Strategies: These strategies only invest in the Large Cap US when invested, as a result they both had very good years even with larger than the S&P Drawdowns.

Full reporting Deck

Allocation worksheet