LT Gain Strategies

BIG changes around DMS - out with 3 strategies, in with 2 strategies

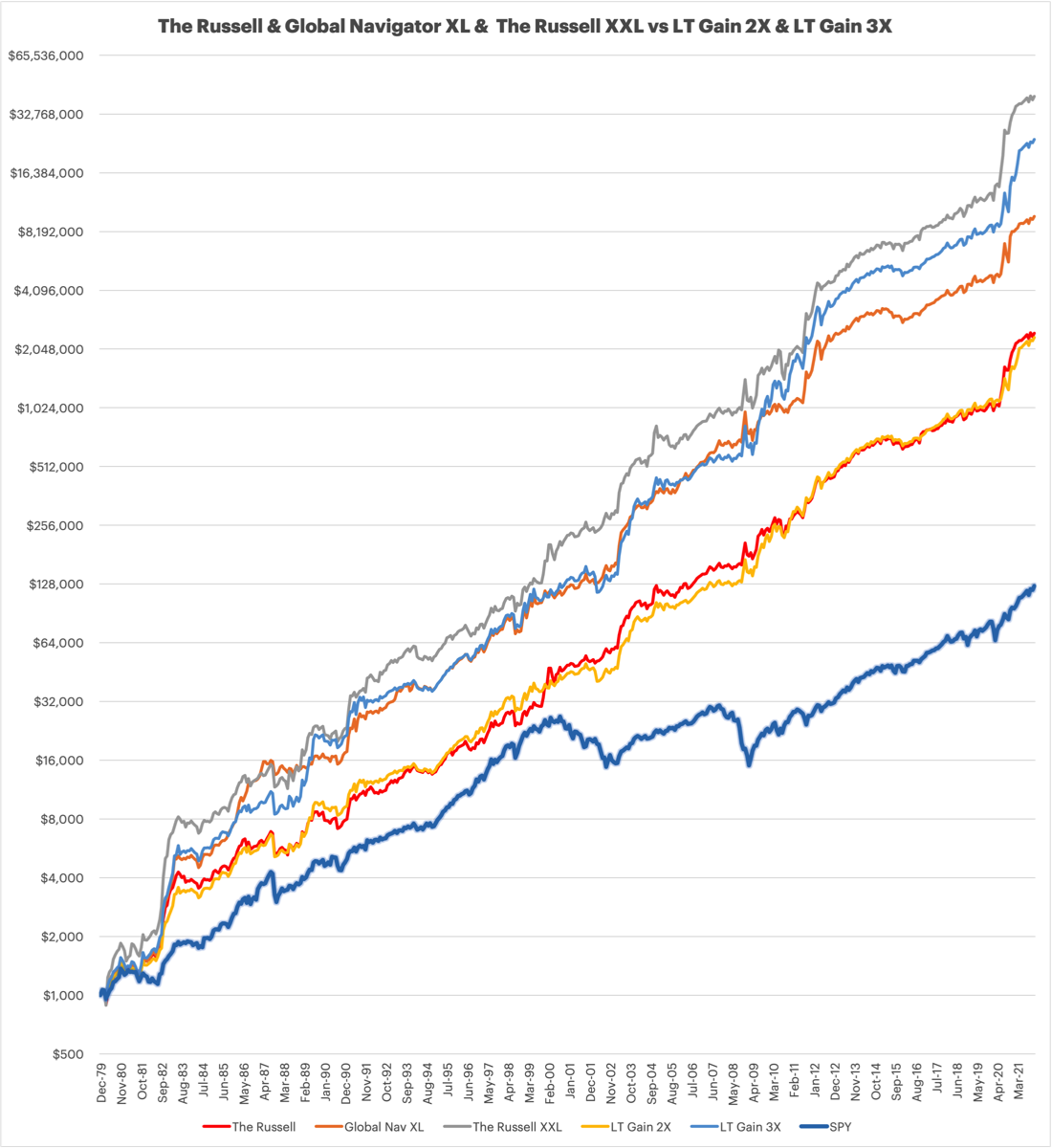

I have some accounts which are not tax deferred and I found myself looking at some strategies by other people and per usual started looking at how I could change my strategies to better accomplish more of the gains going to long term instead of short term. The end result is that I am deprecating The Russell, Global Navigator XL, and The Russell XXL and replacing them with two new strategies, LT Gain 2X, and LT Gain 3X.

When presented with new compelling information, I change my mind.

The Russell, looking at results from 1980 through 2021, only has about 12.5% of it's gains as long term, the bulk of the gains are realized as short term. LT Gain 2X has nearly identical performance as The Russell but manages to have nearly 70% of it's gains realized as long term. This does not matter in tax deferred accounts, but it can be a significant difference for invested funds in a regular non-tax deferred account.

