April 2025

May 31, 2025

March 2025

Mar 31, 2025

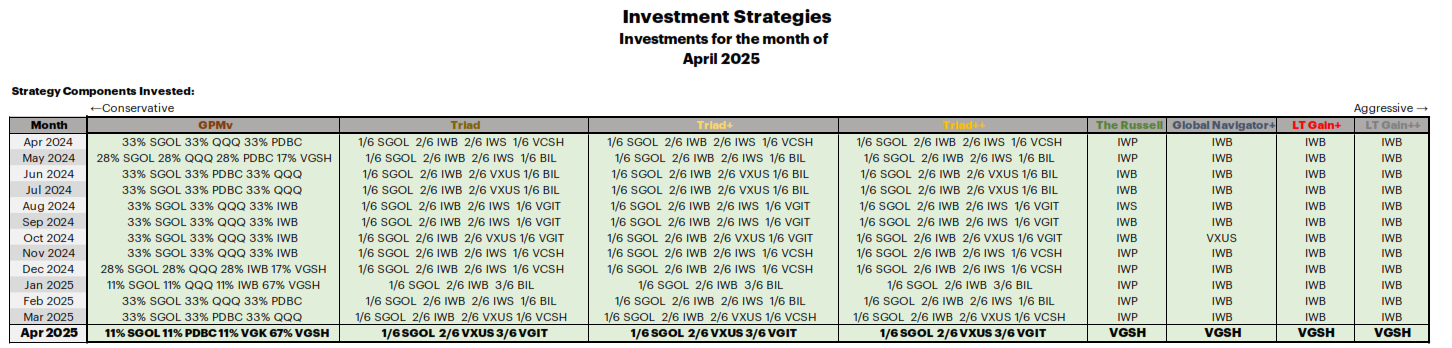

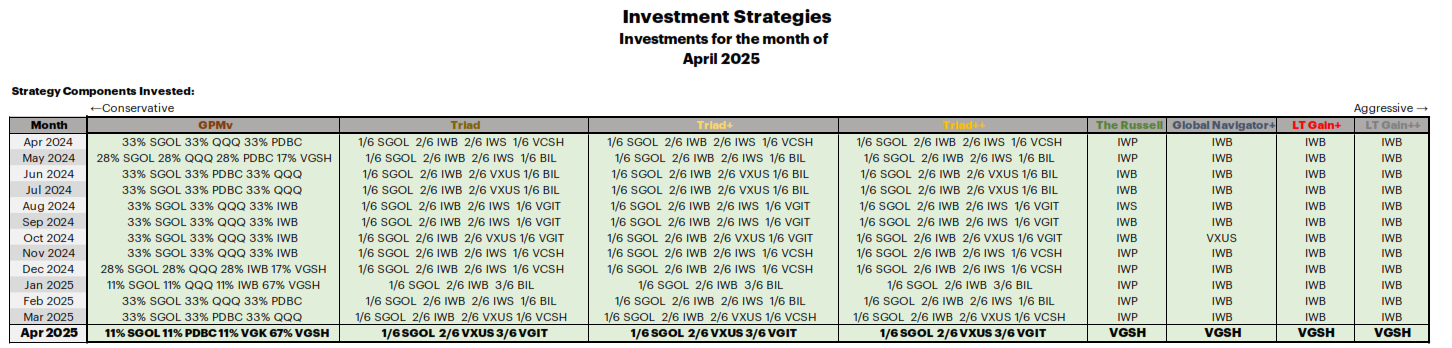

All of the strategies go less risky. Many go into VGSH, short term Government debt. Others scale back significantly. The strategies are taking a wait and see approach after the performance of the past months.

Be sure to look at the Strategy and Model Portfolio Fact Sheets, the following PDF/Excel files are combined into the single ZIP for download, link below:

DMS Model Portfolios

DMS Strategies

DMS Bamboo Allocations

DMS High Test

DMS Allocation Spreadsheet

…all of the above included in this Zip file.

As always, subscribe for free to get the Reporting Decks as soon as they are released.

Be sure to look at the Strategy and Model Portfolio Fact Sheets, the following PDF/Excel files are combined into the single ZIP for download, link below:

DMS Model Portfolios

DMS Strategies

DMS Bamboo Allocations

DMS High Test

DMS Allocation Spreadsheet

…all of the above included in this Zip file.

As always, subscribe for free to get the Reporting Decks as soon as they are released.

February 2025

Mar 31, 2025

Last month I mentioned: “We got news of North America tariffs, 5 years ago we signed the USMCA (new NAFTA) and now it is broken with new tariffs to Mexico and Canada. Is this a posturing or is it just a new tax on the American public? Regardless of the answer to that question, it caused a 1% drop in the market late Friday afternoon, bump in the road or something more? We will see soon enough.”

Looks like we got a bit of pullback, likely from all the tariff talk, and other geopolitical events.

Regardless, we had a great January, and February was looking stellar right up until it wasn’t… Time to see if this is a ‘buy the dip’ or something else.

Not many changes for the strategies month to month, see the reporting decks, and image below of changes to the main strategies is after the chart of February 2025 Russell 1000.

GPMv goes fully invested for February, and Triad goes more aggressive, but keeps a 1/6th position in BIL.

Be sure to look at the Strategy and Model Portfolio Fact Sheets, the following PDF/Excel files are combined into the single ZIP for download, link below:

DMS Model Portfolios

DMS Strategies

DMS Bamboo Allocations

DMS High Test

DMS Allocation Spreadsheet

Reporting Desks and Allocation file download.

Looks like we got a bit of pullback, likely from all the tariff talk, and other geopolitical events.

Regardless, we had a great January, and February was looking stellar right up until it wasn’t… Time to see if this is a ‘buy the dip’ or something else.

