Bear Markets and Major Pullbacks with TDL

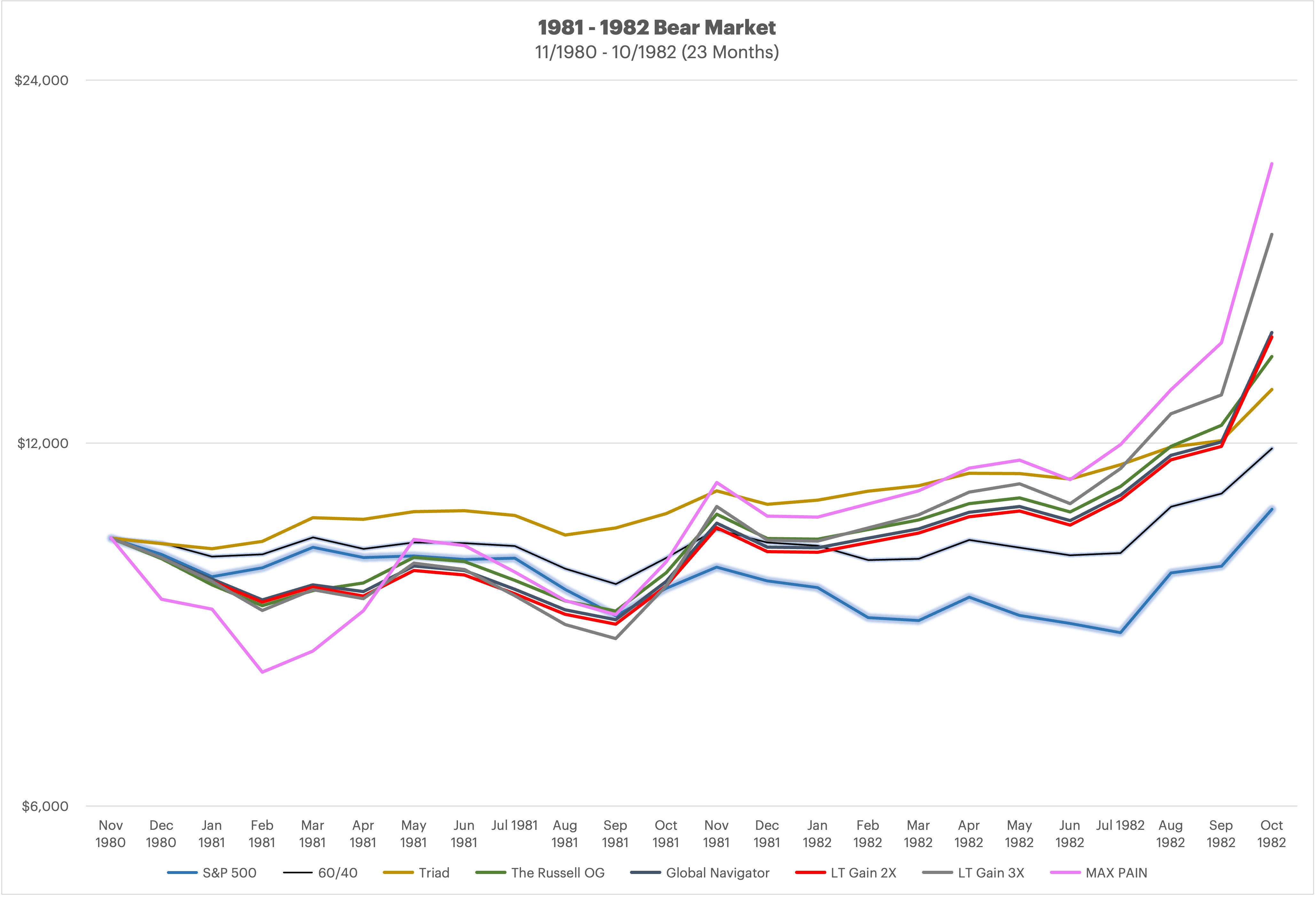

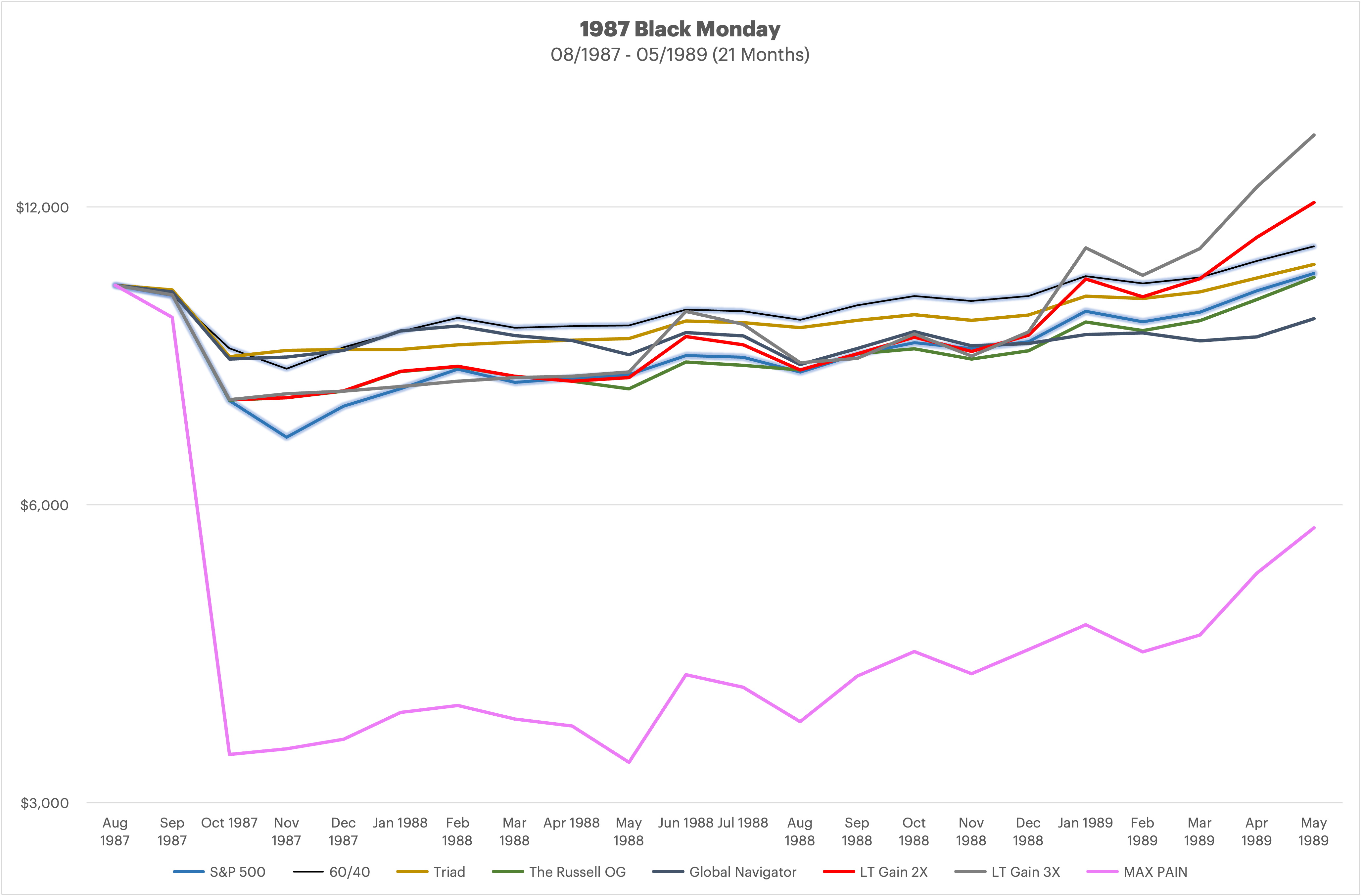

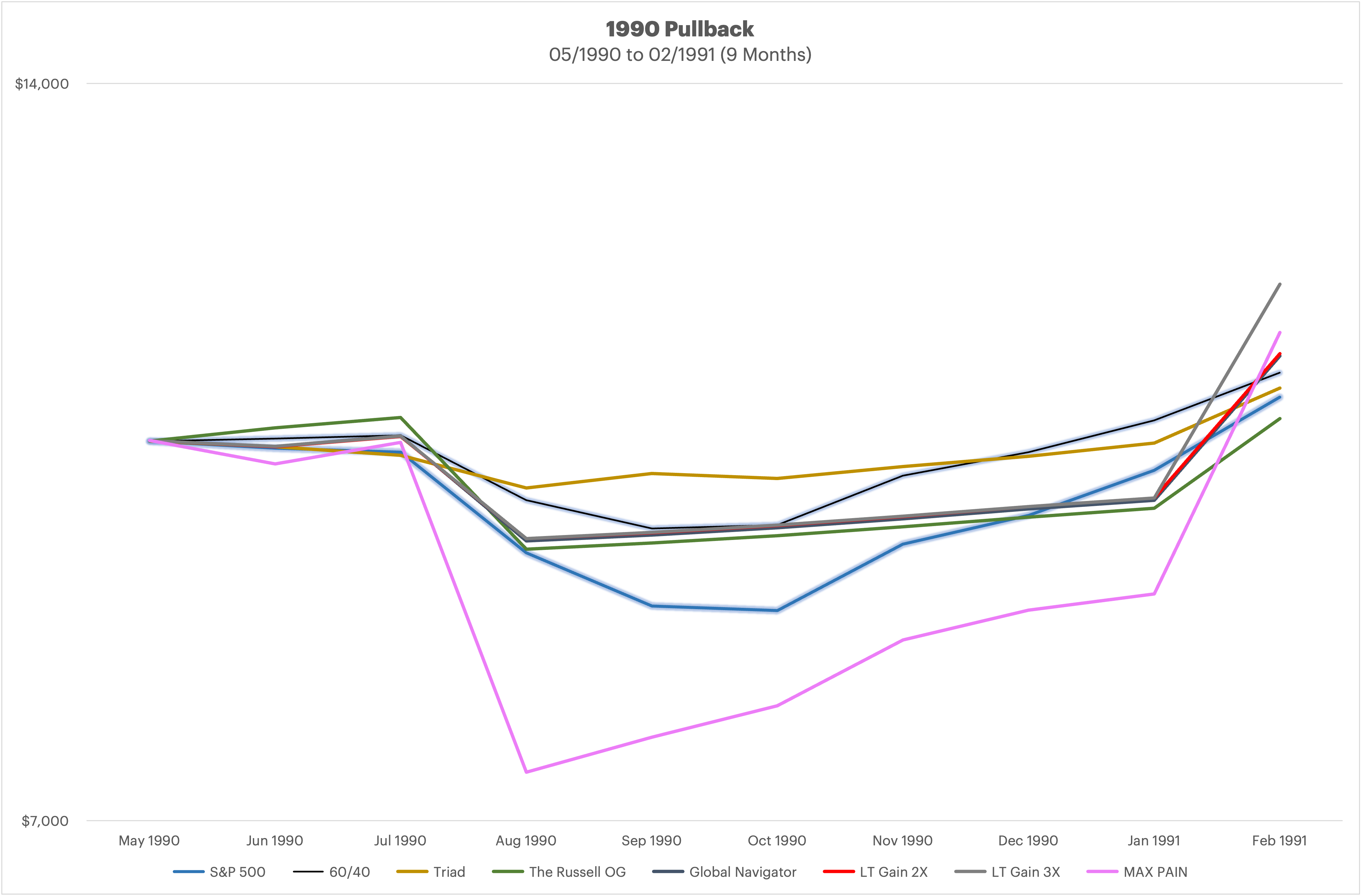

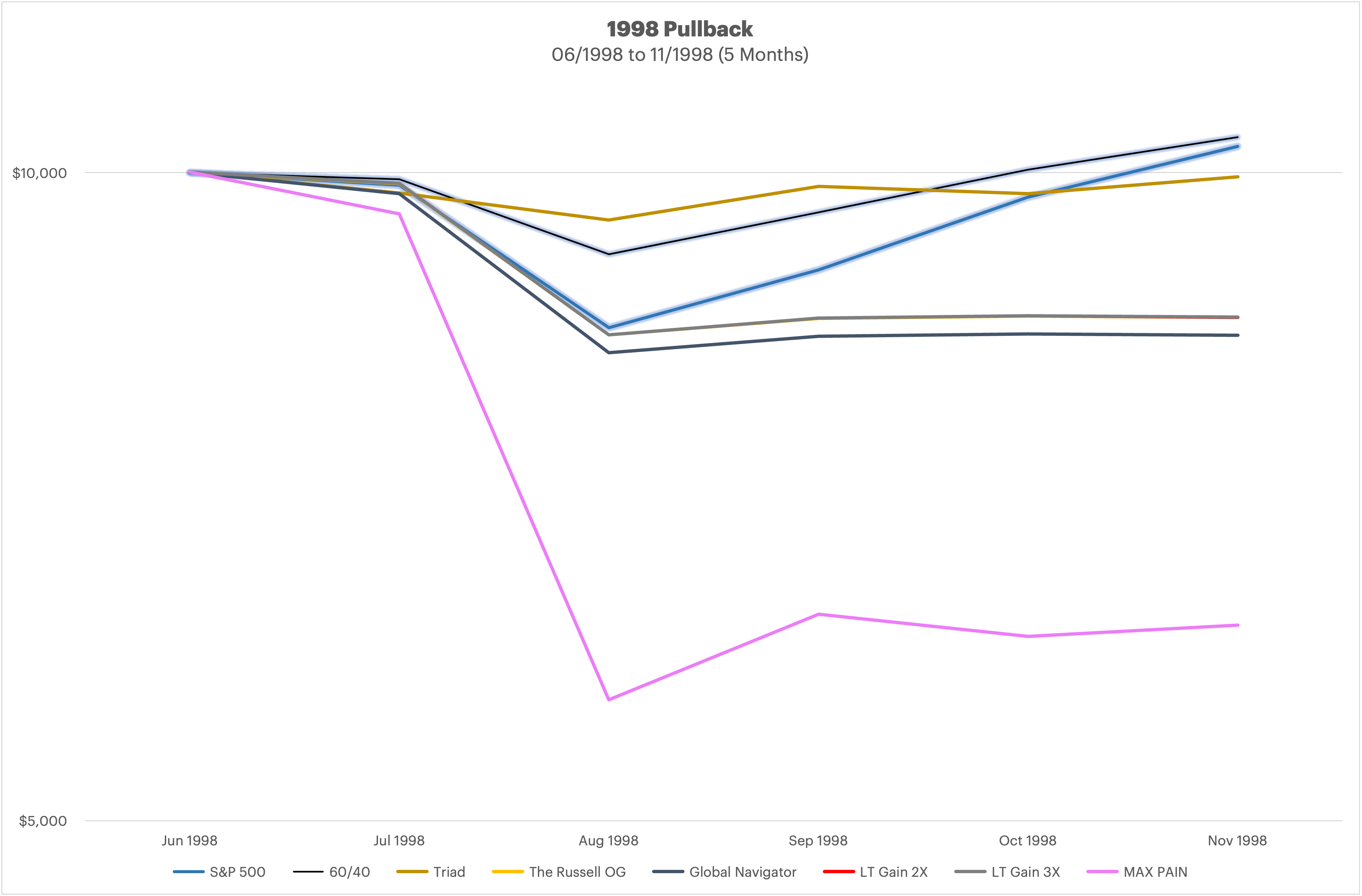

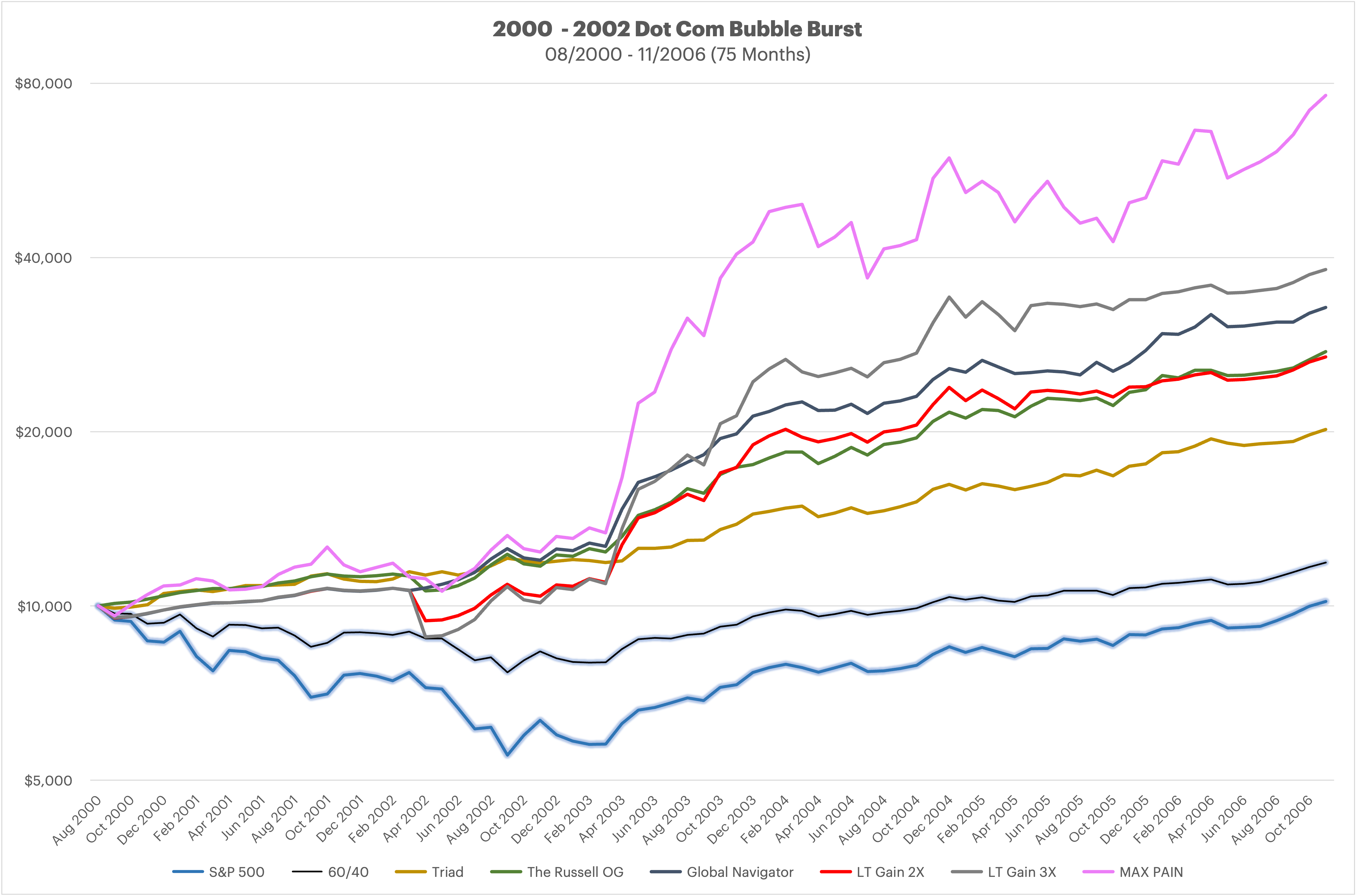