The Russell vs LT Gain 2X

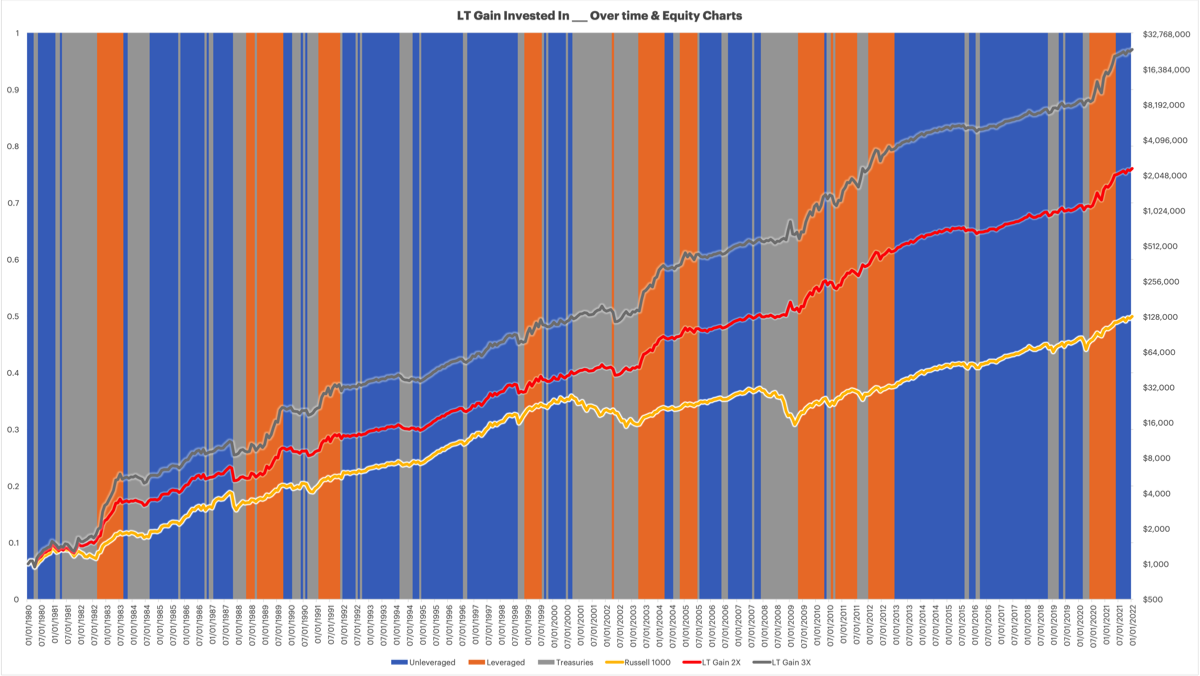

Both strategies go into Long Term Treasuries when not invested in equities. The Russell invests in the best relative performer of three options when the general market has upward momentum. The change to LT Gain 2X is instead of looking for the best relative performer, it only goes into the Russell 1000 when it is moving upward, there is no dual momentum here, just [single] momentum. Smart Leverage is still used, and after an outsized month end drawdown in the markets LT Gain 2X will go into SSO which is 2X the S&P 500. This strategy will remain in the leveraged ETF for up to 1 year at which time it exits the leveraged ETF, locks in the long term gains and goes back into the unleveraged Russell 1000. The performance of exiting leverage after 12 months holding is only about 0.5% CAGR lower than not having this 1 year hold filter, and the volatility is noticeably lower, it is a great trade off.

From 1980 through 2021:

CAGR

The Russell 20.44%

LT Gain 2X 20.29%

Sortino Ratio

The Russell 2.20

LT Gain 2X 2.26

Maximum Drawdown

The Russell -24.12%

LT Gain 2X -23.41%

Ulcer Index

The Russell 6.07

LT Gain 2X 5.58

Very similar long term results, and a huge improvement in the amount of gains that are realized as long term instead of short term.

Global Navigator XL & The Russell XXL vs LT Gain 3X

Global Navigator XL goes into Extended Duration Treasuries when out of equities, The Russell XXL goes into 3X Long Term Treasuries the 1st month out of equities, and Extended Duration Treasuries in subsequent months when out of equities. LT Gain 3X uses Extended Duration Treasuries when out of equities.

GN XL and TR XXL each use Smart Leverage going into 3X, as does LT Gain 3X. The new strategy also uses just 1 investment in order to maximize the hold times without switching to the better relative performer, and it pays huge dividends for long term gains, they are nearly 70% instead of the about 15% for GN XL and TR XXL.

