A look at Triad

Triad

Why a conservative strategy?

The Triad strategy created out of necessity. I have a couple of accounts where I want to be invested, but more conservatively, for example one of the accounts is our general savings/emergency money. A balanced approach like a 60/40 doesn't seem like a great strategy going forward. I've heard several heads of large investment firms when asked what they were going to do with investors accounts who used to be in 60/40 portfolios [with the understanding that bonds are not likely performing well in the years ahead] and they straight faced replied that they were shifting to a 70/30 allocation. Excuse me? What the heck, that's not a solution in my book. I had been investing in SWAN, a barbell approach ETF, but it heavily relies on intermediate term treasuries and this didn't seem like a great option going forward either.

This struck me as a worthwhile challenge, would I be able to come up with a sustainable strategy which was close in performance historically compared to a Balanced 60/40 portfolio, but likely be positioned to perform better than a 60/40 allocation going forward? Yes I was able to! The resulting strategy is Triad.

Why Triad, why not just invest in the market? The "index" is tough to beat, here are some staggering statistics from Dalbar:

Investors don't beat the Index, so why not just index?

For the twenty years ending 12/31/2015, the S&P 500 Index averaged 9.85% a year. A pretty attractive historical return. The average equity fund investor earned a market return of only 5.19%.

Why is this? Investor behavior is illogical and often based on emotion. This does not lead to wise long-term investing decisions.

-Dalbar, Inc.

Over the longest span, the numbers were particularly brutal. The S&P 500 outperformed more than 92% of large-cap funds over the last 15 years. Mid- and small-cap funds fared no better over the time period, with their benchmarks besting them 95.4% and 93.2% of the time, respectively. Overall, 82.2% of all active funds were outperformed over the 15-year period.

