Could there be underperformance?

QUESTION:

"I respect your work and Triad is certainly exceptional. All of your strategies are well crafted.

Do you see anything in the future that could turn some of the strategies underperforming from the past? When I decide that I have found an optimum mix of strategies then I find something new and that forces me to rethink. I am inherently slow in making decisions and making portfolio changes, and then picking another strategy brings another dimension.

Looking at your slide-deck, I think the key is compounding and managing drawdowns gives additional emotional boost. So as long as the general trend of the US economy remains in the up trend I think we would be fine with these strategies I guess. But looking at the past with the help of your strategies it feels that I missed such a great investment environment."

-H.S.

ANSWER:

Thank you!

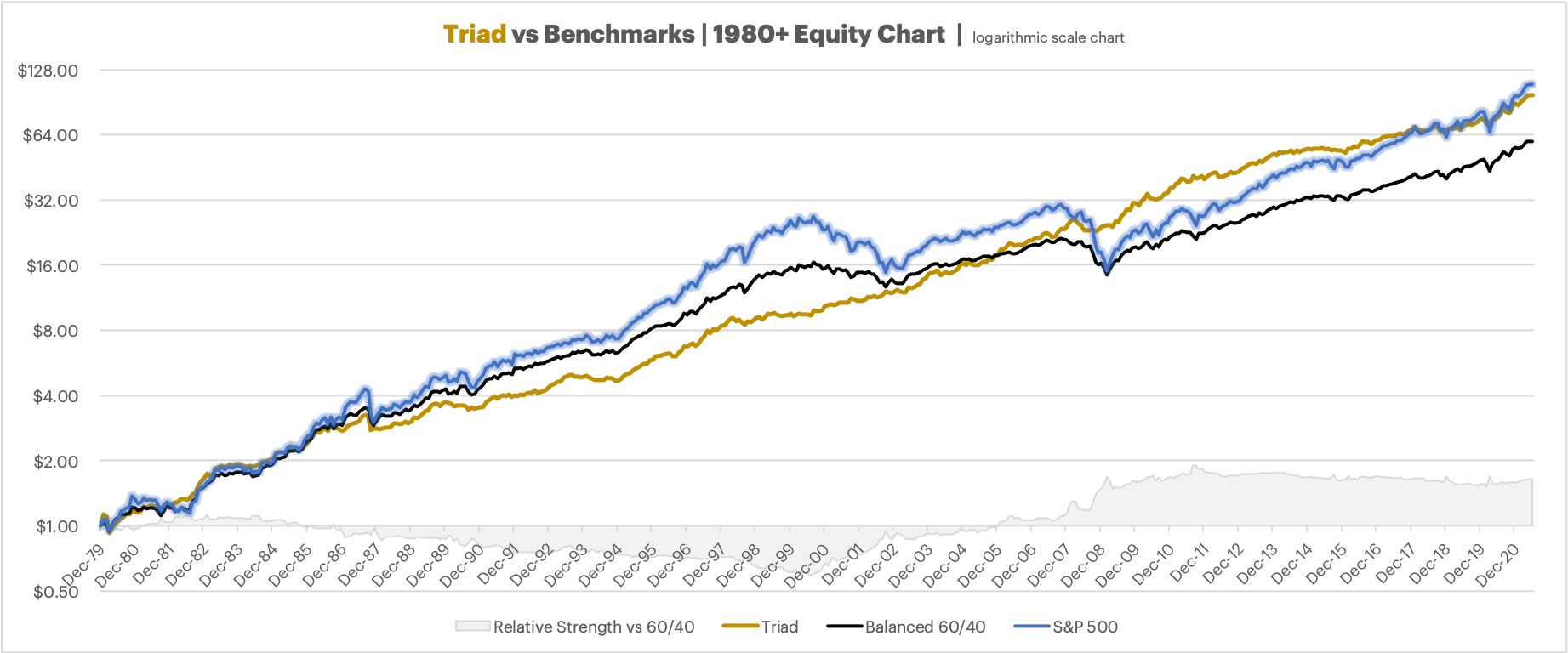

Regarding the future performance of the strategies, I have a high degree of confidence that they will continue to perform well given the backtesting to 1980 providing us with over 4 decades of performance. To nitpick, I know, some of the data is simulated - regardless, they have done great every decade! There is always a risk of a multiple years of underperformance to the S&P when it is firing on all cylinders, or maybe a flash crash gets us out at the bottom and we miss a rapid recovery, things like that could take several years to recover from. However, we have 40 years history of those situations to evaluate and get comfortable with.

You mention the general trend of the US economy, go look at the years 2000 through 2009, the S&P had a 1% negative annual average return that decade, but every one of my strategies performed terrifically!

Look at the chart below - as great as I think that Triad is, and especially considering it was constructed for the new bond market, not the past 40 years of booming bond market, from 1987 through about September 2000 it under performed the 60/40 portfolio. Then the dot com bomb hit and the 60/40 dove while Triad kept right on going, similarly in 2008 the 60/40 performed terribly and Triad keeps right on performing well.

I just want to point out that in the long term I think all of these strategies will do very well, but they shouldn't be judged on a short term time frame against some index, they are designed to do much better in the bad times but still good in the good times, if you only compare the good times they may not look as attractive.

My guess is that you are a moderate investor, just to show you an example portfolio made up of:

Hard to argue against in both a 20 and 40 year time frame of backtests. 17%+ returns, very moderate drawdowns, really nice low volatility, great performance metrics. Looks good to me!

- * 25% Triad

- * 25% The Russell OG

- * 25% Global Navigator

- * 25% The Russell

Hard to argue against in both a 20 and 40 year time frame of backtests. 17%+ returns, very moderate drawdowns, really nice low volatility, great performance metrics. Looks good to me!