August 2022

August 2022 Deck

Aug 31, 2022

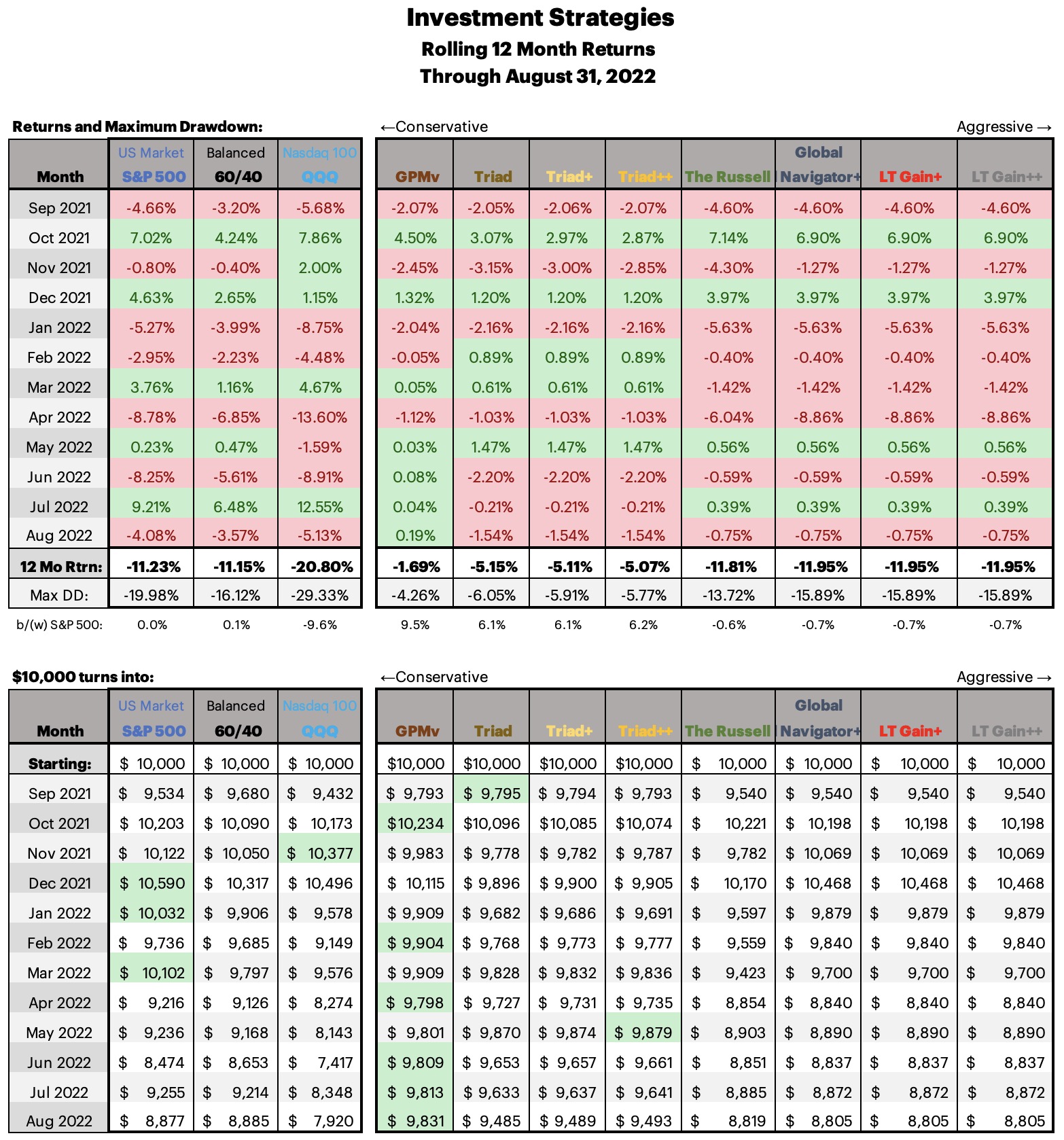

August investing has now completed.