-Fortune Magazine, 2017

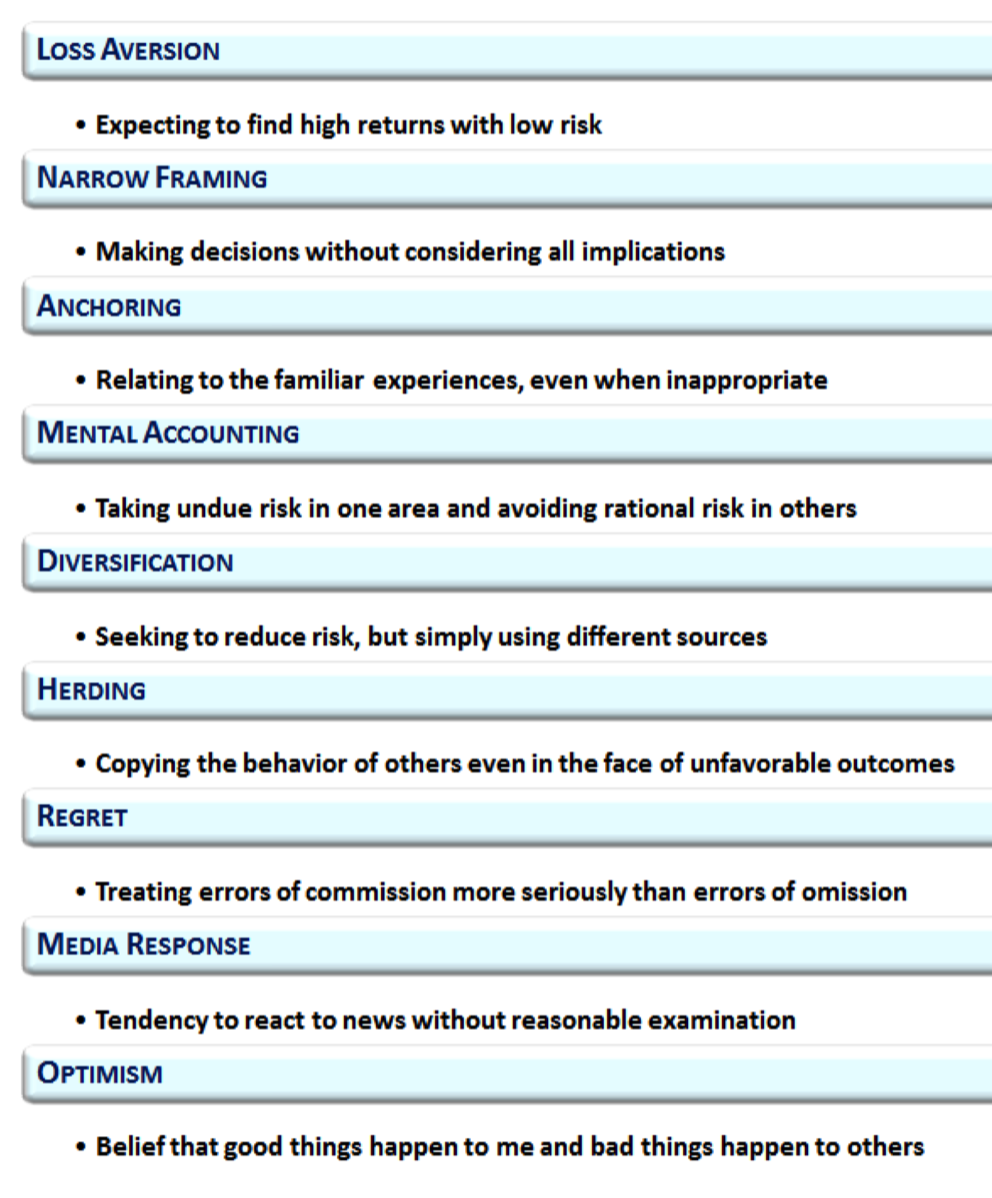

There are many psychological investing barriers which investors face:

If the average retail investor and professional managers fail to beat the index over time, why does anybody even try, why doesn't everybody just by the S&P 500 and be done with it? I think it is because of the volatility and drawdowns that one experiences in an index like the S&P 500. The long term results are great, but massive drawdowns and volatility are difficult for many to stomach. I am no different, I can't stomach massive drawdowns, espeically for accounts from which I may need the money in a short term time frame.

This is why I wanted to see if I could come up with a strategy for the future that will excel the traditional 60/40 allocation.

Triad Basics

Triad splits the portfolio into 1/3rds. Based on the lookback methodology (which I am not divulging at this time) Triad will invest 1/3rd of the portfolio into the Russell 1000, another 1/3rd into the Russell MidCap Value, and 1/3rd into Gold. Triad only invests those 3 separate 1/3rd allocations if the investments qualify based on the lookback. If the lookback for the Russell 1000 is a go, then 1/3rd of the portfolio is invested in the Russell 1000, if the lookback says to stay out of the Russell 1000 for the next month, then that 1/3rd is instead invested in the best option of Short Term Treasuries, Intermediate Term Treasuries, or Short Term Corporate Investment Grade Bonds based on their lookback relative performance. Each of the three separate investments works this way, we either invest in three components, or their amounts are put into holding in one of the bonds.

This is why I wanted to see if I could come up with a strategy for the future that will excel the traditional 60/40 allocation.

Triad Basics

Triad splits the portfolio into 1/3rds. Based on the lookback methodology (which I am not divulging at this time) Triad will invest 1/3rd of the portfolio into the Russell 1000, another 1/3rd into the Russell MidCap Value, and 1/3rd into Gold. Triad only invests those 3 separate 1/3rd allocations if the investments qualify based on the lookback. If the lookback for the Russell 1000 is a go, then 1/3rd of the portfolio is invested in the Russell 1000, if the lookback says to stay out of the Russell 1000 for the next month, then that 1/3rd is instead invested in the best option of Short Term Treasuries, Intermediate Term Treasuries, or Short Term Corporate Investment Grade Bonds based on their lookback relative performance. Each of the three separate investments works this way, we either invest in three components, or their amounts are put into holding in one of the bonds.

How does the lookback work?