From 1980 through 2021:

CAGR

Global Navigator XL 24.46%

The Russell XXL 28.72%

LT Gain 3X 27.17%

Sortino Ratio

Global Navigator XL 2.49

The Russell XXL 2.59

LT Gain 3X 2.40

Maximum Drawdown

Global Navigator XL -28.54%

The Russell XXL -29.49%

LT Gain 3X -28.54%

Ulcer Index

Global Navigator XL 5.45

The Russell XXL 6.9

LT Gain 3X 6.62

And regarding the CAGR, if I slot in TMF for the 1st month out of equities with LT Gain 3X as is done by The Russell XXL, the CAGR for LT Gain 3X goes up to 29.99%, even higher than The Russell XXL and maintaining those excellently high long term gains. I am keeping LT Gain 3X with EDV for all months out of equities, if you want to try and juice your returns a little, you can always go with TMF the first month in Treasuries.

I have some accounts which are not tax deferred and I found myself looking at some strategies by other people and per usual started looking at how I could change my strategies to better accomplish more of the gains going to long term instead of short term. The end result is that I am deprecating The Russell, Global Navigator XL, and The Russell XXL and replacing them with two new strategies, LT Gain 2X, and LT Gain 3X.

When presented with new compelling information, I change my mind.

The Russell, looking at results from 1980 through 2021, only has about 12.5% of it's gains as long term, the bulk of the gains are realized as short term. LT Gain 2X has nearly identical performance as The Russell but manages to have nearly 70% of it's gains realized as long term. This does not matter in tax deferred accounts, but it can be a significant difference for invested funds in a regular non-tax deferred account.

The Russell vs LT Gain 2X

Both strategies go into Long Term Treasuries when not invested in equities. The Russell invests in the best relative performer of three options when the general market has upward momentum. The change to LT Gain 2X is instead of looking for the best relative performer, it only goes into the Russell 1000 when it is moving upward, there is no dual momentum here, just [single] momentum. Smart Leverage is still used, and after an outsized month end drawdown in the markets LT Gain 2X will go into SSO which is 2X the S&P 500. This strategy will remain in the leveraged ETF for up to 1 year at which time it exits the leveraged ETF, locks in the long term gains and goes back into the unleveraged Russell 1000. The performance of exiting leverage after 12 months holding is only about 0.5% CAGR lower than not having this 1 year hold filter, and the volatility is noticeably lower, it is a great trade off.

From 1980 through 2021:

CAGR

The Russell 20.44%

LT Gain 2X 20.29%

Sortino Ratio

The Russell 2.20

LT Gain 2X 2.26

Maximum Drawdown

The Russell -24.12%

LT Gain 2X -23.41%

Ulcer Index

The Russell 6.07

LT Gain 2X 5.58

Very similar long term results, and a huge improvement in the amount of gains that are realized as long term instead of short term.

Global Navigator XL & The Russell XXL vs LT Gain 3X

Global Navigator XL goes into Extended Duration Treasuries when out of equities, The Russell XXL goes into 3X Long Term Treasuries the 1st month out of equities, and Extended Duration Treasuries in subsequent months when out of equities. LT Gain 3X uses Extended Duration Treasuries when out of equities.

GN XL and TR XXL each use Smart Leverage going into 3X, as does LT Gain 3X. The new strategy also uses just 1 investment in order to maximize the hold times without switching to the better relative performer, and it pays huge dividends for long term gains, they are nearly 70% instead of the about 15% for GN XL and TR XXL.

From 1980 through 2021:

CAGR

Global Navigator XL 24.46%

The Russell XXL 28.72%

LT Gain 3X 27.17%

Sortino Ratio

Global Navigator XL 2.49

The Russell XXL 2.59

LT Gain 3X 2.40

Maximum Drawdown

Global Navigator XL -28.54%

The Russell XXL -29.49%

LT Gain 3X -28.54%

Ulcer Index

Global Navigator XL 5.45

The Russell XXL 6.9

LT Gain 3X 6.62

And regarding the CAGR, if I slot in TMF for the 1st month out of equities with LT Gain 3X as is done by The Russell XXL, the CAGR for LT Gain 3X goes up to 29.99%, even higher than The Russell XXL and maintaining those excellently high long term gains. I am keeping LT Gain 3X with EDV for all months out of equities, if you want to try and juice your returns a little, you can always go with TMF the first month in Treasuries.

By dropping 3 of the strategies for 2 new strategies, we streamline the strategy offerings a little bit, and otherwise offer very similar strategies with superior long term gains, this is a big win to my eyes, even if the new strategies strictly speaking aren't Dual Momentum, just [single] Momentum. The backtests show that they do not suffer in performance or volatility, we only gain from them without losing anything other than more frequent trades.

Housekeeping note, I will have put a new Reporting Deck for the end of December that reflects the new strategies on the site as well as updated the recent Smart Leverage post from 12/25/2021 to reflect the Smart Leverage history for LT Gain 3X instead of Global Navigator XL.

Housekeeping note, I will have put a new Reporting Deck for the end of December that reflects the new strategies on the site as well as updated the recent Smart Leverage post from 12/25/2021 to reflect the Smart Leverage history for LT Gain 3X instead of Global Navigator XL.