My investing update for the first half of 2021

How do I invest my money? Do I put my money where my mouth is and invest in the DMS strategies that I run?

YES is the short answer.

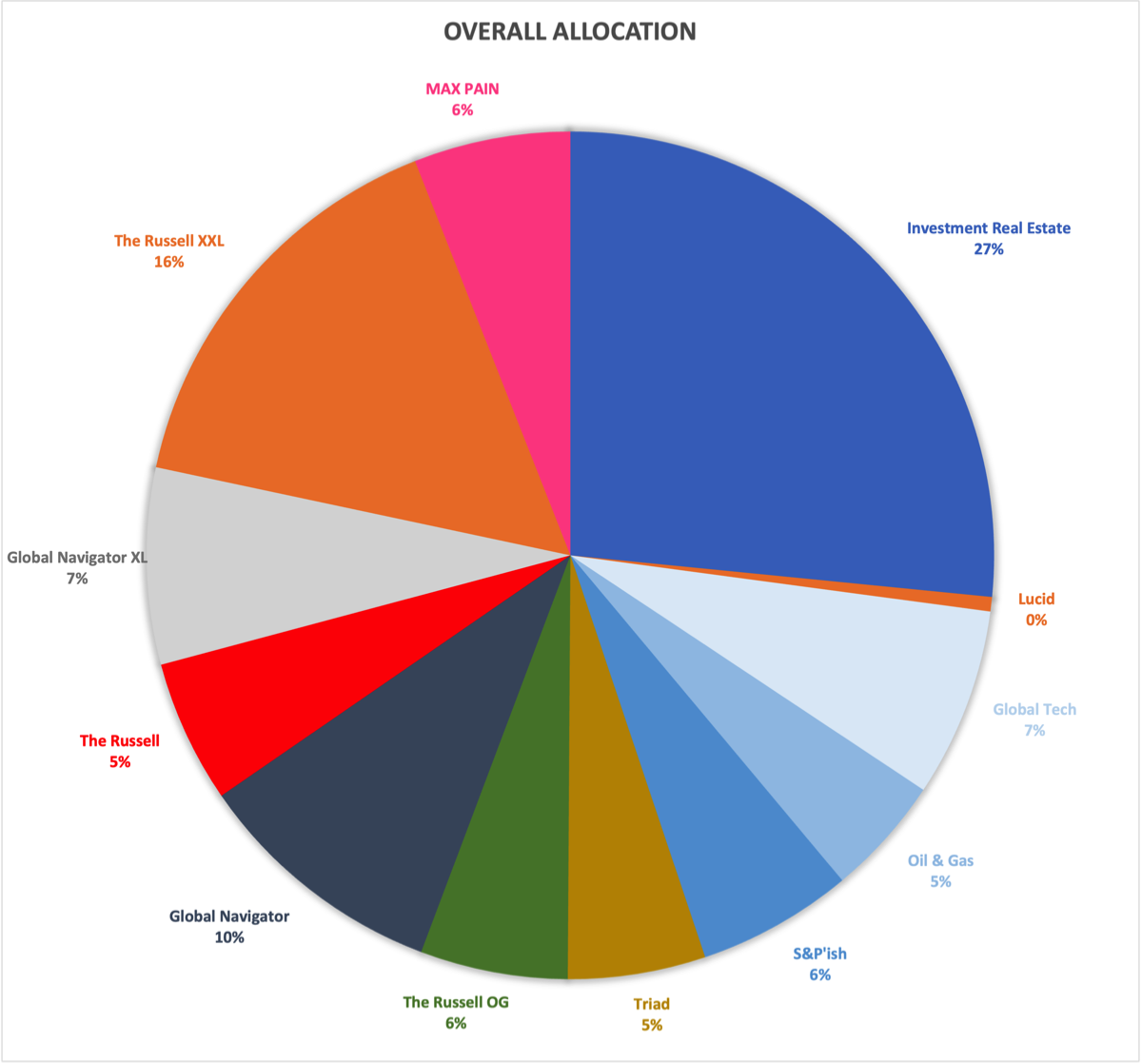

My high level targets are to have around 25% of my investments in investment real estate (residence does not go towards this allocation), and 75% in the markets, of that 75%, I have two accounts that are in the S&P, a 529 plan and my 401k. I hold 2% of my IRA in Lucid stock, and around a 6% total allocation in two oil and gas stocks. The remainder is invested in the DMS strategies.

