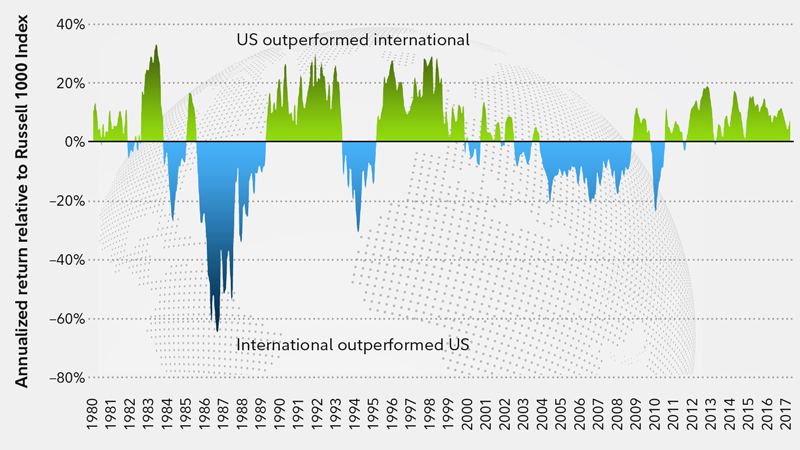

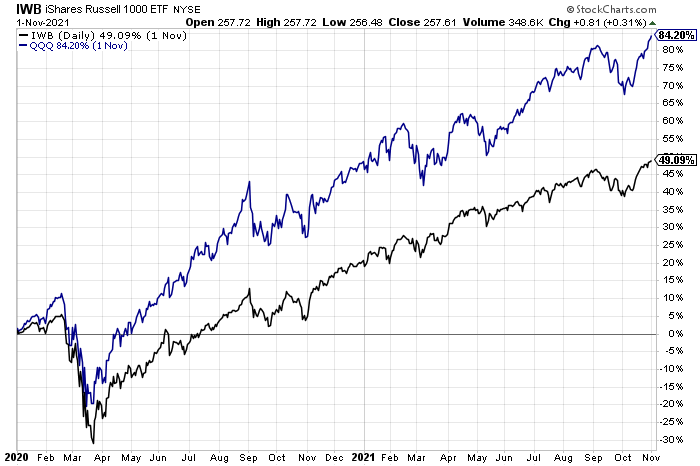

The chart above shows how there are periods when the International markets have outperformed the US markets. Triad now capitalizes on this situation. Similar to how Triad now invests in the stronger of gold or commodities, it will put 2/6th of the strategy into either the Russell Mid-Cap Value or International, whichever has the higher relative momentum. If neither of them have absolute momentum, then the 2/6th goes into the best performer of the bonds/treasuries.

The 2/6 allocation into the Russell 1000 remains unchanged.

