TDL and the Triad Trio

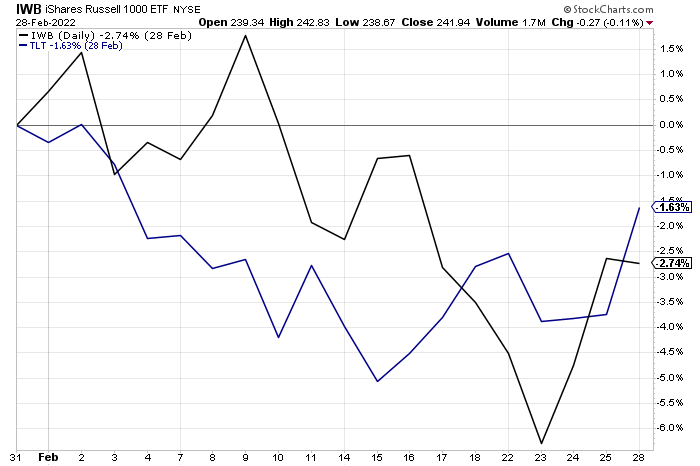

The strategies (not Triad, it uses a different lookback and different risk off treasuries and bonds) went into treasuries for the months of February and March this year. During the month of February, treasuries didn't end the month terribly even though they underperformed the Russell 1000 most of the month, this chart below shows February 2022 for long duration treasuries and the Russell 1000. The treasuries lost about 1% less than the market.

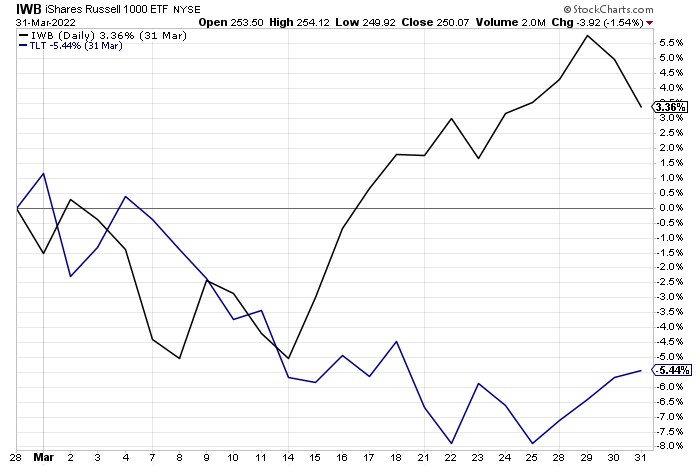

March was far worse for treasuries. Traditionally the treasuries act as a flight to safety and provide safety and returns when stocks aren't doing well, this didn't happen the 1st half of the month as stocks went down, Treasuries were down equally, then as the equities recovered and made gains, the treasuries lagged tremendously. Treasury yields have seen some of the biggest increases in this short of a time and has been devastating for the price of treasuries and bonds, especially the longer duration ones.

