Triad October FOMO

September was a big down month in the markets and as a result the Triad strategy exited it's position in the Russell Mid-Cap Value [IWS] (it did maintain it's holding in the Russell 1000 [IWB].)

FOMO: Fear Of Missing Out

October has been a booming month so far in the markets, and IWS is up almost 4.5%, this means that Triad would have realized an additional 1.5% gain this month if it had maintained the position in IWS.

Let's take a look below at how the Triad equity positions do over time when compared to a Buy & Hold approach and see if there is reason to justify FOMO.

FOMO: Fear Of Missing Out

October has been a booming month so far in the markets, and IWS is up almost 4.5%, this means that Triad would have realized an additional 1.5% gain this month if it had maintained the position in IWS.

Let's take a look below at how the Triad equity positions do over time when compared to a Buy & Hold approach and see if there is reason to justify FOMO.

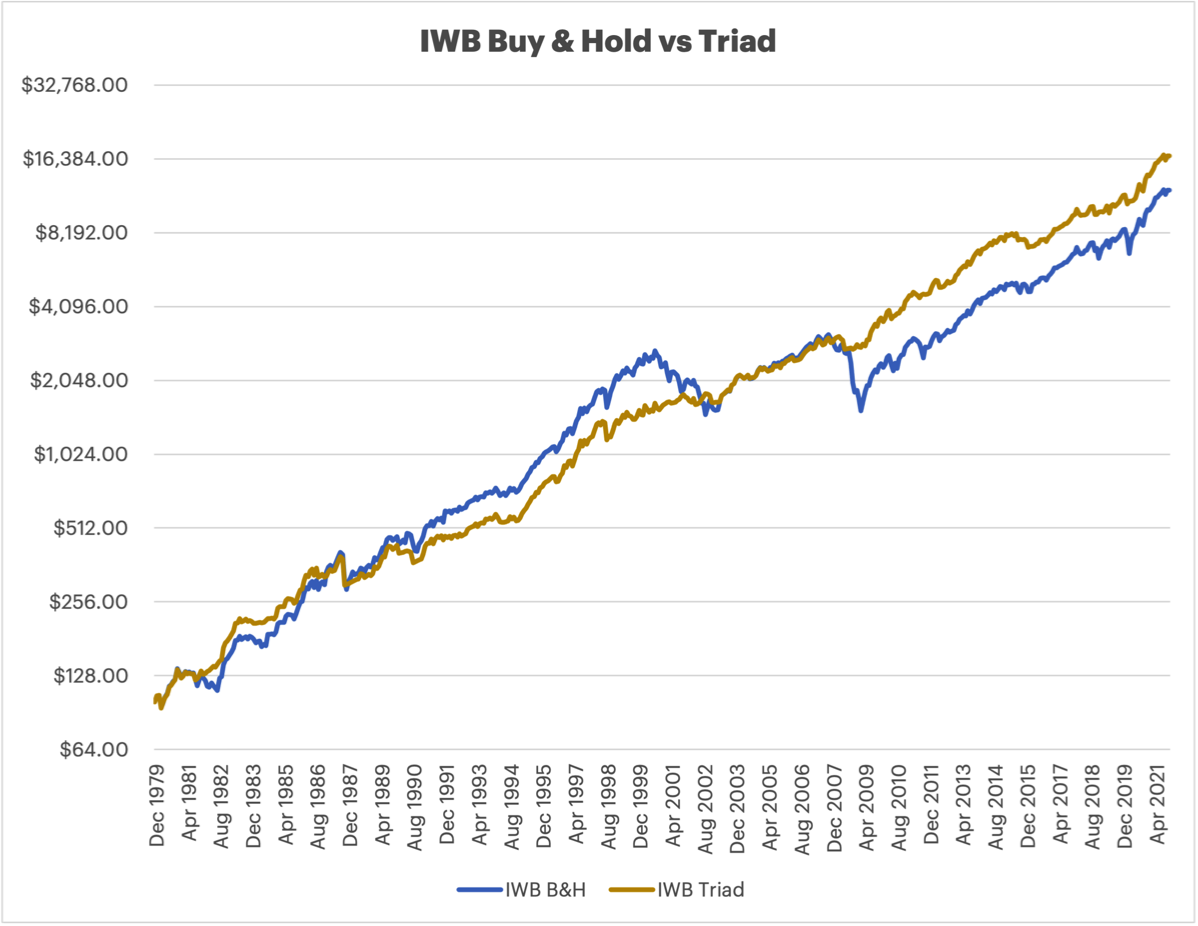

The blue line in the chart above of the Russell 1000 [IWB] buy and hold equity line. The golden colored line is Triad's holding in IWB when it's lookback methodology says to be in IWB, and alternatively in bonds when it says to be out of equities.

Without running the metrics, we can visually see that the Triad line is far less volatile than is the Russell 1000 line, especially with regard to the two large drawdowns in the IWB. We can see that in the 1990's buy and hold outperformed Triad's methodology, but the two equalized after the 1990 boom and then early 2000's bust, and when we get to the 2008 drop in the markets - we witness IWB taking a massive dive but Triad only has a dip and keeps moving upward.