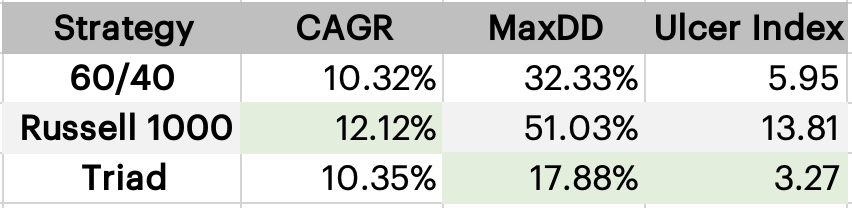

From January 1980 through May 2021 a buy and hold investment into a 60/40 portfolio would have provided an annualized return of 10.35%, however, it also had a maximum drawdown of 32.33% and has an ulcer index of 5.95 which is a measure of it's relative overall drawdown behavior (the higher the Ulcer Index the worse.) For reference, the Russell 1000 had an average annualized return of 12.12% with a maximum drawdown of 51.03% and an Ulcer Index of 13.81, the balanced 60/40 portfolio does have a reduced annualized return but it also has much more tame drawdown and Ulcer Index compared to 100% in broad US Market equities.

Triad uses a lookback which I believe to be something unique, I've not ever heard of this methodology used in other investment strategies. It is not looking for upward momentum over X number of months, nor is it using a weighted lookback, it is not looking for the current price to be above the SMA or EMA, it is not looking for moving average lines to intercept. It's something different that I came up with in order to try and be invested in the components without being subjected to too much drawdown, let's see how well it works.

By investing in the Russell 1000 using the lookback of Triad which has us invested when the lookback says to be invested, and out of the market in cash when not invested. This would result in an annualized return of 10.00%, which is only 0.35% lower than a balanced 60/40 [2.12% worse than the Russell 1000 buy and hold.] This would result in a maximum drawdown of 23.41% with an Ulcer Index of 8.22, this is a lower maximum drawdown than a 60/40 but a higher Ulcer Index. But of course, we're not having money sit idle when it isn't invested into the Russell 1000, it goes into the best performer based of either Short or Intermediate Term Treasuries, or Short Term Corporate Investment Grade Bonds. When we invest the idle funds in the best of the bonds instead of cash the return jumps up to 13.00% annualized returns, with the same maximum drawdown as with cash of 23.41%, and an even lower Ulcer Index of 6.84. This is far better returns that both a Balanced 60/40 and even a 100% Russell 1000 buy and hold portfolio with lower maximum drawdown and a good Ulcer Index.

But Triad has a goal of both a very low drawdown and a very low Ulcer Index paired with solid returns. The above results may be very attractive for some investors, but it is too volatile for what Triad was conceived to be.

The above example was putting 100% into the Russell 1000, or into the bonds. Now we look at the results of fully going into the Triad strategy. We split the portfolio into 1/3rds. The Russell 1000 and the Russell MidCap Value are both equity components and the ⅓ that goes into gold is intended to be a diversifier, a method of providing some returns when equities are not, and not being too heavily invested in equities which brings volatility and a higher Ulcer Index. By having up to 2/3rds of the portfolio equities, it roughly appromixates the equity allocation of a 60/40 portfolio.

When we use all three of the components, we results in an annualized return from 1980 through May 2021 of 11.70%, which a maximum drawdown of 17.88%, and a super low Ulcer Index of 3.27.

