Bear Markets and Major Pullbacks

Allocate Smartly is a site that I follow their blog, they track over 60 Tactical Asset Allocation Strategies, I enjoy reading what they put out on the blog. They recently put out a post comparing the average of all the strategies that they follow over all bear markets and major market pullbacks and compare that average to the S&P 500 and a 60/40 allocation.

Note that Allocate Smartly does not track any strategies which use leverage, they are all unleveraged all of the time.

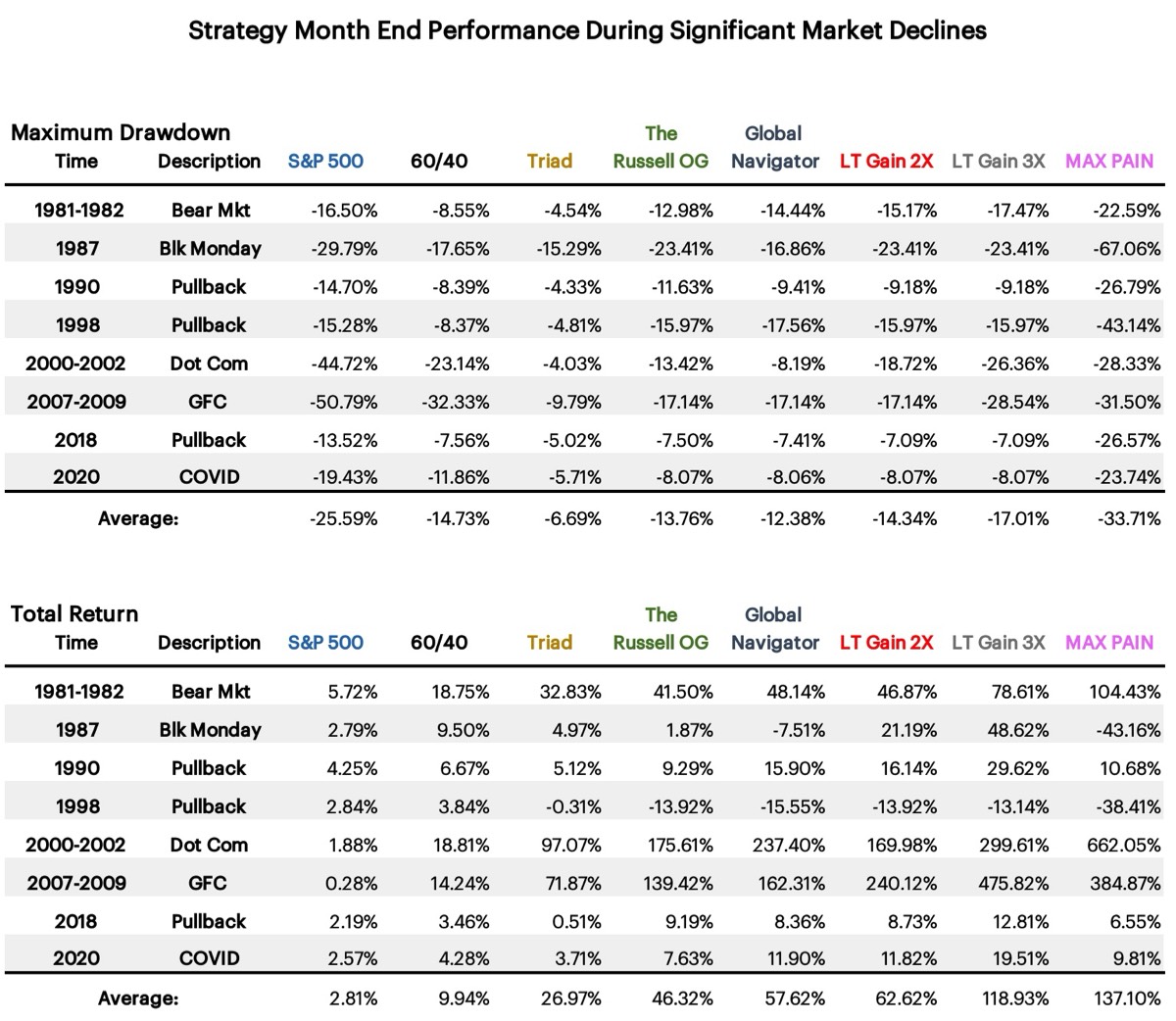

I had thought of doing a similar post before for the DMS strategies, so now seemed like the time.

