When I was scouring the internet, gaining interest in Tactical Asset Allocation strategies, TAA, I found myself on JW Keuning's website

Index Swing Trader by his online name TrendXplorer. TrendXplorer and his co-hort in several strategies Wouter Keller have come up with some really interesting strategies. They iterated Protective Asset Allocation, PAA, to become Generalized Protective Momentum, GPM. The goal as TrendXplorer told me was extremely low drawdown, low drawdowns were given higher priority over returns. When I first ran across GPM, honestly I thought it was rather unique and brilliant how they used the correlations and used the positive count to scale into and out of the Risk On universe and the Safety assets. However, I also thought - BORING.

Some times, boring is good, in fact boring can be great. It took me a few years to come around to it, but I recently found myself investigating retirement portfolios for myself, not for today - but not too far off in the future. It was during this investigation that I found myself looking at GPM once again, and viewing it in a different light.

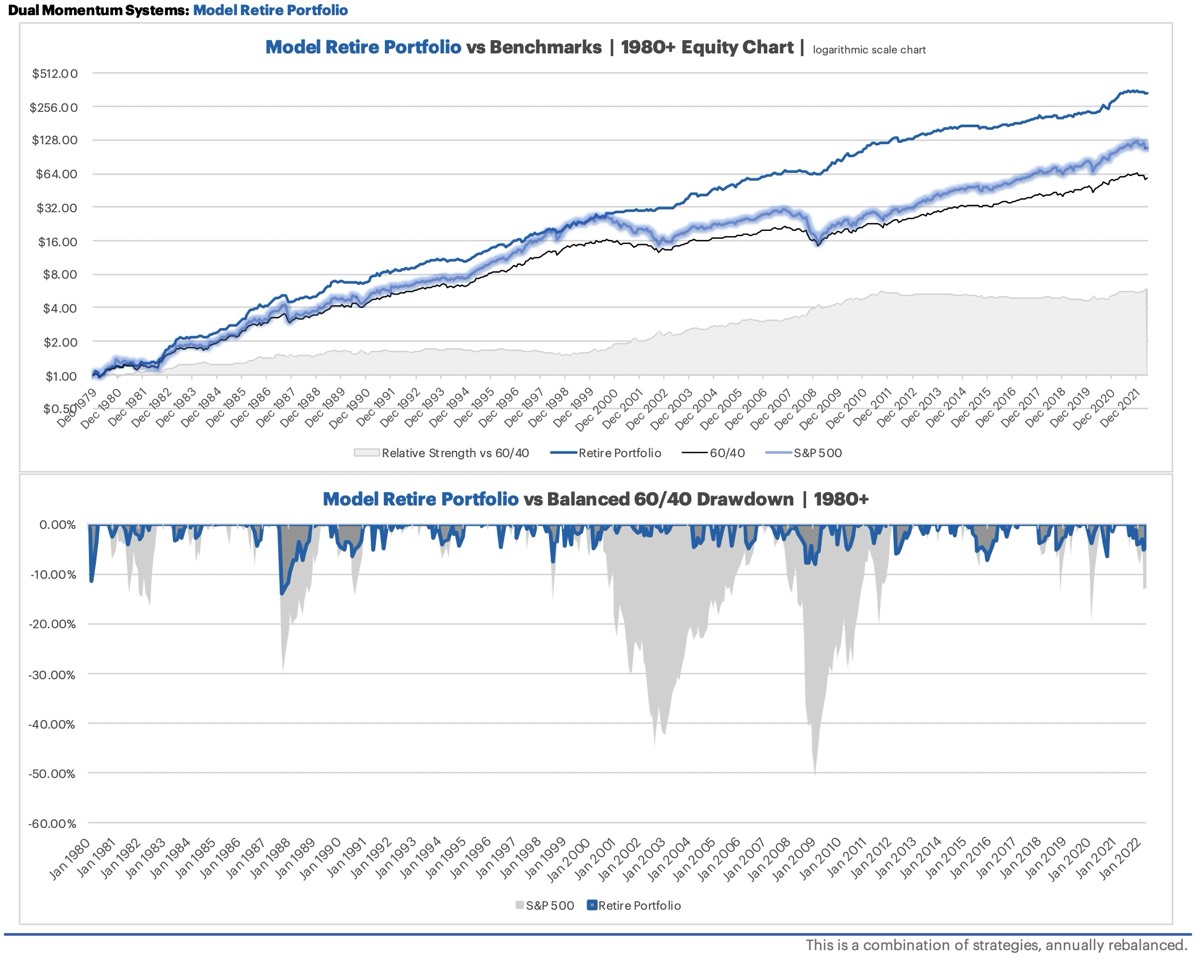

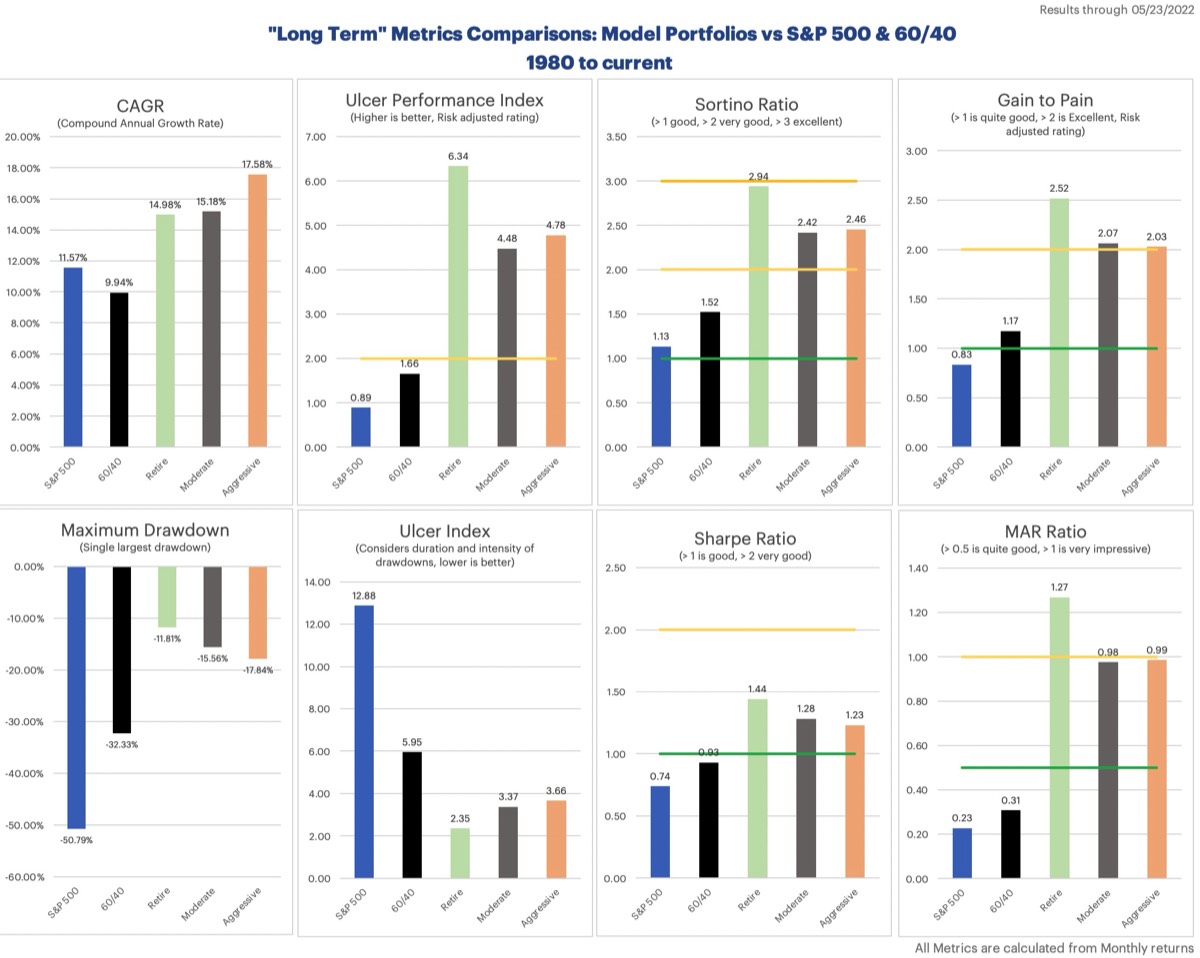

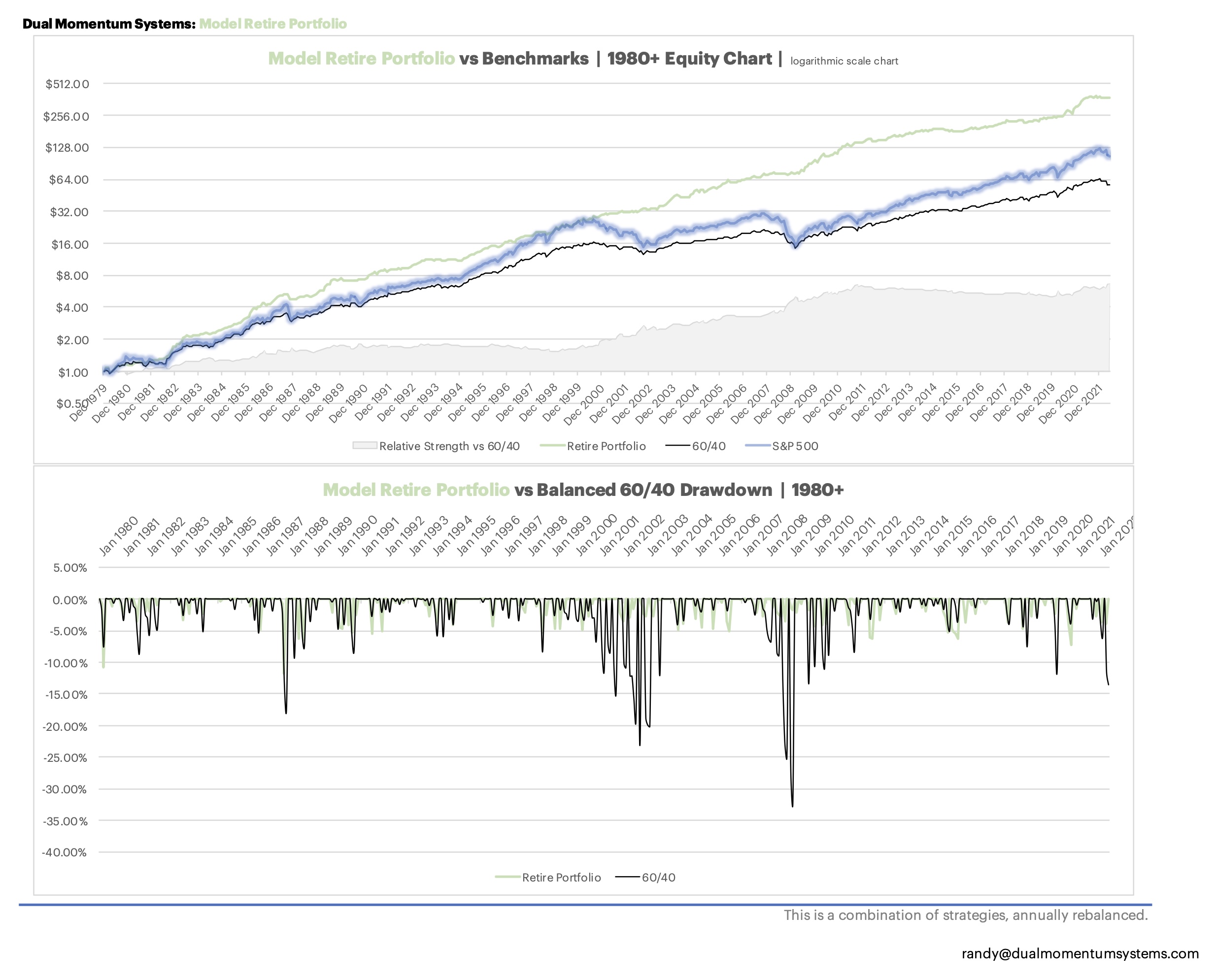

When people are accumulating assets, it is often the case that more risk and less diversity is taken. This can work well for capital growth, albeit likely accompanied with higher volatility. In retirement though, steady eddy is the goal. The lower the volatility the more reliable a portfolio is for drawing money in retirement without too large drawdowns. It is why allocation strategies like Golden Butterfly, Permanent Portfolio, and All Weather each far outperform the general market in retirement, they are far less volatile than the overall market and this keeps drawdowns from getting too large.

