Please welcome The Triad+ Strategy

Welcome the new DMS strategy, Triad+. It is very simple to explain, because it is Triad with the addition of Smart Leverage the way the LT Gain strategies implement it, instead of using IWB, if there is a month end drawdown of 15% or greater, the next time the strategy would go into IWB, instead it goes into SSO. It will hold SSO for as long as Triad would be staying in IWB, if that time period exceeds 12 months, SSO is exited after 12 months to lock in long term gains and the strategy switches to IWB to de-leverage and de-risk the strategy.

The results are really great. No worse Maximum Draw Down from 1980 forward, and a nice improvement in the returns with a slight increase to the risk profile. I have been working on evidence based retirement withdrawal rates, and Triad+ is a mainstay in this model portfolio allocation, it is also a great addition to any portfolio, not just for retirement.

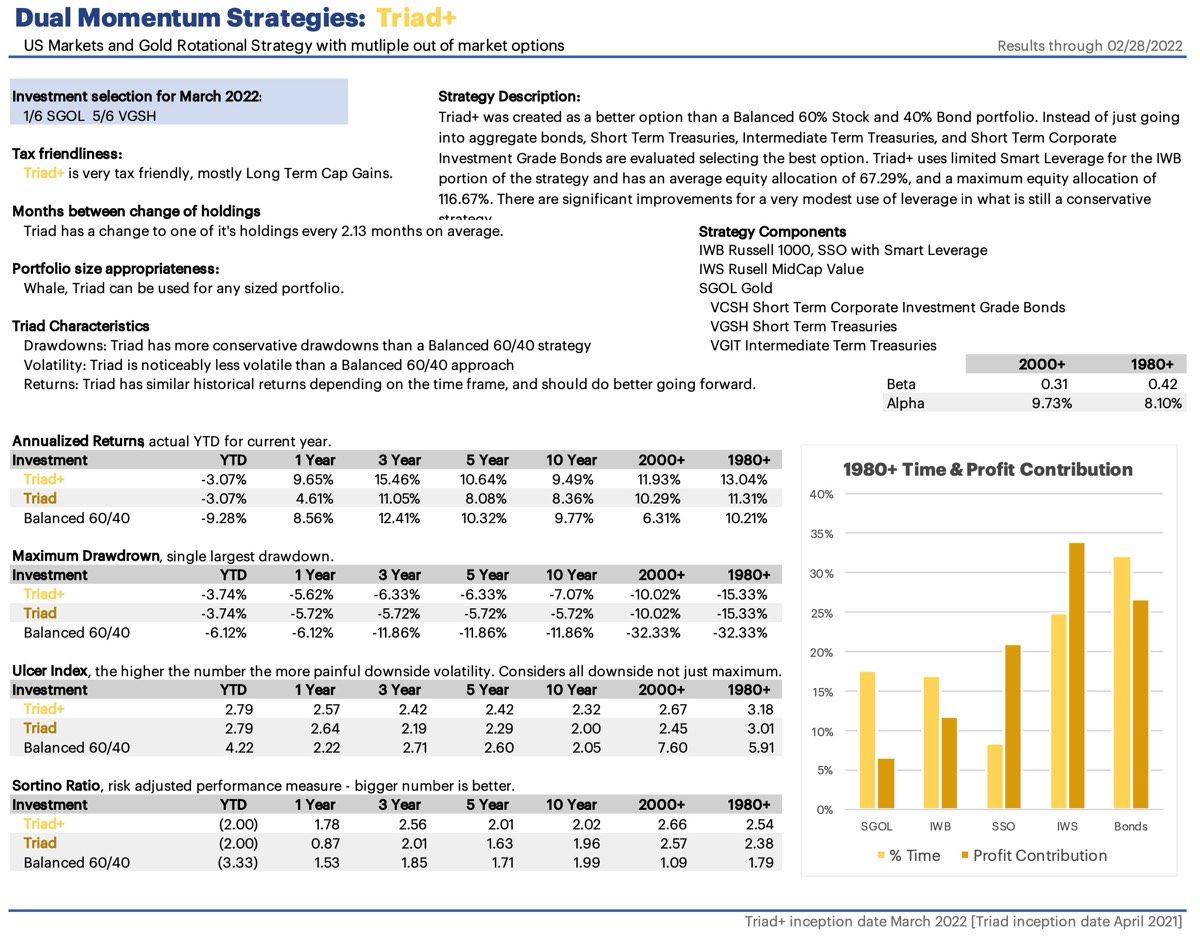

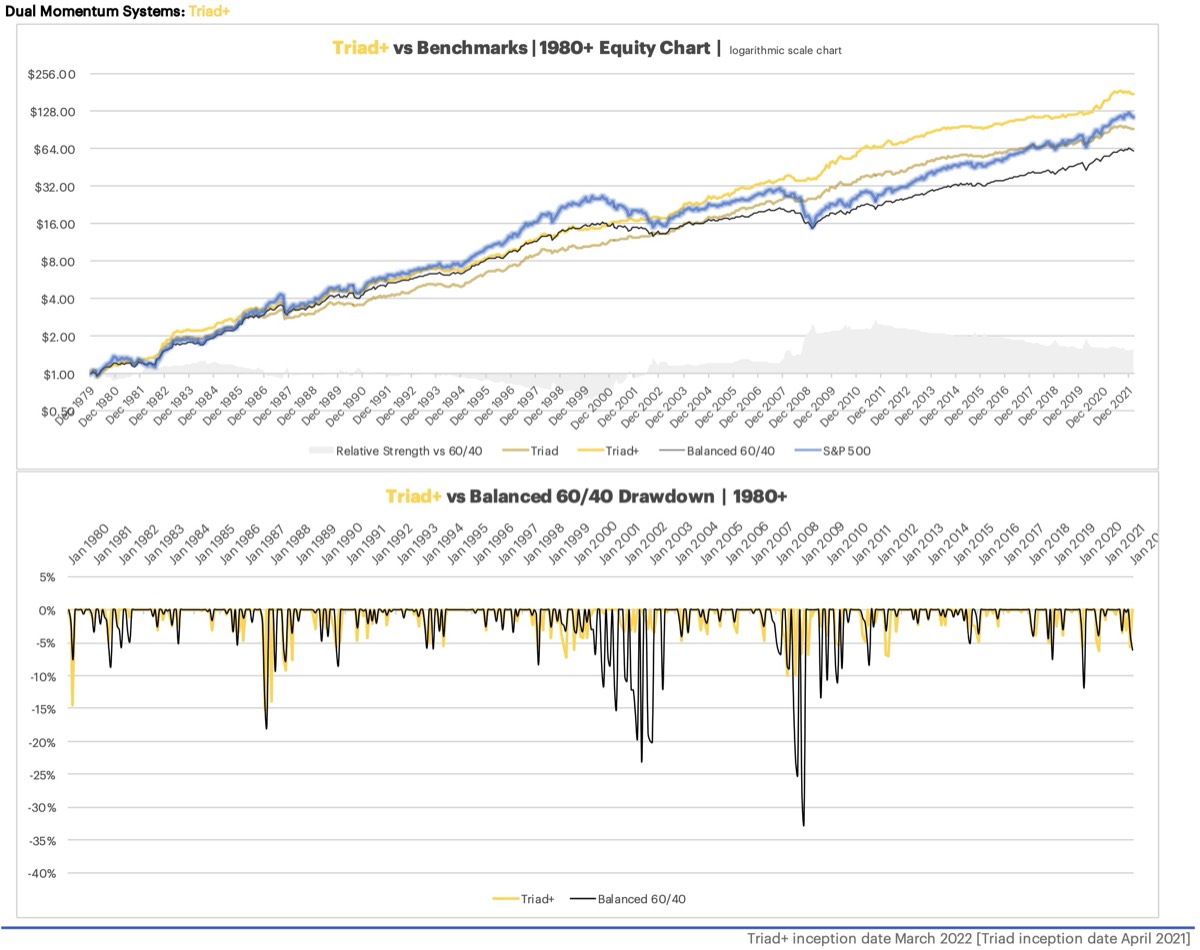

The FactSheet for Triad+, and Triad, are shown below through February 28, 2022.

I am leaving Triad as it is and adding Triad+, instead of replacing changing Triad to include Smart Leverage because I know there are people who will want nothing to do with leverage whatsoever, and that is why Triad remains. Do understand that the amount of leverage with Triad+ is very modest. In a "Fully Invested" allocation, Triad would be 1/6 Gold, 1/3 Russell 1000, 1/3 Russell Mid-Cap Value, and 1/6 in Bonds or Treasuries. By adding Smart Leverage, the 1/3rd position in the Russell 1000 