Welcome new subscribers, if you haven’t already, poke around the website, there are many of blog entries, presentations, the current Reporting Deck is of prime interest, if you have questions or comments please send them my way: randy@dualmomentumsystems.com

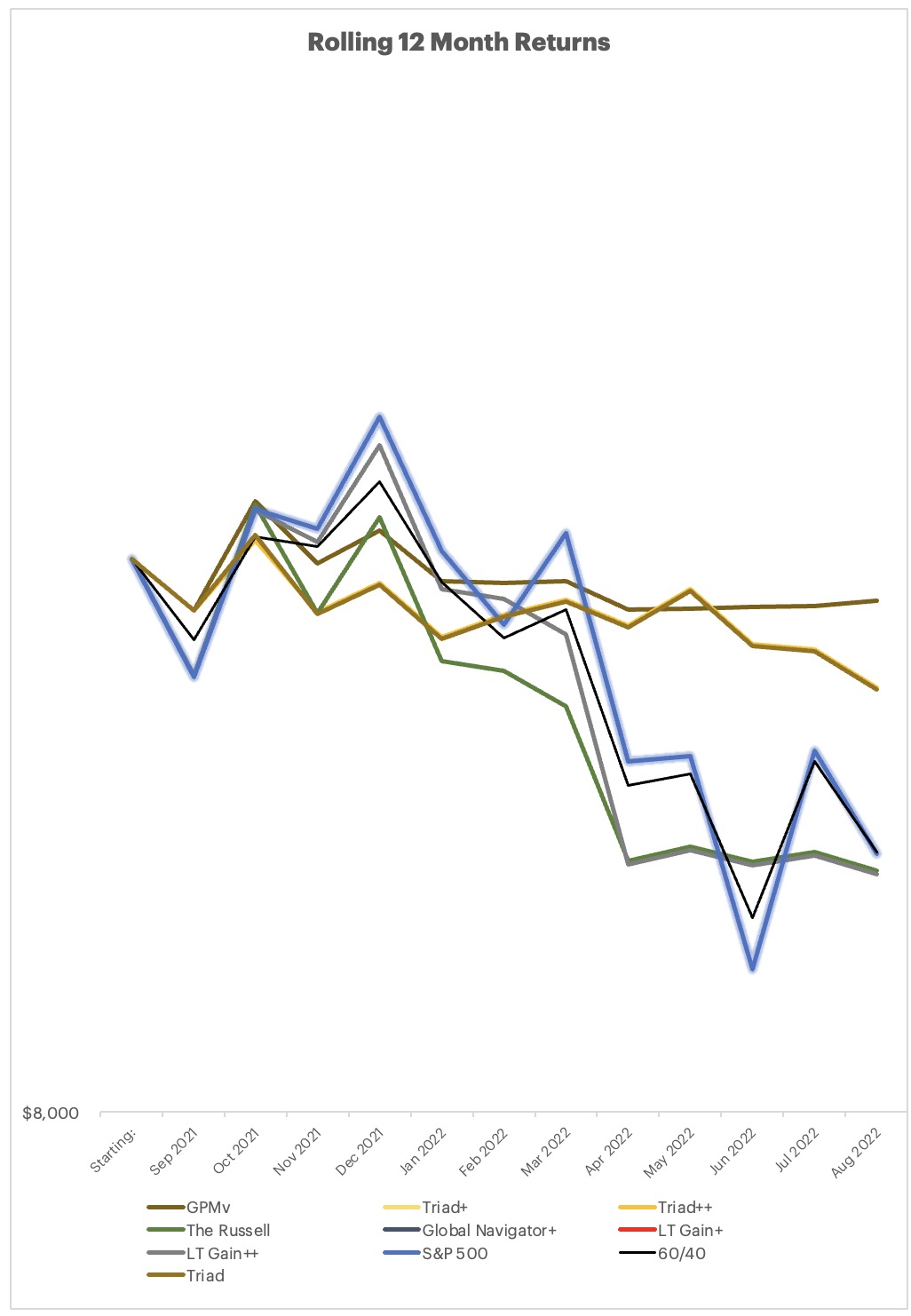

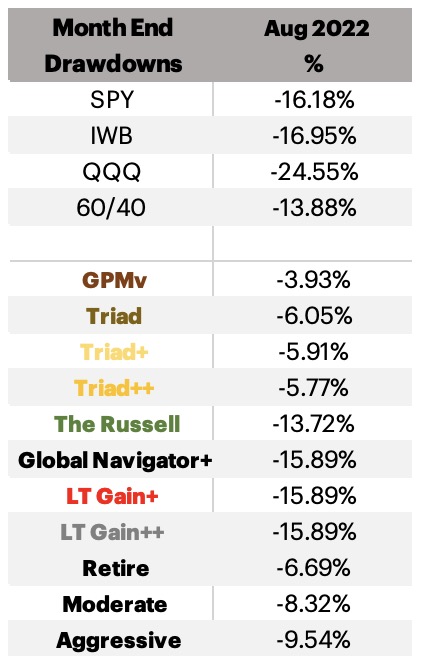

The markets kept powering upward through mid-month before plunging back to reality. I would speculate that we have been seeing a bear market rally, but I invest with the strategies and not my subjective opinion. I was a concerned mid month when we tripped the investment strategy signals to go back into the markets (because it seems likely that we are in a bear market rally to me), didn’t want to get left holding a leveraged bag… But we go with month end performance figures and we are not going back into equities for September. Whether we see more downside is something we will know in time. With inflation so high, even with gas prices coming down, it seems like we are already in or very likely we will see a recession soon.

I put together an allocation spreadsheet in case that helps working with multiple strategies. Just enter the percent allocated to the strategies, and the amount of money to allocate overall to the strategies, and it tells you which ETF’s that you should be holding in what quantities. Excel Allocation Workbook for September 2022.