If you are familiar with this Dual Momentum Systems website, you likely know that my Global Navigator+ strategy is largely a derivative of Gary Antonacci's GEM strategy. I have a faster acting weighted lookback, and have implemented Smart Leverage for greater growth opportunities and Treasury Duration Limiter for safer Risk Off, but in a general sense you can see the resemblance. The Russell is a bit more varied from GEM. The LT Gain strategies, like Global Navigator+ you can see have inspiration from GEM, again with my take on them with the Single Momentum, the lookback, Smart Leverage, and Treasury Duration Limiter. The Triad Strategies are I would like to think wholly my own, there may be resemblance to other strategies, but I really came up with them without any inspiration of other strategies. I mention the strategies only to say that when I re-visted GPM, I found myself wondering, what if I changed this, and that, hmm, what about this. Compulsion forced me to tinker with the already excellent strategy to see what the effects of my ideas would have.

When I re-familiarized myself with GPM, as mentioned above, I began wondering how the strategy would perform if I made some changes to it. I will run through the changes that I pondered, and eventually tested, and a brief mention why I was looking at the specific change.

- Japan, one of the risk on assets in GPM is EWJ, Japan. While this choice didn't offend me, I wondered why not use a more broad geographical index like Pacific which is the entire region, not just Japan. Recently, the top countries represented in the Pacific ETF VPL were: 55% Japan, 20% Australia, 13% Republic of Korea, 7% Hong Kong, 3.4% Singapore, 1% New Zealand.

- Russell 2000, I have an affinity for Mid-Cap Russell indexes and wanted to see how the Russell Mid-Cap would do when swapped in for the Russell 2000 (small cap) index.

- Emerging Markets, I didn't like the idea of allocating up to 33% to Emerging Markets so I want to remove it entirely.

- Safety Assets, I wasn't sure why there wasn't an option to not just go into Short Term or Intermediate Treasuries, given the goal of the strategy I thought that BIL should also be an option.

- The strategy multiplies the returns and correlations and adds up the positive results, this number is used to scale into and out of the Risk On and Safety assets. Given the protective, low drawdown, nature of this strategy, I wondered, what if I add 1 to this count to force it to allocate a bit more to Risk On instead of the Safety assets.