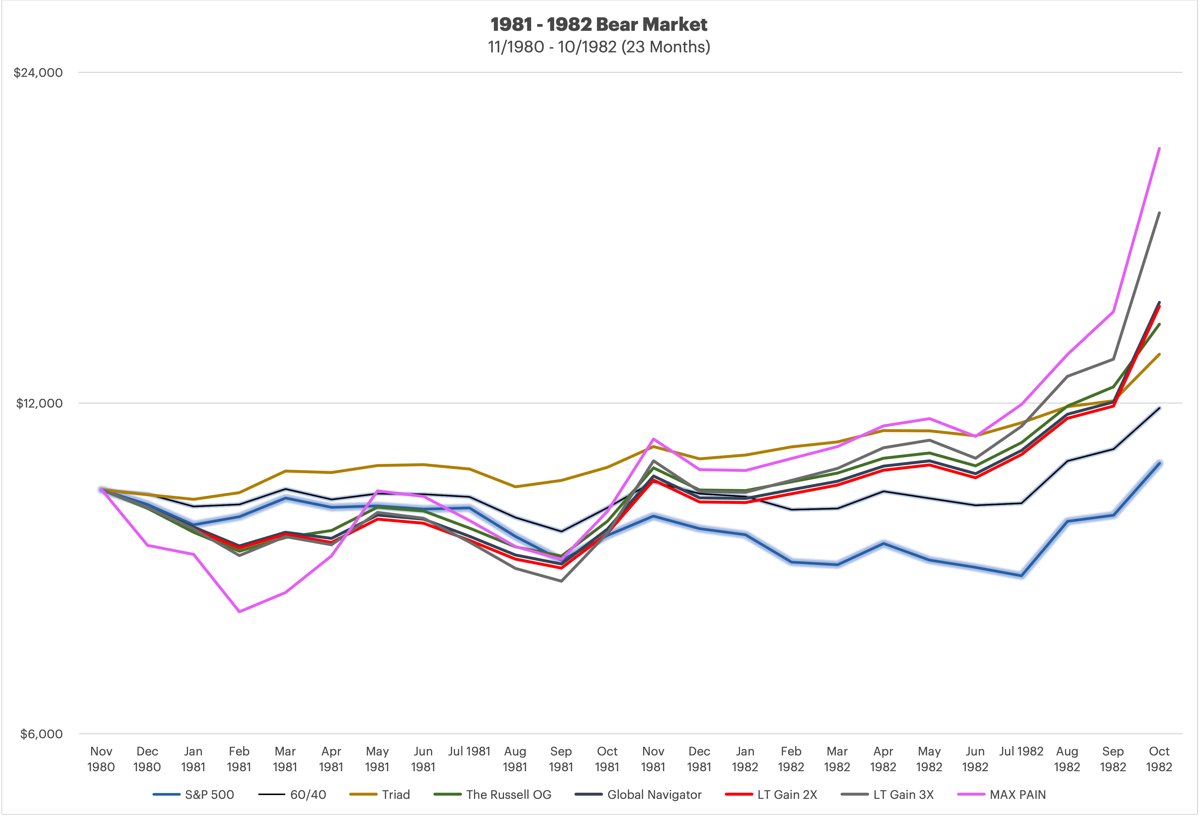

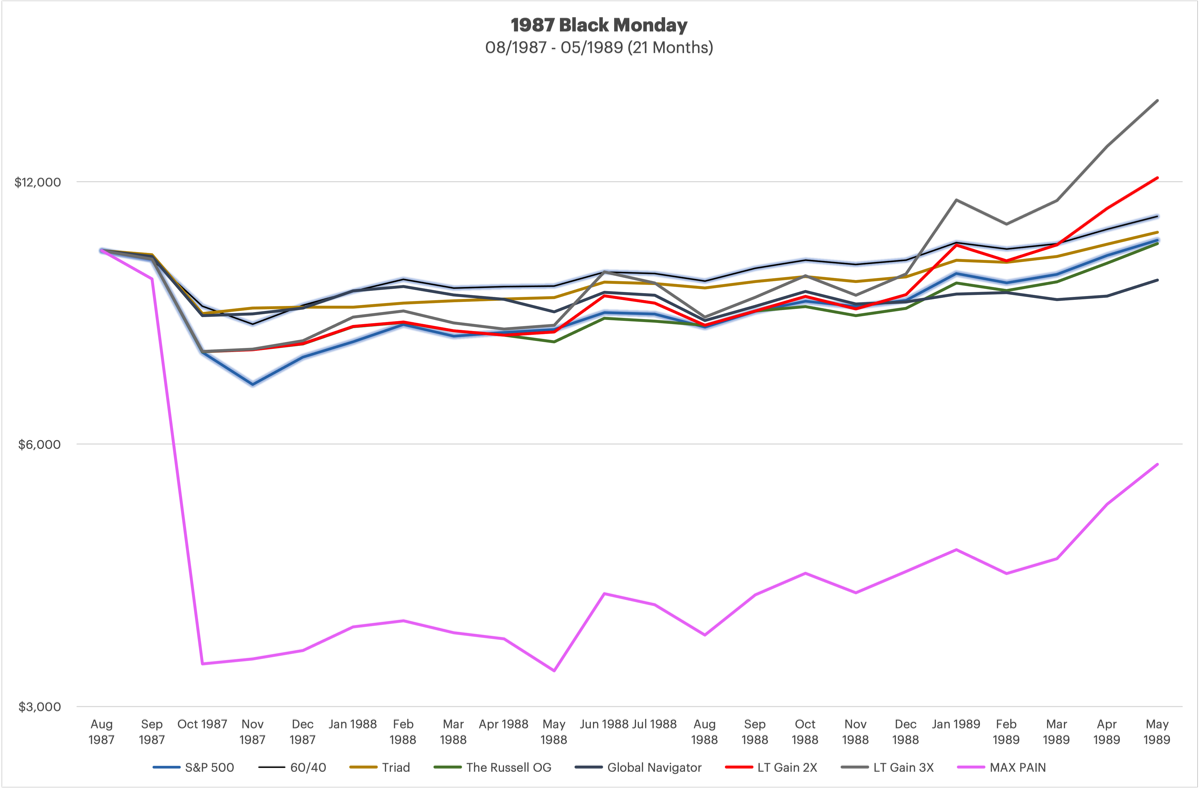

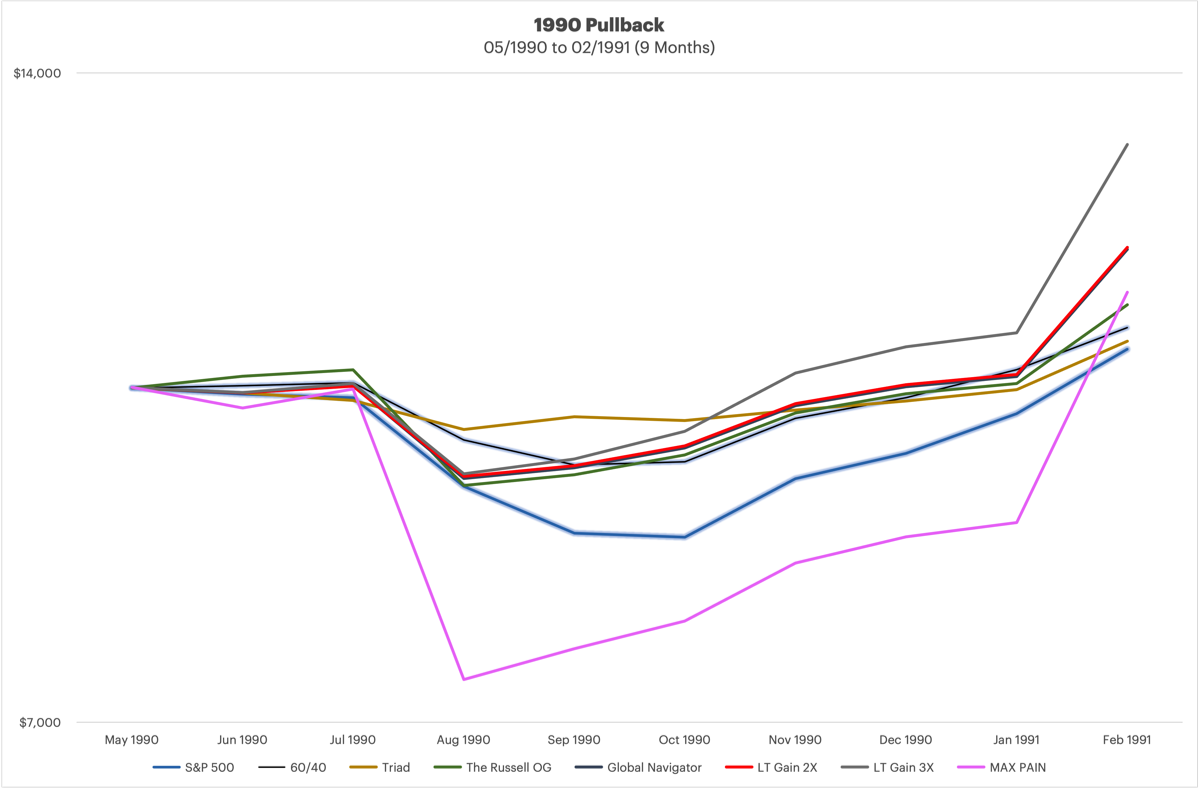

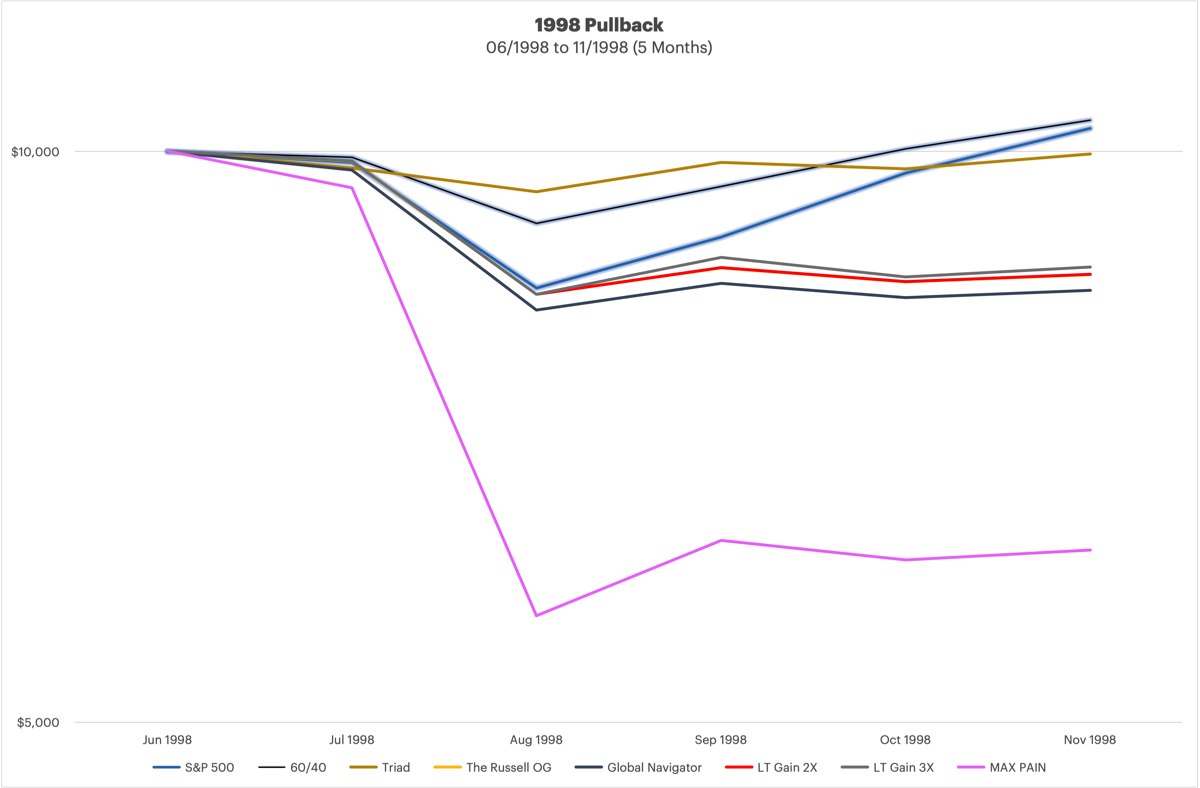

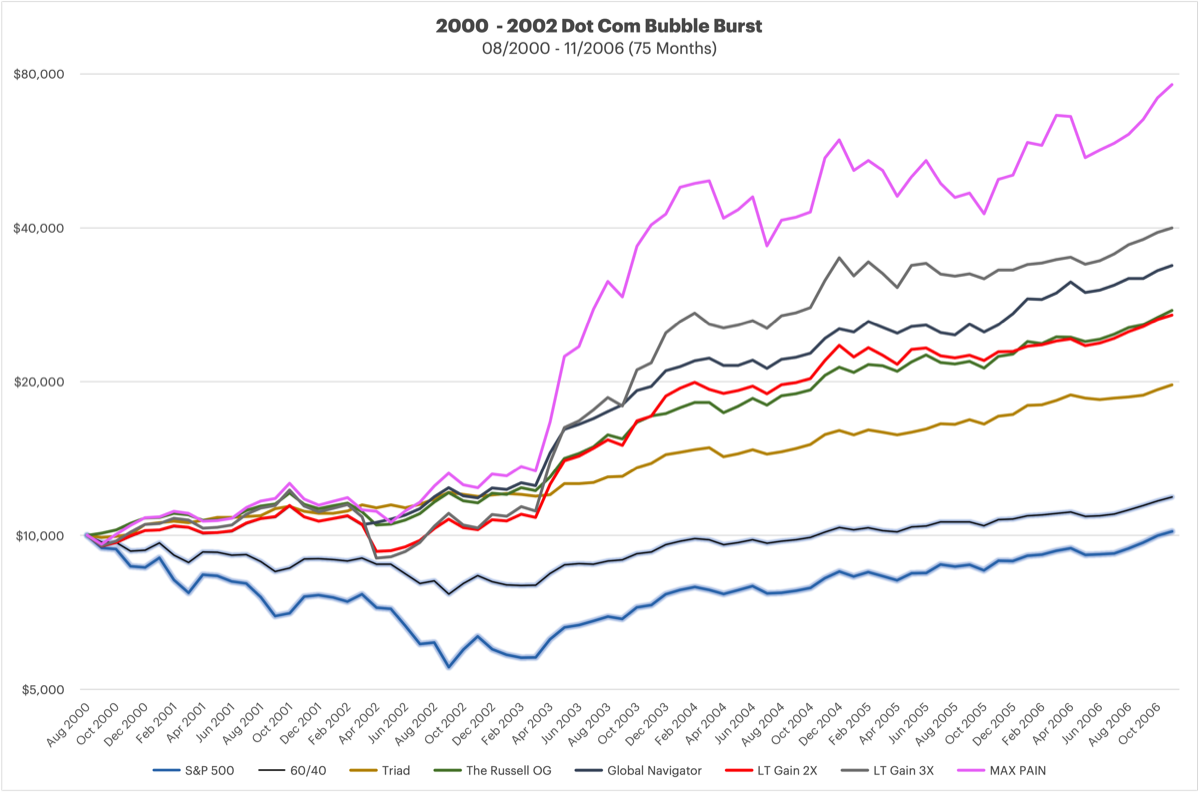

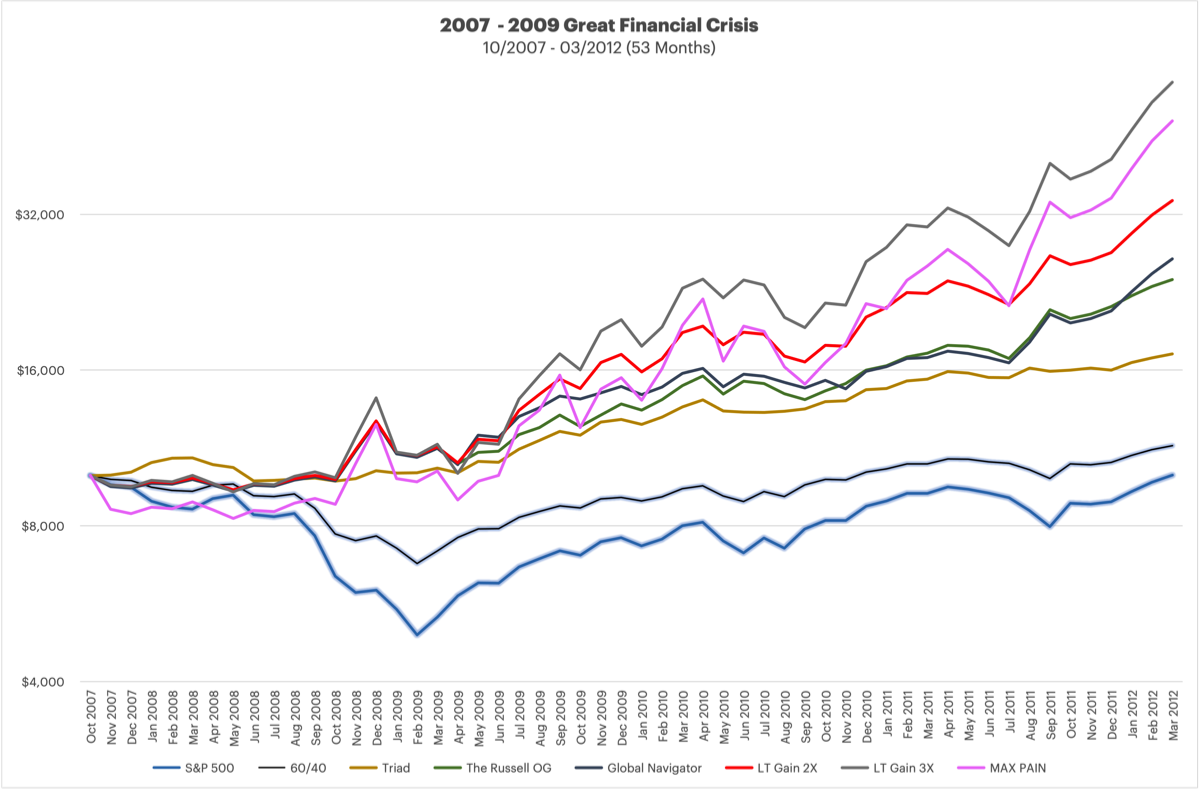

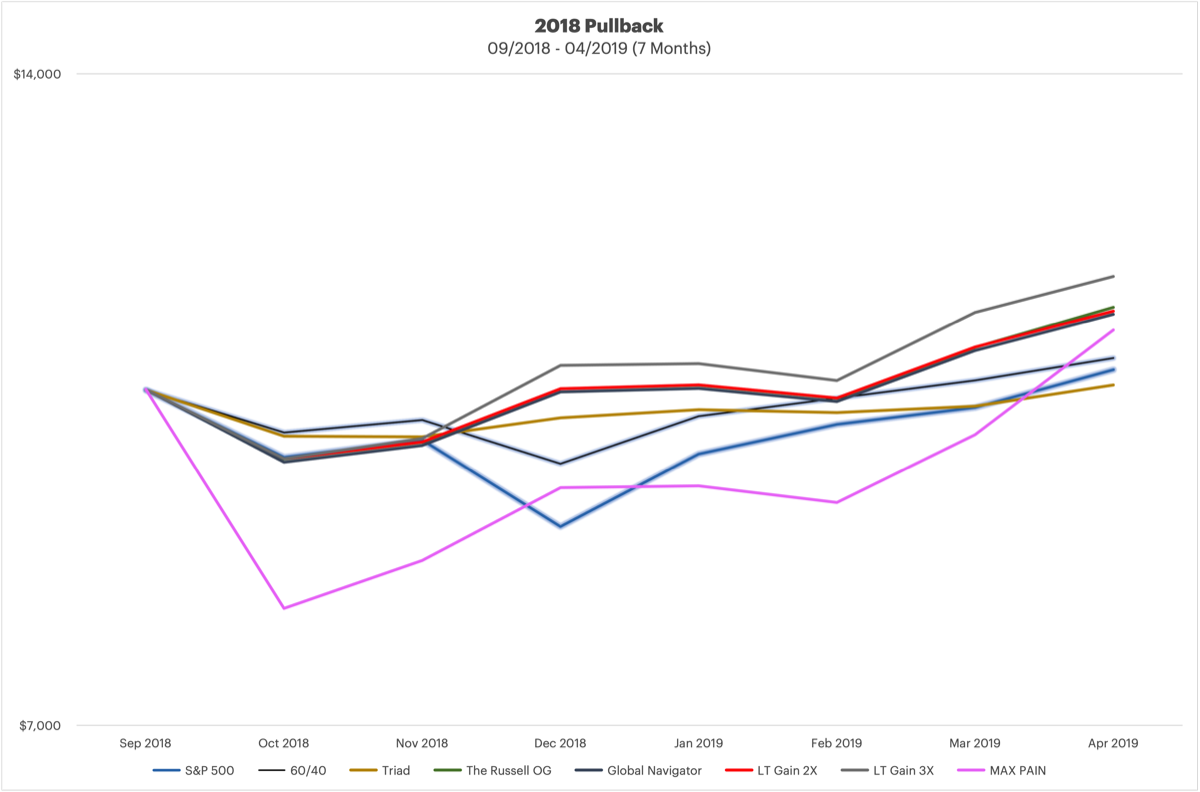