I am of the opinion that if you do not write down your investment goals and target allocations, then it is not too likely to happen the way that you want. I have mine documented to help keep me on track.

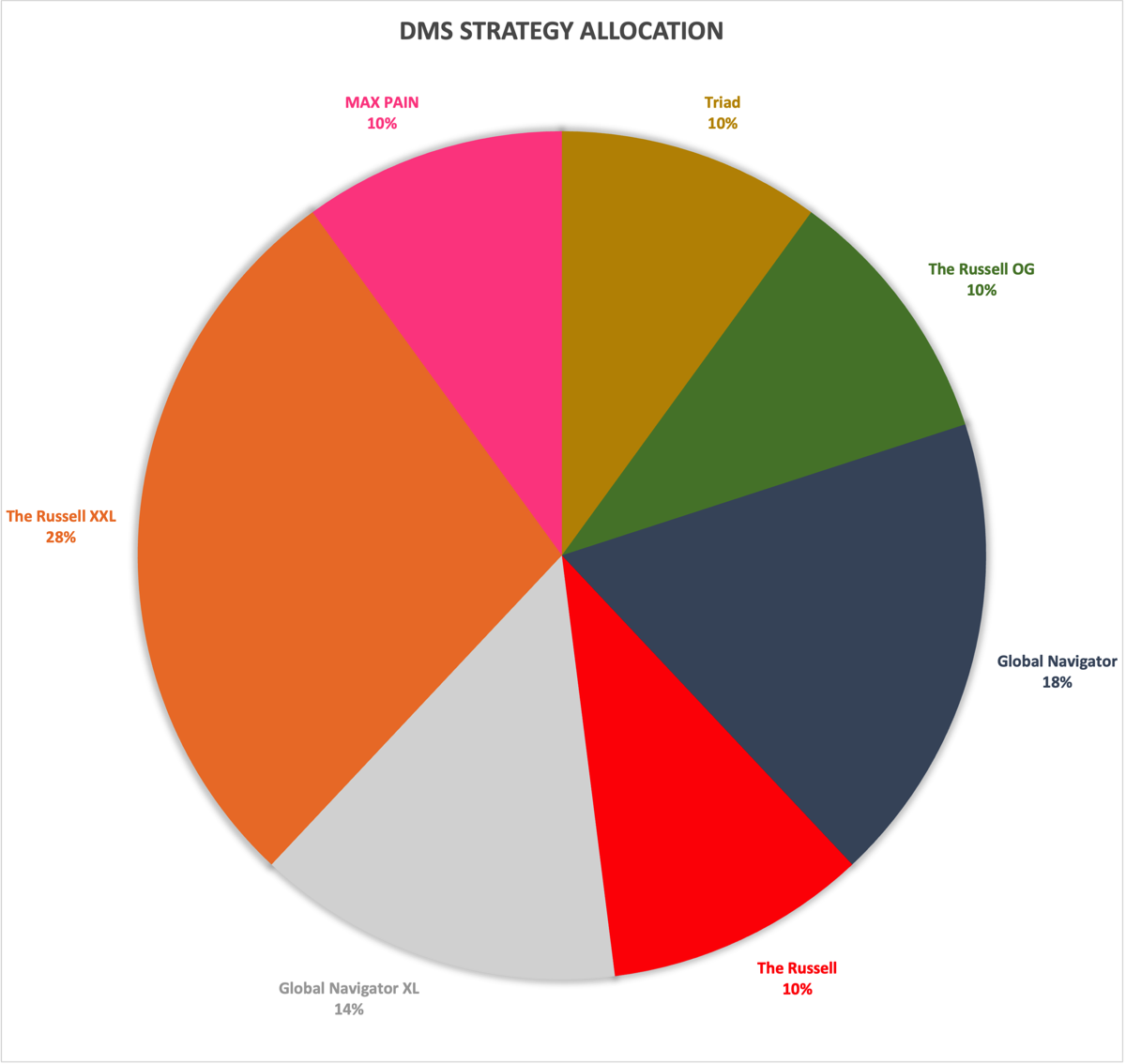

2021 has been a year with quite a few changes and updates to the DMS strategies, my allocation has changed as a result. This is how I am currently invested into the DMS strategies.

