April 2023

March 2023 Deck

Apr 12, 2023

Sign up for automatic emails with the reporting decks just after the month closes.

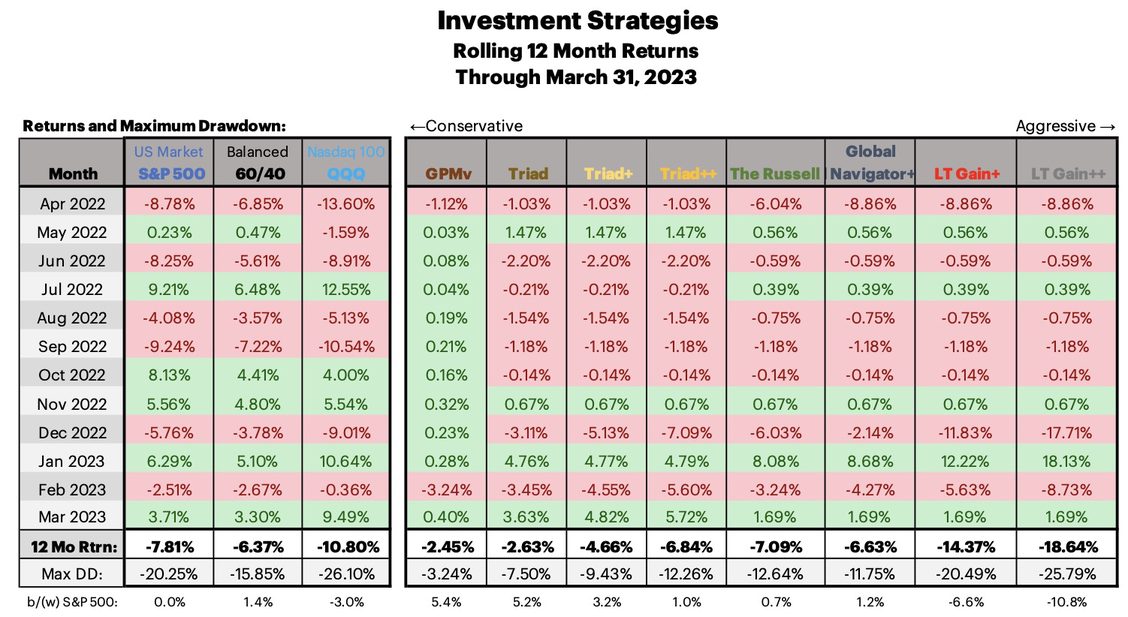

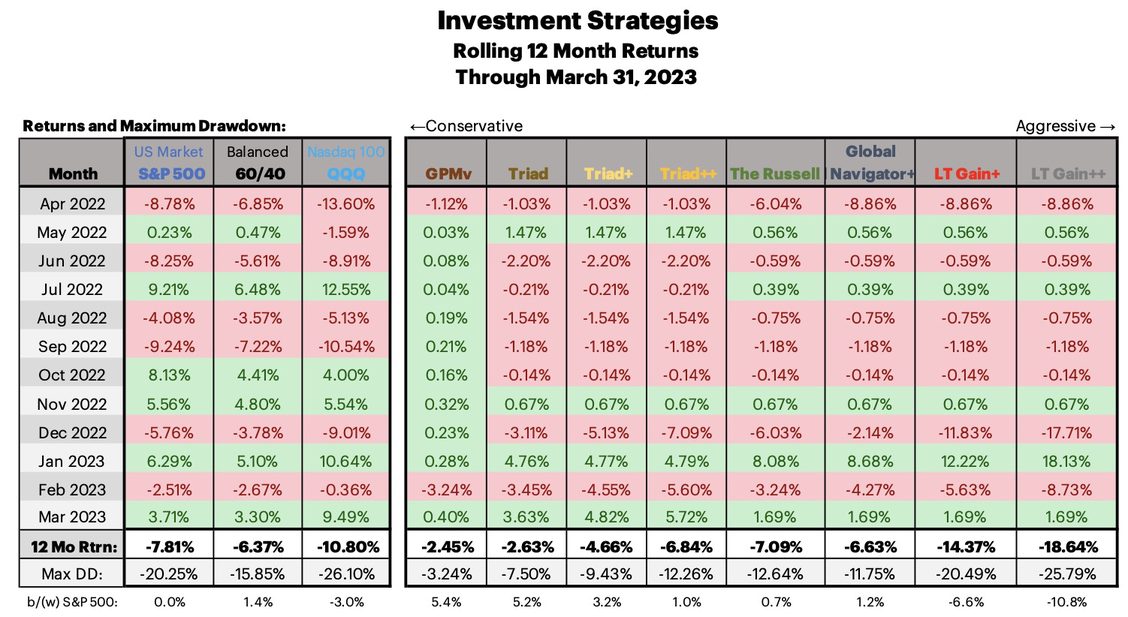

March felt like a very volatile month to me, looking at it in retrospect it doesn’t look so bad. The Triad strategies were rewarded for staying in the markets in March - they earned between 3.6% and 5.7% for the month of March depending on the version.

The other strategies were sitting in Risk Off and still made some money, almost 1.7% so it wasn’t so terrible.

Even though it’s been a very up/down many months in the markets, the prior six months are rather positive, so the strategies are going in full bore!

I’ve got a couple things I’ll be posting on the site this month. A post about a static 4 ETF allocation with some newish ETF’s, I can’t show much back test history because the components are new, bit it’s a viable option to my eyes for some.

Also, a post coming about how to track the DMS strategies using Google Colabs.

Here is the allocation spreadsheet in case that helps working with multiple strategies. Just enter the percent allocated to the strategies, and the amount of money to allocate overall to the strategies, and it tells you which ETF’s that you should be holding in what quantities. Excel Allocation Workbook for April 2023.

Here is a link to the March Reporting Deck

Cheers

March felt like a very volatile month to me, looking at it in retrospect it doesn’t look so bad. The Triad strategies were rewarded for staying in the markets in March - they earned between 3.6% and 5.7% for the month of March depending on the version.

The other strategies were sitting in Risk Off and still made some money, almost 1.7% so it wasn’t so terrible.

Even though it’s been a very up/down many months in the markets, the prior six months are rather positive, so the strategies are going in full bore!

I’ve got a couple things I’ll be posting on the site this month. A post about a static 4 ETF allocation with some newish ETF’s, I can’t show much back test history because the components are new, bit it’s a viable option to my eyes for some.

Also, a post coming about how to track the DMS strategies using Google Colabs.

Here is the allocation spreadsheet in case that helps working with multiple strategies. Just enter the percent allocated to the strategies, and the amount of money to allocate overall to the strategies, and it tells you which ETF’s that you should be holding in what quantities. Excel Allocation Workbook for April 2023.

Here is a link to the March Reporting Deck

Cheers