Not many changes for the strategies month to month, see the reporting decks, and image below of changes to the main strategies is after the chart of February 2025 Russell 1000.

GPMv goes fully invested for February, and Triad goes more aggressive, but keeps a 1/6th position in BIL.

Be sure to look at the Strategy and Model Portfolio Fact Sheets, the following PDF/Excel files are combined into the single ZIP for download, link below:

DMS Model Portfolios

DMS Strategies

DMS Bamboo Allocations

DMS High Test

DMS Allocation Spreadsheet

Reporting Desks and Allocation file download.

January 2025

Mar 31, 2025

We got news of North America tariffs, 5 years ago we signed the USMCA (new NAFTA) and now it is broken with new tariffs to Mexico and Canada. Is this a posturing or is it just a new tax on the American public? Regardless of the answer to that question, it caused a 1% drop in the market late Friday afternoon, bump in the road or something more? We will see soon enough.

GPMv goes fully invested for February, and Triad goes more aggressive, but keeps a 1/6th position in BIL.

See the Model deck for the history of the Model Portfolios, and the DMS Strategies for the main deck with all the individual strategies. Bamboo Allocation deck of course included - but until we go into Smart Leverage, Bamboo remains a fixed allocation. The High Test deck is included, for entertainment value only.

Happy New Year! January was great, though with a bit of volatility. Let’s work towards a profitable 2025.

…all of the above included in this Zip file.

Good luck out there, and happy investing. Please forward this to anybody who you may think would appreciate it.

GPMv goes fully invested for February, and Triad goes more aggressive, but keeps a 1/6th position in BIL.

See the Model deck for the history of the Model Portfolios, and the DMS Strategies for the main deck with all the individual strategies. Bamboo Allocation deck of course included - but until we go into Smart Leverage, Bamboo remains a fixed allocation. The High Test deck is included, for entertainment value only.

Happy New Year! January was great, though with a bit of volatility. Let’s work towards a profitable 2025.

…all of the above included in this Zip file.

Good luck out there, and happy investing. Please forward this to anybody who you may think would appreciate it.

December 2024

Jan 02, 2025

Happy New Year to the now 379 subscribers, I hope that you find far more value than your annual subscription price of $0.00. As always, please forward to friends and family who may find this valuable.