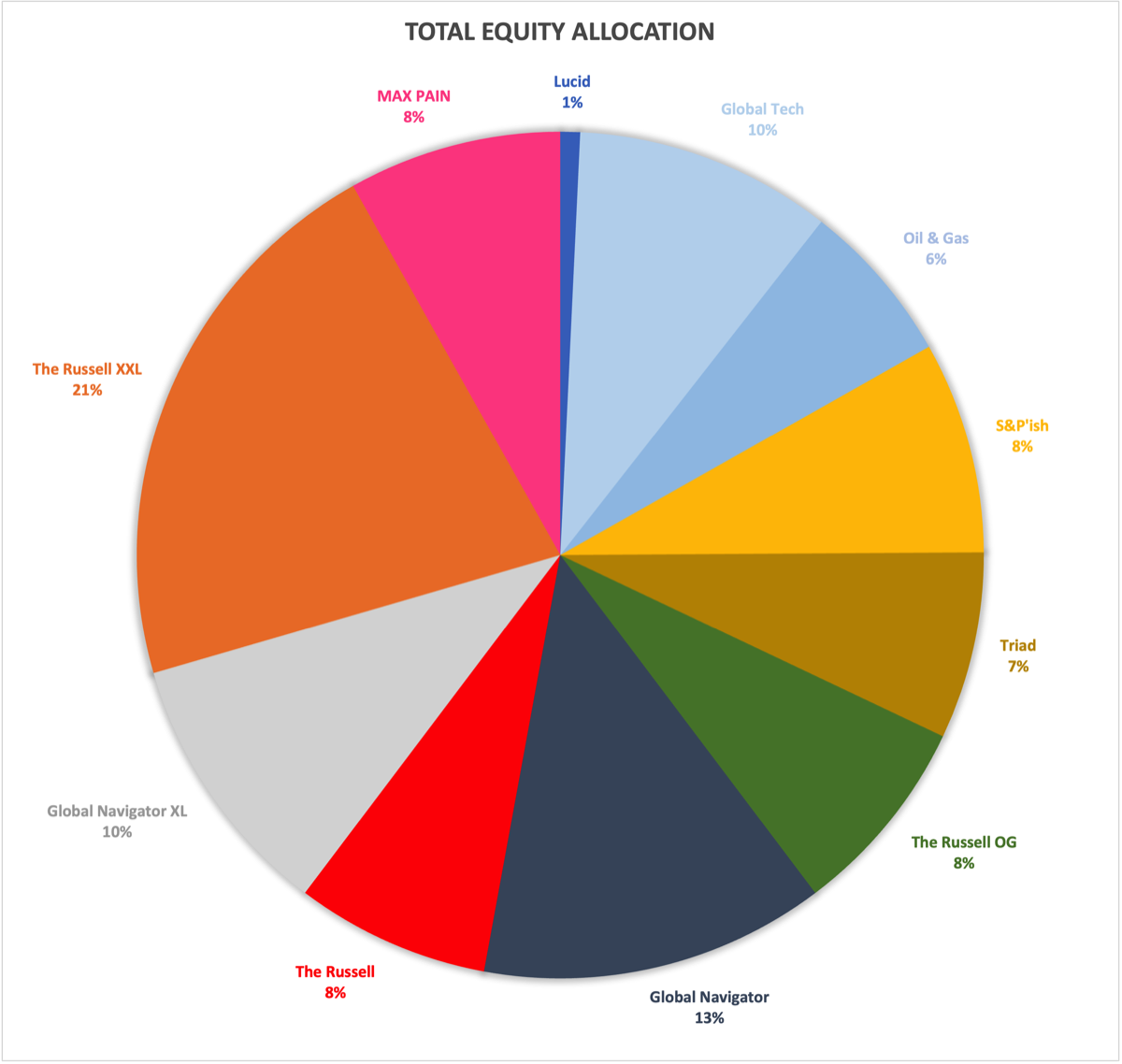

My equity investments have the three stocks I mentioned, and the 529, and 401k accounts, I also hold around a 10% allocation in global technology. These non-DMS investments total 25% of my equity investments, the remaining 75% is invested into DMS strategies as follows:

10% Triad

10% The Russell OG

18% Global Navigator

10% The Russell

14% Global Navigator XL

28% The Russell XXL

10% MAX PAIN

I did not come to this allocation from a macro perspective, rather I look at each individual account and take the goals for it into account and select which strategies to use. I look at the metrics for the strategies to decide how aggressive or conservative I want to be.