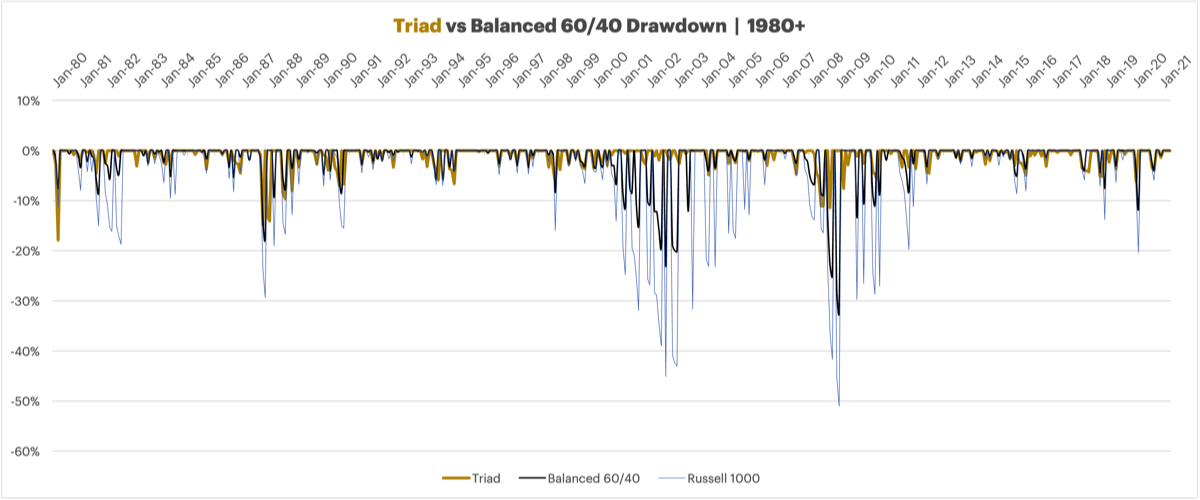

Mission Accomplished. The annualized returns handily beat a Balanced 60/40 portfolio 10.35% and in fact are only slightly lower than the buy and hold of the Russell 1000 which was 12.12%. The maximum drawdown is only 17.88% down from 32.33% for the 60/40 and 51.03% for the Russell 1000, and the Ulcer Index was reduced from 5.95 for the 60/40 and from 13.81 for the Russell 1000 to 3.27 for Triad. How large of a reduction in drawdowns is it going from an Ulcer Index of 5.95 or 13.81 to 3.27? The chart below shows it graphically, and it shows just how much more volatile not just the Russell 1000 but also a Balanced 60/40 portfolio are.

From January 1980 through May 2021 a buy and hold investment into a 60/40 portfolio would have provided an annualized return of 10.35%, however, it also had a maximum drawdown of 32.33% and has an ulcer index of 5.95 which is a measure of it's relative overall drawdown behavior (the higher the Ulcer Index the worse.) For reference, the Russell 1000 had an average annualized return of 12.12% with a maximum drawdown of 51.03% and an Ulcer Index of 13.81, the balanced 60/40 portfolio does have a reduced annualized return but it also has much more tame drawdown and Ulcer Index compared to 100% in broad US Market equities.

Triad uses a lookback which I believe to be something unique, I've not ever heard of this methodology used in other investment strategies. It is not looking for upward momentum over X number of months, nor is it using a weighted lookback, it is not looking for the current price to be above the SMA or EMA, it is not looking for moving average lines to intercept. It's something different that I came up with in order to try and be invested in the components without being subjected to too much drawdown, let's see how well it works.

By investing in the Russell 1000 using the lookback of Triad which has us invested when the lookback says to be invested, and out of the market in cash when not invested. This would result in an annualized return of 10.00%, which is only 0.35% lower than a balanced 60/40 [2.12% worse than the Russell 1000 buy and hold.] This would result in a maximum drawdown of 23.41% with an Ulcer Index of 8.22, this is a lower maximum drawdown than a 60/40 but a higher Ulcer Index. But of course, we're not having money sit idle when it isn't invested into the Russell 1000, it goes into the best performer based of either Short or Intermediate Term Treasuries, or Short Term Corporate Investment Grade Bonds. When we invest the idle funds in the best of the bonds instead of cash the return jumps up to 13.00% annualized returns, with the same maximum drawdown as with cash of 23.41%, and an even lower Ulcer Index of 6.84. This is far better returns that both a Balanced 60/40 and even a 100% Russell 1000 buy and hold portfolio with lower maximum drawdown and a good Ulcer Index.