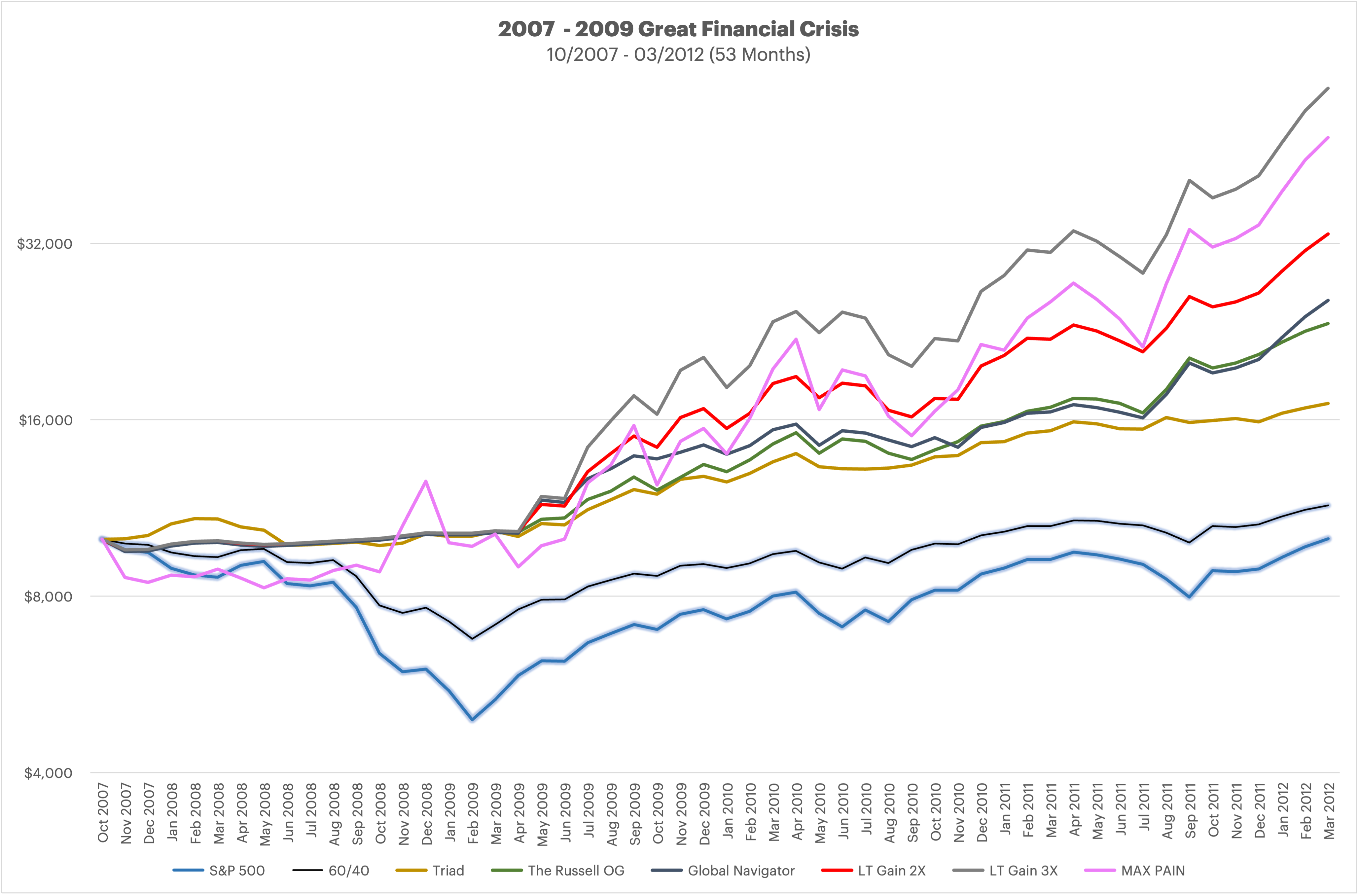

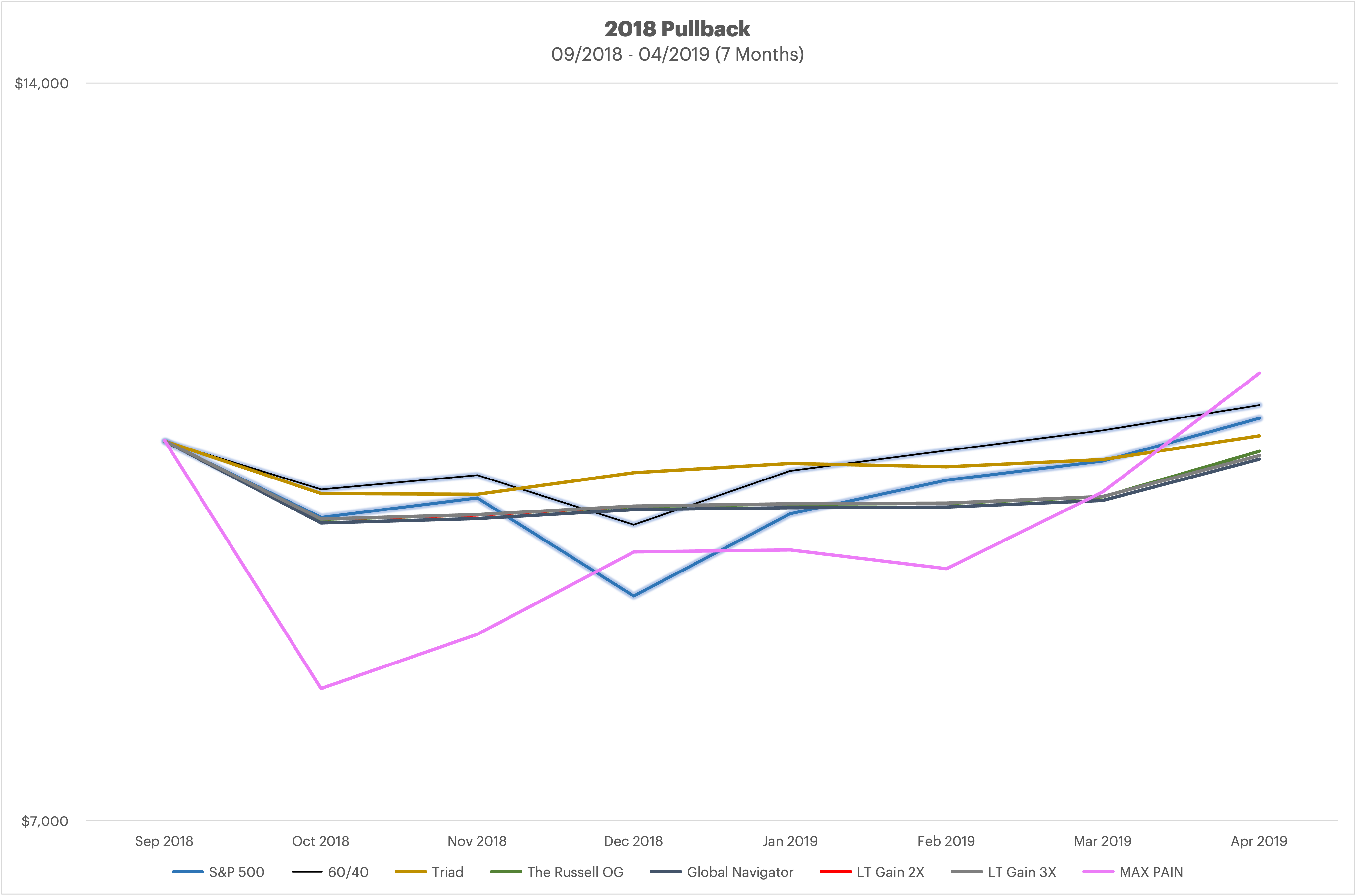

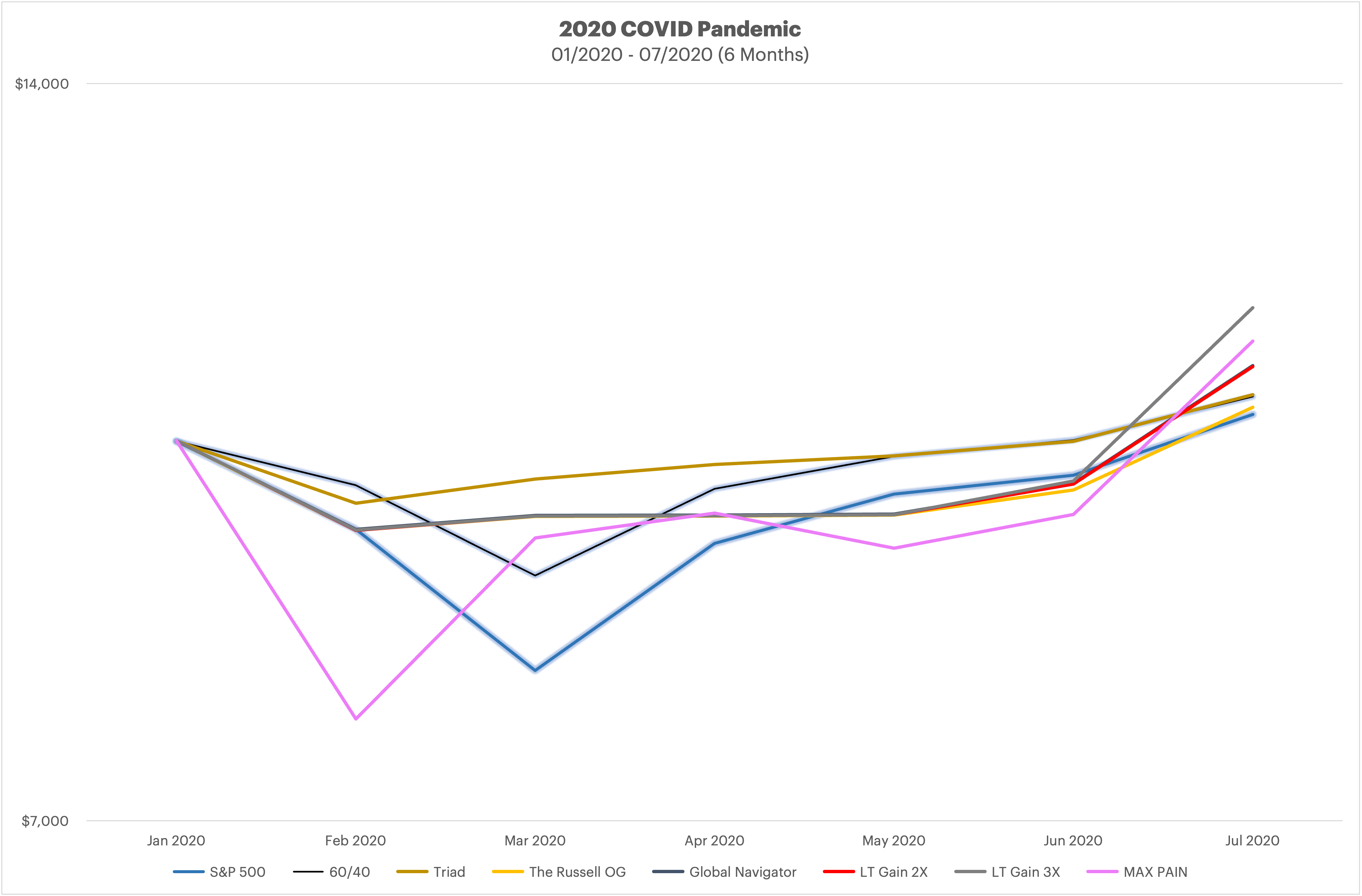

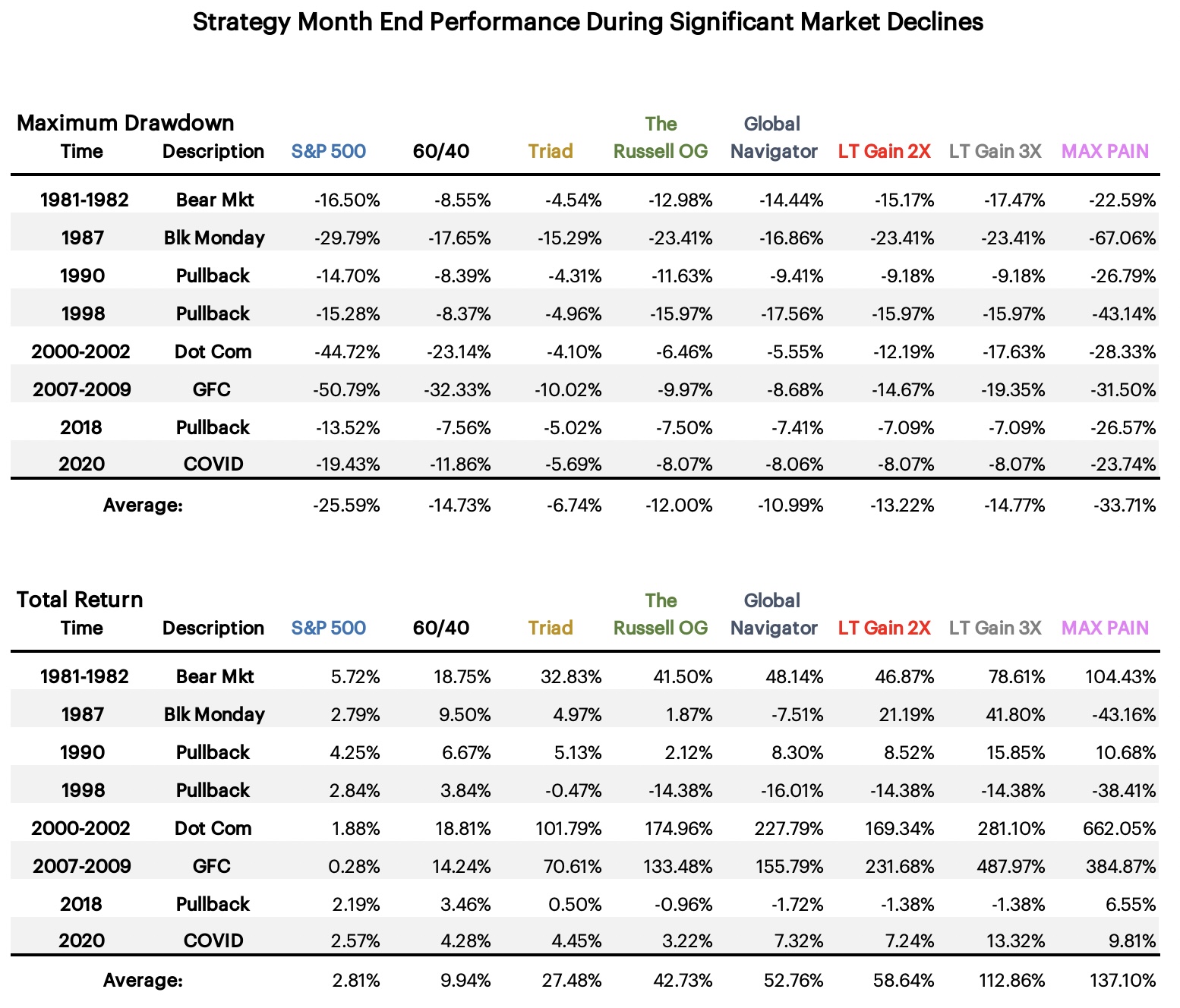

There was a recent post about Bear Markets and Major Pullbacks, showing how the strategies did and comparing