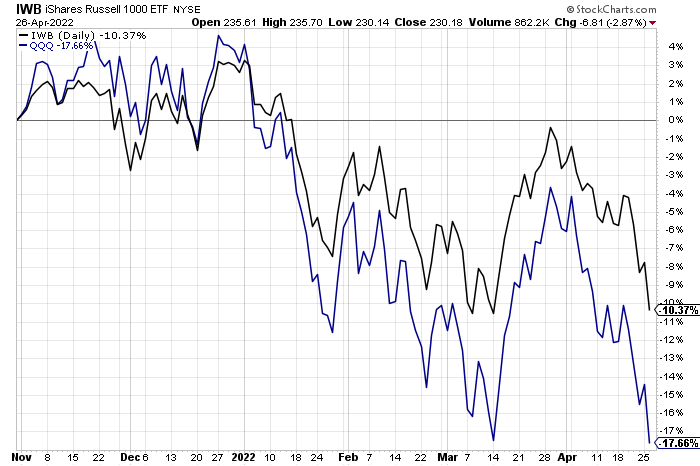

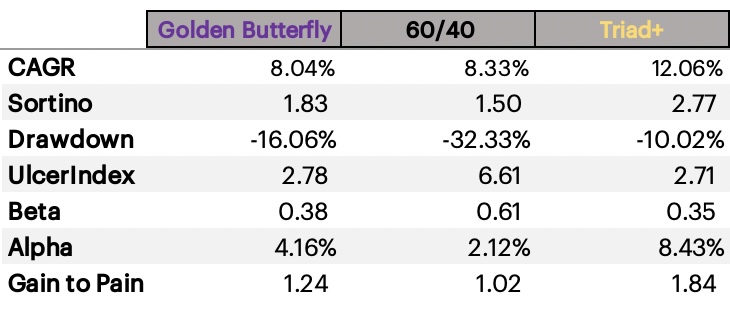

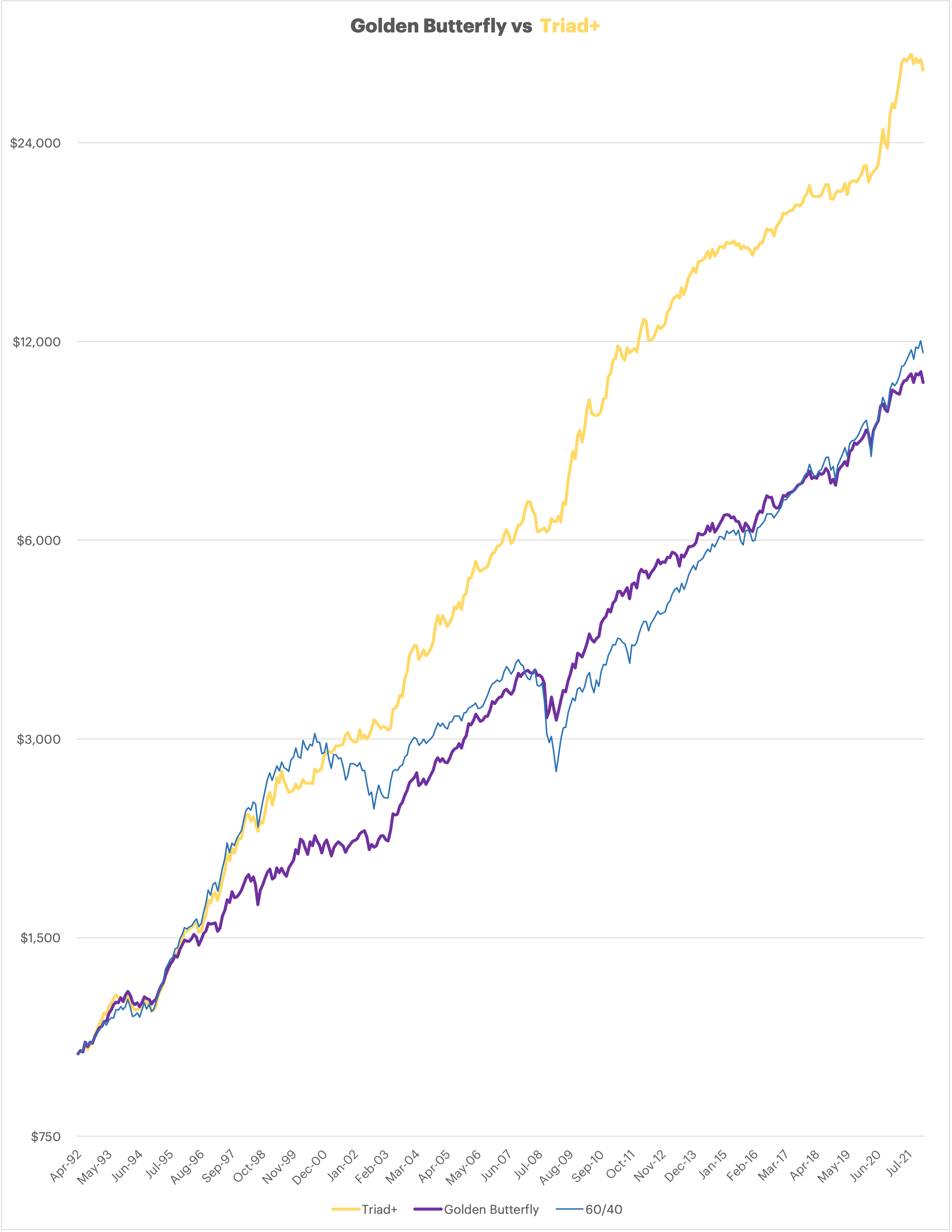

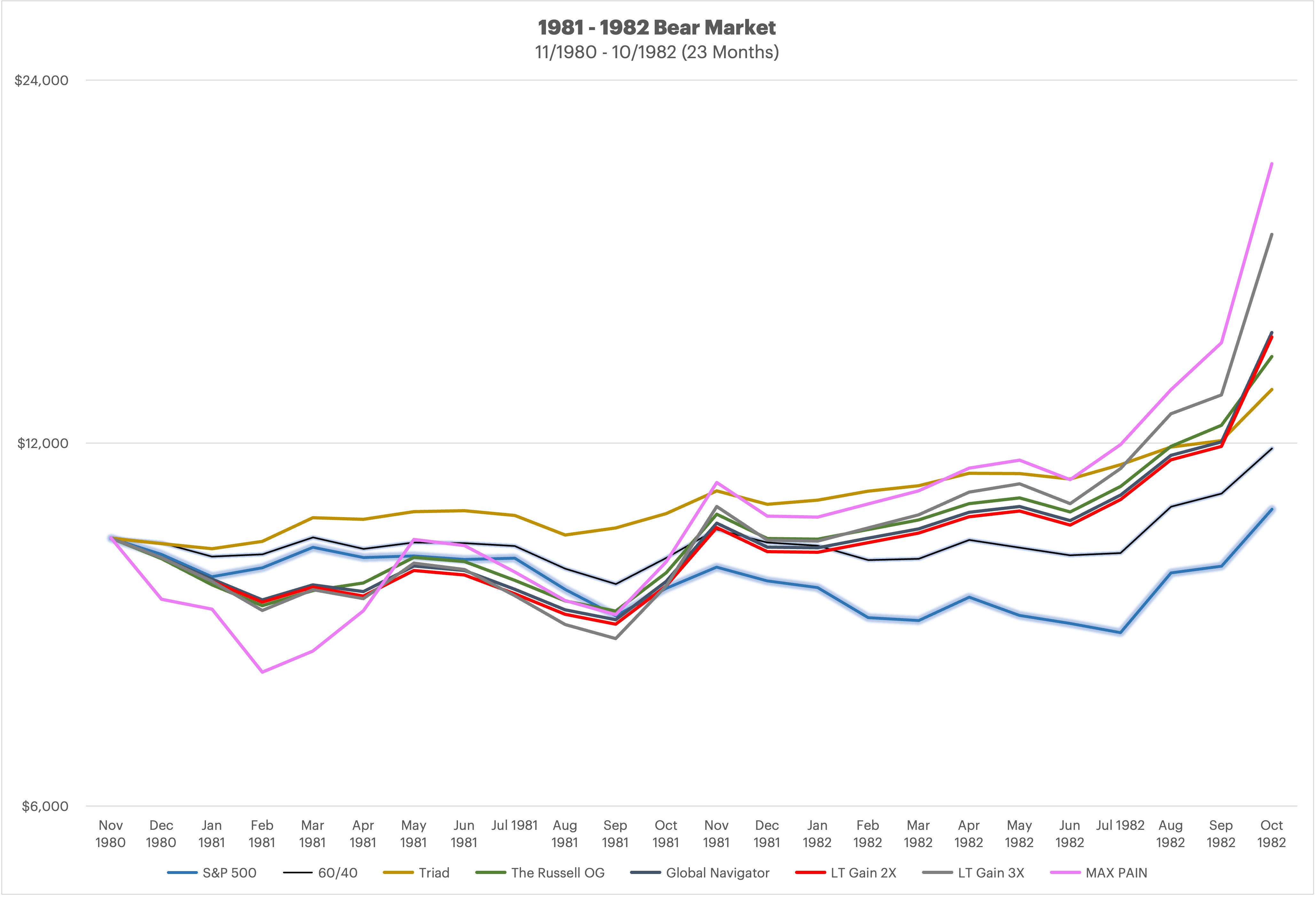

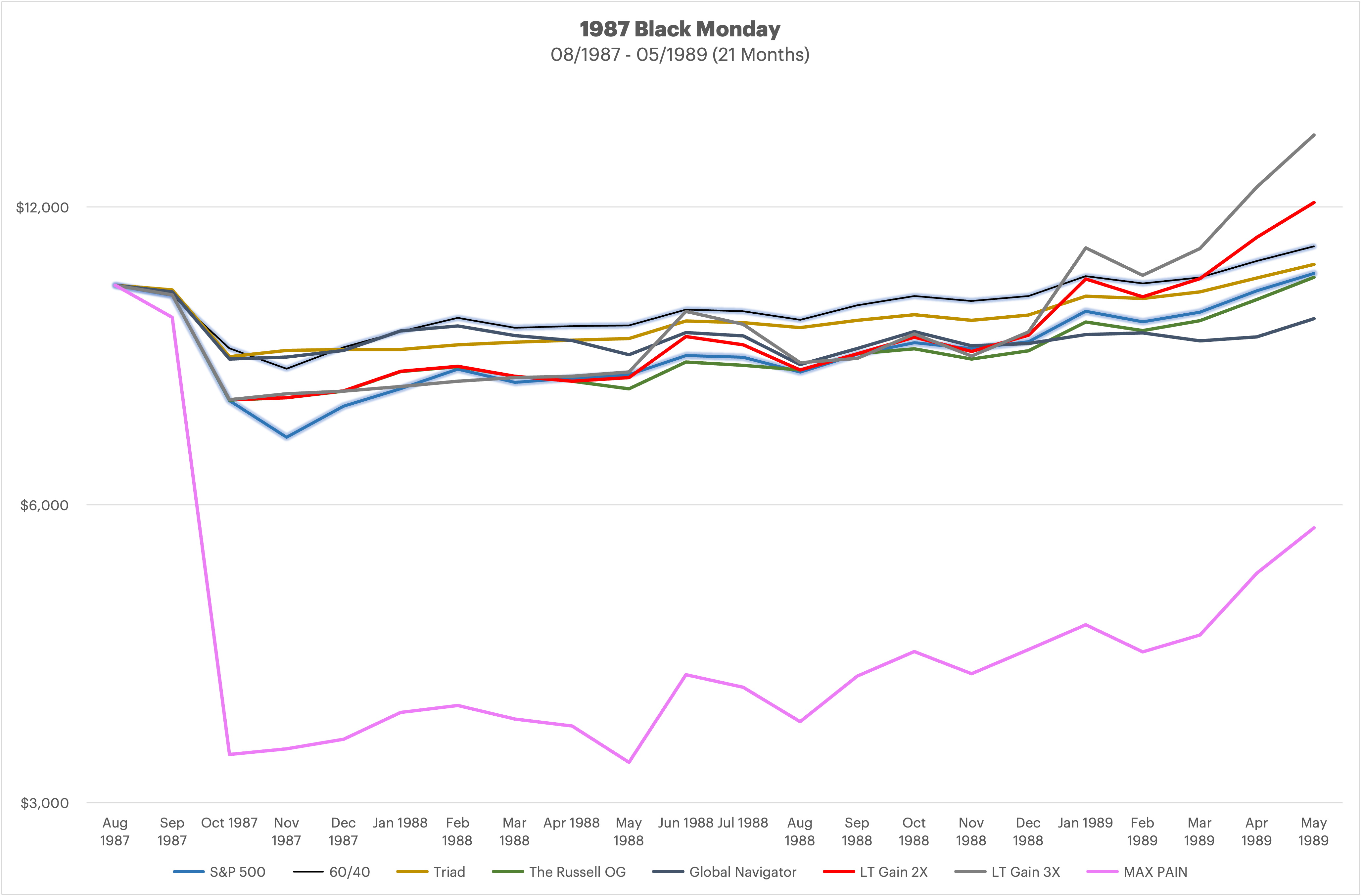

