May 2023

April 2023

May 13, 2023

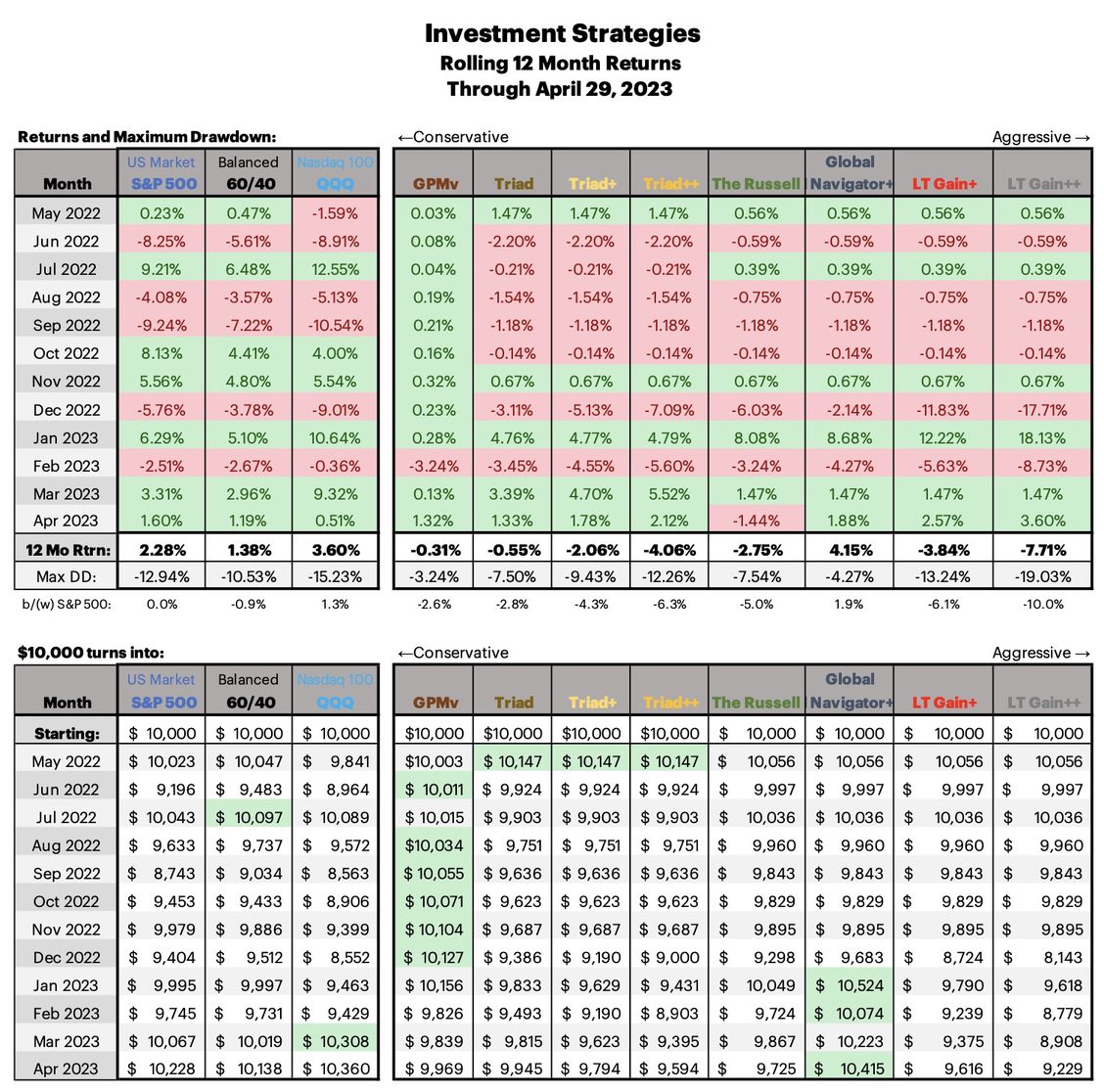

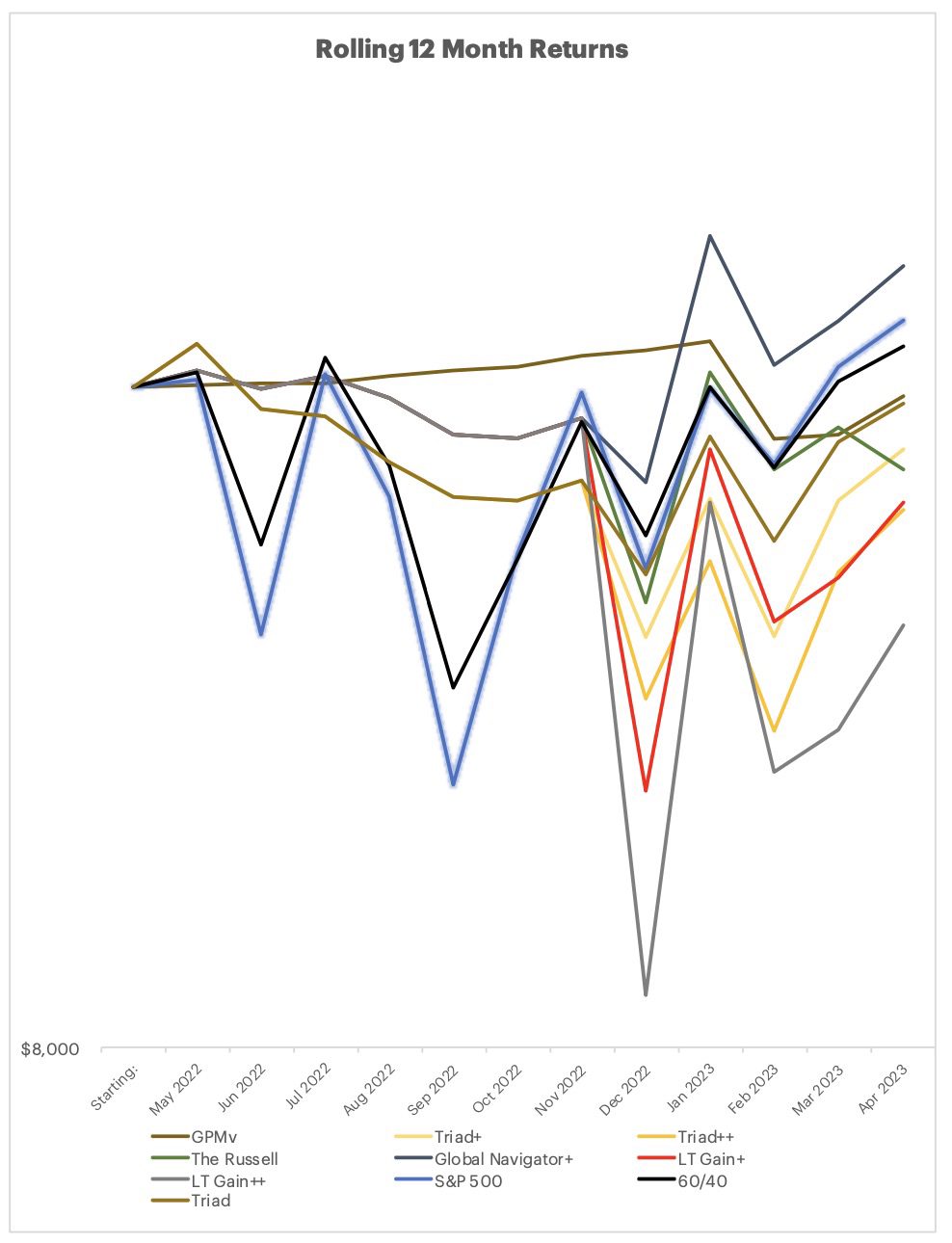

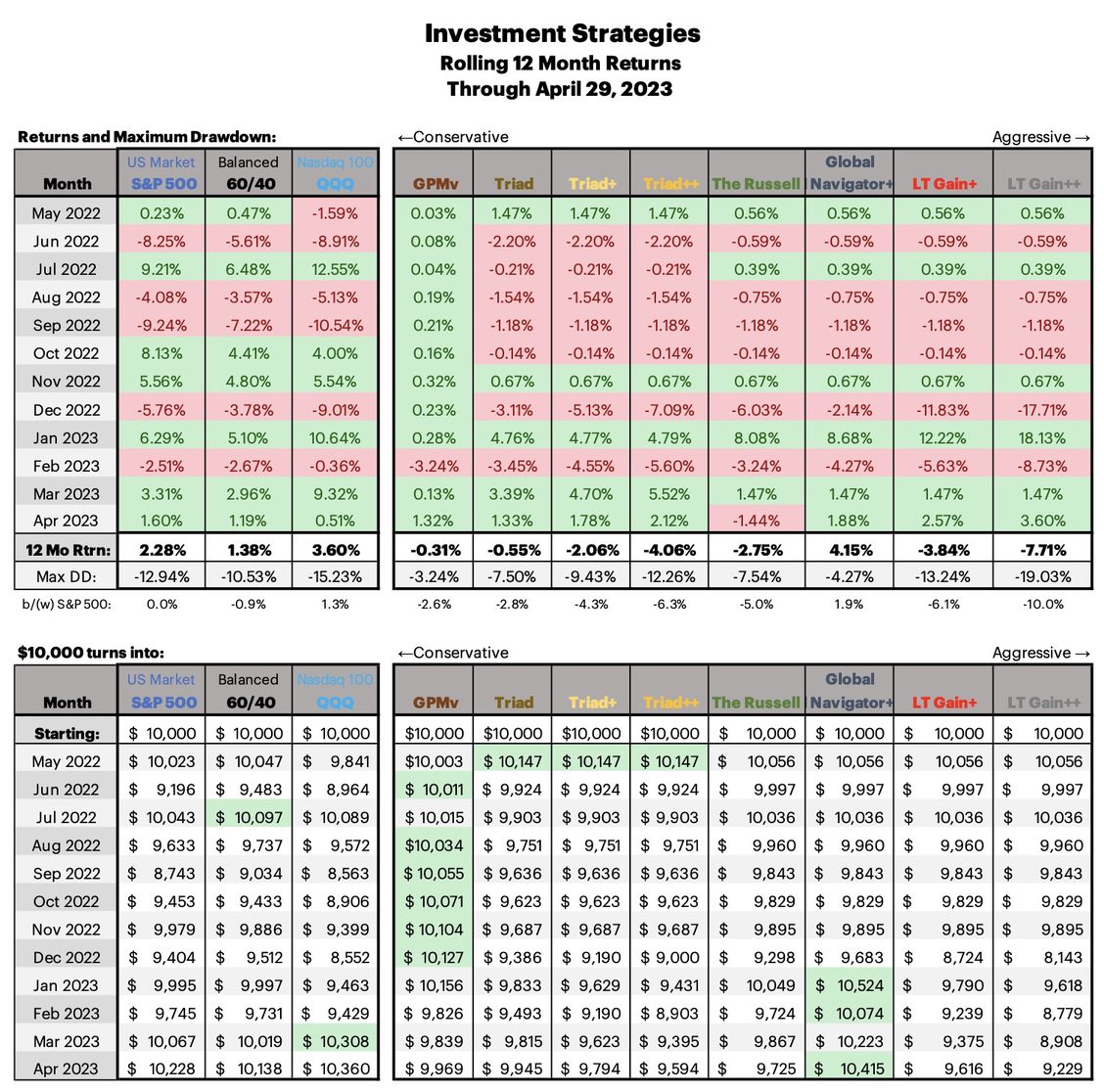

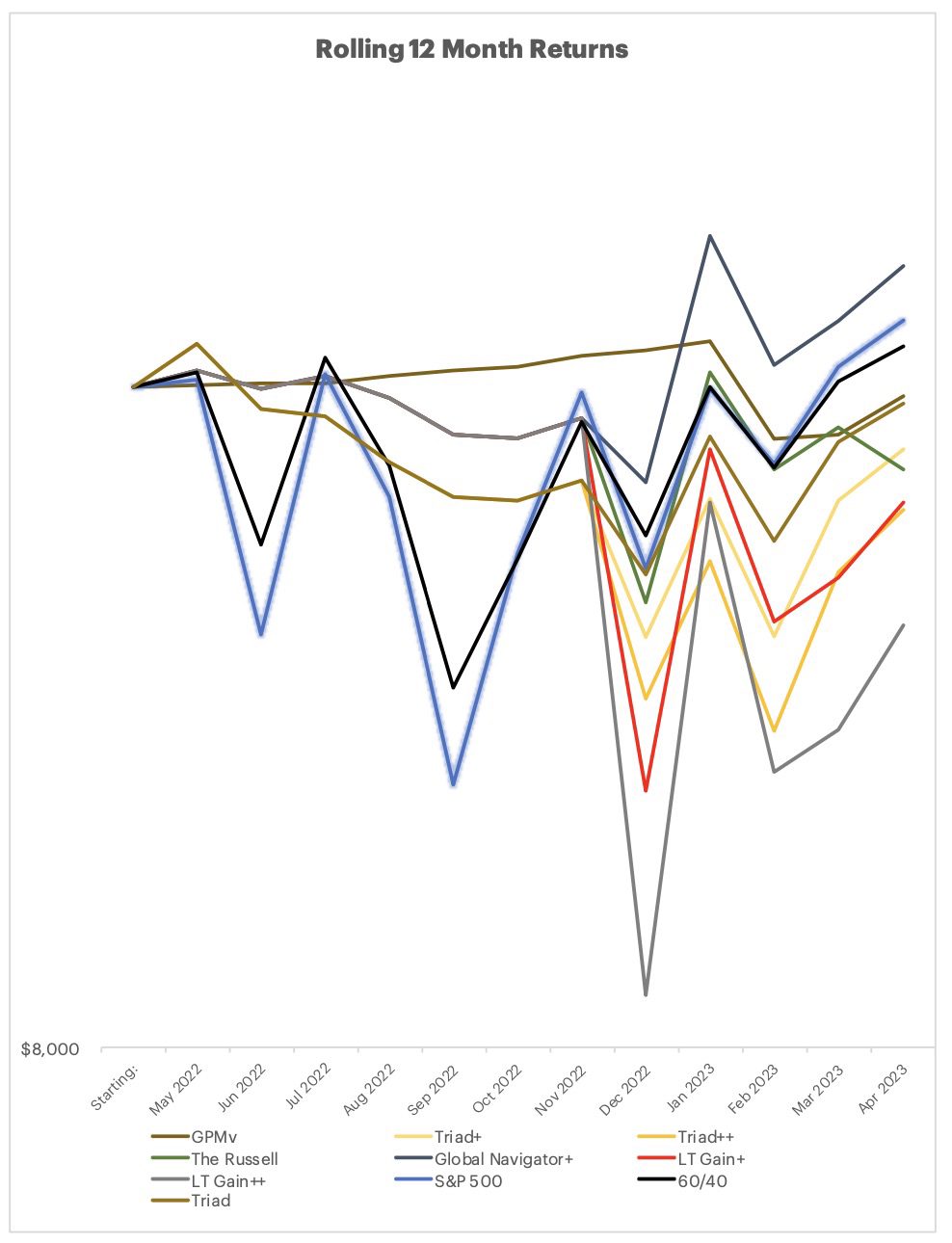

All strategies ended the month of April in the black, aside from The Russell which was a bit of a surprise. Global Navigator has the highest 12 month returns, besting all other DMS strategies, and the S&P and the QQQ. Very little changes for the strategy holdings for May. GPMv switches to Intermediate Bonds, and The Russell switches to the Russell 1000, all else holding steady.