Lucid is a car company that I appreciate and decided to take a flyer on it, put a little money into it and see where it is in 10 years. If I lose it all, bummer. If it does amazing, terrific! There are two individual oil and gas companies I own which have been terrible long term holdings for me, that is up through about April 2020, and they have been on fire ever since. I have literally been sitting on paper losses since buying them and just recently that flipped to turning a profit. I have already sold some of them and will continue to liquidate them fully before the end of 2021. The proceeds will go into my strategies. Ultimately I'm glad to have gone through this experience with these stocks 1st hand, it really reinforced my opinion that the only way that I want to be holding individual securities is when they are above their 200 day moving average, if they tank, sell them and move on, don't hold forever hoping that they will recover - I consider myself fortunate that these have recovered.

YES is the short answer.

My high level targets are to have around 25% of my investments in investment real estate (residence does not go towards this allocation), and 75% in the markets, of that 75%, I have two accounts that are in the S&P, a 529 plan and my 401k. I hold 2% of my IRA in Lucid stock, and around a 6% total allocation in two oil and gas stocks. The remainder is invested in the DMS strategies.

I am of the opinion that if you do not write down your investment goals and target allocations, then it is not too likely to happen the way that you want. I have mine documented to help keep me on track.

2021 has been a year with quite a few changes and updates to the DMS strategies, my allocation has changed as a result. This is how I am currently invested into the DMS strategies.

My equity investments have the three stocks I mentioned, and the 529, and 401k accounts, I also hold around a 10% allocation in global technology. These non-DMS investments total 25% of my equity investments, the remaining 75% is invested into DMS strategies as follows:

10% Triad

10% The Russell OG

18% Global Navigator

10% The Russell

14% Global Navigator XL

28% The Russell XXL

10% MAX PAIN

I did not come to this allocation from a macro perspective, rather I look at each individual account and take the goals for it into account and select which strategies to use. I look at the metrics for the strategies to decide how aggressive or conservative I want to be.

Lucid is a car company that I appreciate and decided to take a flyer on it, put a little money into it and see where it is in 10 years. If I lose it all, bummer. If it does amazing, terrific! There are two individual oil and gas companies I own which have been terrible long term holdings for me, that is up through about April 2020, and they have been on fire ever since. I have literally been sitting on paper losses since buying them and just recently that flipped to turning a profit. I have already sold some of them and will continue to liquidate them fully before the end of 2021. The proceeds will go into my strategies. Ultimately I'm glad to have gone through this experience with these stocks 1st hand, it really reinforced my opinion that the only way that I want to be holding individual securities is when they are above their 200 day moving average, if they tank, sell them and move on, don't hold forever hoping that they will recover - I consider myself fortunate that these have recovered.

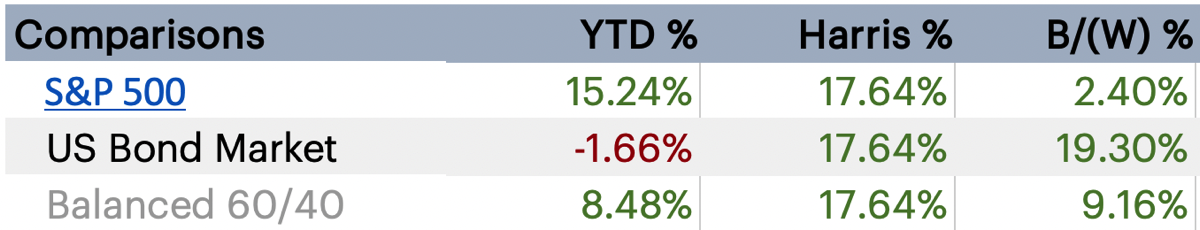

From January 1, 2021 through June 30, 2021 my overall brokerage returns for all accounts is 17.64% using money weighted returns. I track all +/- into the accounts, however, I use a mid-month date for all money in and money out to make it easier, I don't track the actual day of the month that there was money in or out. I assume it kind of washes out over time, so my actual return could be just slightly +/- if I had tracked it all by the day not mid-month.

17.64% is 2.4% ahead of the S&P halfway through the year, and 19.3% better than the aggregate bond return, resulting in a 9.16% better performance than the venerable 60/40 return of 8.48%.

The two oil & gas stocks gave me a bump in performance this year, otherwise I would likely be just slightly ahead of the S&P.