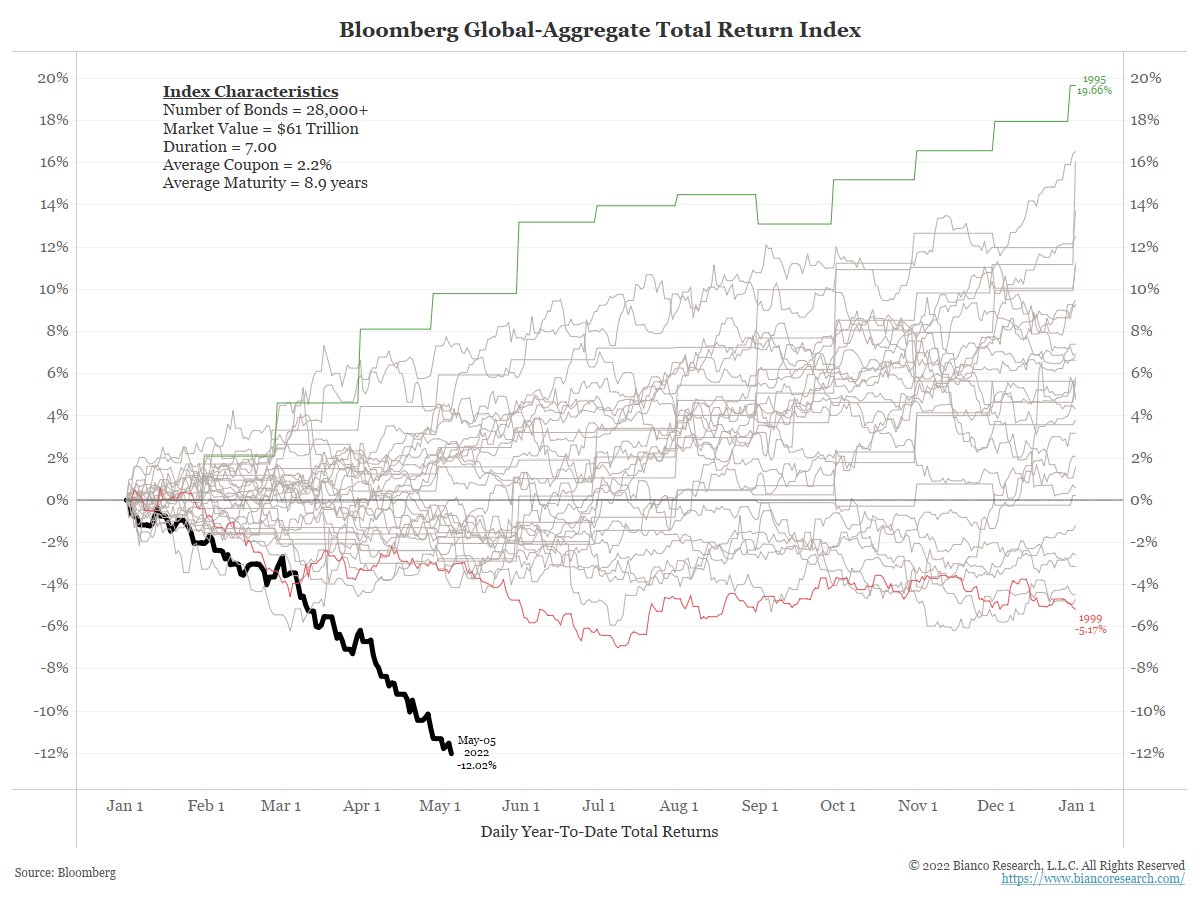

This chart below, tweeted by Jim Bianco, shows the treasury returns year to date for all history available - this is the worst year on record so far. Just crazy, we've not seen this happen before.

The result is that we took a hit in March in the strategies like The Russell, Global Navigator, LT Gain, and LT Gain 3X. They went out of equities based on the model and ended up performing terribly in long duration treasuries.

The result is that we took a hit in March in the strategies like The Russell, Global Navigator, LT Gain, and LT Gain 3X. They went out of equities based on the model and ended up performing terribly in long duration treasuries.

TDL, Treasury Duration Limiter, is something that I came up with after that terrible treasury performance in March, the goal is to restrict the strategy to short duration treasuries when going long duration presents too high of a risk. I ended up making TDL operate on the 30 year treasury yield, subtract the 5 year treasury yield, and if the spread is less than 1% then TDL kicks in and the strategy would go into short term instead of long duration treasuries.

Recently, I have been looking into TrendXplorer's Generalized Protective Momentum, GPM, strategy - it is of interest to me, particularly in a retirement portfolio. I found myself thinking about the strategy and making a couple changes based on my perspective to see how it looked on historical data. In my making a few adjustments to GPM I found myself implementing a TDL type filter for GPM, and it dawned on me that it should also work well for the DMS strategies.

It is elegantly simple, and works better than the 30 year - 5 year treasury yields so I have swapped out the inner workings of the TDL filter. TDL now simply looks at the weighted lookback of long duration treasuries, my weighted lookbacks for the strategies are 25% of the 1 month return, 25% of the 3 month return, and 50% of the 6 month return. However, I wanted this to be faster acting and more protective, so I changed the weighted lookback to 50% of the 1 month return, 25% of the 3 month return, and 25% of the 6 month return.

If we are risk off for multiple months, TDL can kick in at any month end, maybe in February we start off in long duration treasuries, but TDL kicks in for March so then we switch to short duration treasuries. The way I have TDL set, if in April the new signal is for long duration treasuries - we stay in the TDL limited option until we go back into equities. It avoids switching back and fort from long to short treasuries for those times when it is many months, the returns are not hurt and volatility is lowered.

