June 2022 Deck

Jun 30, 2022

June 2022 Reporting Deck Download here

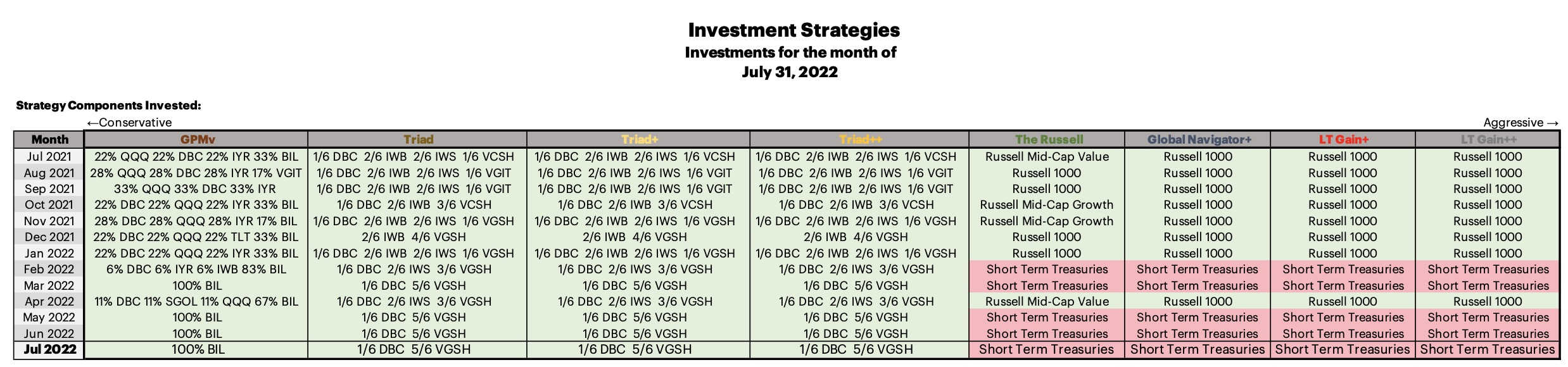

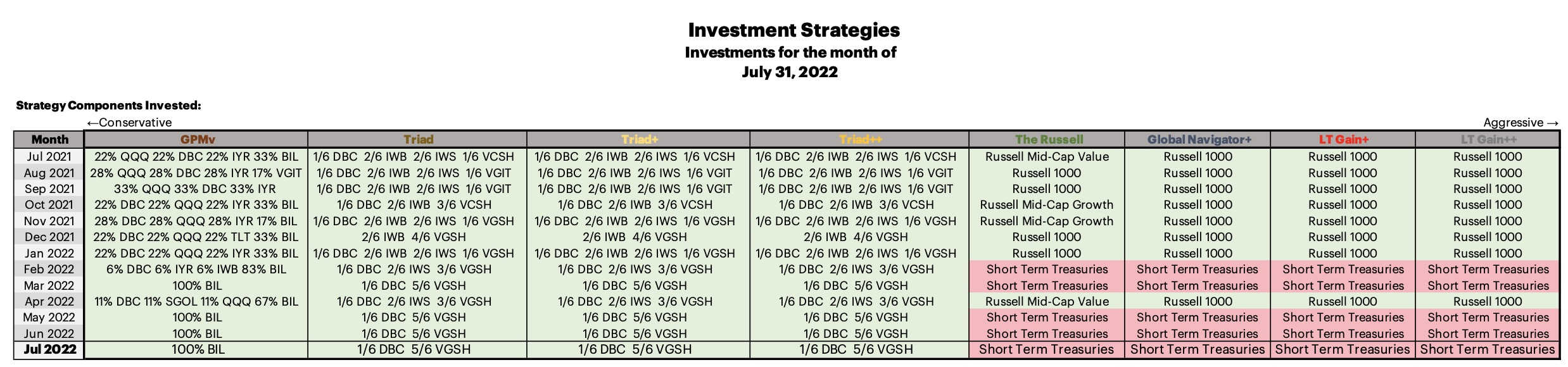

Change of investments from May to June:

Nothing, everything remains the same from June to July

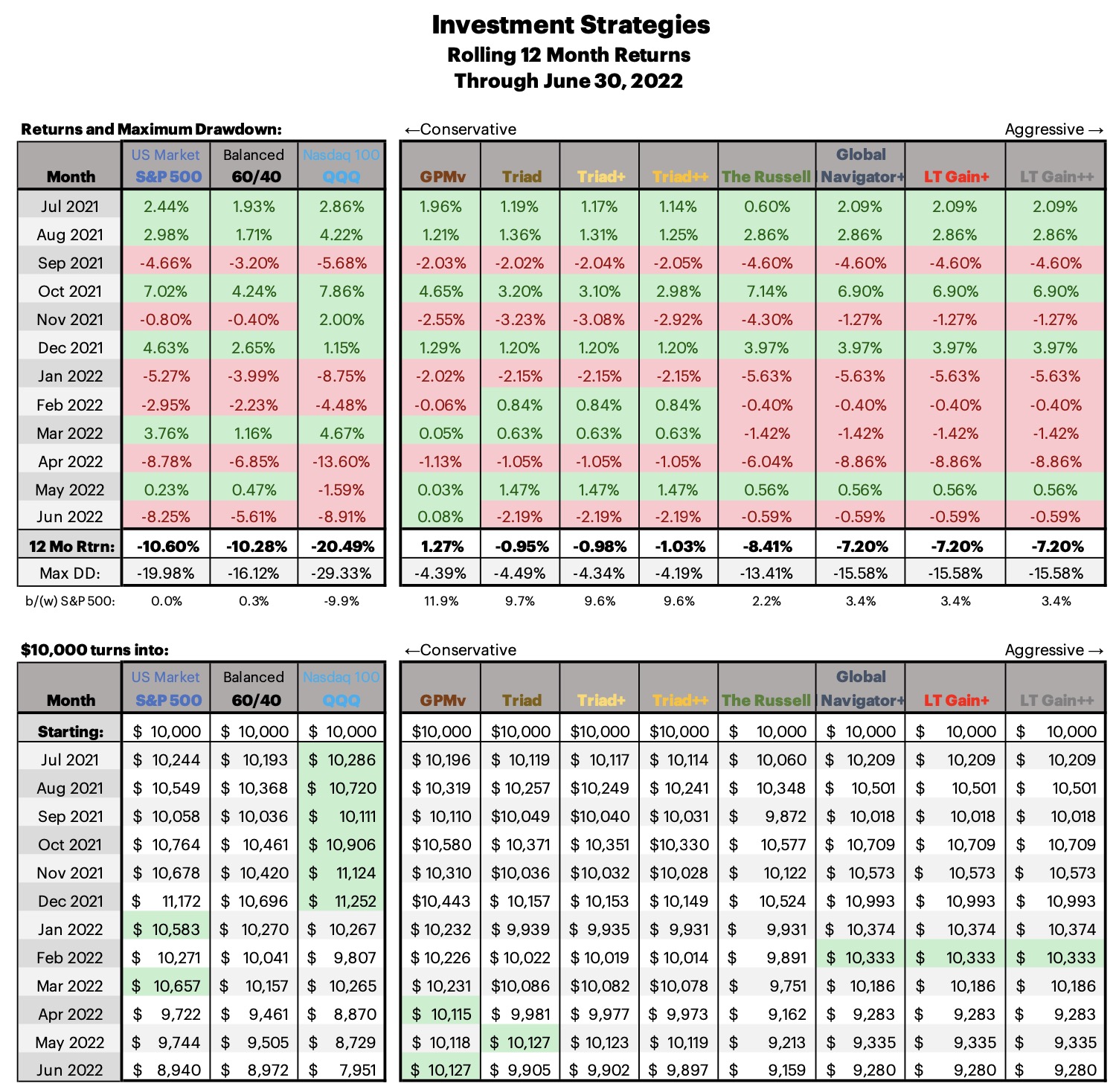

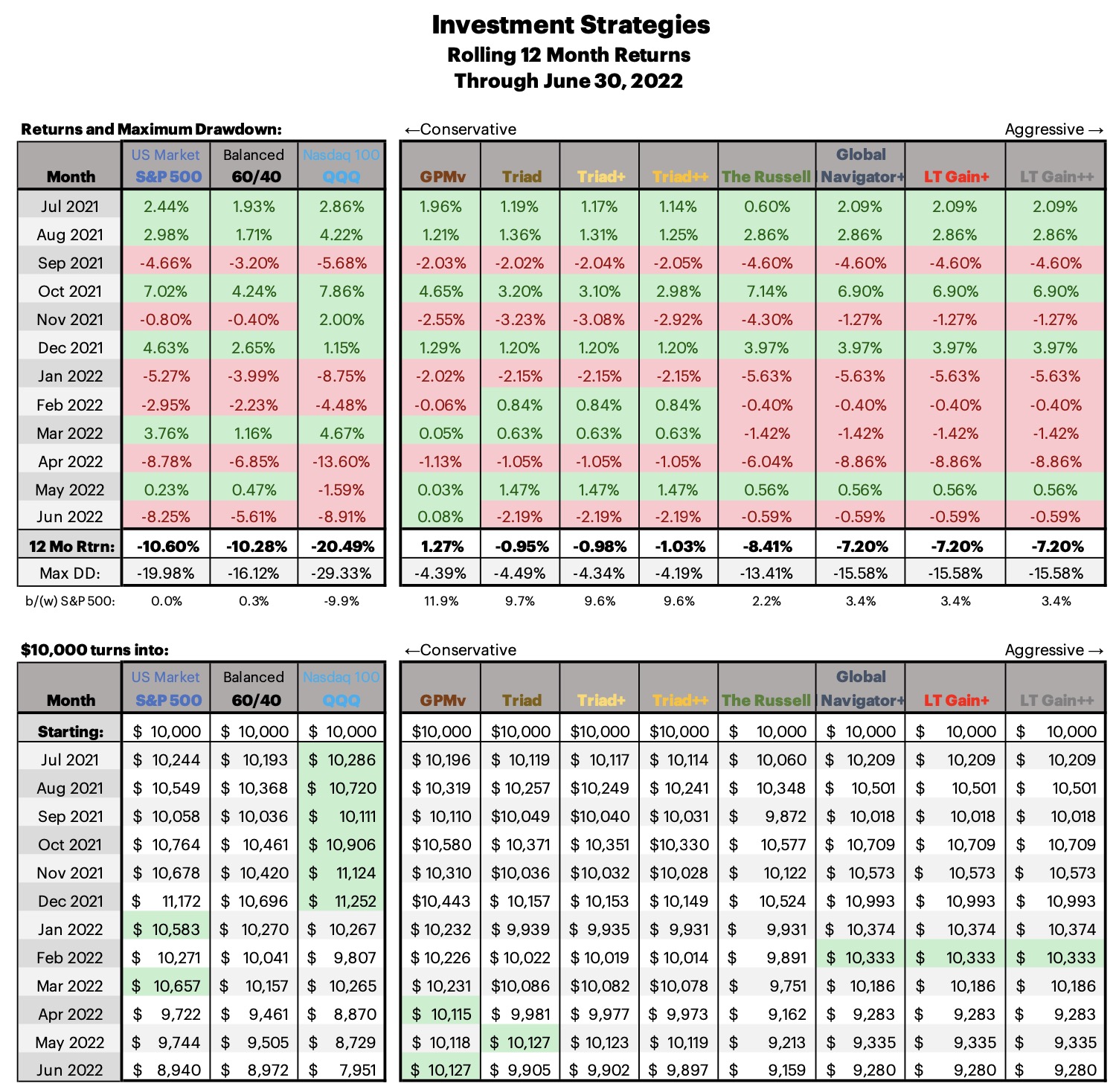

Market volatility continued in June, all strategies are on the side line, except for the Triad strategies 1/6th allocation to commodities. I am going with the strategies and what they tell me to do with regards to my investments. I will say that it doesn’t feel like the bottom yet to me, we haven’t had a real panic yet, and when I put on my technician hat and look at a chart, I have been seeing the S&P retracing all the way back to 3,200 which is still a ways below the end of June levels.

I read today that this is the worst 1st six months performance in the markets since 1970, saw somewhere else where they said since 1962, which ever it is, this has been a terrible 1st half to the year, and I would guess one of the absolute worst for a 60/40 (have you been made aware that both GPMv and Triad are far better alternatives to a 60/40…)

Smart Leverage was triggered in June, so the next time we go into equities, the + and ++ strategies will do so with leverage. Smart Leverage is triggered with a 15% or greater drawdown in the Russell 1000 from the month end high water mark to the current month end results. From December month end through June month end, the IWB is down 21%.

GPMv, my adaptation of Keller & Keuning's GPM strategy was the only strategy this month to eek out a positive gain, and in fact it is the highest performing strategy and the only strategy with positive returns over the past 12 months. It can be mind bending how the most conservative