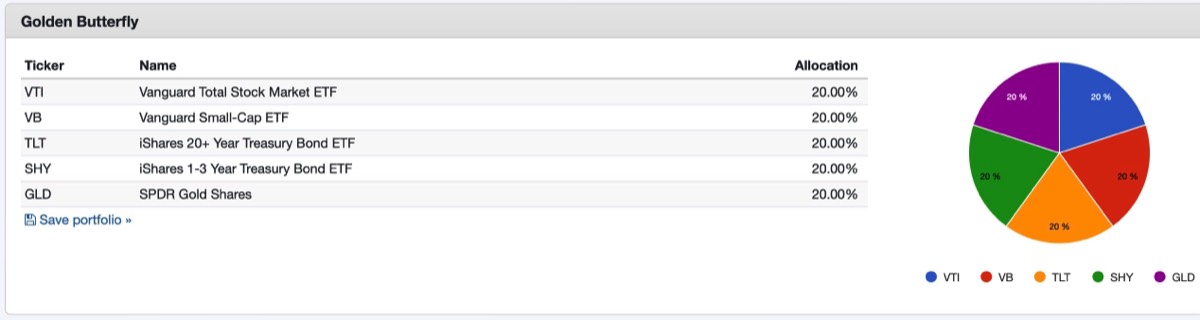

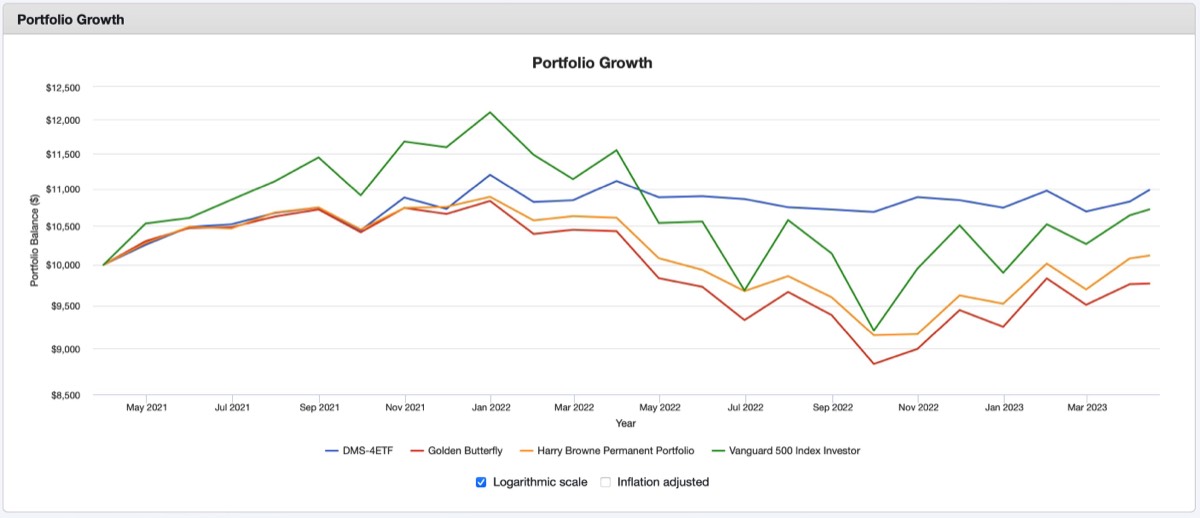

Harry Browne came up with the Permanent Portfolio in the 1980's and it is brilliant in design. The PP has 4 equal weighted components, US Stocks, Gold, Long term treasuries, and Cash. The idea is that even in the worst of economic conditions, at least one quarter of the portfolio should be doing well, and several can be doing well. It has lower drawdowns, more steady returns than investing in the broad stock market. Returns can lag the S&P, but the drawdowns are also far better. Tyler's site, www.PortfolioCharts.com highlight the Permanent Portfolio, his Golden Butterfly and many other allocation based strategies which only need annual rebalancing.