I wish I had come up with this originally, I had it in my head that the risk off asset should be restricted from an outside metric, but as always, price is usually the best metric available.

This additional filter, TDL, to the strategies will help to protect us any time the long duration treasuries may not be a safe place to park our investments. The reporting deck for May will be complete with the updated TDL.

Recently, I have been looking into TrendXplorer's Generalized Protective Momentum, GPM, strategy - it is of interest to me, particularly in a retirement portfolio. I found myself thinking about the strategy and making a couple changes based on my perspective to see how it looked on historical data. In my making a few adjustments to GPM I found myself implementing a TDL type filter for GPM, and it dawned on me that it should also work well for the DMS strategies.

It is elegantly simple, and works better than the 30 year - 5 year treasury yields so I have swapped out the inner workings of the TDL filter. TDL now simply looks at the weighted lookback of long duration treasuries, my weighted lookbacks for the strategies are 25% of the 1 month return, 25% of the 3 month return, and 50% of the 6 month return. However, I wanted this to be faster acting and more protective, so I changed the weighted lookback to 50% of the 1 month return, 25% of the 3 month return, and 25% of the 6 month return.

If we are risk off for multiple months, TDL can kick in at any month end, maybe in February we start off in long duration treasuries, but TDL kicks in for March so then we switch to short duration treasuries. The way I have TDL set, if in April the new signal is for long duration treasuries - we stay in the TDL limited option until we go back into equities. It avoids switching back and fort from long to short treasuries for those times when it is many months, the returns are not hurt and volatility is lowered.

I wish I had come up with this originally, I had it in my head that the risk off asset should be restricted from an outside metric, but as always, price is usually the best metric available.

This additional filter, TDL, to the strategies will help to protect us any time the long duration treasuries may not be a safe place to park our investments. The reporting deck for May will be complete with the updated TDL.

The Triad Trio!

Triad is one of the newer strategies, and it has become one of my favorites. When I was originally designing Triad last year, I wanted to include both gold and or commodities as up to a 1/6th investment option, but I wasn't able to source commodities monthly returns back to 1980 so decided to just leave it with gold as the option. I recently was able to obtain the monthly commodities returns back to before 1980 and have implemented it into the strategy.

The strategy will invest 1/6th of the strategy into either gold or commodities, whichever has the stronger relative momentum, and if neither has positive absolute momentum, then that 1/6th is invested into our safety holdings, treasuries or bonds.

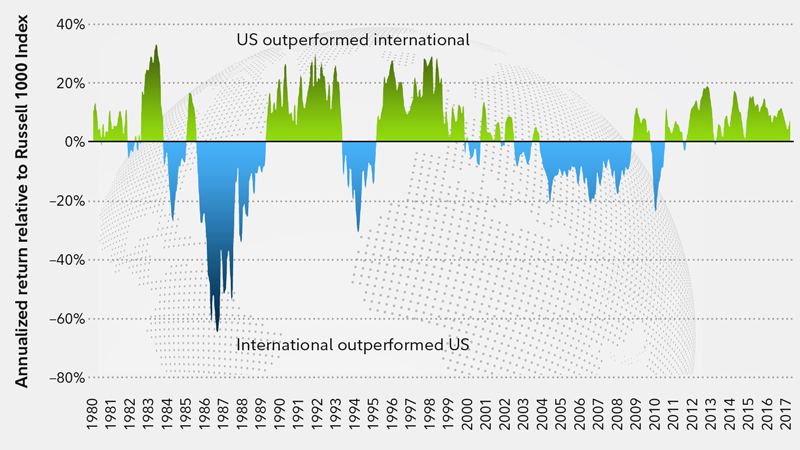

I've decided to make Triad a little more robust in regards to International equities, similar to Global Navigator. Recency bias has everybody looking away from International and at the US Markets, but historically up until about 12 years ago, International markets had the same historical returns as the US, and they tend to outperform when the US Markets are underperforming.

Triad is one of the newer strategies, and it has become one of my favorites. When I was originally designing Triad last year, I wanted to include both gold and or commodities as up to a 1/6th investment option, but I wasn't able to source commodities monthly returns back to 1980 so decided to just leave it with gold as the option. I recently was able to obtain the monthly commodities returns back to before 1980 and have implemented it into the strategy.