strategy performs the best in volatile and downward market conditions. The Triad strategies are very close to GPM over the past 12 months, and the other strategies are not significantly behind at all. A 12 month rolling return chart is shown just below.

If you receive these emails, I’m going to start delaying the posts on the website to the reporting decks which contains what the investment allocations for the month ahead are, I would like to encourage people to subscribe. Donations are always appreciated, I am not looking to profit from individual investors but do hope to cover the costs of hosting the site.

Maybe significantly lower market action ahead, but maybe not… I’m sticking with the DMS evidence based, rules based strategies to guide me and my investments.

Happy investing, and good luck to you all.

Change of investments from May to June:

Nothing, everything remains the same from June to July

Market volatility continued in June, all strategies are on the side line, except for the Triad strategies 1/6th allocation to commodities. I am going with the strategies and what they tell me to do with regards to my investments. I will say that it doesn’t feel like the bottom yet to me, we haven’t had a real panic yet, and when I put on my technician hat and look at a chart, I have been seeing the S&P retracing all the way back to 3,200 which is still a ways below the end of June levels.

I read today that this is the worst 1st six months performance in the markets since 1970, saw somewhere else where they said since 1962, which ever it is, this has been a terrible 1st half to the year, and I would guess one of the absolute worst for a 60/40 (have you been made aware that both GPMv and Triad are far better alternatives to a 60/40…)

Smart Leverage was triggered in June, so the next time we go into equities, the + and ++ strategies will do so with leverage. Smart Leverage is triggered with a 15% or greater drawdown in the Russell 1000 from the month end high water mark to the current month end results. From December month end through June month end, the IWB is down 21%.

GPMv, my adaptation of Keller & Keuning's GPM strategy was the only strategy this month to eek out a positive gain, and in fact it is the highest performing strategy and the only strategy with positive returns over the past 12 months. It can be mind bending how the most conservative strategy performs the best in volatile and downward market conditions. The Triad strategies are very close to GPM over the past 12 months, and the other strategies are not significantly behind at all. A 12 month rolling return chart is shown just below.

If you receive these emails, I’m going to start delaying the posts on the website to the reporting decks which contains what the investment allocations for the month ahead are, I would like to encourage people to subscribe. Donations are always appreciated, I am not looking to profit from individual investors but do hope to cover the costs of hosting the site.

Maybe significantly lower market action ahead, but maybe not… I’m sticking with the DMS evidence based, rules based strategies to guide me and my investments.

Happy investing, and good luck to you all.