DMS-4ETF, why did I keep it so long?The allocation portfolio name took on a moniker of "4ETF" for the simple reason, it used 4 ETF's. I knew that I would name the allocation, but it just never came. I have to wonder if deep down I wasn't happy with the allocation which is why a name never materialized.

Below I go into some detail on how and why I just recently tweaked the allocations for the better, and in the process a name came to me. From know on, the newly tweaked DMS-4ETF allocation strategies will be known as the Bamboo Portfolios.

DMS-4ETF and it’s original goal:When I came up with the allocation strategy for the DMS-4ETF funds, my thought was something better than a 60/40 with once a year re-balancing, make Smart Leverage for outperformance an optional version. When it came together, I was very happy that it panned out, the returns were better than 60/40 with similar drawdown. I was happy with the results and put it into production.

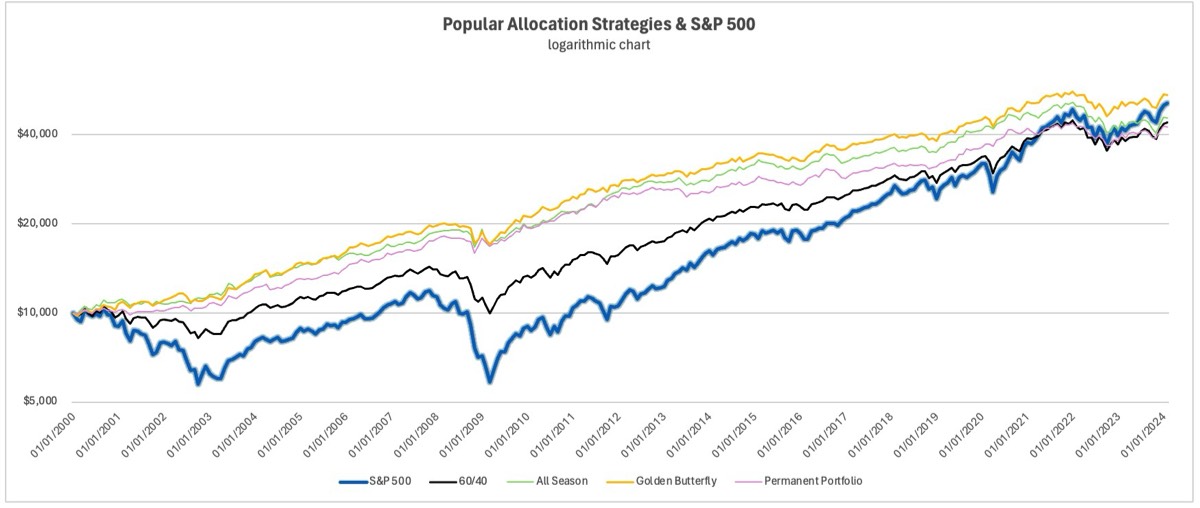

Why did DMS-4ETF just change?The other day I working on putting together comparative data from some very popular allocation strategies like 60/40 which is pretty much the benchmark allocation, Permanent Portfolio by Harry Dent, All Season / All Weather by Ray Dalio, and Golden Butterfly by “Tyler" of

PortfolioCharts. [I would have liked to go back further, but my allocation uses Managed Futures and I couldn’t get return data back to 1980] After compiling all the data from 2000 forward I was really impressed, again, with Golden Butterfly. I say again because I had looked at Golden Butterfly in the past but forgot how very good an allocation it is, even compared to the allocations from industry heavyweights. Tyler goes for allocation strategies with only annual rebalancing, I primarily go towards tactical strategies which have possible investment changes each month, to me the extra movement is worth the outsized gains. However, I totally understand that many people would just rather allocate and leave it to be re-balanced in a year, and I had the desire to come up with an allocation strategy that could take advantage by using Smart Leverage. I also like to use a portfolio like this to pair with the Dual Momentum strategies, they complement each other nicely - in fact I may update my Model Portfolios to include the Bamboo Portfolios in the Model Portfolios.

