March 2022 Deck

Mar 31, 2022

March 2022 Reporting Deck Download here

UPDATE: Here is the new version of the March 2022 Reporting Deck with Treasury Duration Limiter integrated.

NOTE: I said below that everything was in stocks for April 2022, I mistakenly said that because the Triad Strategies are NOT in a 1/3rd IWB position for April but VGSH instead.

NOTE: I was didn't have the correct numbers for LT Gain 2X with Treasury Duration Limiter in the original post, I have corrected it, and it is now more in line with the Gain to Pain Ratio improvements as the other strategies now.

This was a painful month for all but the Triad Strategies. Yields didn’t just rise on treasuries, they flew higher this month causing pain in long duration Treasuries. In last month’s email I wrote about the 1970’s, a decade of high inflation and how that worked with the Global Navigator strategy which has results back through that decade (it worked out well). Maybe ‘this time is different’, or maybe we just got caught in the huge rising of yields this past month. Regardless, I am not willing to take that sort of hit again without some sort of precaution in place. I find it prudent to implement a duration limiting filter into the strategies.

Treasury Duration Limiter, aka TDL. It looks at the spread of 30 year treasuries minus the 5 year Treasuries, if that spread is below 1% the strategy will go into short duration treasuries instead of long duration treasuries. In order to prevent whipsaw (switching back and forth month after month from one duration treasury into the other), the following rule is obeyed. While out of equities and in treasuries, we can shorten the duration if the filter indicates to do so, but we hold that shorter duration treasury until we go back into equities, we do not move from shorter duration into longer duration. If I let the duration move up or down the results are a little better, but it makes for a lot more switching for what really isn’t a meaningful increase in performance. The goal of TDL is to limit duration risk.

Triad and the new Triad+ (which I wrote about on the website recently - please go visit the article if you haven’t yet seen it) do not use this treasury filter, those strategies only go between short and intermediate duration and do not need the TDL filter.

MAX PAIN does not use the TDL filter, this turbo charged strategy can’t be limited full steam ahead! In reality, the shorter duration treasuries should be considered for holding by anybody using this strategy, but the mixing of short duration treasury with the 3X equities doesn’t mix well on paper so I am leaving MAX PAIN unchanged.