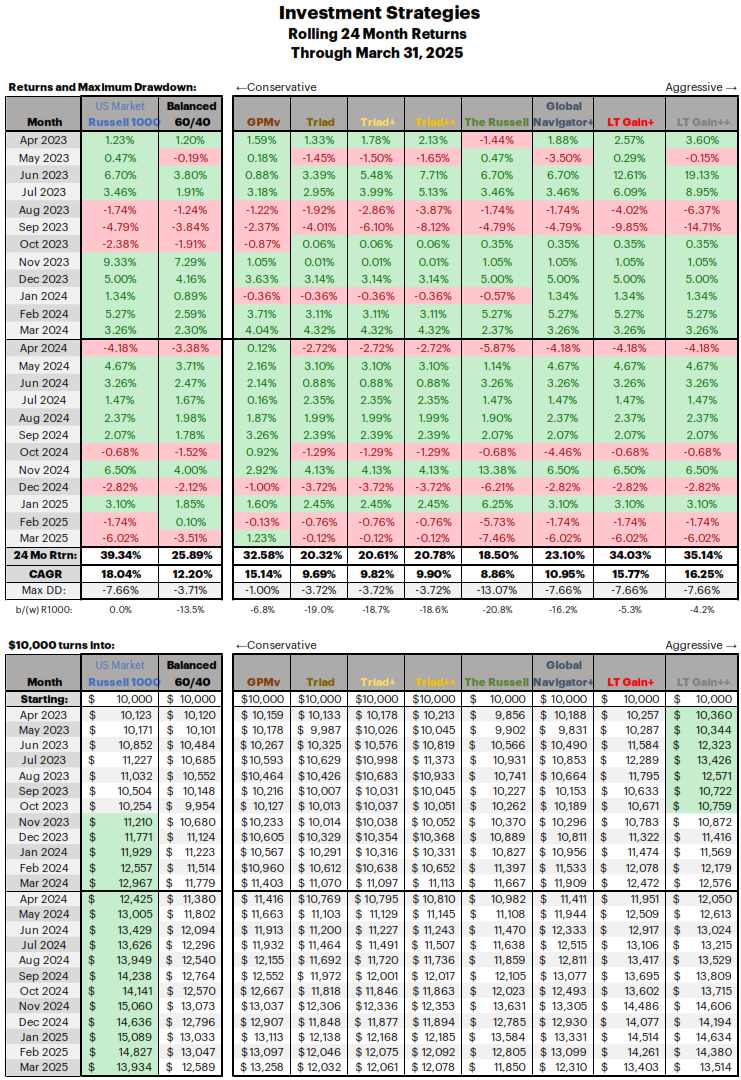

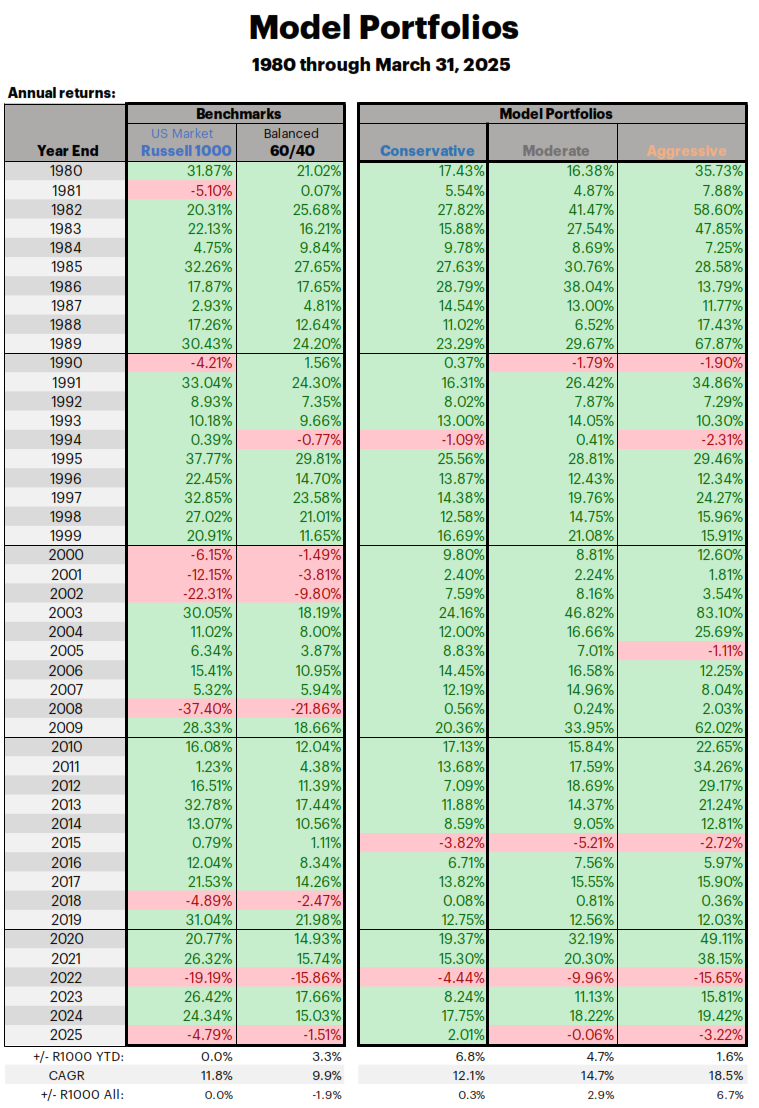

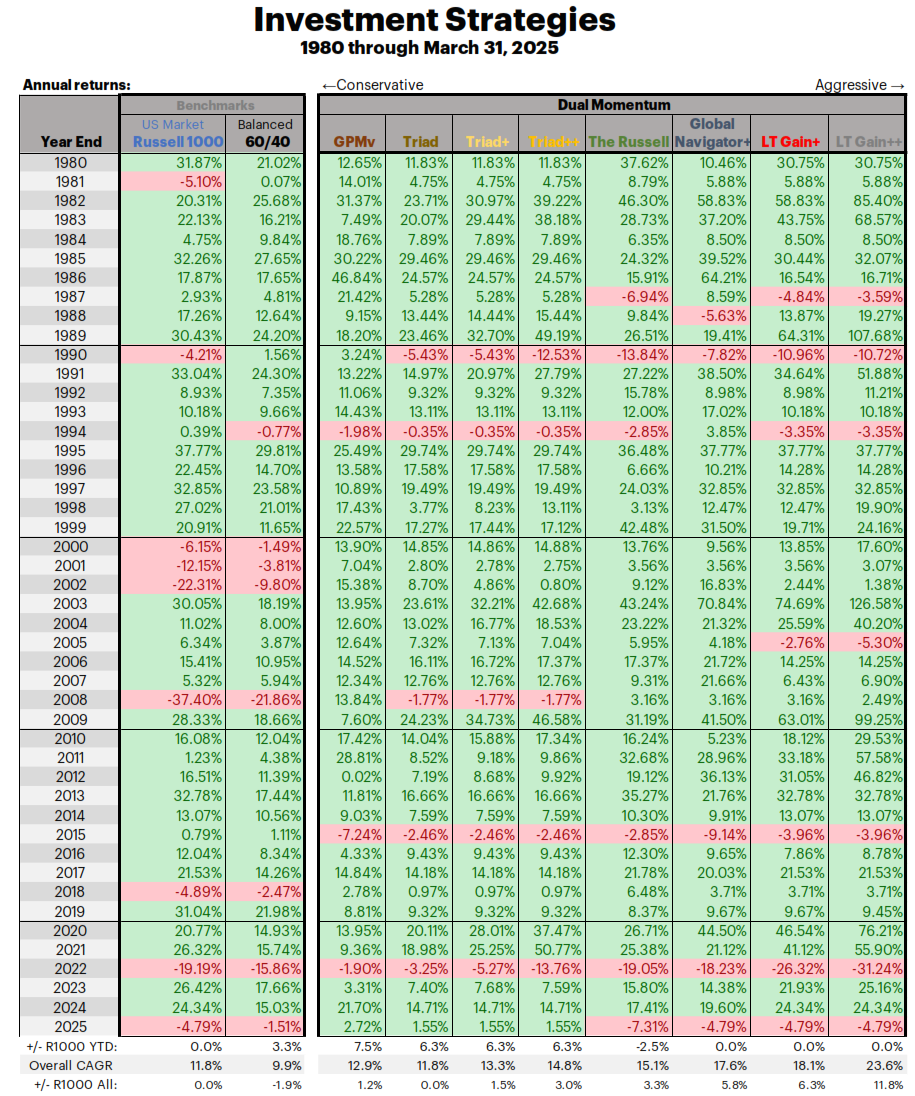

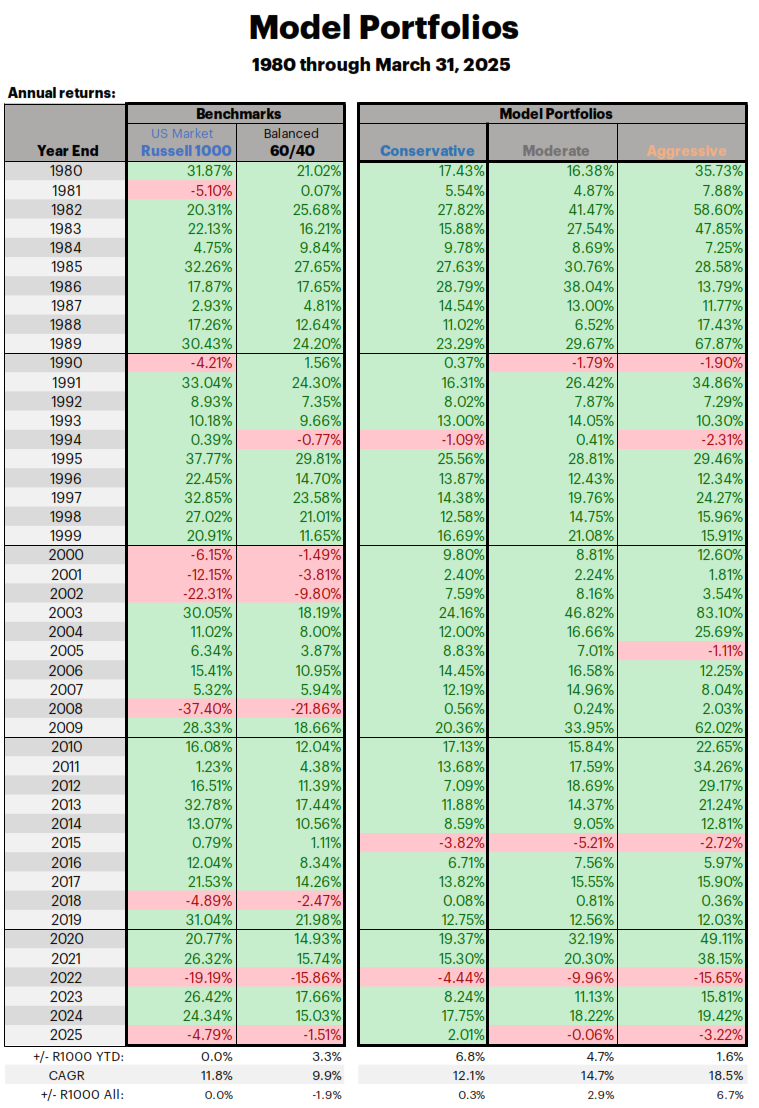

Golden material for sure, no the strategies haven’t kept pace with the S&P the past couple of years, nor should they. Keep in touch and watch over a longer time frame a you will see the value of the higher absolute returns with less drawdown. That is mission accomplished.

Starting this month, I broke out the Model Portfolios into their own PDF. I feel so strongly that these are terrific portfolios for many people, I didn’t like seeing them sort of buried in the main reporting deck so I broke them out into their own Deck.

December wasn’t great, and no Santa Claus Rally this year. All in all a solid year, after a solid year in 2023. So I hope nobody is complaining about a slightly sour end to an otherwise productive year

CHANGES FOR JANUARY:

GPMv goes very bearish for January, and the Triad strategies also go defensive. Full steam ahead with the other strategies.

Happy New Years to you all, and Happy Investing.

Be sure to look at the MODEL PORTFOLIOS in the Reporting Decks, it is where I think is the best place to be.

HOW DID THE STRATEGIES PERFORM IN 2024:

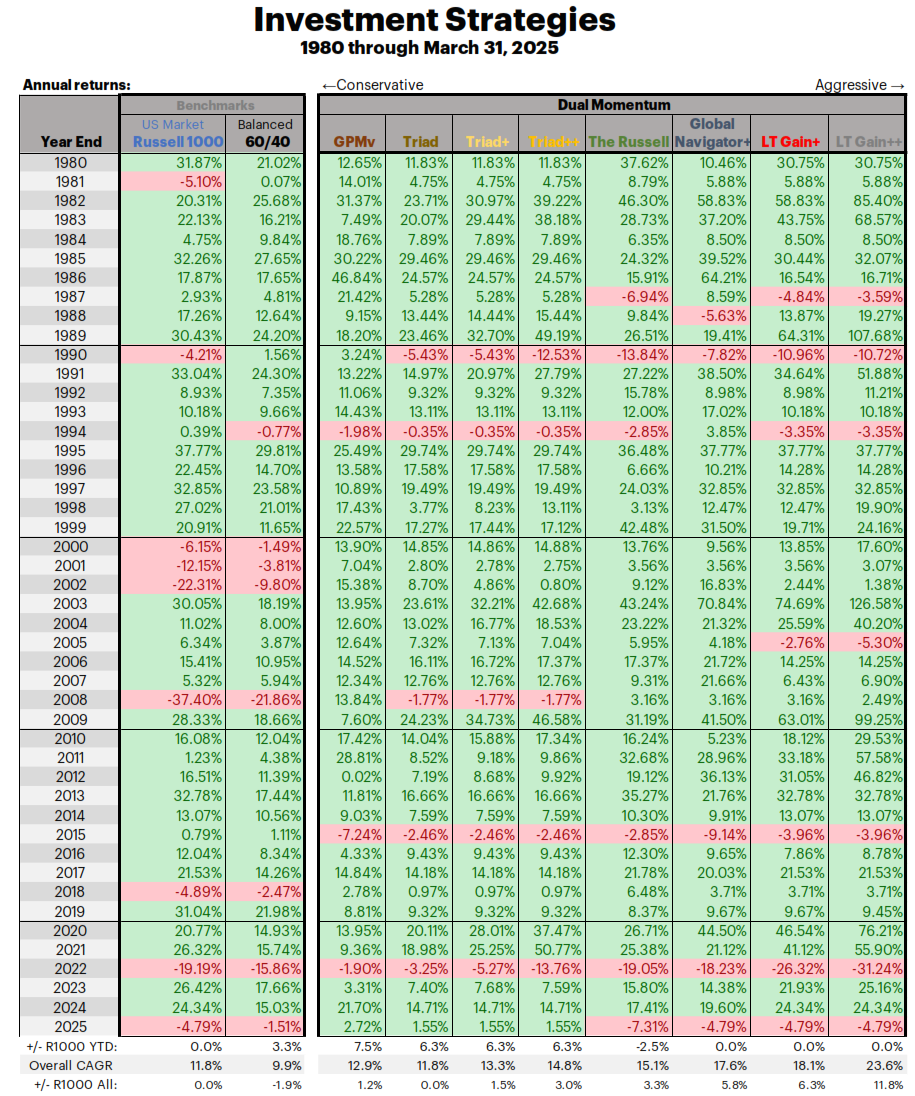

GPMv [Generalized Protection Momentum variant], This is the only model that I didn’t come up with myself, GPM you can search, it is a highly regarded low vol strategy from two original thinkers in the investment space. I had found myself re-visiting it and thinking that I had some ideas on how to improve it, and thus GPMv was born.

For the past two years, GPMv has outperformed GPM by a staggering 18.4%. That actually is something to write home about, and with lower volatility also. 2024 specific, while GPM generated a 4.67% return, GPMv managed a far better than 60/40 return of 21.40%.

Bamboo Allocations are a trio of investment options which are an alternative to a 60/40, or Golden Butterfly, or Permanent Portfolio, or All Weather, etc. For 2024 the Bamboo, Bamboo+, and Bamboo++ all had the exact same return since Smart Leverage was not in play, the return was 15.95%. Marginally better than the 60/40 return of 14.65% and more significantly better than the Golden Butterfly return of 11.275. Ray Dalio’s All Season had a paltry return of 5.28%, and Harry Brown’s Permanent Portfolio 11.73%. (I am not throwing stones at lower returns, things different than the indexes perform differently, just stating the 2024 returns to compare.)

Triad Strategies had an ok year, not bad, not great, they were marginally lower than the 60/40’s return of 14.65% at 14.31%. Ironic since the Triad strategies are far more diversified than the 60/40, and similar to the Bamboo Allocations, none of the Triad strategies were in Smart Leverage during 2024.

Global Navigator+ This is essentially my riff on Gary Antonacci’s GEM strategy. For 2024 GN+ returned 19.40%, better than the 60/40 return of 14.65%, not as high of return as the Russell 1000 return of 23.95%. Remember, our goal isn’t to beat the market year in year out, but do well in good years, far better in bad years, and crush it with Smart Leverage.

LT Gain+ and ++ These returns both equaled the Russell 1000 for the year these are single choice in risk on markets, with variable risk off choices, and 2X and 3X options when Smart Leverage is enabled. Solid return for both of these this year.

Please note that while I am including the High Test Reporting Deck in the download, for gods sake, please don’t invest in them or if you must only a small percentage of your investments. I personally max out my risk at LT Gain++, YMMV.

I apologize that last month the Allocation Excel spreadsheet had some issues. I had made some changes with the Model Portfolios and they did not correctly flow through to the Allocation spreadsheet. Thanks to the astute and attentive subscribers who pointed this out and allowed me to know it needed correcting.

If you are just watching, now may be a great time to join the strategies, this crazy bull market won’t last forever, and we will steer you on a better course than the major indexes are able to do.

Reporting Desks and Allocation file download.

Good luck out there, and happy investing. Please forward this to anybody who you may think would appreciate it.

Golden material for sure, no the strategies haven’t kept pace with the S&P the past couple of years, nor should they. Keep in touch and watch over a longer time frame a you will see the value of the higher absolute returns with less drawdown. That is mission accomplished.

Starting this month, I broke out the Model Portfolios into their own PDF. I feel so strongly that these are terrific portfolios for many people, I didn’t like seeing them sort of buried in the main reporting deck so I broke them out into their own Deck.

December wasn’t great, and no Santa Claus Rally this year. All in all a solid year, after a solid year in 2023. So I hope nobody is complaining about a slightly sour end to an otherwise productive year

CHANGES FOR JANUARY:

GPMv goes very bearish for January, and the Triad strategies also go defensive. Full steam ahead with the other strategies.

Happy New Years to you all, and Happy Investing.

Be sure to look at the MODEL PORTFOLIOS in the Reporting Decks, it is where I think is the best place to be.

HOW DID THE STRATEGIES PERFORM IN 2024:

GPMv [Generalized Protection Momentum variant], This is the only model that I didn’t come up with myself, GPM you can search, it is a highly regarded low vol strategy from two original thinkers in the investment space. I had found myself re-visiting it and thinking that I had some ideas on how to improve it, and thus GPMv was born.

For the past two years, GPMv has outperformed GPM by a staggering 18.4%. That actually is something to write home about, and with lower volatility also. 2024 specific, while GPM generated a 4.67% return, GPMv managed a far better than 60/40 return of 21.40%.

Bamboo Allocations are a trio of investment options which are an alternative to a 60/40, or Golden Butterfly, or Permanent Portfolio, or All Weather, etc. For 2024 the Bamboo, Bamboo+, and Bamboo++ all had the exact same return since Smart Leverage was not in play, the return was 15.95%. Marginally better than the 60/40 return of 14.65% and more significantly better than the Golden Butterfly return of 11.275. Ray Dalio’s All Season had a paltry return of 5.28%, and Harry Brown’s Permanent Portfolio 11.73%. (I am not throwing stones at lower returns, things different than the indexes perform differently, just stating the 2024 returns to compare.)

