A Closer look at DMS Model Portfolios

Model Retire Portfolio

(You can look at the latest Reporting Decks for the DMS Strategies, and DMS Bamboo Portfolios for more detail.)

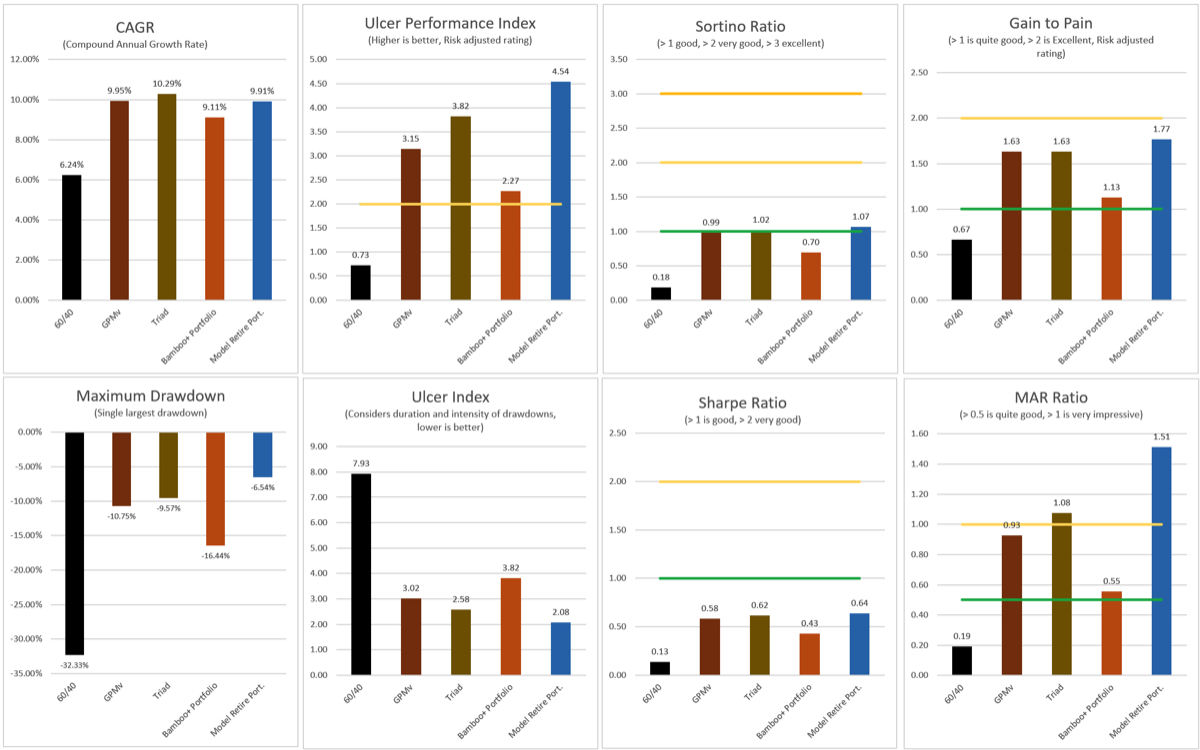

Let's dig into the returns and metrics of the strategies that make up some Model Portfolios here at DMS and see how it plays out. From Jan 2000 through Mar 2024 the three strategies that are a part of the Model Retire Portfolio provided similar compounded annual growth rate, CAGR:

Bamboo+ Portfolio 9.11%, Triad 11.70%, GPMv 9.95%

If we look at some key metrics over the same time period we can see how these three strategies compare to each other.

Maximum Drawdown

(the closer to 0 the better)

Bamboo+ Portfolio -16.44%, Triad -11.33%, GPMv -10.75%

Ulcer Index

(the lower the better)

Bamboo+ Portfolio 3.82, Triad 2.58, GPMv 3.02

Ulcer Performance Index

(the higher the number the better)

Bamboo+ Portfolio 2.27, Triad 3.82, GPMv 3.15

Gain to Pain

(the higher the number the better)

Bamboo+ Portfolio 1.13, Triad 1.63, GPMv 1.63

These metrics show that all three strategies had far less maximum drawdown than the -32.33% that a 60/40 portfolio experienced, and miles better than the -50.79% that the S&P 500 suffered. GPMv had the lowest drawdown, followed closely by Triad, Bamboo+ was not at all bad with a drawdown of -16.44%, and it is not surprisingly a little higher since this is an allocation strategy which is positioned for holding all the time, and it does not go risk off.