I put a post on the site recently to introduce an allocation based holding, not an active strategy, but an allocation between 4 ETF’s, aptly given the sexy name ‘DMS-4ETF’. It is a nice low vol strategy which uses several newer ETF’s so it doesn’t have the ability to go back really far in time to show how well it works, but the history it has is really encouraging, great returns and very low volatility and downside. Check it out on the site here.

I didn’t get to point about Google Colabs, soon!

Here is the allocation spreadsheet in case that helps working with multiple strategies. Just enter the percent allocated to the strategies, and the amount of money to allocate overall to the strategies, and it tells you which ETF’s that you should be holding in what quantities. Excel Allocation Workbook for May 2023.

Here is a link to the April Reporting Deck

Don’t forget that you can track the strategies any day of the month from this URL.

Cheers

I put a post on the site recently to introduce an allocation based holding, not an active strategy, but an allocation between 4 ETF’s, aptly given the sexy name ‘DMS-4ETF’. It is a nice low vol strategy which uses several newer ETF’s so it doesn’t have the ability to go back really far in time to show how well it works, but the history it has is really encouraging, great returns and very low volatility and downside. Check it out on the site here.

I didn’t get to point about Google Colabs, soon!

Here is the allocation spreadsheet in case that helps working with multiple strategies. Just enter the percent allocated to the strategies, and the amount of money to allocate overall to the strategies, and it tells you which ETF’s that you should be holding in what quantities. Excel Allocation Workbook for May 2023.

Here is a link to the April Reporting Deck

Don’t forget that you can track the strategies any day of the month from this URL.

Cheers