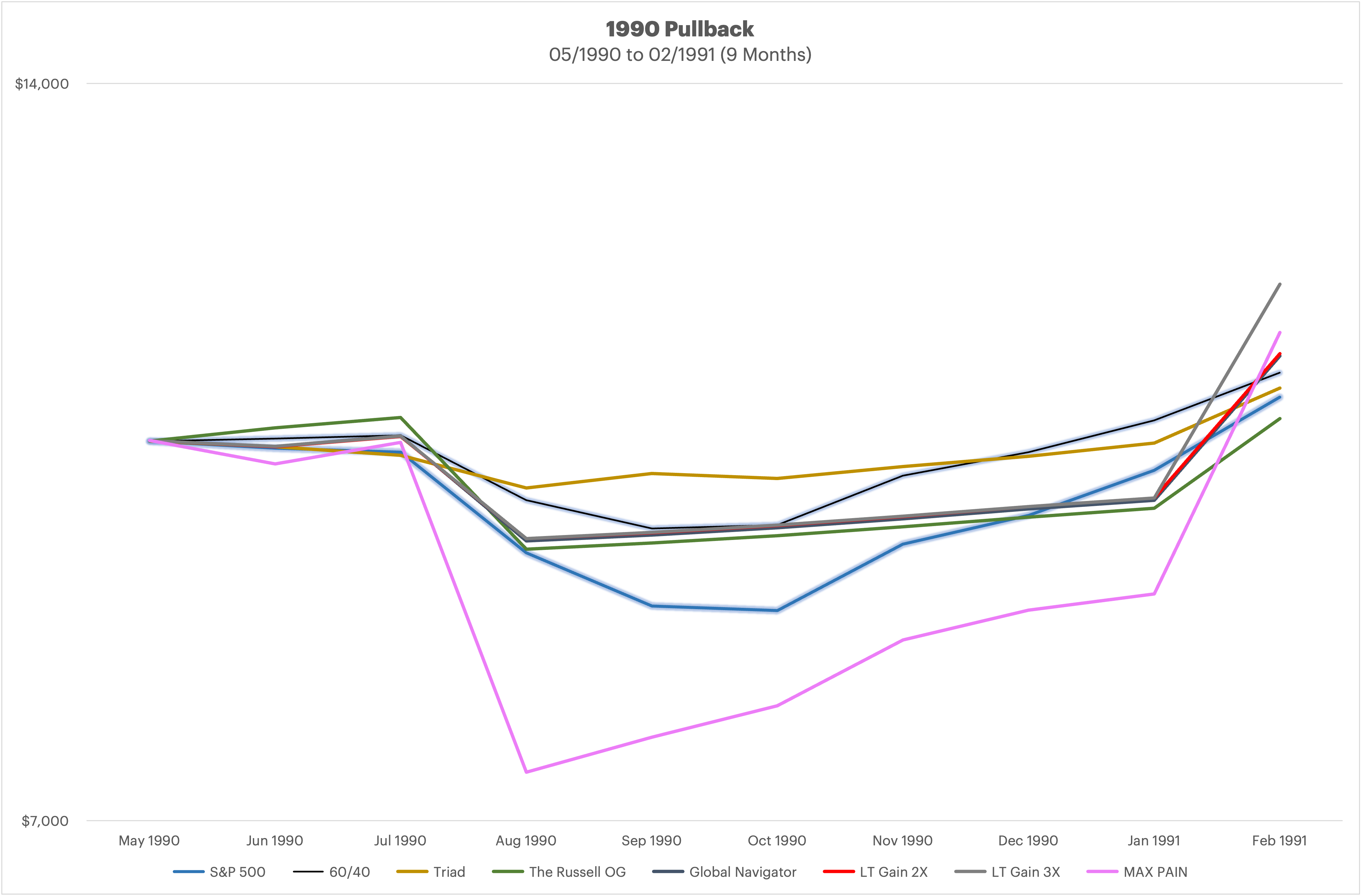

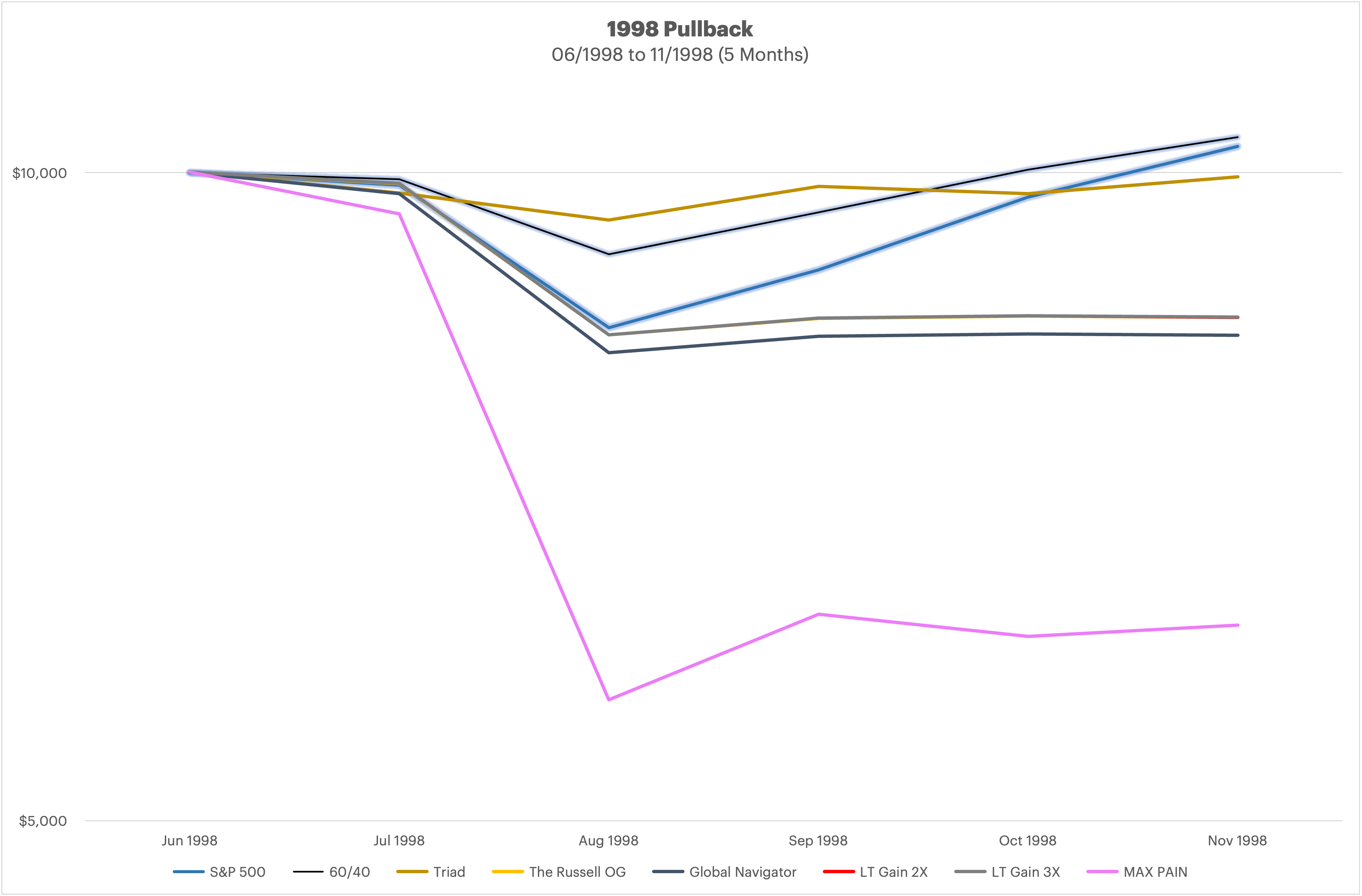

Triad+ is the same as Triad, but adds Smart Leverage and will go into 2X S&P 500 instead of the Russell 1000 when going back into equities after a 15% or larger drawdown in the Russell 1000. This position is held until a natural change of investments in the strategy up to 1 year at which time the position is closed and we would de-leverage into the Russell 1000.

Triad++ is the same as Triad+ but the 2/6th position that would go into the Russell 1000, with Smart Leverage in Triad++ it would go into 3X S&P 500.

