Short vs Long Term Gains

An investor in DMS strategies asked if I could quantify the effects more gains taxed as long term gains with LT Gain 2X compared to The Russell and the impacts over time.

This investor is saddled with 41% long term and 24% short term tax rates so I used those in the calculations.

For this exercise, current tax rates were extended back in time, this would have been a research project if I tried to figure out what that long and short term tax rates were each year back to 1980, this is more to give an idea as to the benefit of having more gains realized as long term, not an exact calculation on what the actual taxes would have been.

CAGR:

The increased amount of gains realized as long term makes a profound difference in the ending account balance over time.

This investor is saddled with 41% long term and 24% short term tax rates so I used those in the calculations.

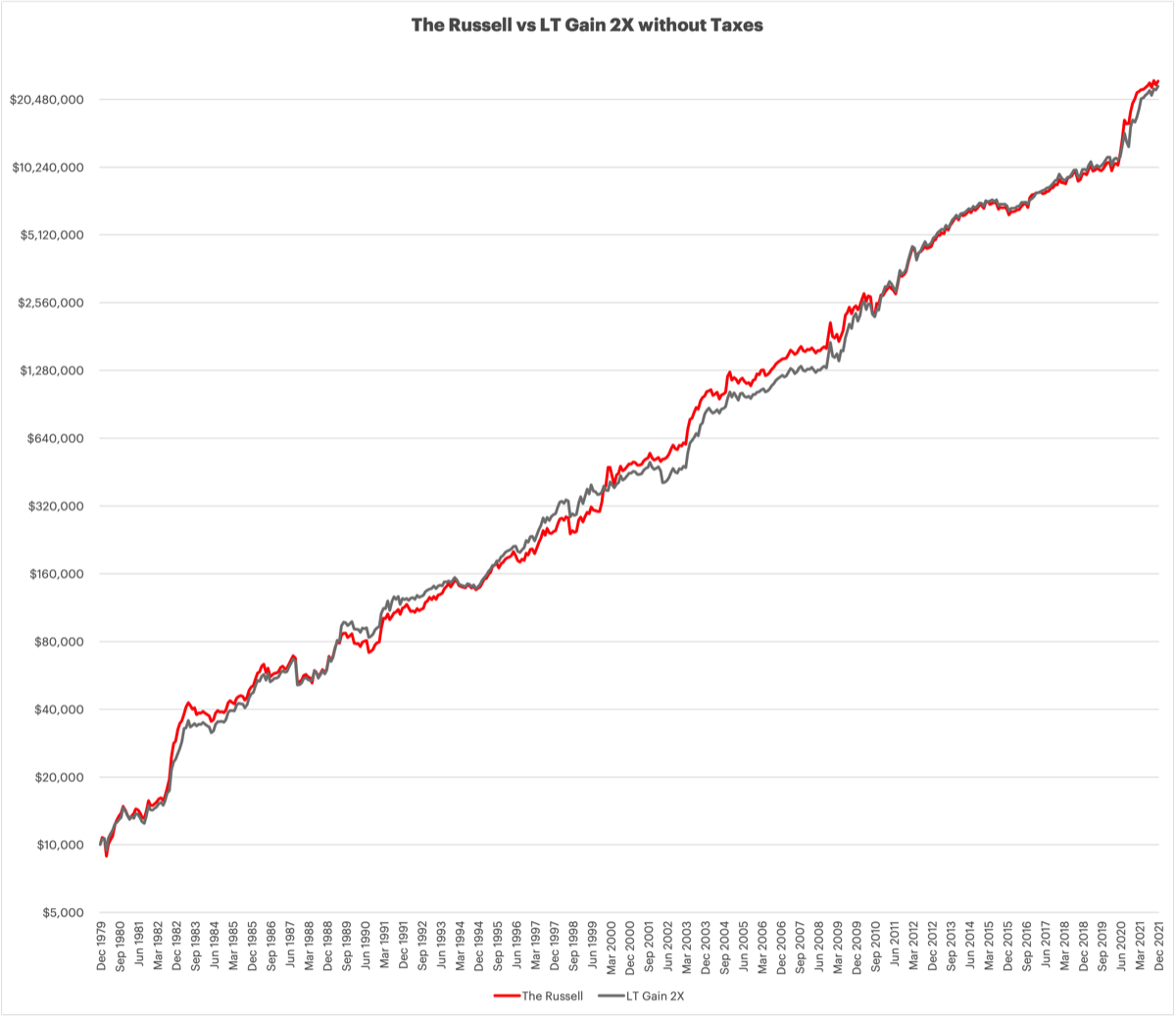

- Looking at The Russell and LT Gain 2X, not accounting for any taxes, The Russell goes from 1980 through 2021 with a 5.2% higher ending balance than LT Gain 2X.