But Triad has a goal of both a very low drawdown and a very low Ulcer Index paired with solid returns. The above results may be very attractive for some investors, but it is too volatile for what Triad was conceived to be.

The above example was putting 100% into the Russell 1000, or into the bonds. Now we look at the results of fully going into the Triad strategy. We split the portfolio into 1/3rds. The Russell 1000 and the Russell MidCap Value are both equity components and the ⅓ that goes into gold is intended to be a diversifier, a method of providing some returns when equities are not, and not being too heavily invested in equities which brings volatility and a higher Ulcer Index. By having up to 2/3rds of the portfolio equities, it roughly appromixates the equity allocation of a 60/40 portfolio.

When we use all three of the components, we results in an annualized return from 1980 through May 2021 of 11.70%, which a maximum drawdown of 17.88%, and a super low Ulcer Index of 3.27.

Mission Accomplished. The annualized returns handily beat a Balanced 60/40 portfolio 10.35% and in fact are only slightly lower than the buy and hold of the Russell 1000 which was 12.12%. The maximum drawdown is only 17.88% down from 32.33% for the 60/40 and 51.03% for the Russell 1000, and the Ulcer Index was reduced from 5.95 for the 60/40 and from 13.81 for the Russell 1000 to 3.27 for Triad. How large of a reduction in drawdowns is it going from an Ulcer Index of 5.95 or 13.81 to 3.27? The chart below shows it graphically, and it shows just how much more volatile not just the Russell 1000 but also a Balanced 60/40 portfolio are.

Pros/Cons

From 1980 to current Triad has returns which are very similar to market returns with far less volatility and drawdown - and it wasn't supposed to compete with the market indexes it was intended to compete with the 60/40. Looking ahead it should do even better than the 60/40 because the aggregate bond holdings of the 60/40 are not likely to provide the incredible benefit that they have for the last 50 years.

Triad is a terrific strategy to my eyes, it is not an eye popping high return strategy, but it has a terrific return for such low drawdown and volatility. This strategy certainly has a home in my personal allocations.

RETURNS and TAXES

The returns as calculated in my Triad model does a complete rebalance each and every month. In practice this is not how I actually invest in it. I don't want to needlessly rebalance and possibly incur a tax event if it is not necessary. Instead of making each invested component to be 1/3rd each month, I instead let a 1/3rd invested amount stay until it goes to bonds. For example, if for January the Russell 1000 is to be invested, I put 1/3rd in the Russell 1000, and I leave it alone until it gets the sell signal. I don't yet have the data on how this affects the returns, it certainly makes the taxes more long term gains than short term. It is seemingly simple but in practice rather complex to change the model for to track the investments how I am actually doing it. I may come back to this later, but for now I'm leaving the model with a fresh ⅓ adjustment every month (which would be fine in a tax deferred account).

From 1980 to current Triad has returns which are very similar to market returns with far less volatility and drawdown - and it wasn't supposed to compete with the market indexes it was intended to compete with the 60/40. Looking ahead it should do even better than the 60/40 because the aggregate bond holdings of the 60/40 are not likely to provide the incredible benefit that they have for the last 50 years.

Triad is a terrific strategy to my eyes, it is not an eye popping high return strategy, but it has a terrific return for such low drawdown and volatility. This strategy certainly has a home in my personal allocations.

RETURNS and TAXES

The returns as calculated in my Triad model does a complete rebalance each and every month. In practice this is not how I actually invest in it. I don't want to needlessly rebalance and possibly incur a tax event if it is not necessary. Instead of making each invested component to be 1/3rd each month, I instead let a 1/3rd invested amount stay until it goes to bonds. For example, if for January the Russell 1000 is to be invested, I put 1/3rd in the Russell 1000, and I leave it alone until it gets the sell signal. I don't yet have the data on how this affects the returns, it certainly makes the taxes more long term gains than short term. It is seemingly simple but in practice rather complex to change the model for to track the investments how I am actually doing it. I may come back to this later, but for now I'm leaving the model with a fresh ⅓ adjustment every month (which would be fine in a tax deferred account).