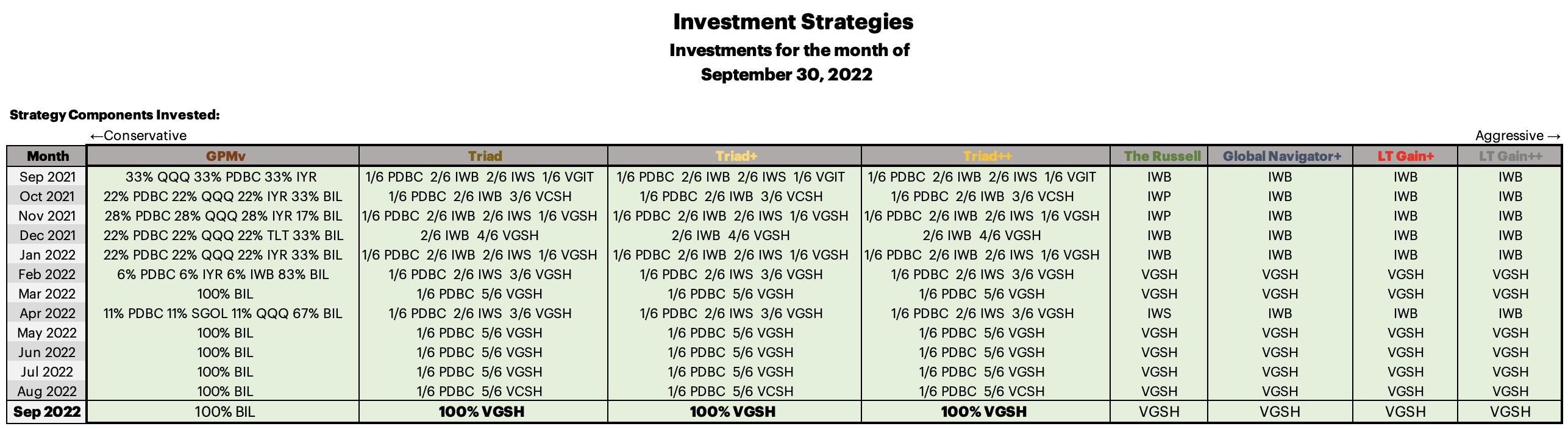

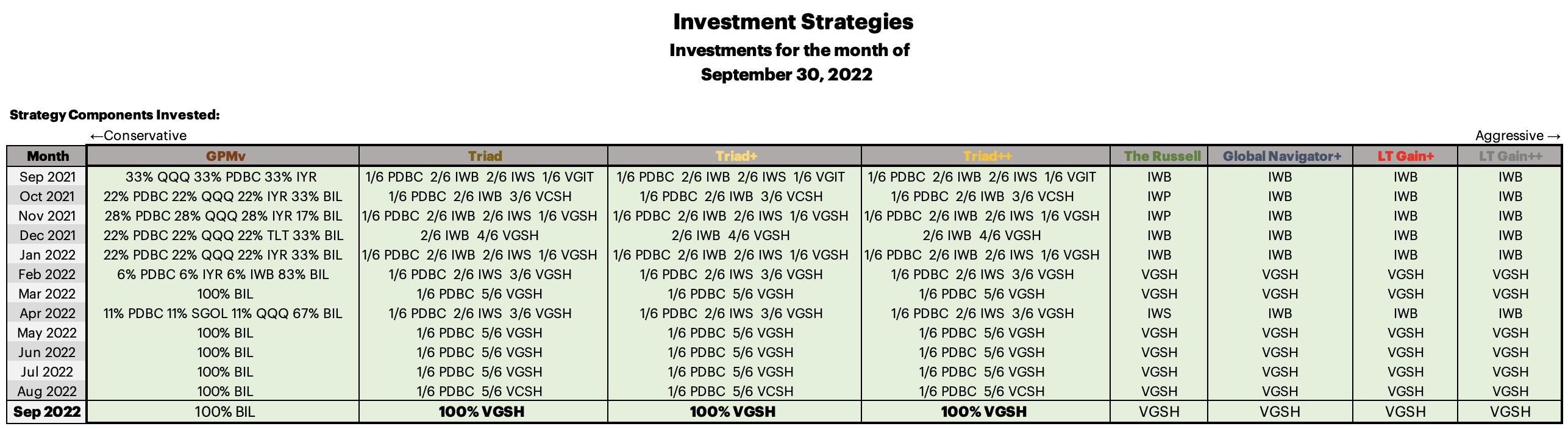

Change of investments from August to September:

Not significant changes of investment positions for September.

The Triad strategies all switch this month from VCSH to VGSH for 100% of the portfolio. We have a little whipsaw and exit VCSH after only 1 month, we also exit the commodities position of either DBC/PDBC.

No other changes for September with any of the strategies.

Here is a link to a August Reporting Deck

Welcome new subscribers, if you haven’t already, poke around the website, there are many of blog entries, presentations, the current Reporting Deck is of prime interest, if you have questions or comments please send them my way: randy@dualmomentumsystems.com

The markets kept powering upward through mid-month before plunging back to reality. I would speculate that we have been seeing a bear market rally, but I invest with the strategies and not my subjective opinion. I was a concerned mid month when we tripped the investment strategy signals to go back into the markets (because it seems likely that we are in a bear market rally to me), didn’t want to get left holding a leveraged bag… But we go with month end performance figures and we are not going back into equities for September. Whether we see more downside is something we will know in time. With inflation so high, even with gas prices coming down, it seems like we are already in or very likely we will see a recession soon.

I put together an allocation spreadsheet in case that helps working with multiple strategies. Just enter the percent allocated to the strategies, and the amount of money to allocate overall to the strategies, and it tells you which ETF’s that you should be holding in what quantities. Excel Allocation Workbook for September 2022.

Change of investments from August to September:

Not significant changes of investment positions for September.

The Triad strategies all switch this month from VCSH to VGSH for 100% of the portfolio. We have a little whipsaw and exit VCSH after only 1 month, we also exit the commodities position of either DBC/PDBC.

No other changes for September with any of the strategies.