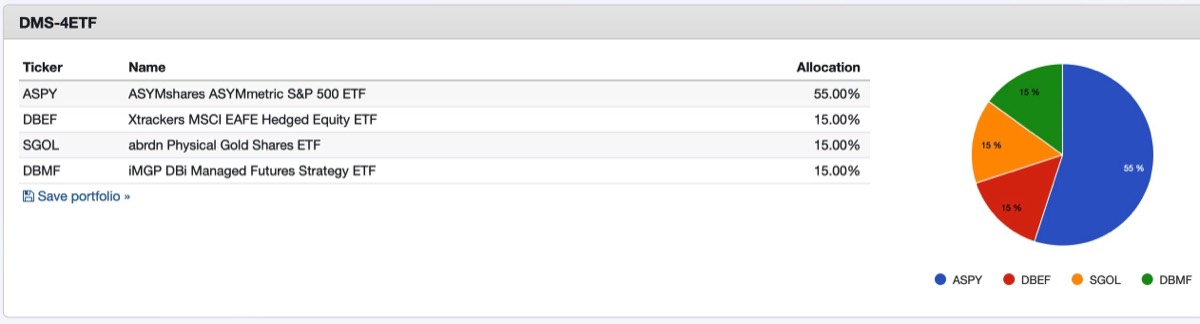

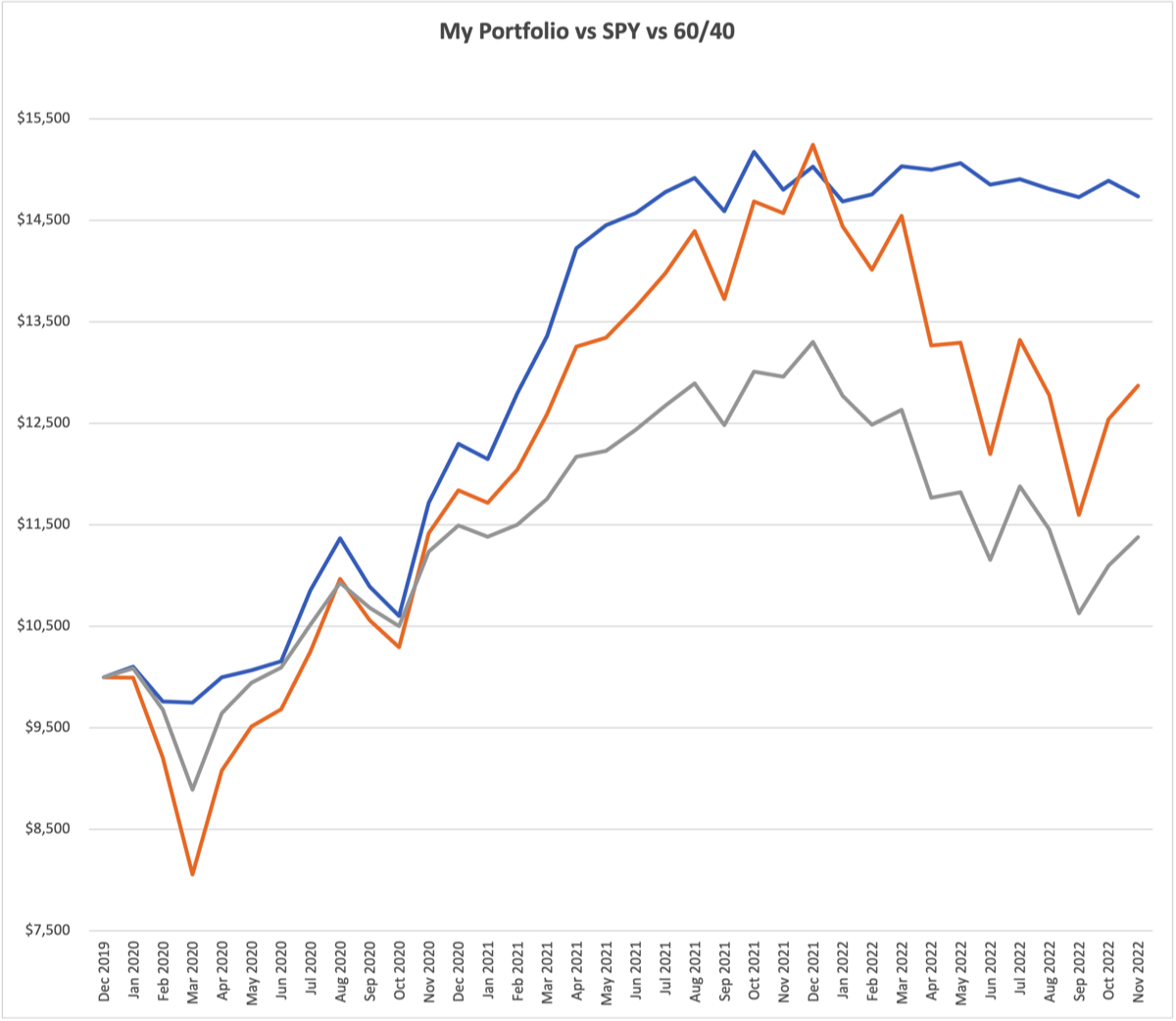

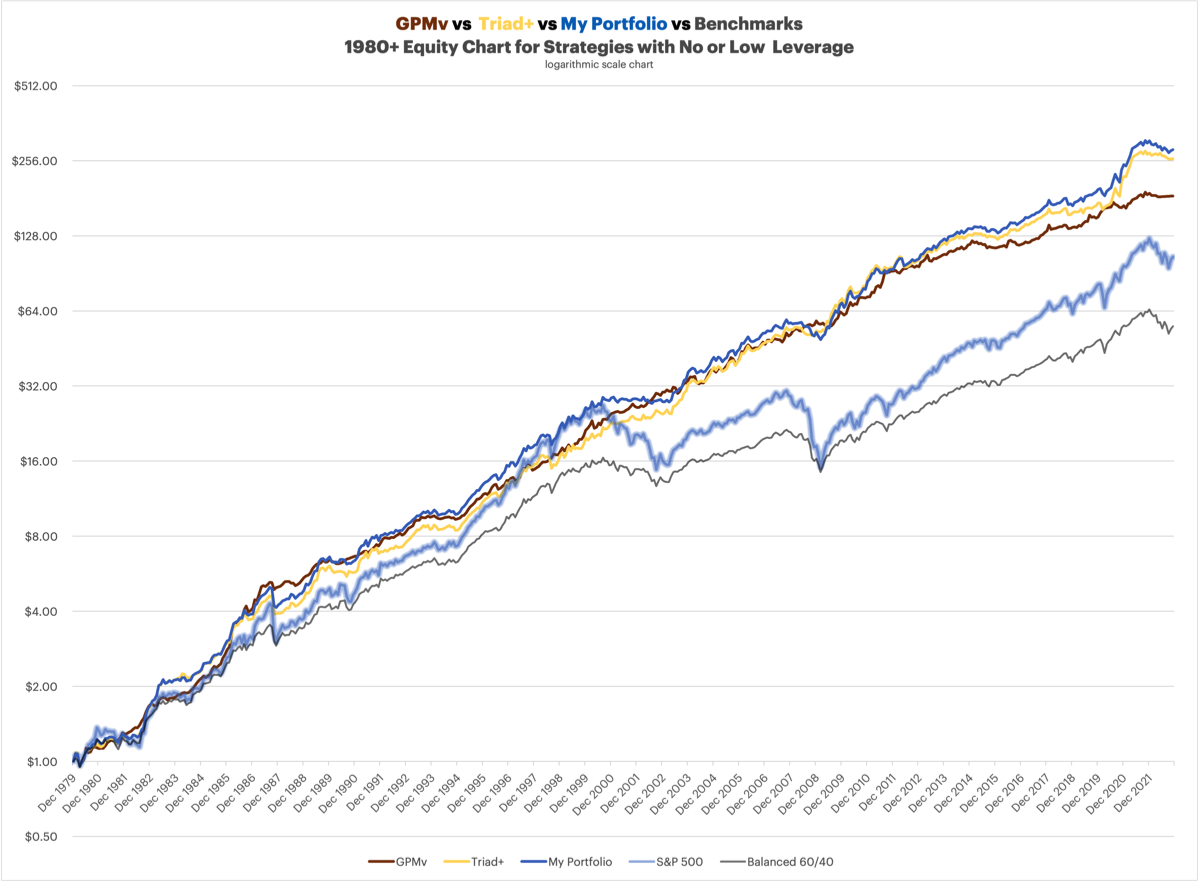

I have gravitated to the dual momentum style of investing and don't mind potentially making changes at the end of a month, I feel the benefits outweigh the drawbacks. This type of strategy may seem too fiddly for some though, which is why I introduce the DMS-4ETF strategy. Similar to the Permanent Portfolio, or the Golden Butterfly, the DMS-4ETF is a static allocation which only needs annual rebalancing.

My take on this is slightly different from the other allocation strategies mentioned, DMS-4ETF uses 4 ETF's that are a bit different, and less tested over the longer horizon.

- ASPY is the main holding at 55%, in a nutshell, ASPY is an ETF which holds futures, similar to a dual momentum strategy which will go risk on / risk off, so does ASPY through futures, but you pay them a ~ 1% fee to manage it and it's hands off from your end. This is the newest ETF in the allocation, but it has done well since inception.

- DBEF is an international fund which hedges to the US Dollar with a 15% allocation, this makes it less volatile than other funds like ACWX and VXUS, and DBEF has historically outperformed the non-hedged funds, this may not hold going forward.

- SGOL is a Gold ETF with a 15% allocation.

- DBMF is a managed futures ETF with a 15% allocation. A traditional managed futures account often would require an individual investor to commit a large sum of money to get into such a strategy, but DBMF, and other similar ETF's bring this type of investment to the masses. The managed futures account is very uncorrelated to the market, it could be completely opposite the market, somewhat similar, or at times completely correlated.

The limited time that I have to show results for this allocation is really encouraging. It is a bit nouveau in how it is using more modern and non traditional ETF's like ASPY and DBMF, and through the use of the US-hedged DBEF for international.

I am a bit unsure how to incorporate this into the monthly reporting because I cannot extend back in time and only have a short results period. I may not have something in the deck for this in the April Reporting Deck, but I'll figure out something soon.

btw - If you want true simplicity without any rebalancing at all, you could just buy ASPY, a single stock portfolio. The 4 ETF allocation I've outlined looks really intriguing to me, and seems worth the hassle of having to rebalance it once a year, but if you really want zero effort investment and to get near market returns with lower volatility, you could just buy ASPY and be done with it!

More information on:

ASPY,

DBEF,

SGOL, and

DBMF