The strategy will invest 1/6th of the strategy into either gold or commodities, whichever has the stronger relative momentum, and if neither has positive absolute momentum, then that 1/6th is invested into our safety holdings, treasuries or bonds.

I've decided to make Triad a little more robust in regards to International equities, similar to Global Navigator. Recency bias has everybody looking away from International and at the US Markets, but historically up until about 12 years ago, International markets had the same historical returns as the US, and they tend to outperform when the US Markets are underperforming.

The chart above shows how there are periods when the International markets have outperformed the US markets. Triad now capitalizes on this situation. Similar to how Triad now invests in the stronger of gold or commodities, it will put 2/6th of the strategy into either the Russell Mid-Cap Value or International, whichever has the higher relative momentum. If neither of them have absolute momentum, then the 2/6th goes into the best performer of the bonds/treasuries.

The 2/6 allocation into the Russell 1000 remains unchanged.

Triad+ is the same as Triad, but adds Smart Leverage and will go into 2X S&P 500 instead of the Russell 1000 when going back into equities after a 15% or larger drawdown in the Russell 1000. This position is held until a natural change of investments in the strategy up to 1 year at which time the position is closed and we would de-leverage into the Russell 1000.

Triad++ is the same as Triad+ but the 2/6th position that would go into the Russell 1000, with Smart Leverage in Triad++ it would go into 3X S&P 500.

Even using 2X and 3X leverage with the 2/6th position the risk adjusted returns on the strategy are phenomenal, and for me it becomes a single strategy that fits more needs without having to combine multiple strategies. Note that leveraged equities do present a risk, a terrible month in the markets is amplified if in leveraged assets. This is not investment advice.

Going forward with the May Reporting Deck, all three Triad strategies will be included.

You can download the Fact Sheets for all three Triad strategies here.

I am really excited for the Triad offerings and am using them heavily myself. Please pay attention to the MAX Leverage of strategies. Triad++ has a 166% max leverage on it's own. the 2/6 position will effectively become 6/6 in Triad++ when it goes into UPRO. Triad always has at least 1/6 in treasuries/bonds, I personally don't consider that a 1:1 leverage the same as equities, but I didn't want to downplay the overall effective leverage all the same.

Happy Investing, geez, especially in this environment. If the couple people I follow who's opinions I respect are correct, we could see a really big drop still to come in the equities markets. Dual Momentum Systems strategies have had some whipsaw this year, and got caught in long duration treasuries in March, but they should fare well if faced with a large drawdown in the markets, and get us back in when they have some positive momentum.

The 2/6 allocation into the Russell 1000 remains unchanged.

Triad+ is the same as Triad, but adds Smart Leverage and will go into 2X S&P 500 instead of the Russell 1000 when going back into equities after a 15% or larger drawdown in the Russell 1000. This position is held until a natural change of investments in the strategy up to 1 year at which time the position is closed and we would de-leverage into the Russell 1000.

Triad++ is the same as Triad+ but the 2/6th position that would go into the Russell 1000, with Smart Leverage in Triad++ it would go into 3X S&P 500.

Even using 2X and 3X leverage with the 2/6th position the risk adjusted returns on the strategy are phenomenal, and for me it becomes a single strategy that fits more needs without having to combine multiple strategies. Note that leveraged equities do present a risk, a terrible month in the markets is amplified if in leveraged assets. This is not investment advice.

Going forward with the May Reporting Deck, all three Triad strategies will be included.

You can download the Fact Sheets for all three Triad strategies here.

I am really excited for the Triad offerings and am using them heavily myself. Please pay attention to the MAX Leverage of strategies. Triad++ has a 166% max leverage on it's own. the 2/6 position will effectively become 6/6 in Triad++ when it goes into UPRO. Triad always has at least 1/6 in treasuries/bonds, I personally don't consider that a 1:1 leverage the same as equities, but I didn't want to downplay the overall effective leverage all the same.

Happy Investing, geez, especially in this environment. If the couple people I follow who's opinions I respect are correct, we could see a really big drop still to come in the equities markets. Dual Momentum Systems strategies have had some whipsaw this year, and got caught in long duration treasuries in March, but they should fare well if faced with a large drawdown in the markets, and get us back in when they have some positive momentum.