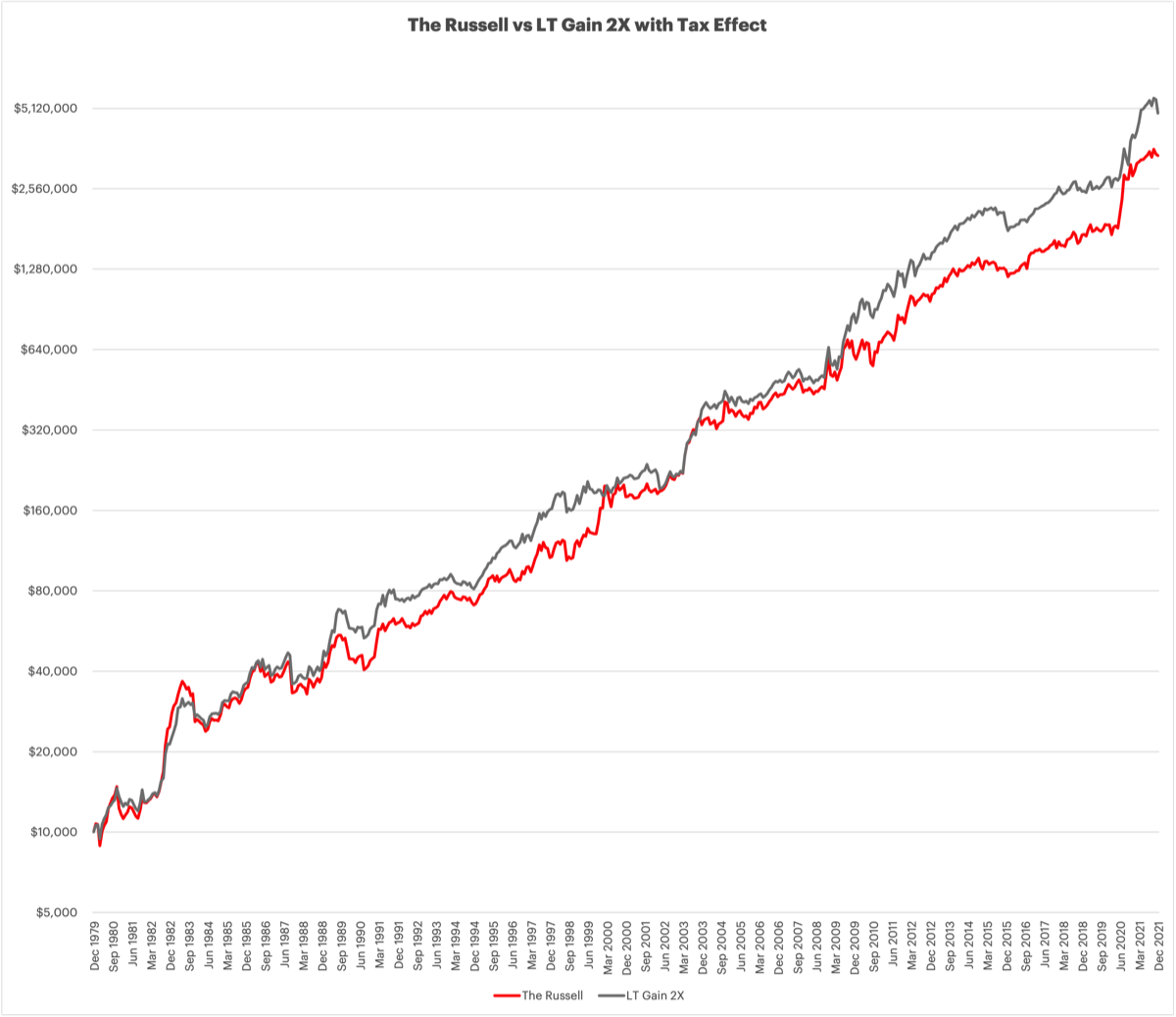

- If $1,000 had been invested in The Russell from 1980 through 2021 they would have $3,407,664 at the end. Taxes were taken out at the end of every December, including 2021.

- If $1,000 had been invested in LT Gain 2X from 1980 through 2021 they would have $4,914,314 at the end. An increase of 44% ending account balance due to the LT Gain 2X strategy having more long term gains.

- The 44% higher ending balance is over and above the 5.2% lower balance originally in looking at the untaxed strategy returns. Roughly 50% better returns because of the increased long term gains.

For this exercise, current tax rates were extended back in time, this would have been a research project if I tried to figure out what that long and short term tax rates were each year back to 1980, this is more to give an idea as to the benefit of having more gains realized as long term, not an exact calculation on what the actual taxes would have been.

CAGR:

- The Russell 20.44% untaxed

- LT Gain 2X 20.29% untaxed

- The Russell 14.89% taxed

- LT Gain 2X 15.90% taxed

- The Russell -27.15% Change in untaxed CAGR to taxed CAGR

- LT Gain 2X -21.63% Change in untaxed CAGR to taxed CAGR

The increased amount of gains realized as long term makes a profound difference in the ending account balance over time.

The first chart below is the baseline showing how The Russell and LT Gain 2X performed without accounting for any taxes.

This chart shows the impacts of the 41% short term and 24% long term tax rates.