Triad Strategies had an ok year, not bad, not great, they were marginally lower than the 60/40’s return of 14.65% at 14.31%. Ironic since the Triad strategies are far more diversified than the 60/40, and similar to the Bamboo Allocations, none of the Triad strategies were in Smart Leverage during 2024.

Global Navigator+ This is essentially my riff on Gary Antonacci’s GEM strategy. For 2024 GN+ returned 19.40%, better than the 60/40 return of 14.65%, not as high of return as the Russell 1000 return of 23.95%. Remember, our goal isn’t to beat the market year in year out, but do well in good years, far better in bad years, and crush it with Smart Leverage.

LT Gain+ and ++ These returns both equaled the Russell 1000 for the year these are single choice in risk on markets, with variable risk off choices, and 2X and 3X options when Smart Leverage is enabled. Solid return for both of these this year.

Please note that while I am including the High Test Reporting Deck in the download, for gods sake, please don’t invest in them or if you must only a small percentage of your investments. I personally max out my risk at LT Gain++, YMMV.

I apologize that last month the Allocation Excel spreadsheet had some issues. I had made some changes with the Model Portfolios and they did not correctly flow through to the Allocation spreadsheet. Thanks to the astute and attentive subscribers who pointed this out and allowed me to know it needed correcting.

If you are just watching, now may be a great time to join the strategies, this crazy bull market won’t last forever, and we will steer you on a better course than the major indexes are able to do.

Reporting Desks and Allocation file download.

Good luck out there, and happy investing. Please forward this to anybody who you may think would appreciate it.

November 2024

Jan 02, 2025

Wow, another stellar month in the markets - and for the strategies, The Russell was in IWP this month with really flew. The Russell had been lagging a bit this year but caught up in November. I guess this is the Trump Bump 2.0.

Great year to be in equities, enjoy!

Be sure to look at the MODEL PORTFOLIOS in the Reporting Decks, it is where I think is the best place to be.

GPMv had a slight reduction in equities for December, no changes in the other strategies.

I would be interested to hear from subscribers how you are using the DMS models, are you investing in them, using them for alternate investment input, or?

I am including the High Test Reporting Deck in the download, for gods sake, please don’t invest in them or if you must only a small percentage of your investments.

Reporting Desks and Allocation file download.

Good luck out there, and happy investing. Please forward this to anybody who you may think would appreciate it.

Great year to be in equities, enjoy!

Be sure to look at the MODEL PORTFOLIOS in the Reporting Decks, it is where I think is the best place to be.

GPMv had a slight reduction in equities for December, no changes in the other strategies.

I would be interested to hear from subscribers how you are using the DMS models, are you investing in them, using them for alternate investment input, or?

I am including the High Test Reporting Deck in the download, for gods sake, please don’t invest in them or if you must only a small percentage of your investments.

Reporting Desks and Allocation file download.

Good luck out there, and happy investing. Please forward this to anybody who you may think would appreciate it.

October 2024

Jan 02, 2025

There are some changes to the investments this month, foreign investments went on a big enough run to switch into them last month with some of the strategies and then they completely broke trend and fell apart in October, we’ll try again next time! That end of month drop didn’t really affect the changes, they were already set before that.