All three strategies have very respectable Ulcer Index's, especially when you consider than the highly guarded and staple portfolio of 60% stocks and 40% bonds has an Ulcer Index of 7.93, and the S&P 500 16.37!

The Ulcer Performance Index, UPI, is highest with Triad, this is a factor of it's best return over the time period, combined it's very low Ulcer Index. The other two strategies have lower UPI, but far better than the 60/40 and S&P 500 which are 0.73 and 0.42.

For this time period, Triad is the winner (GPMv is the winner if we look at 1980 forward). That isn't really the focus of this post though, I want to show how the Model Retire Portfolio which consists of 1/3rd of each of these strategies compares to the individual strategies.

Simple math tells us that the average return of the three strategies is 10.25%, and the Model Retire Portfolio clocks in very close at 9.91%.

The maximum drawdown of the three strategies was -16.44%, -11.33%, and -10.75%, but the maximum drawdown of the Model Retire Portfolio is just -6.54%! The three strategies move differently from one another, and instead of amplifying drawdowns, they are uncorrelated in their movement and end up canceling out some of the larger drawdowns. We can also see this in the Ulcer Index. the three strategies had Ulcer Index of 3.82, 2.58, and 3.02, but the Model Retire Portfolio has an Ulcer Index of just 2.08, the Model Retire Portfolio is significantly less volatile than any of the three strategies which make up this portfolio. As a result of the very low Ulcer Index the UPI soars at 4.54, far higher than the 2.27, 3.82, and 3.15 of the three strategies in the Portfolio.

Gain to Pain for the three strategies are 1.13, 1.63, and 1.63, and the Model Retire Portfolio has a Gain to Pain of 1.77, another nice improvement.

Let this sink in, over a period greater than 24 years the Model Retire Portfolio generates a return which is far higher than the S&P or a 60/40 and never sustained even a 7% drawdown along the way.

(You can look at the latest Reporting Decks for the DMS Strategies, and DMS Bamboo Portfolios for more detail.)

Let's dig into the returns and metrics of the strategies that make up some Model Portfolios here at DMS and see how it plays out. From Jan 2000 through Mar 2024 the three strategies that are a part of the Model Retire Portfolio provided similar compounded annual growth rate, CAGR:

Bamboo+ Portfolio 9.11%, Triad 11.70%, GPMv 9.95%

If we look at some key metrics over the same time period we can see how these three strategies compare to each other.

Maximum Drawdown

(the closer to 0 the better)

Bamboo+ Portfolio -16.44%, Triad -11.33%, GPMv -10.75%

Ulcer Index

(the lower the better)

Bamboo+ Portfolio 3.82, Triad 2.58, GPMv 3.02

Ulcer Performance Index

(the higher the number the better)

Bamboo+ Portfolio 2.27, Triad 3.82, GPMv 3.15

Gain to Pain

(the higher the number the better)

Bamboo+ Portfolio 1.13, Triad 1.63, GPMv 1.63

These metrics show that all three strategies had far less maximum drawdown than the -32.33% that a 60/40 portfolio experienced, and miles better than the -50.79% that the S&P 500 suffered. GPMv had the lowest drawdown, followed closely by Triad, Bamboo+ was not at all bad with a drawdown of -16.44%, and it is not surprisingly a little higher since this is an allocation strategy which is positioned for holding all the time, and it does not go risk off.

All three strategies have very respectable Ulcer Index's, especially when you consider than the highly guarded and staple portfolio of 60% stocks and 40% bonds has an Ulcer Index of 7.93, and the S&P 500 16.37!

The Ulcer Performance Index, UPI, is highest with Triad, this is a factor of it's best return over the time period, combined it's very low Ulcer Index. The other two strategies have lower UPI, but far better than the 60/40 and S&P 500 which are 0.73 and 0.42.

For this time period, Triad is the winner (GPMv is the winner if we look at 1980 forward). That isn't really the focus of this post though, I want to show how the Model Retire Portfolio which consists of 1/3rd of each of these strategies compares to the individual strategies.

Simple math tells us that the average return of the three strategies is 10.25%, and the Model Retire Portfolio clocks in very close at 9.91%.

The maximum drawdown of the three strategies was -16.44%, -11.33%, and -10.75%, but the maximum drawdown of the Model Retire Portfolio is just -6.54%! The three strategies move differently from one another, and instead of amplifying drawdowns, they are uncorrelated in their movement and end up canceling out some of the larger drawdowns. We can also see this in the Ulcer Index. the three strategies had Ulcer Index of 3.82, 2.58, and 3.02, but the Model Retire Portfolio has an Ulcer Index of just 2.08, the Model Retire Portfolio is significantly less volatile than any of the three strategies which make up this portfolio. As a result of the very low Ulcer Index the UPI soars at 4.54, far higher than the 2.27, 3.82, and 3.15 of the three strategies in the Portfolio.