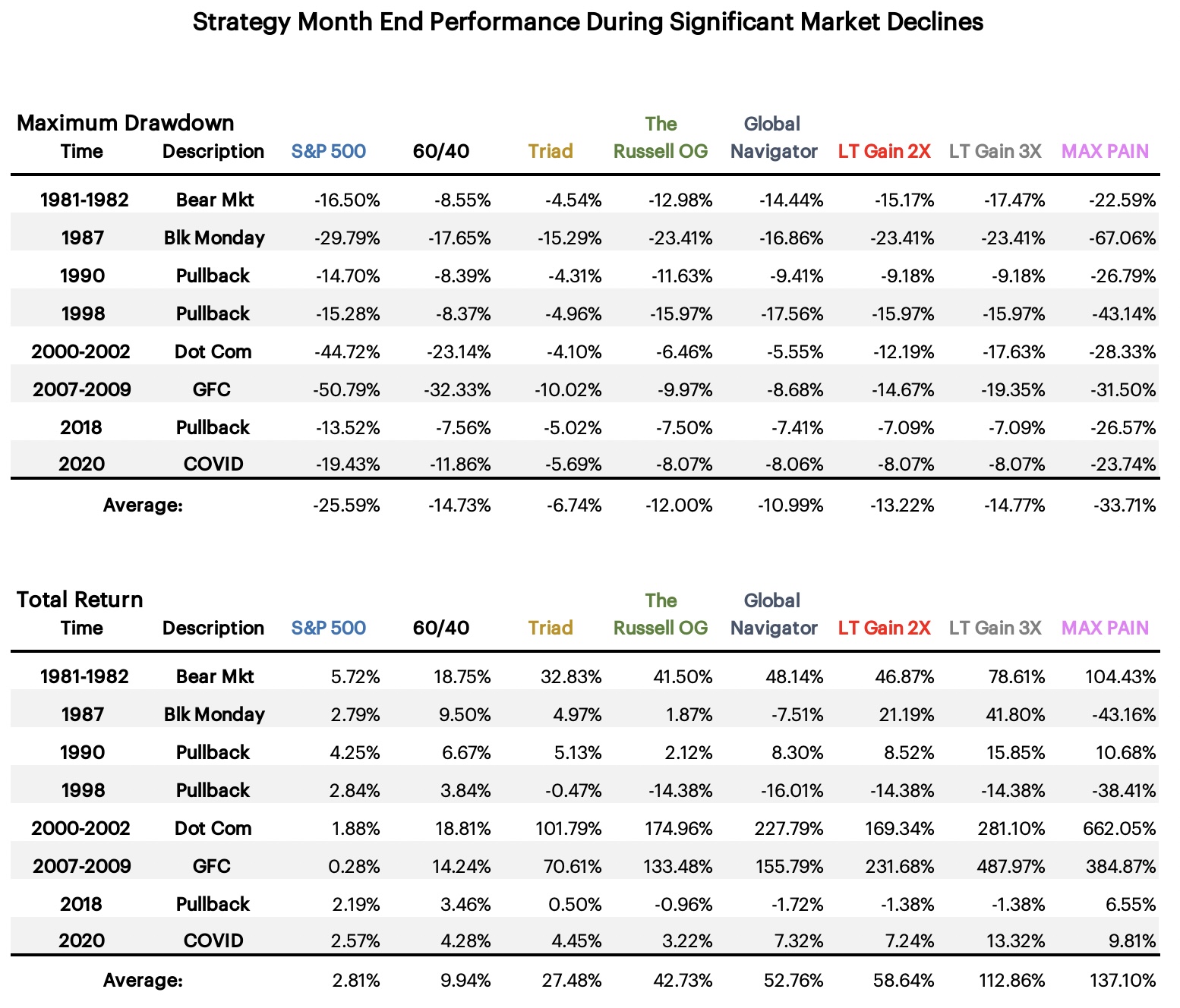

Even using 2X and 3X leverage with the 2/6th position the risk adjusted returns on the strategy are phenomenal, and for me it becomes a single strategy that fits more needs without having to combine multiple strategies. Note that leveraged equities do present a risk, a terrible month in the markets is amplified if in leveraged assets. This is not investment advice.

Going forward with the May Reporting Deck, all three Triad strategies will be included.

You can download the Fact Sheets for all three Triad strategies here.I am really excited for the Triad offerings and am using them heavily myself. Please pay attention to the MAX Leverage of strategies. Triad++ has a 166% max leverage on it's own. the 2/6 position will effectively become 6/6 in Triad++ when it goes into UPRO. Triad always has at least 1/6 in treasuries/bonds, I personally don't consider that a 1:1 leverage the same as equities, but I didn't want to downplay the overall effective leverage all the same.