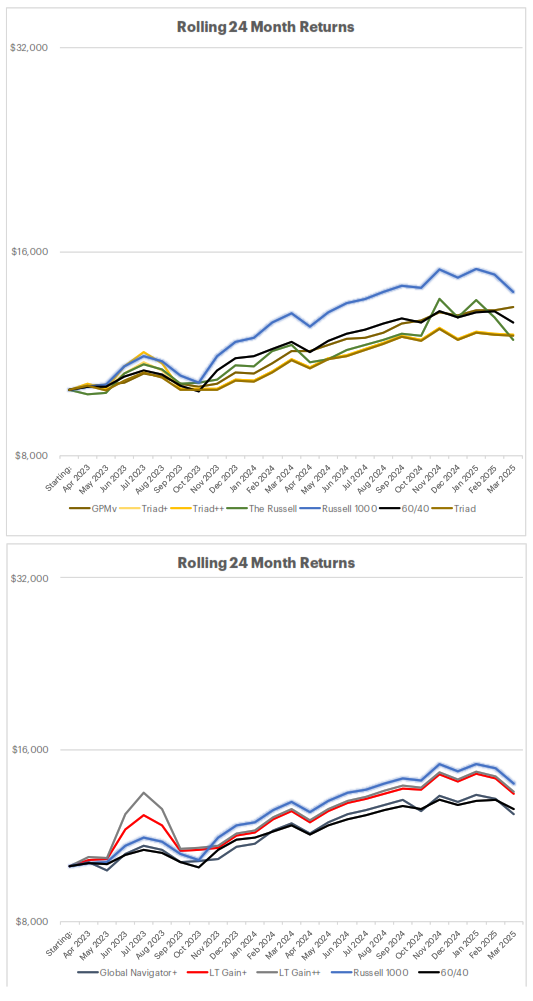

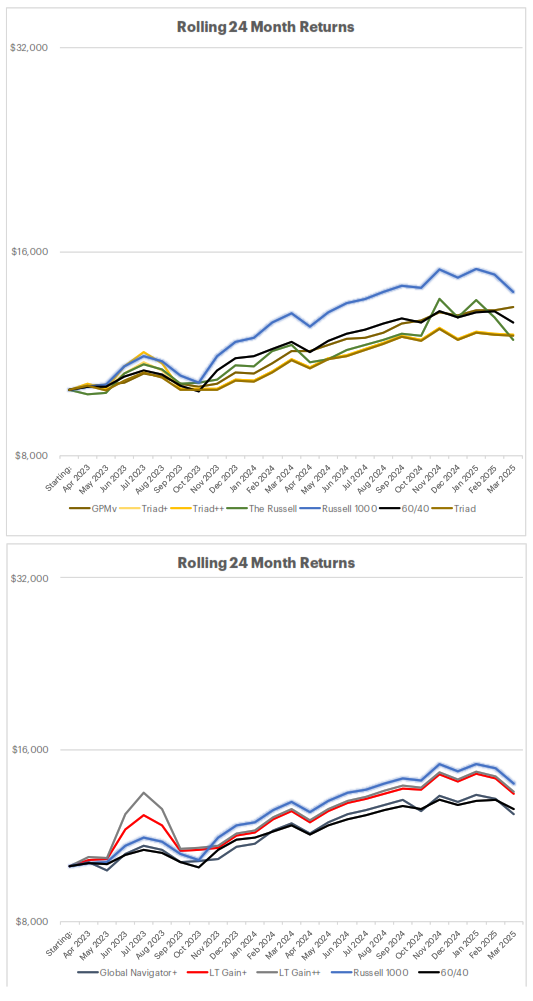

When the broader US market is on a tear, it is really something. From November 2022 through October 29th, 2024 the Russell 1000 is up a monster 54.05% aka a 24.12% CAGR. My strategies have paled in comparison to those high flying numbers.

Should we be concerned that the Dual Momentum Systems strategies have lagged the broader markets over the past 24 months? Absolutely not. The strategies don’t catch every little uptrend or downtrend on queue, but they perform exceedingly well over time and when the market has more ups and downs.

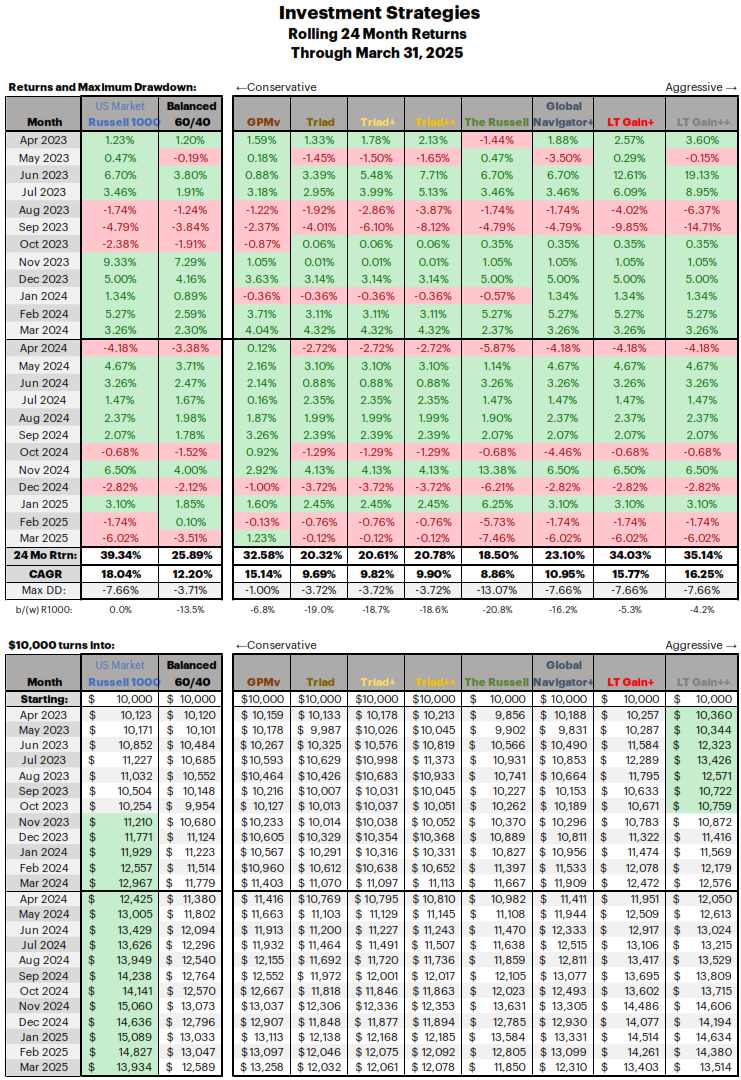

For example, here are some CAGR results compared to the Russell 1000 over the past 1, 3, 5, 10 year rolling periods, and from 2000, and also 1980 forward.

STRATEGY 1 Year 3 Year 5 Year 10 Year 2000+ 1980+

Russell 1000 40.88% 8.78% 15.34% 12.85% 7.80% 11.98%

GPMv 27.79% 6.92% 8.69% 7.00% 10.26% 13.00%

Triad+ 19.55% 5.14% 18.23% 10.01% 11.72% 13.39%

Global Nav+ 24.05% 3.93% 15.35% 10.30% 15.99% 17.82%

LT Gain++ 30.21% 2.73% 25.36% 15.66% 23.08% 23.92%

The further back we go, and include not just stellar market times, but also so-so, and some really terrible times - we see the strategy returns shine in comparison to the broader markets. This is only the return side of things, it is even more dramatic when we look at drawdowns. Please re-visit the strategy Fact Sheets in the reports for a the numerical data as well as the charts illustrating the returns, equity curves, and drawdown curves.

I am including the High Test Reporting Deck in the download, for gods sake, please don’t invest in them or if you must only a small percentage of your investments.

Reporting Desks and Allocation file download.

Good luck out there, and happy investing. Please forward this to anybody who you may think would appreciate it.

When the broader US market is on a tear, it is really something. From November 2022 through October 29th, 2024 the Russell 1000 is up a monster 54.05% aka a 24.12% CAGR. My strategies have paled in comparison to those high flying numbers.

