September 2021 Deck

Sep 30, 2021

A subscriber asked me to compare Triad to Harry Browne’s Permanent Portfolio, I did a post on this topic, it’s a brutal story worth the quick read.

Change of Strategy Notice:

Triad has been slightly changed, as well as the backtested results for it. Previously Triad would put up to 1/3rd into IWB [Russell 1000], up to 1/3rd into IWS [Russell Mid-Cap Value], and up to 1/3rd into SGOL [Gold]. If any or all of those 1/3rd investments were not invested, the money would go into the best performer of VCSH [Short Term Corporate Bonds], VGSH [Short Term Treasuries], or VGIT [Intermediate Term treasuries].

The change to Triad is that it will only invest up to 1/6th into Gold, instead of 1/3rd. Having personally being invested in Triad for the past 5 months, I have realized that the 1/3rd Gold position adds more volatility than was the goal for this strategy. By going only 1/6th into Gold, the returns only come down a very small amount (around 0.20% CAGR), but the volatility comes down more significantly, the Ulcer Index drops from about 3.25 down to 2.92.

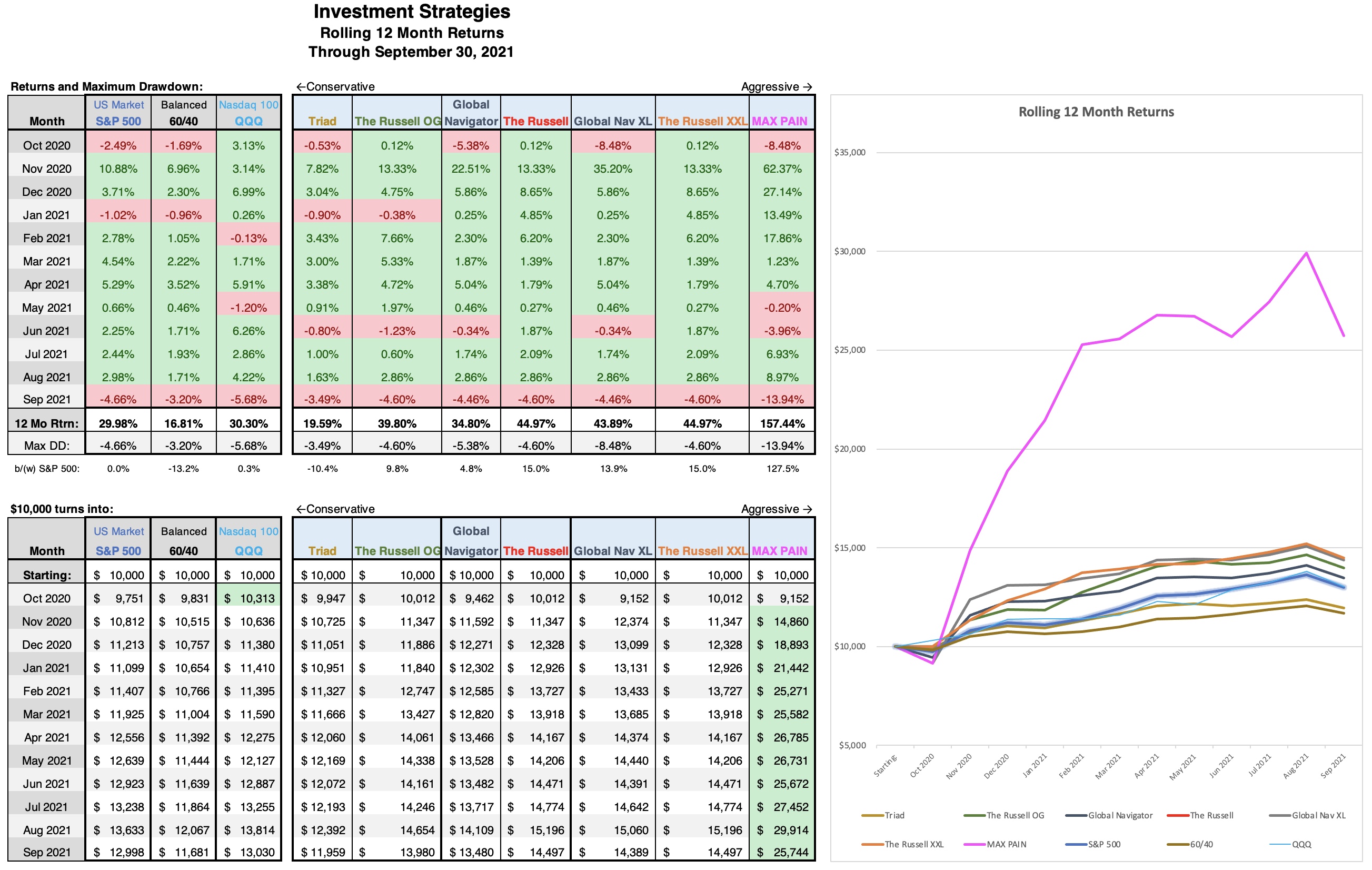

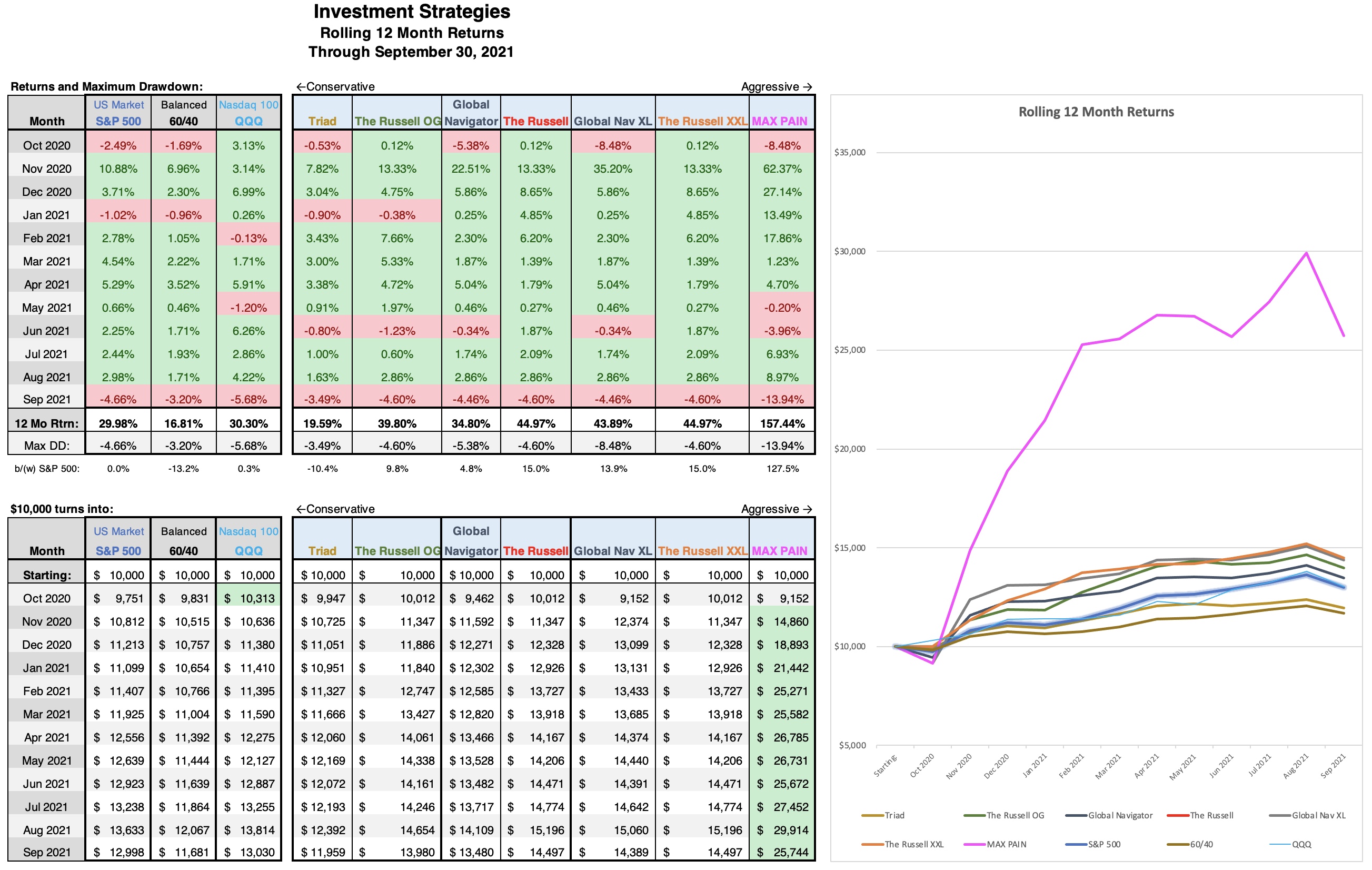

September was no bueno!

August was a very good month for the markets, however, September was even worse. I am personally down 5.14% for the month of September, and my YTD returns now stand at 14.49%. For comparison, the S&P is down 4.65% for the month, and up 15.93% for the year.

There was a lot of volatility and an obvious downward bias this past month. In September we have seen the 2nd largest drawdown of the year, I am not expecting but would not be surprised for more drawdown to come in October, even with all the stimulus money. I am hoping for a Santa Claus rally toward the end of the year.

October Investment Changes:

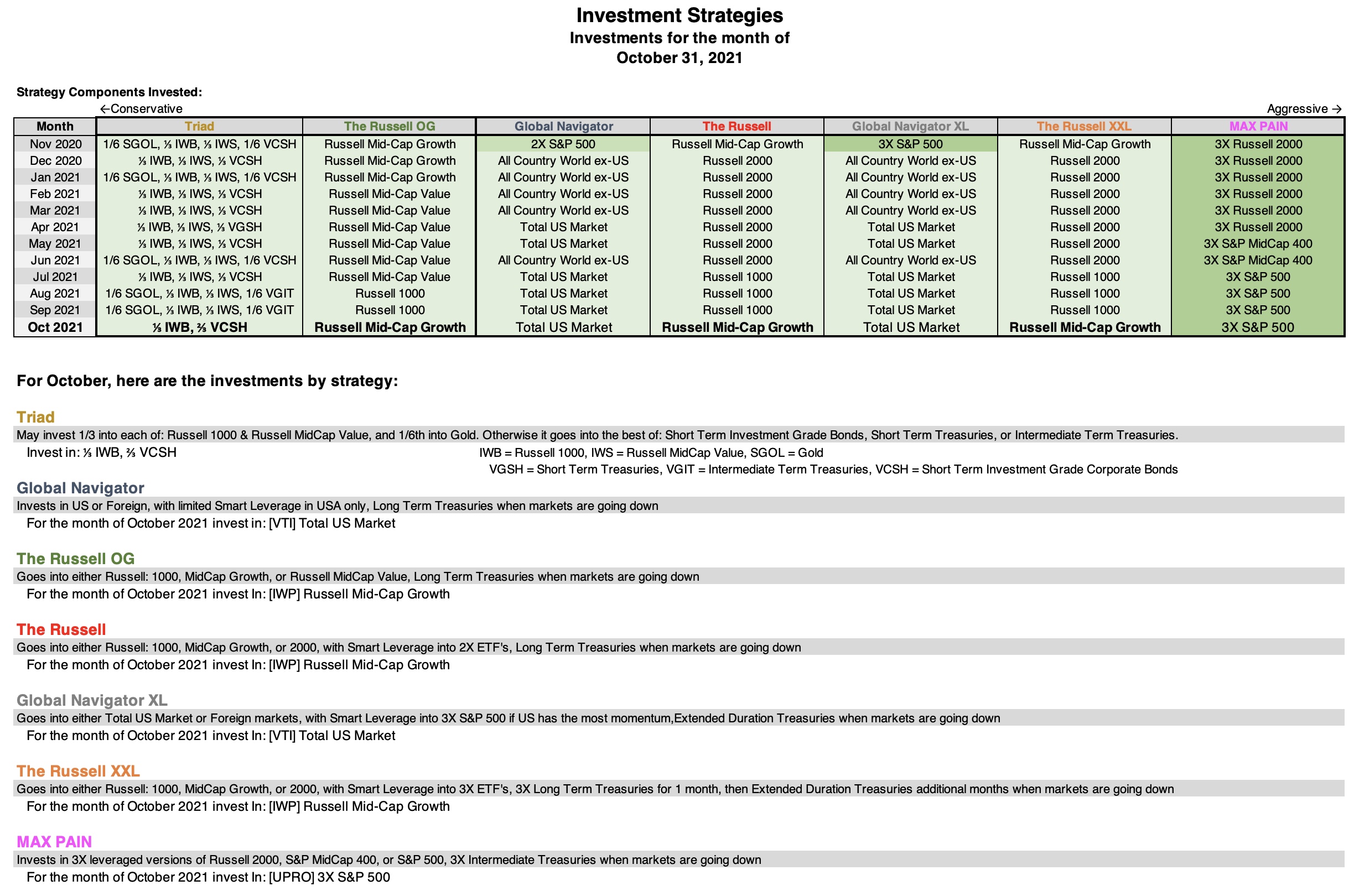

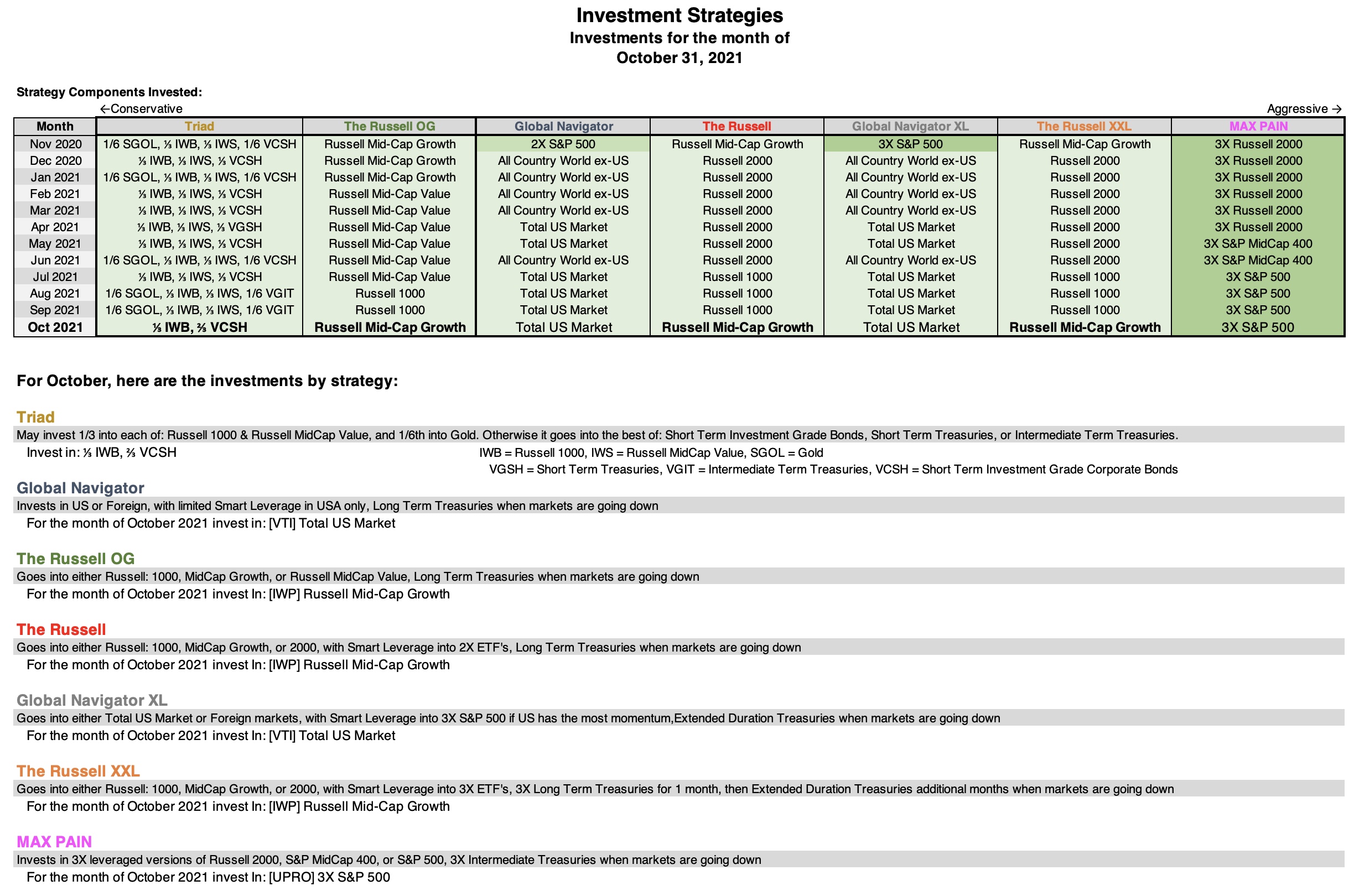

There are changes to the Triad and Russell strategies for October. Triad goes out of both Gold and Russell Mid-Cap Value, and the Russell strategies exit Russell 1000 in favor of Russell Mid-Cap Growth.

See the October 2021 investments, September 2021 results, and link to the full reporting deck here.

Change of Strategy Notice:

Triad has been slightly changed, as well as the backtested results for it. Previously Triad would put up to 1/3rd into IWB [Russell 1000], up to 1/3rd into IWS [Russell Mid-Cap Value], and up to 1/3rd into SGOL [Gold]. If any or all of those 1/3rd investments were not invested, the money would go into the best performer of VCSH [Short Term Corporate Bonds], VGSH [Short Term Treasuries], or VGIT [Intermediate Term treasuries].

The change to Triad is that it will only invest up to 1/6th into Gold, instead of 1/3rd. Having personally being invested in Triad for the past 5 months, I have realized that the 1/3rd Gold position adds more volatility than was the goal for this strategy. By going only 1/6th into Gold, the returns only come down a very small amount (around 0.20% CAGR), but the volatility comes down more significantly, the Ulcer Index drops from about 3.25 down to 2.92.

September was no bueno!

August was a very good month for the markets, however, September was even worse. I am personally down 5.14% for the month of September, and my YTD returns now stand at 14.49%. For comparison, the S&P is down 4.65% for the month, and up 15.93% for the year.

There was a lot of volatility and an obvious downward bias this past month. In September we have seen the 2nd largest drawdown of the year, I am not expecting but would not be surprised for more drawdown to come in October, even with all the stimulus money. I am hoping for a Santa Claus rally toward the end of the year.

October Investment Changes:

There are changes to the Triad and Russell strategies for October. Triad goes out of both Gold and Russell Mid-Cap Value, and the Russell strategies exit Russell 1000 in favor of Russell Mid-Cap Growth.

See the October 2021 investments, September 2021 results, and link to the full reporting deck here.