Here is a link to a August Reporting Deck

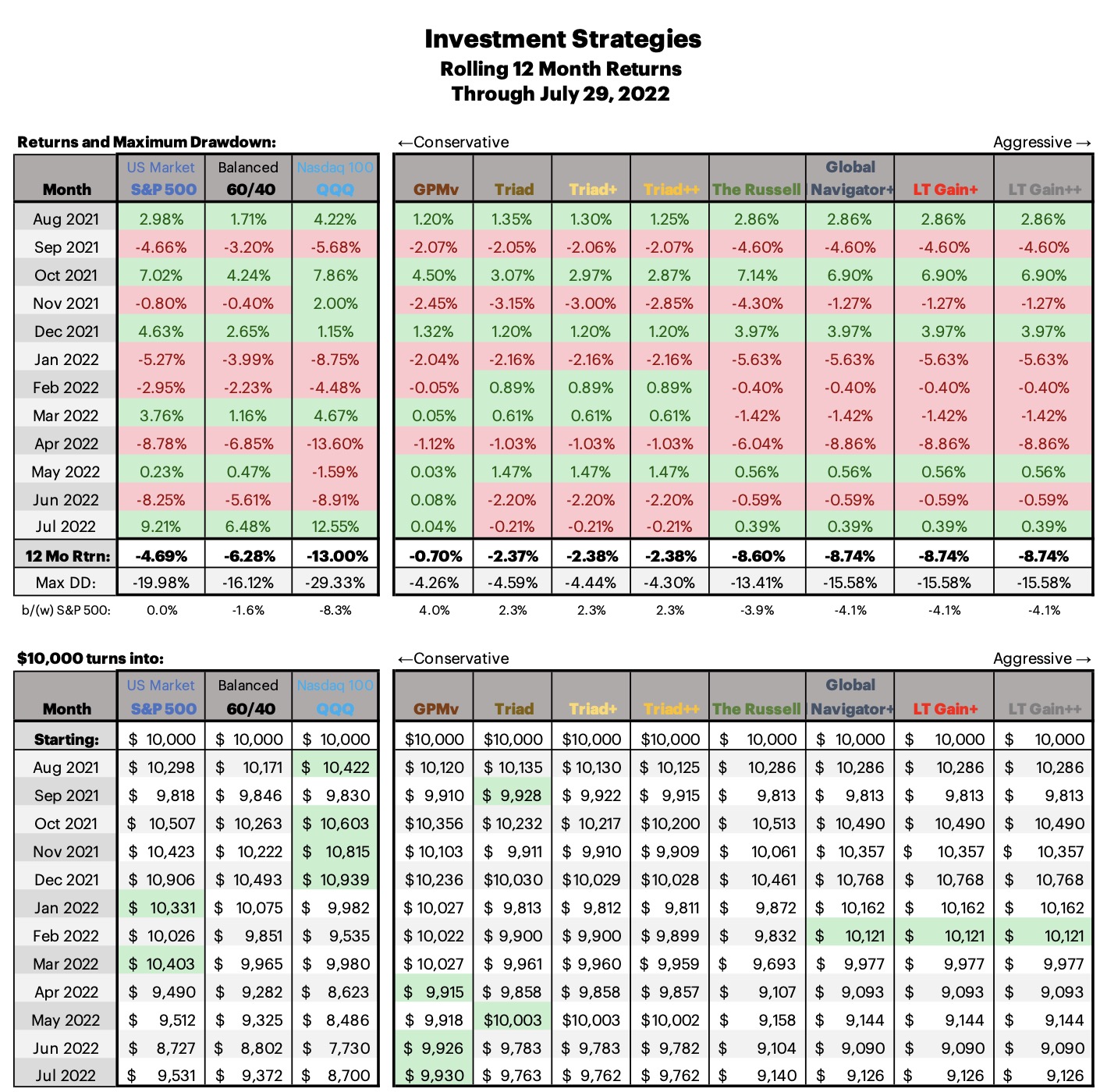

July 2022 Deck

Aug 05, 2022

| July investing has now completed. A big welcome to the many new subscribers, if you haven’t already, poke around the website, there are many of blog entries, presentations, the current Reporting Deck is of prime interest, if you have questions or comments please send them my way. The markets saw some recovery in July, a bear market gain, or the start of a bigger new upward trend? Time will tell. I put together an allocation spreadsheet in case that helps working with multiple strategies. Just enter the percent allocated to the strategies, and the amount of money to allocate overall to the strategies, and it tells you which ETF’s that you should be holding in what quantities. Link to download the Excel Allocation Workbook for August 2022. |