Should we be concerned that the Dual Momentum Systems strategies have lagged the broader markets over the past 24 months? Absolutely not. The strategies don’t catch every little uptrend or downtrend on queue, but they perform exceedingly well over time and when the market has more ups and downs.

For example, here are some CAGR results compared to the Russell 1000 over the past 1, 3, 5, 10 year rolling periods, and from 2000, and also 1980 forward.

STRATEGY 1 Year 3 Year 5 Year 10 Year 2000+ 1980+

Russell 1000 40.88% 8.78% 15.34% 12.85% 7.80% 11.98%

GPMv 27.79% 6.92% 8.69% 7.00% 10.26% 13.00%

Triad+ 19.55% 5.14% 18.23% 10.01% 11.72% 13.39%

Global Nav+ 24.05% 3.93% 15.35% 10.30% 15.99% 17.82%

LT Gain++ 30.21% 2.73% 25.36% 15.66% 23.08% 23.92%

The further back we go, and include not just stellar market times, but also so-so, and some really terrible times - we see the strategy returns shine in comparison to the broader markets. This is only the return side of things, it is even more dramatic when we look at drawdowns. Please re-visit the strategy Fact Sheets in the reports for a the numerical data as well as the charts illustrating the returns, equity curves, and drawdown curves.

I am including the High Test Reporting Deck in the download, for gods sake, please don’t invest in them or if you must only a small percentage of your investments.

Reporting Desks and Allocation file download.

Good luck out there, and happy investing. Please forward this to anybody who you may think would appreciate it.

September 2024

Jan 02, 2025

Always a delay by a day getting this out when the 1st day of the month is mid-week. I checked at 10PM last night and the final results for September still weren’t available to me.

Another plus month after a minor draw down. Middle East conflict may impact markets further than today, we will know more later.

Just a single file to download with all Reporting Desks in it.

Not much change this much, Triad strategies swap Foreign in favor of the Russell 1000, and Global Navigator does the same.

I am including the High Test Reporting Deck in the download, for gods sake, please don’t invest in them or if you must only a small percentage of your investments.

Reporting Desks and Allocation file download.

Good luck out there, and happy investing. Please forward this to anybody who you may think would appreciate it.

Another plus month after a minor draw down. Middle East conflict may impact markets further than today, we will know more later.

Just a single file to download with all Reporting Desks in it.

Not much change this much, Triad strategies swap Foreign in favor of the Russell 1000, and Global Navigator does the same.

I am including the High Test Reporting Deck in the download, for gods sake, please don’t invest in them or if you must only a small percentage of your investments.

Reporting Desks and Allocation file download.

Good luck out there, and happy investing. Please forward this to anybody who you may think would appreciate it.

August 2024

Sep 07, 2024

All strategies profitable in August (other than MAX PAIN, which I seriously hope you are only watching for entertainment value.) We saw a big dip in the markets in August with a speedy retracement. There may be more fun ahead in the next several months, time will tell. For now all the strategies remain as last month with the exception of The Russell which switches from Mid Cap Value to the Russell 1000.

Several strategy changes this month, pay attention to the info in the Decks.

From last month, I made this comment about Smart Leverage, crazy month and I didn’t get to it but hope to in September. Thanks for your patience.

I receive emails from people now and then seeking clarification on the Smart Leverage 15% drawdown and exactly how it works, I realize that it is hard to give exact detail so that everybody understands how I am describing it - so I have decided that I will do a post in August on this topic to help clarify how Smart Leverage is triggered.

Full Dual Momentum Reporting Deck

DMS Bamboo Portfolio allocation Reporting Deck

Allocation worksheet

If you are a thrill seeker, I do still update the three “High Test strategies just don’t post them in the main deck, High Test Reporting Deck

Several strategy changes this month, pay attention to the info in the Decks.

From last month, I made this comment about Smart Leverage, crazy month and I didn’t get to it but hope to in September. Thanks for your patience.

I receive emails from people now and then seeking clarification on the Smart Leverage 15% drawdown and exactly how it works, I realize that it is hard to give exact detail so that everybody understands how I am describing it - so I have decided that I will do a post in August on this topic to help clarify how Smart Leverage is triggered.

Full Dual Momentum Reporting Deck

DMS Bamboo Portfolio allocation Reporting Deck

Allocation worksheet

If you are a thrill seeker, I do still update the three “High Test strategies just don’t post them in the main deck, High Test Reporting Deck

July 2024

Sep 07, 2024

All strategies profitable in July. This market just keeps melting up even if there seems to be a rotation.

Several strategy changes this month, pay attention to the info in the Decks.

I receive emails from people now and then seeking clarification on the Smart Leverage 15% drawdown and exactly how it works, I realize that it is hard to give exact detail so that everybody understands how I am describing it - so I have decided that I will do a post in August on this topic to help clarify how Smart Leverage is triggered.

Full Dual Momentum Reporting Deck

DMS Bamboo Portfolio allocation Reporting Deck

Allocation worksheet

If you are a thrill seeker, I do still update the three “High Test strategies just don’t post them in the main deck, High Test Reporting Deck

Several strategy changes this month, pay attention to the info in the Decks.

I receive emails from people now and then seeking clarification on the Smart Leverage 15% drawdown and exactly how it works, I realize that it is hard to give exact detail so that everybody understands how I am describing it - so I have decided that I will do a post in August on this topic to help clarify how Smart Leverage is triggered.

Full Dual Momentum Reporting Deck

DMS Bamboo Portfolio allocation Reporting Deck

Allocation worksheet

If you are a thrill seeker, I do still update the three “High Test strategies just don’t post them in the main deck, High Test Reporting Deck