would be 2/3rd via SSO instead of IWB. The "Fully Invested" allocation would then be 1/6, 2/3, 1/3, and 1/6. If we don't consider the Bonds/Treasuries, the equity allocation would max out at 116%. This makes a meaningful addition to the returns, but is a modest amount and does not induce too much volatility or risk to the strategy.

The results are really great. No worse Maximum Draw Down from 1980 forward, and a nice improvement in the returns with a slight increase to the risk profile. I have been working on evidence based retirement withdrawal rates, and Triad+ is a mainstay in this model portfolio allocation, it is also a great addition to any portfolio, not just for retirement.

The FactSheet for Triad+, and Triad, are shown below through February 28, 2022.

I am leaving Triad as it is and adding Triad+, instead of replacing changing Triad to include Smart Leverage because I know there are people who will want nothing to do with leverage whatsoever, and that is why Triad remains. Do understand that the amount of leverage with Triad+ is very modest. In a "Fully Invested" allocation, Triad would be 1/6 Gold, 1/3 Russell 1000, 1/3 Russell Mid-Cap Value, and 1/6 in Bonds or Treasuries. By adding Smart Leverage, the 1/3rd position in the Russell 1000 would be 2/3rd via SSO instead of IWB. The "Fully Invested" allocation would then be 1/6, 2/3, 1/3, and 1/6. If we don't consider the Bonds/Treasuries, the equity allocation would max out at 116%. This makes a meaningful addition to the returns, but is a modest amount and does not induce too much volatility or risk to the strategy.