to the S&P 500. My general take away is that the short term pull backs of a few months are a coin toss, these DMS strategies may or may not do any better, if even as good, as the general market does. But it is over the longer drawdowns like 2000 and 2008 where we see a massive improvement to the market results.

What with the recent inversion of the yield curve, and people talking of a recessing looming in the next 6 to 24 months, I thought it was worth re-posting the same article of Bear Markets and Major Pullbacks but this time showing it with TDL, Treasury Duration Limiter, in effect.

All of the charts, and data, in this post are with TDL in effect.

Reminder that Triad and Triad+ do not use Treasury Duration Limiter, they don't need it because of how these strategies were designed originally. Neither does MAX PAIN have TDL as a part of the strategy - and as mentioned a few days ago, MAX PAIN is on the bubble and may be dropped.

What with the recent inversion of the yield curve, and people talking of a recessing looming in the next 6 to 24 months, I thought it was worth re-posting the same article of Bear Markets and Major Pullbacks but this time showing it with TDL, Treasury Duration Limiter, in effect.

All of the charts, and data, in this post are with TDL in effect.

Reminder that Triad and Triad+ do not use Treasury Duration Limiter, they don't need it because of how these strategies were designed originally. Neither does MAX PAIN have TDL as a part of the strategy - and as mentioned a few days ago, MAX PAIN is on the bubble and may be dropped.