Smart Leverage

Smart Leverage: What is it, how does it work, and how successful has it been?

DMS has 6 strategies in total. Triad and The Russell OG don't ever use leverage ever. MAX PAIN is the most aggressive and volatile strategy, it is always in 3X Funds. The other 3 funds are normally in 1X, unleveraged funds, but use Smart Leverage. These funds are: Global Navigator, LT Gain 2X and LT Gain 3X.

Smart Leverage is used to take advantage when the odds are in our favor, to go big with Leveraged ETF's. When there is a bigger than normal drop in the markets on a month end basis, the 3 funds which use Smart Leverage will go from 1X funds into Leveraged Funds. Global Navigator and LT Gain 2X go to 2X funds, and LT Gain 3X goes into 3X funds.

Smart Leverage does not kick in often, it is selective and rules based. I will show the results for all three strategies which use Smart Leverage.

DMS has 6 strategies in total. Triad and The Russell OG don't ever use leverage ever. MAX PAIN is the most aggressive and volatile strategy, it is always in 3X Funds. The other 3 funds are normally in 1X, unleveraged funds, but use Smart Leverage. These funds are: Global Navigator, LT Gain 2X and LT Gain 3X.

Smart Leverage is used to take advantage when the odds are in our favor, to go big with Leveraged ETF's. When there is a bigger than normal drop in the markets on a month end basis, the 3 funds which use Smart Leverage will go from 1X funds into Leveraged Funds. Global Navigator and LT Gain 2X go to 2X funds, and LT Gain 3X goes into 3X funds.

Smart Leverage does not kick in often, it is selective and rules based. I will show the results for all three strategies which use Smart Leverage.

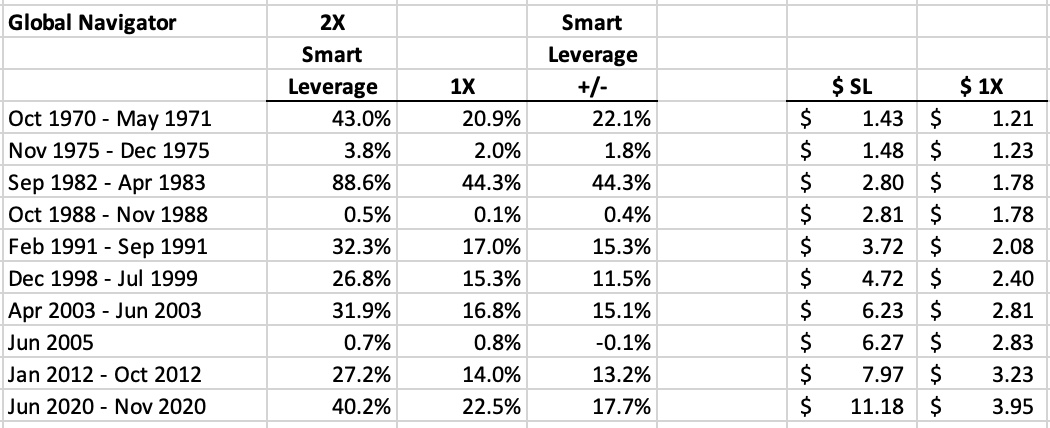

Global Navigator used Smart Leverage a total of 10 times from 1970 through 2021, and for a total of 56 months out of 624 months, 9% of the time. Only 1 of the 10 periods did Smart Leverage perform worse than had you been in a regular 1X unleveraged fund. There was a huge improvement in overall results from using Smart Leverage for Global Navigator.

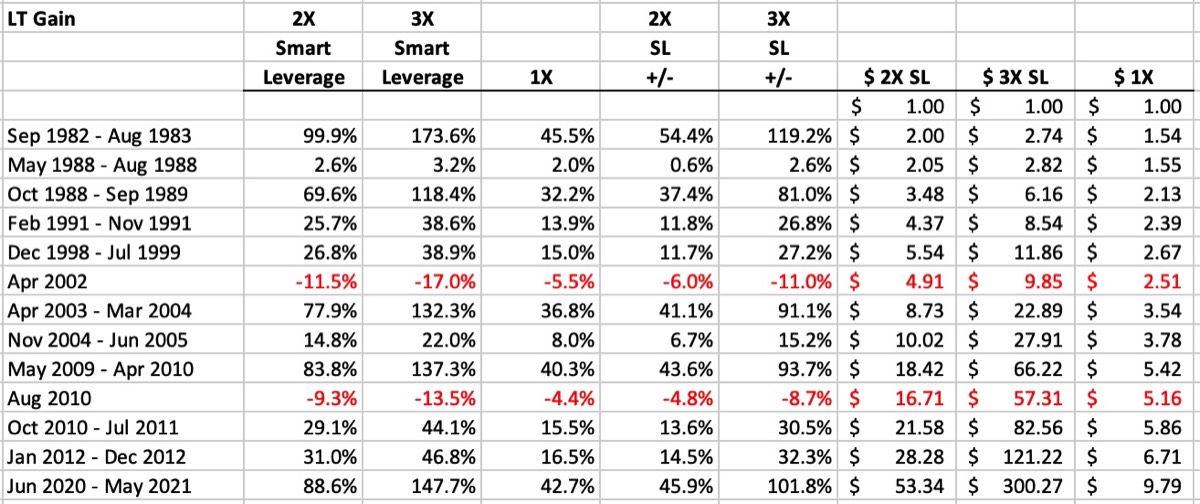

The two LT Gain strategies took advantage of Smart Leverage 13 times from 1980 through 2021, for a total of 114 months, 22.6% of the time. These strategies go into Smart Leverage more than Global Navigator since there isn't a suitable Foreign leveraged ETF with enough volume to use in that strategy, so it only leverages up with the US Market, not Foreign. The LT Gain strategies had 11 instances of positive and better than 1X investments, and two periods with negative returns which were also greater than the 1X losses. If we invested $1 during these time periods of Smart Leverage, the unleveraged 1X investments would have grown to $9.79, while the 2X Smart Leverage grew to $53.34, and the 3X to $300.27. Tremendous improvements in gains.

Smart Leverage has dramatically improved the strategy results in the past, however, it is by no means guaranteed to work in the future and by using leverage could cause rather large drawdowns if the market turns negative while in leveraged funds. Caution is advised, as is choosing an allocation that you are comfortable with.

The two LT Gain strategies took advantage of Smart Leverage 13 times from 1980 through 2021, for a total of 114 months, 22.6% of the time. These strategies go into Smart Leverage more than Global Navigator since there isn't a suitable Foreign leveraged ETF with enough volume to use in that strategy, so it only leverages up with the US Market, not Foreign. The LT Gain strategies had 11 instances of positive and better than 1X investments, and two periods with negative returns which were also greater than the 1X losses. If we invested $1 during these time periods of Smart Leverage, the unleveraged 1X investments would have grown to $9.79, while the 2X Smart Leverage grew to $53.34, and the 3X to $300.27. Tremendous improvements in gains.

Smart Leverage has dramatically improved the strategy results in the past, however, it is by no means guaranteed to work in the future and by using leverage could cause rather large drawdowns if the market turns negative while in leveraged funds. Caution is advised, as is choosing an allocation that you are comfortable with.