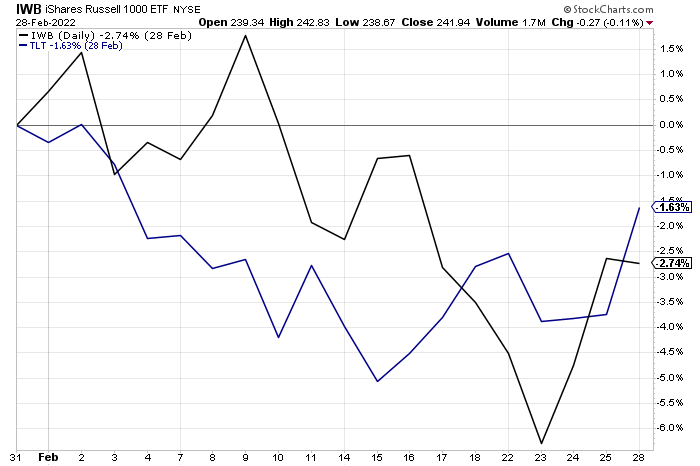

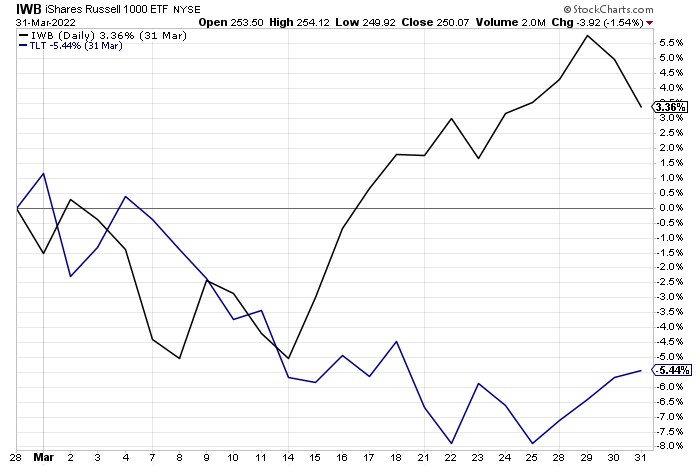

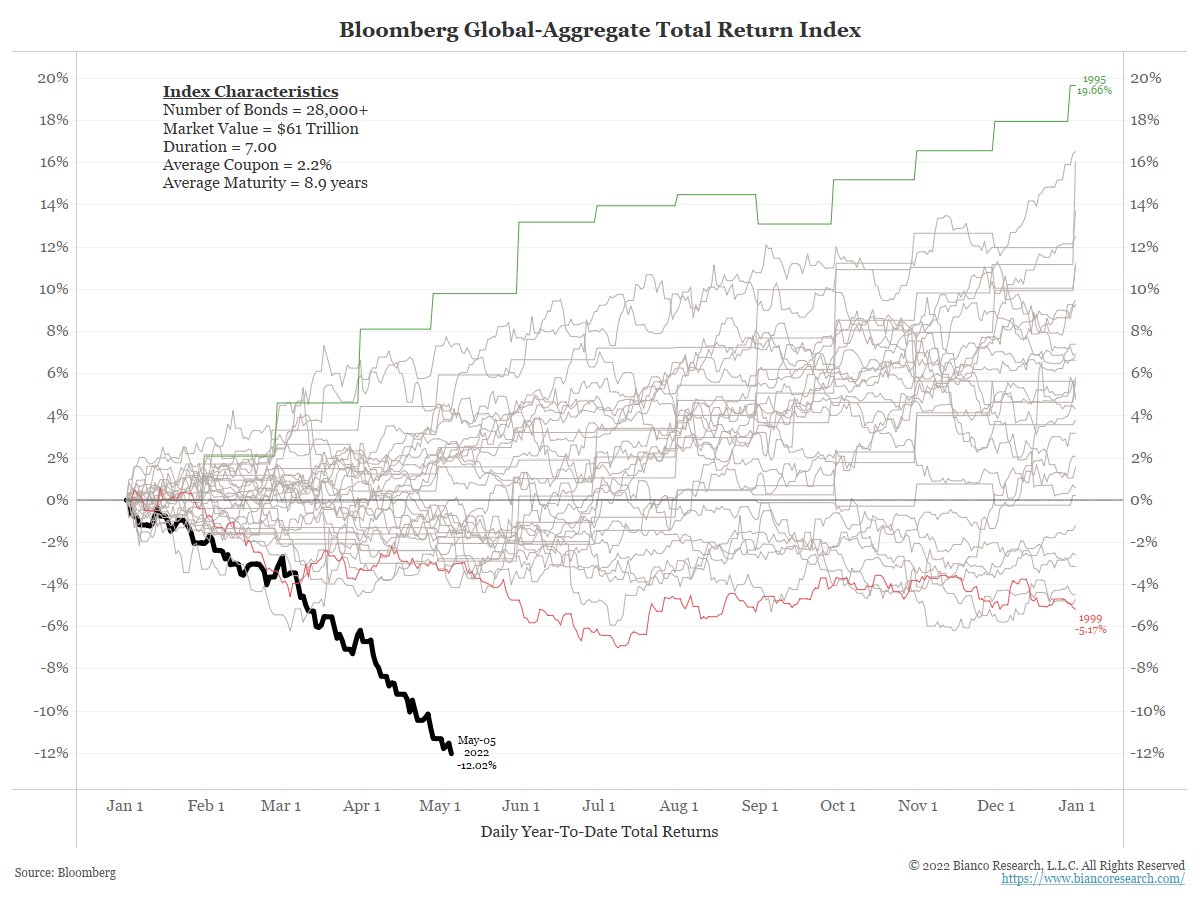

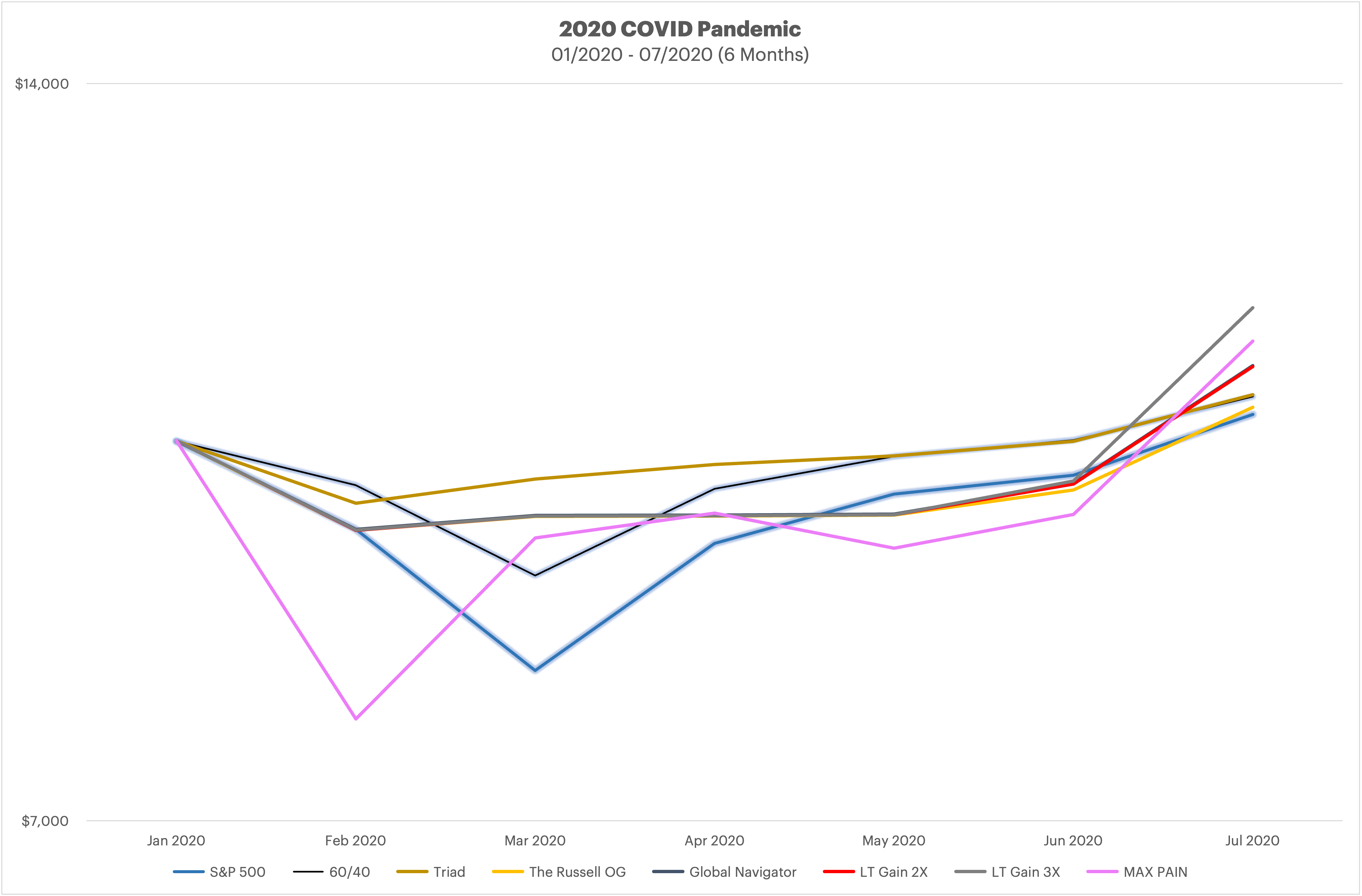

Happy Investing, geez, especially in this environment. If the couple people I follow who's opinions I respect are correct, we could see a really big drop still to come in the equities markets. Dual Momentum Systems strategies have had some whipsaw this year, and got caught in long duration treasuries in March, but they should fare well if faced with a large drawdown in the markets, and get us back in when they have some positive momentum.