Gain to Pain for the three strategies are 1.13, 1.63, and 1.63, and the Model Retire Portfolio has a Gain to Pain of 1.77, another nice improvement.

Let this sink in, over a period greater than 24 years the Model Retire Portfolio generates a return which is far higher than the S&P or a 60/40 and never sustained even a 7% drawdown along the way.

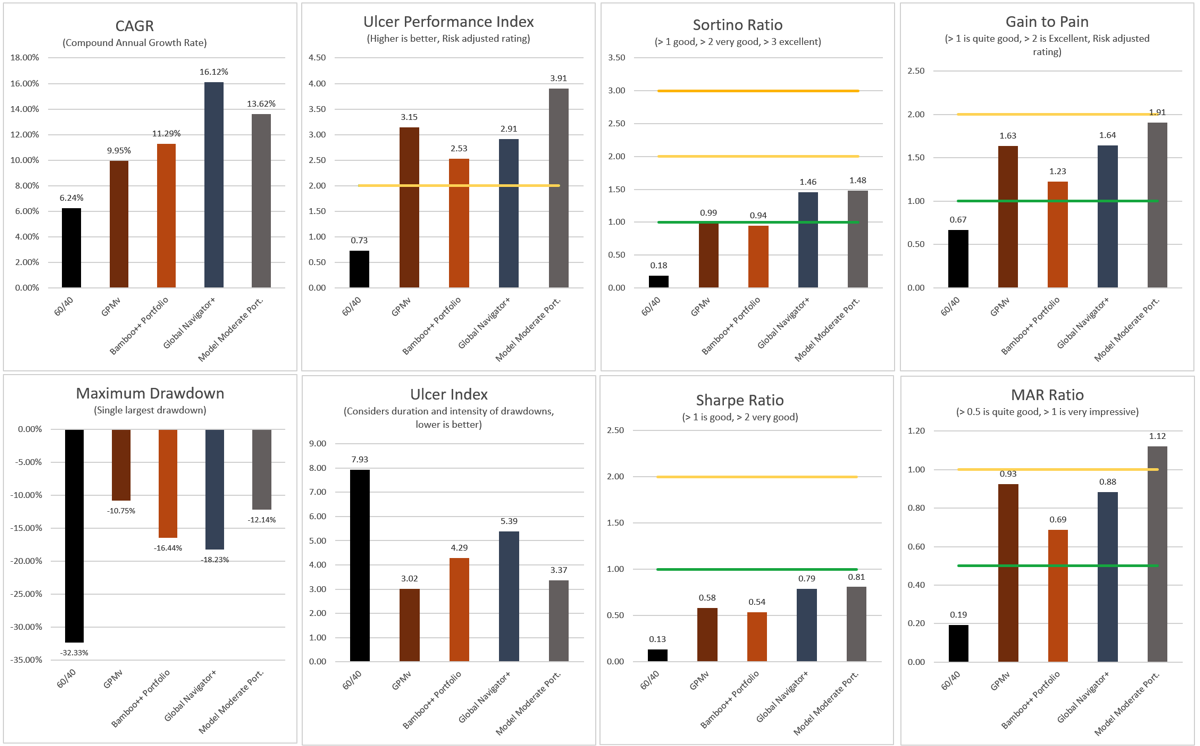

Model Moderate Portfolio

Let's take a quick look at the Model Moderate Portfolio and see if this improvement persists across strategies. The Model Moderate Portfolio consists of 25% GPMv, 25% Bamboo ++ Portfolio, and 50% Global Navigator+ 16.12%. The Model Moderate Portfolio CAGR comes in at 13.62%.

Ulcer Index for the three strategies is: 3.02, 4.29, and 5.39, the Model Moderate Portfolio has an Ulcer Index of 3.37, far better than the weighted average of the three strategies of 4.53.

The individual UPI's are 3.15, 2.53, 2.91 while the Model Moderate Portfolio has a superior UPI of 3.91.

The individual Gain to Pain are 1.63, 1.23, 1.64 while the Model Moderate Portfolio has a superior UPI of 1.91.

The individual Maximum Drawdowns are -10.75%, -16.44%, -18.23% while the Model Moderate Portfolio has a better MaxDD of -12.14%. Only GPMv had a lower drawdown, but the returns are significantly higher for the Model Moderate Portfolio than GPMv.