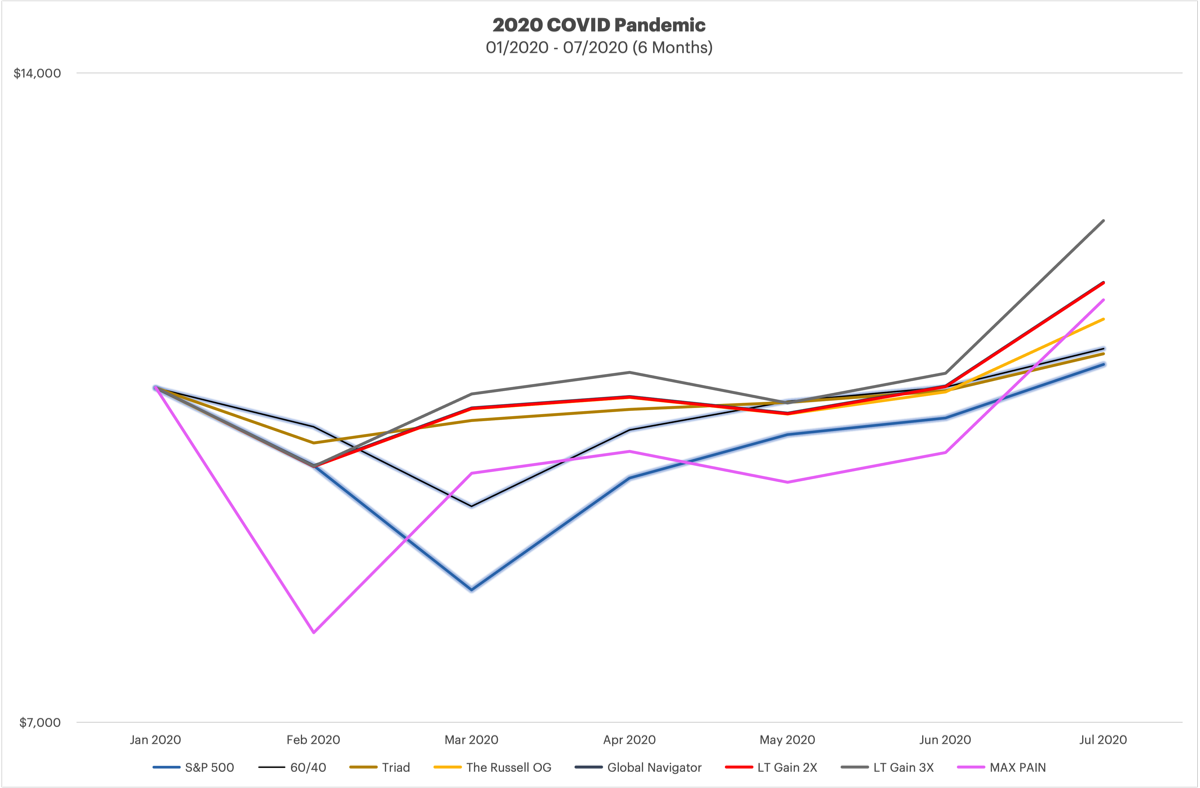

The Allocate Smartly findings are not a surprise to somebody who has dug into TAA strategies, the end result is that the when looking at the shorter term pullbacks, the strategies may or may not do better than the broader market or 60/40, however, during the longer bear markets is were TAA really shines and saves an investor from major drawdowns.

Many DMS strategies incorporate limited use of leverage, and MAX PAIN is always 3X leveraged, and you can see the effects of this in the charts below.

The charts below are all logarithmic with a starting balance of $10,000.

Note that Allocate Smartly does not track any strategies which use leverage, they are all unleveraged all of the time.

I had thought of doing a similar post before for the DMS strategies, so now seemed like the time.

The Allocate Smartly findings are not a surprise to somebody who has dug into TAA strategies, the end result is that the when looking at the shorter term pullbacks, the strategies may or may not do better than the broader market or 60/40, however, during the longer bear markets is were TAA really shines and saves an investor from major drawdowns.

Many DMS strategies incorporate limited use of leverage, and MAX PAIN is always 3X leveraged, and you can see the effects of this in the charts below.

The charts below are all logarithmic with a starting balance of $10,000.