Yes there are period of time when the B&H in IWB outperform Triad's IWB position, but with far greater downside risk and higher overall volatility.

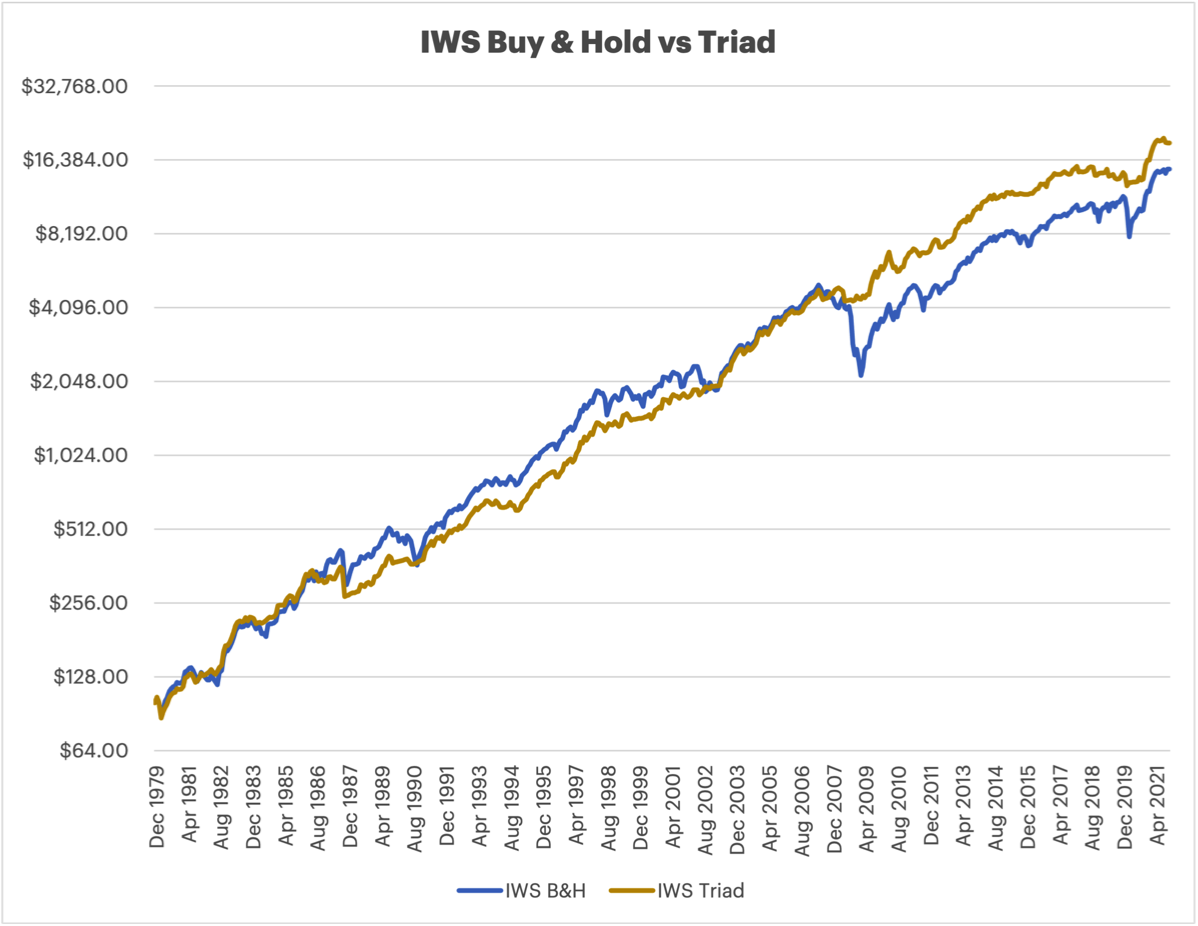

Below we will compare the Russell Mid-Cap Value B&H vs Triad.

Without running the metrics, we can visually see that the Triad line is far less volatile than is the Russell 1000 line, especially with regard to the two large drawdowns in the IWB. We can see that in the 1990's buy and hold outperformed Triad's methodology, but the two equalized after the 1990 boom and then early 2000's bust, and when we get to the 2008 drop in the markets - we witness IWB taking a massive dive but Triad only has a dip and keeps moving upward.

Yes there are period of time when the B&H in IWB outperform Triad's IWB position, but with far greater downside risk and higher overall volatility.

Below we will compare the Russell Mid-Cap Value B&H vs Triad.

Overall this is very similar to the IWB chart above. MidCap Value saw less of an outsized return in the 1990's, but similar to the Russell 1000 the Russell Mid-Cap Value also have a major drubbing in the 2008 market dump, but Triad's strategy of being in equities when it sees upside performance, and in Bonds when the equities are not seeing upside performance results in less volatile results and avoids the major drawdown of market meltdowns.

It's ok to be a little sad that you missed out on a bit of extra gain this month in Triad. Just keep in mind that long term Triad gets the calls far more right than wrong which result in better performance with less volatility - no reason for FOMO.

It's ok to be a little sad that you missed out on a bit of extra gain this month in Triad. Just keep in mind that long term Triad gets the calls far more right than wrong which result in better performance with less volatility - no reason for FOMO.