Once again we saw far better overall metrics, returns vs the associated risks, by combining three of the strategies than the strategies performed in a silo.

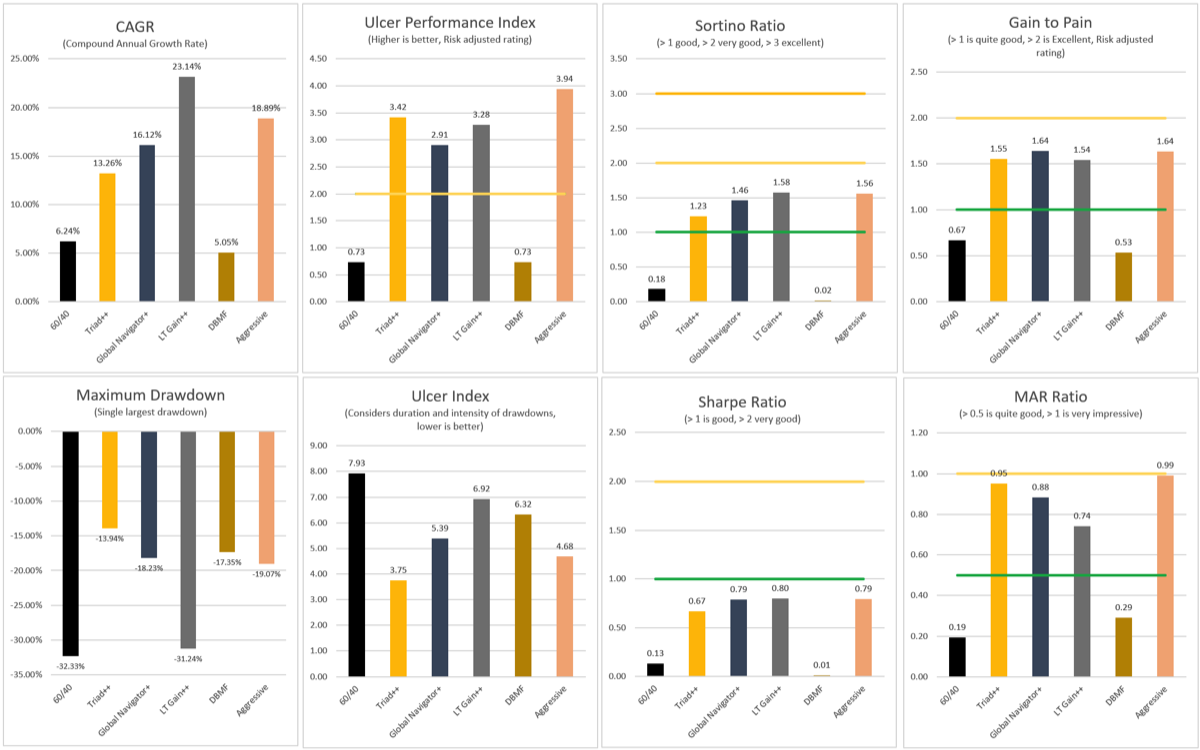

Model Aggressive Portfolio

One more, let's look at the Model Aggressive Portfolio which consists of 15% Triad++, 10% Global Navigator+, 60% LT Gain++, and 15% DBMF.

Metrics for the four components and the Model Aggressive Portfolio:

Maximum Drawdowns: -13.94%, -18.23%, -31.24%, -17.35%; MAP: -19.07%, far better considering 60% of the portfolio experienced over a 30% drawdown.

Ulcer Index: 3.75, 5.39, 6.92, 6.31; MAP: 4.68, tremendous improvement.

Ulcer Performance Index: 3.42, 2.91, 3.28, 0.73; MAP: 3.94, again a tremendous improvement.

Gain to Pain: 1.55, 1.64, 1.54, 0.53; MAP: 1.64, another improvement, not as significant this time with the Gain to Pain, but still an improvement.

Portfolio Construction

When putting together a Model Portfolio, I primarily look at the CAGR, and the average and maximum leverage. I try to make sure that the average and maximum leverage are suitable in my opinion for Retire, Moderate, and Aggressive, of course somebody else's viewpoint could be very different and the portfolios may need tweaking to meet their tolerances. You may have different criteria, but you can certainly improve the risk adjusted returns by combining different strategies, and setting targets for leverage which you are comfortable with.

Which Model Portfolio suites your investing temperament? Or do none of them fit?

Let me know!

randy@dualmomentumsystems.com