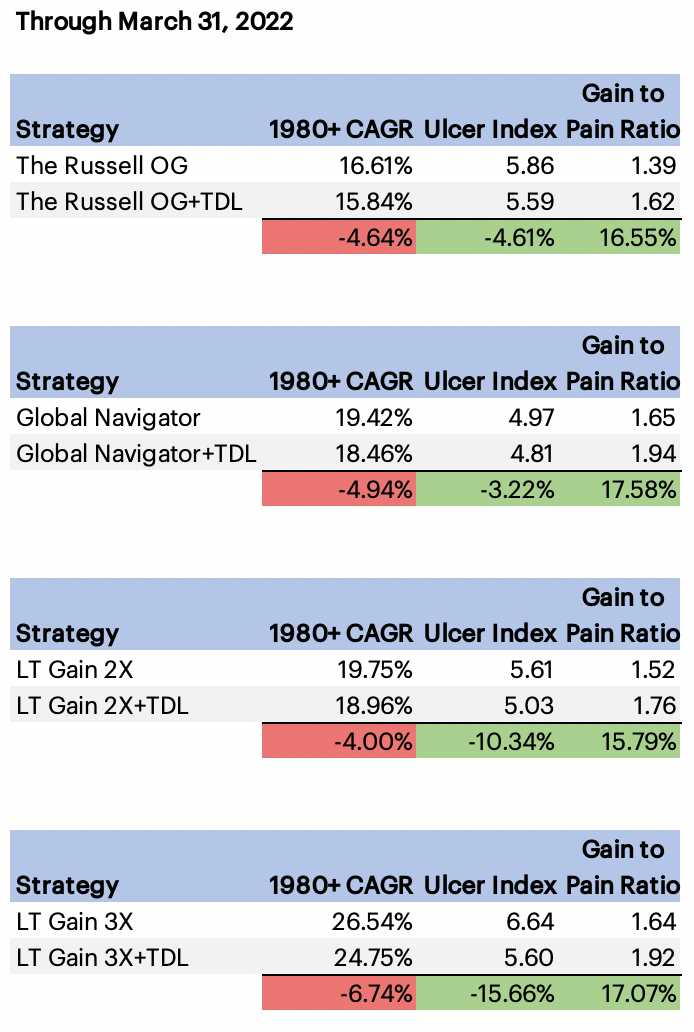

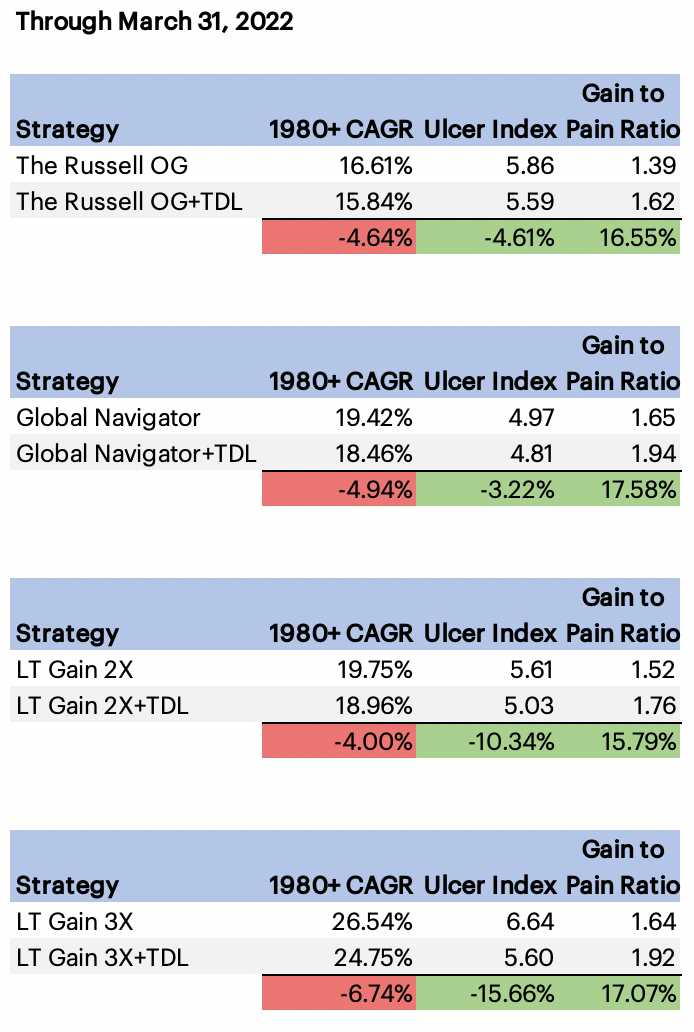

The image down below shows the changes in three key metrics for the strategies implementing TDL.

Through end of the month March I have stats on the strategies before TDL (Treasury Duration Limiter), and then with TDL. For each of the strategies, with the same TDL rules across the board, you can see that the reduction in CAGR is from around 4% to almost 7%. With the exception of Global Navigator, all of the strategies had higher percent improvements in the Ulcer Index than the reduction in CAGR. Global Navigator didn’t fare quite as well as the others in this downward volatility measure, but it did see improvements all the same. The Gain to Pain Ratio is where we see massive improvements.

The strategies with the TDL filters added to them all saw a minor decrease in the CAGR but with the benefits of meaningfully lower Ulcer Index rating and substantially better Gain to Pain Ratio. Especially in the current environment we find ourselves in, I find this to be a worthwhile tradeoff. I will not be able to get this fully implemented in the model before this month’s report is sent out, but check back to the website to the Reporting Deck page, and I will post an update deck with TDL implemented before mid-month.

UPDATE: Here is the new version of the March 2022 Reporting Deck with Treasury Duration Limiter integrated.

NOTE: I said below that everything was in stocks for April 2022, I mistakenly said that because the Triad Strategies are NOT in a 1/3rd IWB position for April but VGSH instead.

NOTE: I was didn't have the correct numbers for LT Gain 2X with Treasury Duration Limiter in the original post, I have corrected it, and it is now more in line with the Gain to Pain Ratio improvements as the other strategies now.

This was a painful month for all but the Triad Strategies. Yields didn’t just rise on treasuries, they flew higher this month causing pain in long duration Treasuries. In last month’s email I wrote about the 1970’s, a decade of high inflation and how that worked with the Global Navigator strategy which has results back through that decade (it worked out well). Maybe ‘this time is different’, or maybe we just got caught in the huge rising of yields this past month. Regardless, I am not willing to take that sort of hit again without some sort of precaution in place. I find it prudent to implement a duration limiting filter into the strategies.

Treasury Duration Limiter, aka TDL. It looks at the spread of 30 year treasuries minus the 5 year Treasuries, if that spread is below 1% the strategy will go into short duration treasuries instead of long duration treasuries. In order to prevent whipsaw (switching back and forth month after month from one duration treasury into the other), the following rule is obeyed. While out of equities and in treasuries, we can shorten the duration if the filter indicates to do so, but we hold that shorter duration treasury until we go back into equities, we do not move from shorter duration into longer duration. If I let the duration move up or down the results are a little better, but it makes for a lot more switching for what really isn’t a meaningful increase in performance. The goal of TDL is to limit duration risk.

Triad and the new Triad+ (which I wrote about on the website recently - please go visit the article if you haven’t yet seen it) do not use this treasury filter, those strategies only go between short and intermediate duration and do not need the TDL filter.

MAX PAIN does not use the TDL filter, this turbo charged strategy can’t be limited full steam ahead! In reality, the shorter duration treasuries should be considered for holding by anybody using this strategy, but the mixing of short duration treasury with the 3X equities doesn’t mix well on paper so I am leaving MAX PAIN unchanged.

The image down below shows the changes in three key metrics for the strategies implementing TDL.

- CAGR is the Compound Annual Growth Rate, or the average annual return, all else equal the higher the better.

- Ulcer Index is a measure of downward volatility, the higher the rating the more downward volatility. All else equal, the lower the number the better.

- Gain to Pain Ratio by Jack Swagger measures how much downward pain you have to endure to get the upside gain. The higher the rating the better.

Through end of the month March I have stats on the strategies before TDL (Treasury Duration Limiter), and then with TDL. For each of the strategies, with the same TDL rules across the board, you can see that the reduction in CAGR is from around 4% to almost 7%. With the exception of Global Navigator, all of the strategies had higher percent improvements in the Ulcer Index than the reduction in CAGR. Global Navigator didn’t fare quite as well as the others in this downward volatility measure, but it did see improvements all the same. The Gain to Pain Ratio is where we see massive improvements.

The strategies with the TDL filters added to them all saw a minor decrease in the CAGR but with the benefits of meaningfully lower Ulcer Index rating and substantially better Gain to Pain Ratio. Especially in the current environment we find ourselves in, I find this to be a worthwhile tradeoff. I will not be able to get this fully implemented in the model before this month’s report is sent out, but check back to the website to the Reporting Deck page, and I will post an update deck with TDL implemented before mid-month.