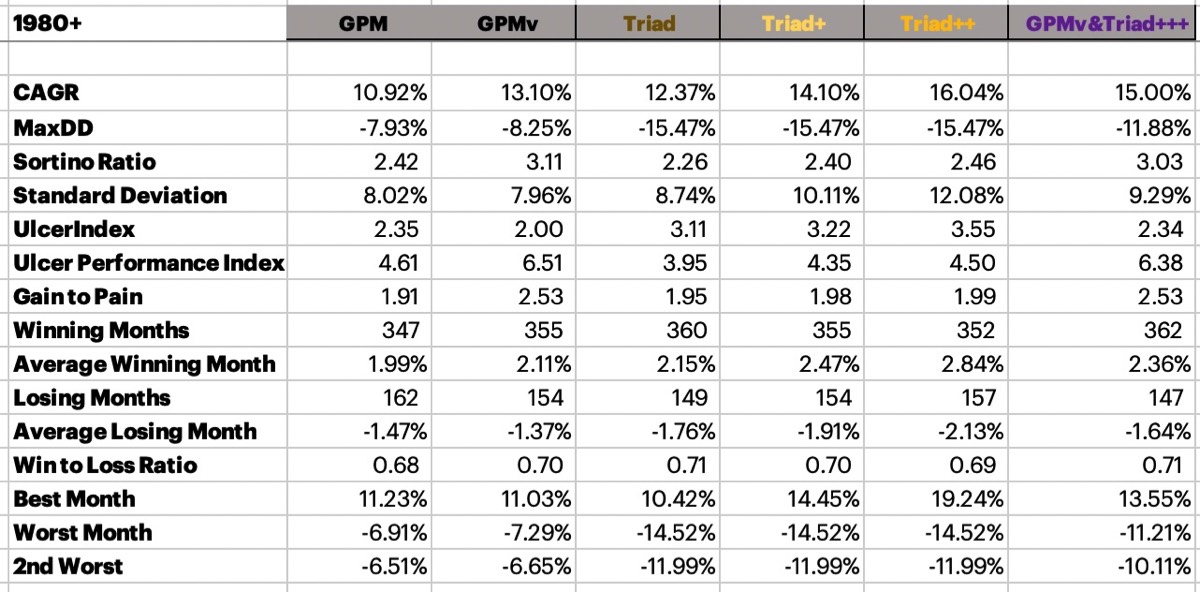

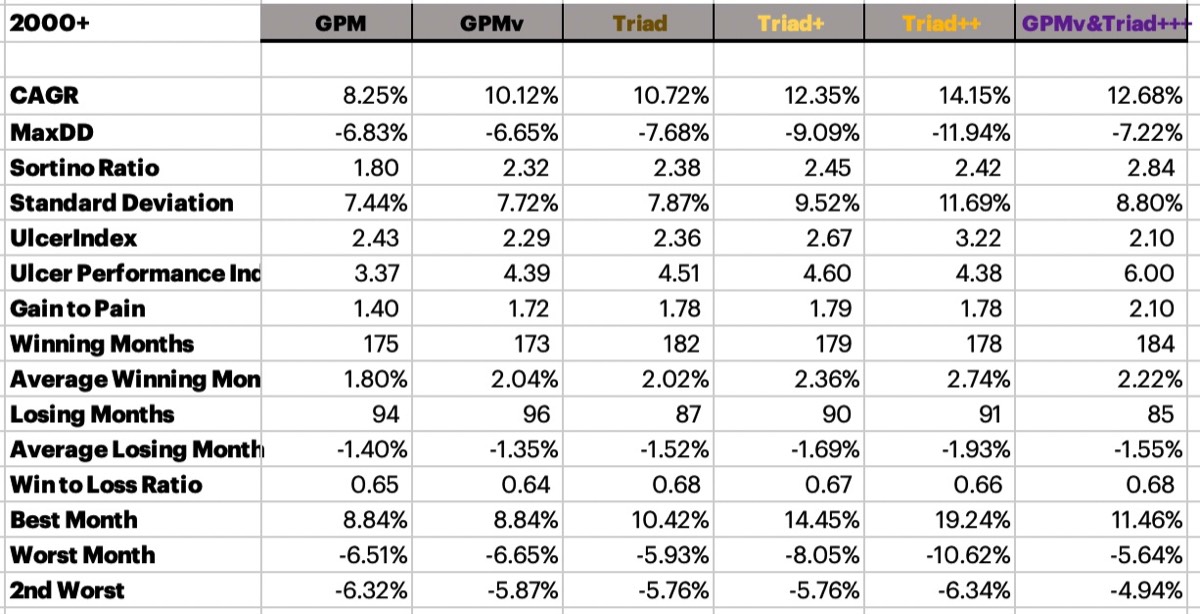

After updating my implementation of TrendXplorer's GPM model and verifying the results where correct, I then began implementing my 5 ideas one by one to see how they worked out. My initial look at a strategy consists of looking at the CAGR, Maximum Drawdown, and UlcerIndex, here is what I found with the 5 changes listed above:

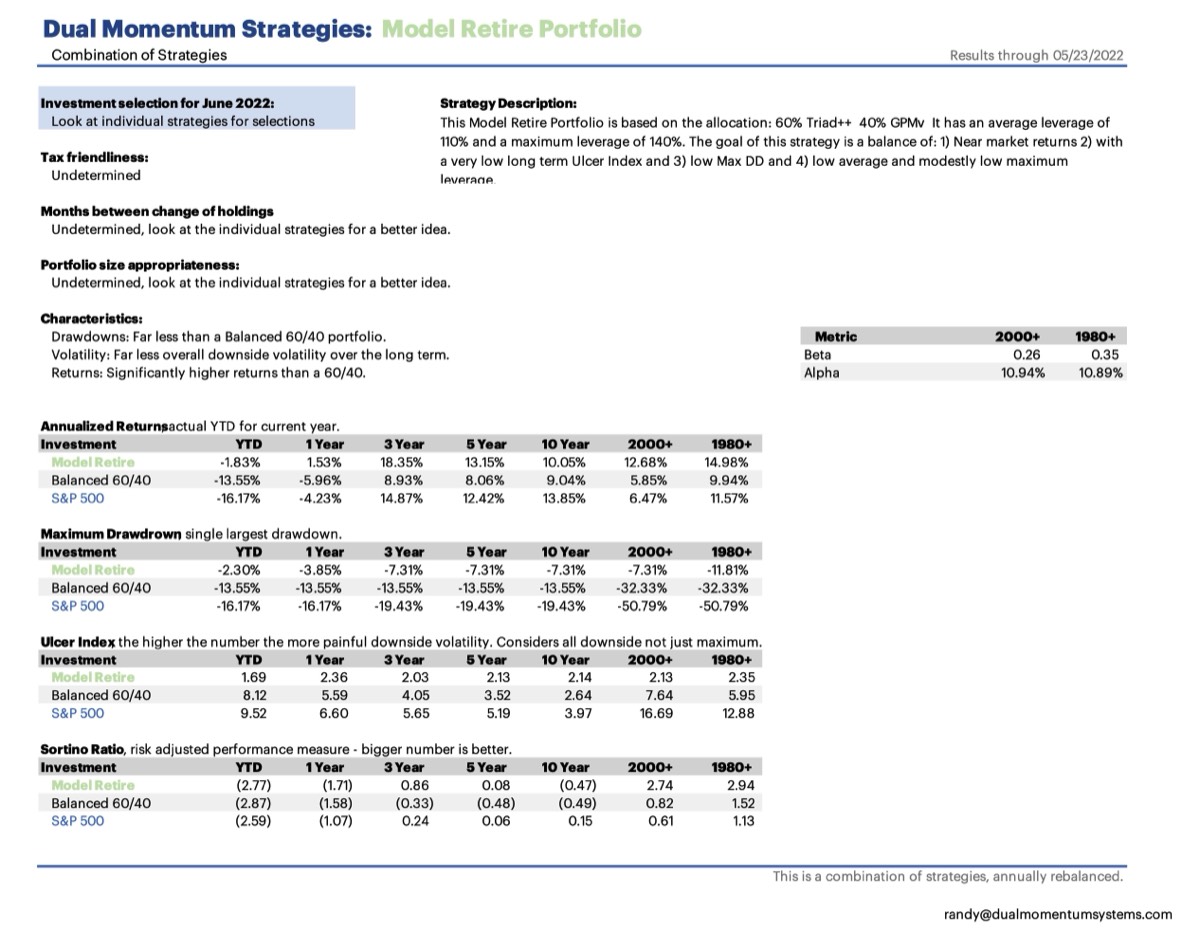

GPM, the base strategy has (from 1980 through May 23, 2020 - with my data set of returns): 10.90% CAGR, -7.93% MaxDD, 2.35 UlcerIndex

The changes below are individual, 1 looks at only changing Japan for Pacific, 2 only looks at changing Russell 2000 for Russell Mod-Cap, it isn't stacking Japan and Russell 2000 changes.

- VPL instead of EWJ: 10.86% CAGR, -9.13% MaxDD, 2.46 UlcerIndex I was okay with this being slightly worse, I knew that Japan had incredible returns during the late 80's, so de-prioritizing that a bit was likely to have a little bit of an adverse effect. I was more of the mind that Pacific was a more well rounded selection and maybe better going forward.

- Russell Mid-Cap instead of Russell 2000: 11.23% CAGR, -7.93% MaxDD, 2.33 UlcerIndex. This was a bigger improvement than I would have guessed.

- Removing Emerging Markets from the universe of Risky Assets (and changing calculations from using "12" to "11"): 10.79% CAGR, -9.35 MaxDD, 2.35 UlcerIndex. It surprised me that the MaxDD was a little higher, but not that the UlcerIndex was slightly lower and the CAGR slightly lower.

- Adding BIL as an option if both SHY and IEF had negative lookback: 11.27% CAGR, -7.93% MaxDD, 2.23 UlcerIndex. This is even better than I would have guessed.

- Changing the count of positive correlation * return assets by 1 to increase Risk On scaling: 11.65% CAGR, -10.05% MaxDD, 2.54 UlcerIndex. Spot on.

Each of the 5 changes seemed reasonable to me, and the 5 changes still keep the essence of the strategy in tact, these are more stylistic preferences than anything. This still very much looks and smells like GPM.

Question, What are the results of putting all 5 of those changes together?