April 2022 Deck

Apr 30, 2022

April 2022 Reporting Deck Download here

The markets were not healthy this month, I mentioned in the email sent with March 2022 that I feared for April, thinking that the huge runup at the end of March could reverse. Unfortunately that did happen. Even though I had this thought, I stuck to the strategies, they do better over time than I do - sometimes I have to remember that the strategy can get a month wrong and gets caught up in some whipsaw, this will happen. However, the flip side is that the strategies will also keep you out in the really big, long drawdowns, as well as keep you in when things are grinding upward.

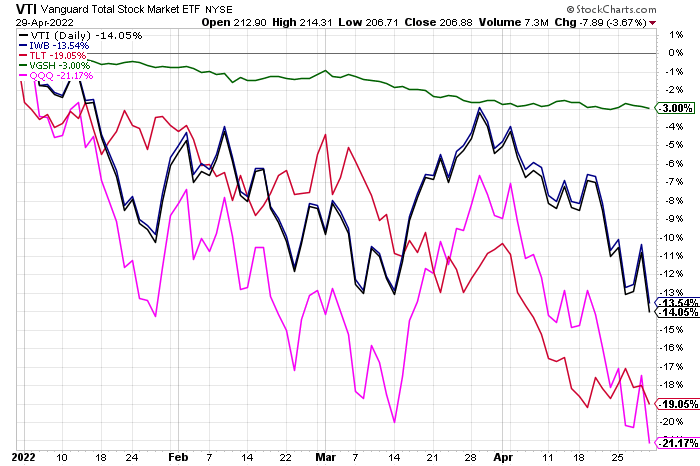

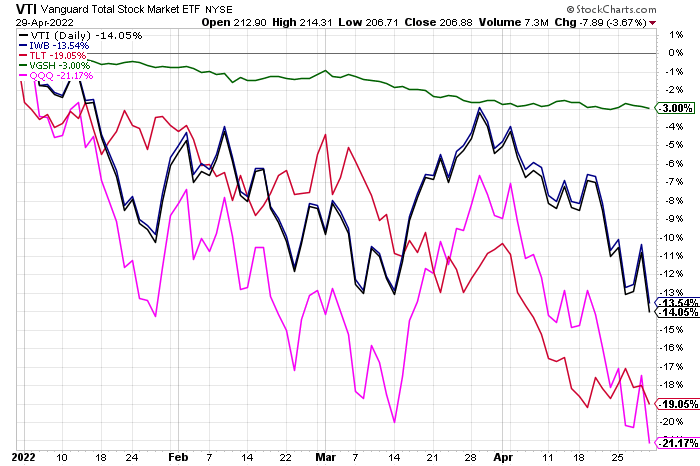

Smart Leverage is triggered, in the strategies that use them, with a 15% or greater drawdown. IWB has a 13.55% at the end of April, almost triggering Smart Leverage. As a reminder, Smart Leverage is only triggered with the end of the month drawdown, so for conversation if the IWB drops to a drawdown of 20% mid May but ends the month down 12%, Smart Leverage is not triggered because the drawdown was not 15% or greater at a month end.

Treasury Duration Limiter, TDL, is in effect this month and restricting all of the strategies go into Short Term Government Treasuries, VGSH, for May. Triad doesn't not use TDL, but also happens to be invested primarily in VGSH for May, and the Triad strategies also maintain a 1/6th position in Gold, SGOL.

As a reminder for everybody, momentum strategies in general tend to be hit or miss on short term volatility and drawdowns, and they tend to be spectacular on the large drawdowns.

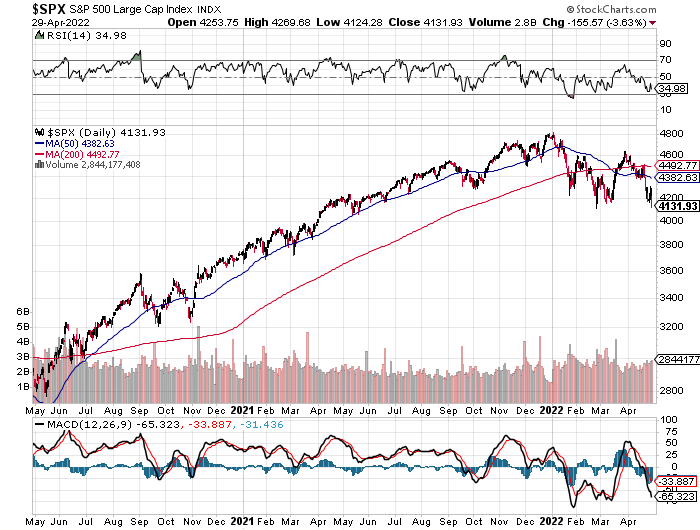

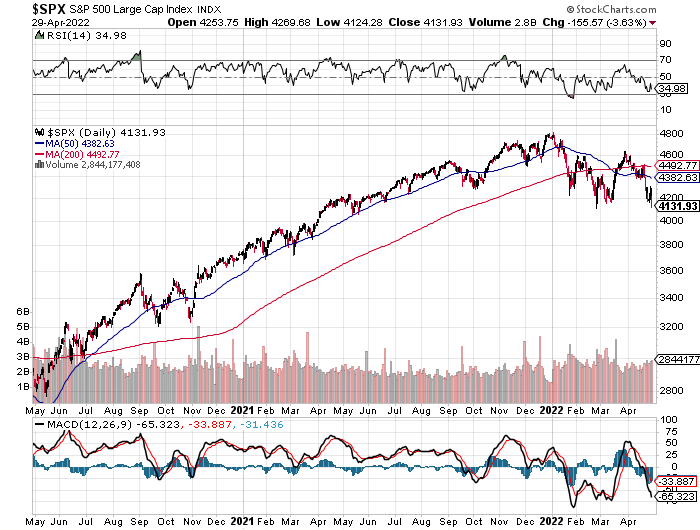

The S&P remains well under both the 50 say and 200 day SMA.

Major indexes remain down YTD

The markets were not healthy this month, I mentioned in the email sent with March 2022 that I feared for April, thinking that the huge runup at the end of March could reverse. Unfortunately that did happen. Even though I had this thought, I stuck to the strategies, they do better over time than I do - sometimes I have to remember that the strategy can get a month wrong and gets caught up in some whipsaw, this will happen. However, the flip side is that the strategies will also keep you out in the really big, long drawdowns, as well as keep you in when things are grinding upward.

Smart Leverage is triggered, in the strategies that use them, with a 15% or greater drawdown. IWB has a 13.55% at the end of April, almost triggering Smart Leverage. As a reminder, Smart Leverage is only triggered with the end of the month drawdown, so for conversation if the IWB drops to a drawdown of 20% mid May but ends the month down 12%, Smart Leverage is not triggered because the drawdown was not 15% or greater at a month end.

Treasury Duration Limiter, TDL, is in effect this month and restricting all of the strategies go into Short Term Government Treasuries, VGSH, for May. Triad doesn't not use TDL, but also happens to be invested primarily in VGSH for May, and the Triad strategies also maintain a 1/6th position in Gold, SGOL.

As a reminder for everybody, momentum strategies in general tend to be hit or miss on short term volatility and drawdowns, and they tend to be spectacular on the large drawdowns.

The S&P remains well under both the 50 say and 200 day SMA.

Major indexes remain down YTD