Middle of April 2025 Ramblings

The markets have had downward action, and very high volatility. The Russell 1000, IWB, is down 8.53% YTD, and almost 13% from all time highs. Looking at the IWB drawdown as the DMS strategies do, from month month end close as of 03/31/2025 the drawdown is 7.66%, and if we look at mid-March the current month end drawdown would be 11.28%.

Note that Smart Leverage won't kick in until there is a month end high to month end low of 15% or greater. If April were over today we would not have hit that trigger yet. If the market drifts lower either before April is over, or in a future month, then Smart Leverage will be triggered.

Note that Smart Leverage won't kick in until there is a month end high to month end low of 15% or greater. If April were over today we would not have hit that trigger yet. If the market drifts lower either before April is over, or in a future month, then Smart Leverage will be triggered.

Fortunately the strategies went Risk Off for April and so far it has been a benefit, avoiding as much drawdown as the market and side stepping a tremendous amount of volatility.

YTD the Russell 1000 is down 8.53%, and a 60/40 portfolio down 4.35%.

By comparison here are the Model Portfolio's YTD performance: Conservative +1.41%, Moderate -0.58%, Aggressive -3.68%. All three are faring better than the Russell 1000 and a 60/40.

YTD the Russell 1000 is down 8.53%, and a 60/40 portfolio down 4.35%.

By comparison here are the Model Portfolio's YTD performance: Conservative +1.41%, Moderate -0.58%, Aggressive -3.68%. All three are faring better than the Russell 1000 and a 60/40.

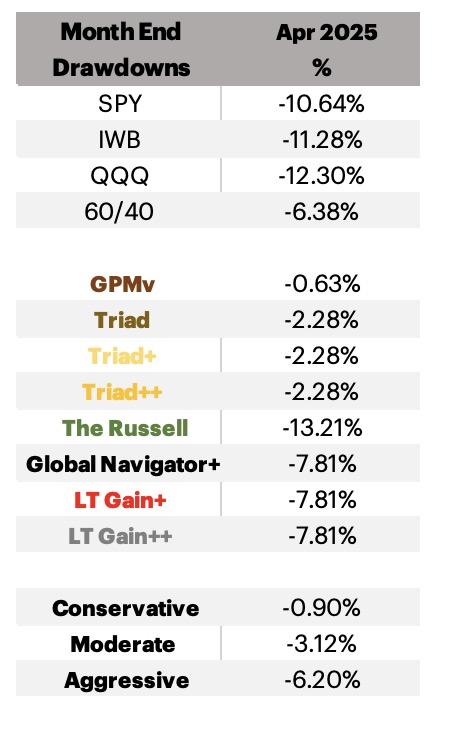

Month end Drawdowns through mid-March are shown above. The only strategy with larger than market drawdowns this year is The Russell, all of the other strategies are performing very well in this market.

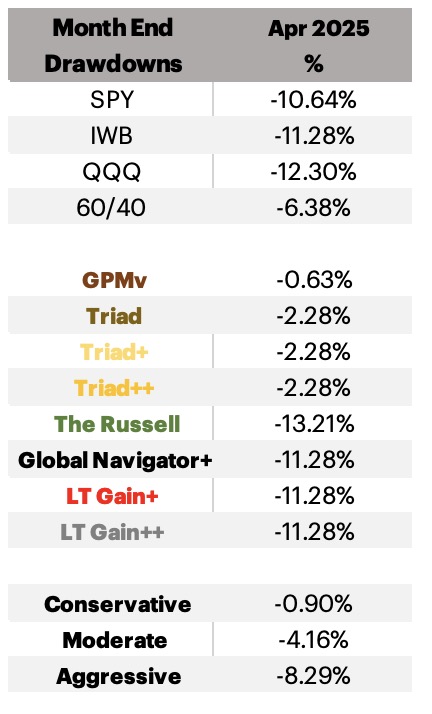

Let's take a look at how those drawdowns would be affected if the following strategies stayed in IWB: Global Navigator+, LT Gain+/++. In other words, if they didn't get the call to move out of the market, how would the drawdowns then look.

Below is what it would look like. Conservative has no change, Moderate is only a little worse, and still noticeably better than a 60/40, the Aggressive portfolio has a bigger drawdown, but still comes in between the 60/40 and Russell 1000 drawdown.

Even if the markets continue to roar back from the lows and April ends with positive returns, I will still be glad to have been largely on the sideline with all of this volatility. I have heard people say that negative returns are about twice the pain as the joy of a gain in the market. I think it may be more like 3X for me!

Let's take a look at how those drawdowns would be affected if the following strategies stayed in IWB: Global Navigator+, LT Gain+/++. In other words, if they didn't get the call to move out of the market, how would the drawdowns then look.

Below is what it would look like. Conservative has no change, Moderate is only a little worse, and still noticeably better than a 60/40, the Aggressive portfolio has a bigger drawdown, but still comes in between the 60/40 and Russell 1000 drawdown.

Even if the markets continue to roar back from the lows and April ends with positive returns, I will still be glad to have been largely on the sideline with all of this volatility. I have heard people say that negative returns are about twice the pain as the joy of a gain in the market. I think it may be more like 3X for me!

Only time will tell where the markets go from here. We certainly have more tariff news to come, and so far tariff news has had a seemingly large impact on the market action.

I am happy to be mostly in the Model Aggressive Portfolio, look forward to staying the course. As mentioned in Deviant Behavior, I am now personally using CAOS instead of BND/AGG in my holdings. And I am splitting DBMF into ½ DBMF and half CTA. I am also considering just going into CAOS for LT Gain+/++, The Russell, and Global Navigator+ when they go risk off.

Happy Investing.

I am happy to be mostly in the Model Aggressive Portfolio, look forward to staying the course. As mentioned in Deviant Behavior, I am now personally using CAOS instead of BND/AGG in my holdings. And I am splitting DBMF into ½ DBMF and half CTA. I am also considering just going into CAOS for LT Gain+/++, The Russell, and Global Navigator+ when they go risk off.

Happy Investing.