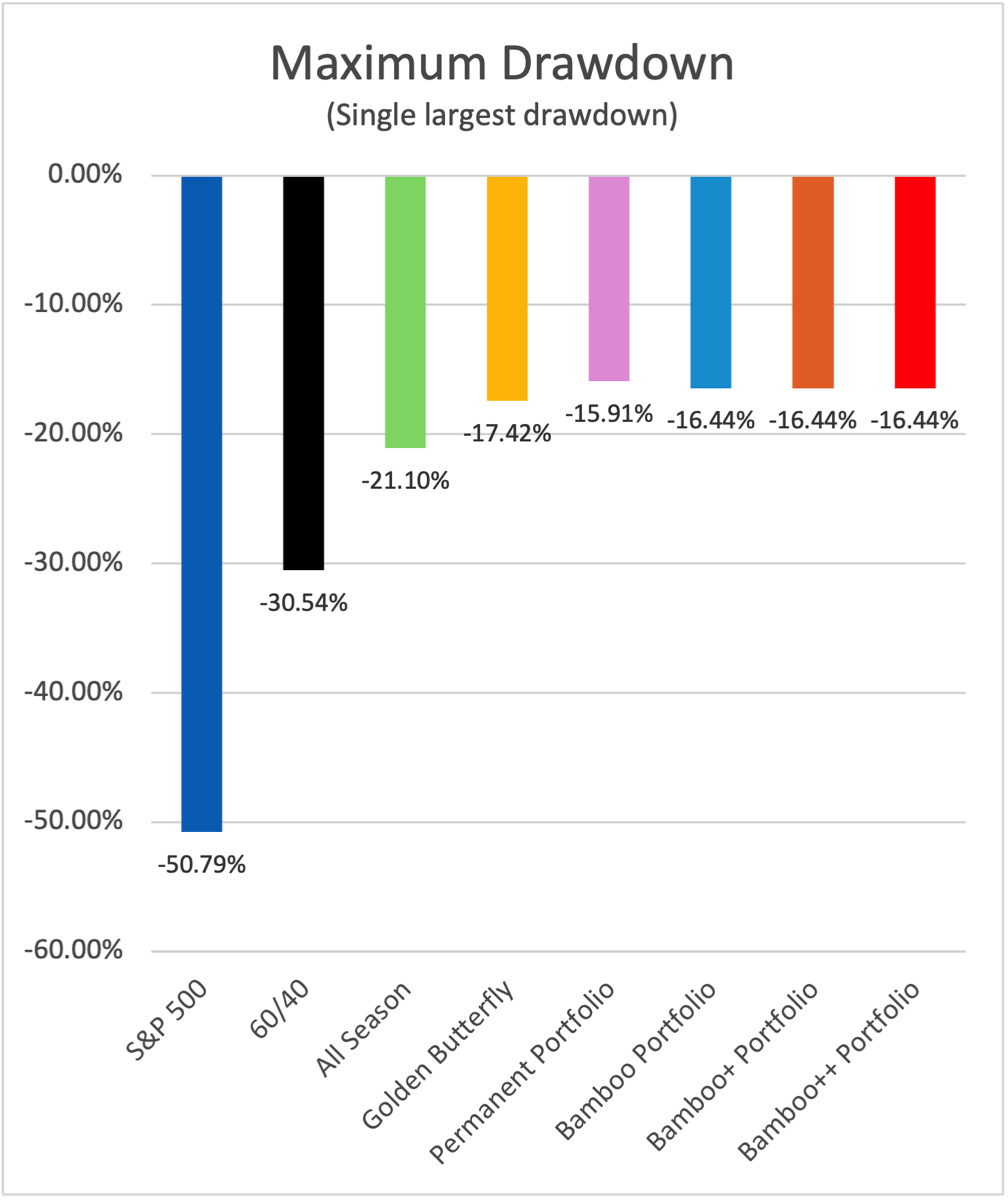

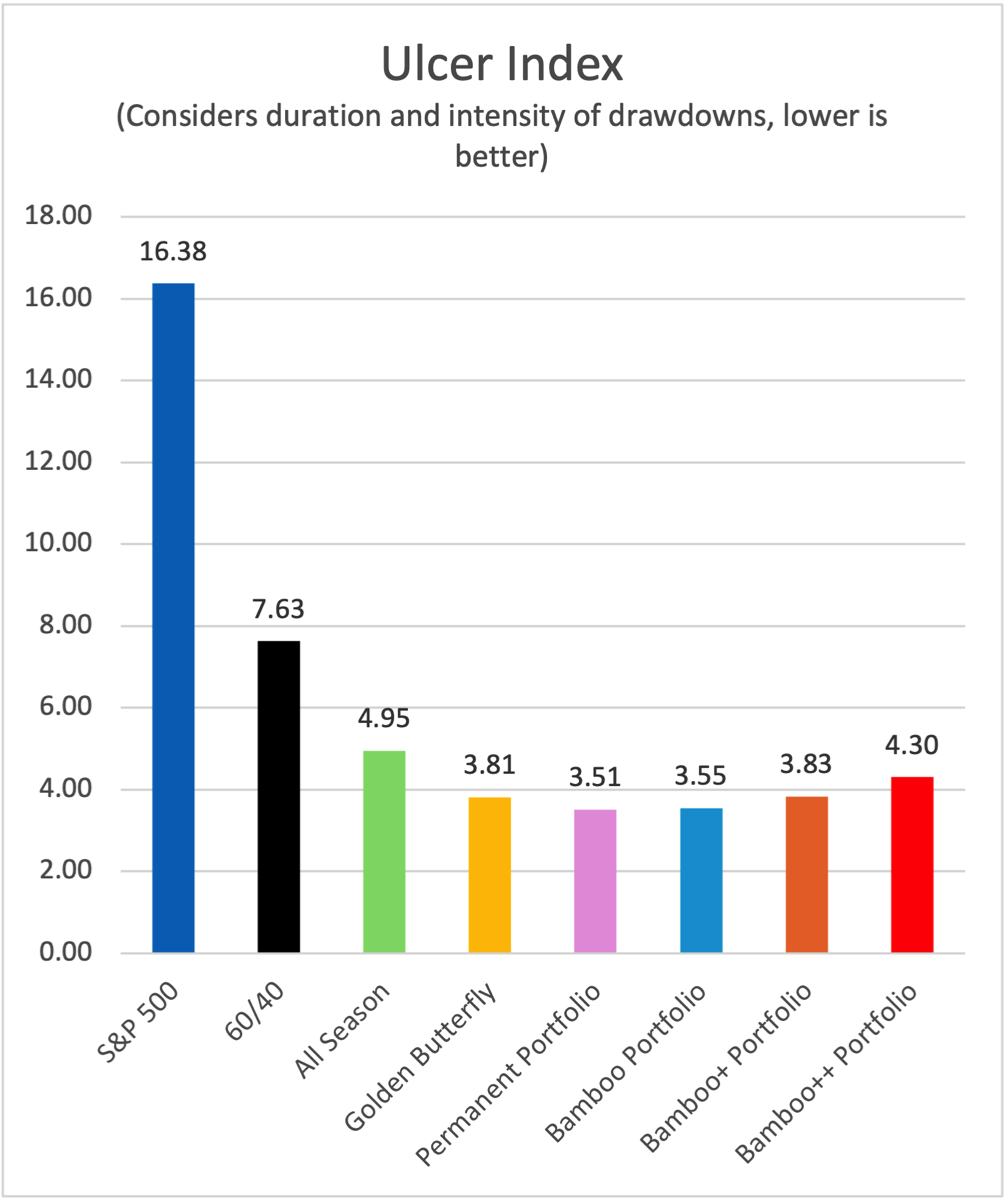

As I was looking at the results of the mentioned strategies, I realized that I wasn’t happy with the weighting to stocks and the drawdowns that are similar to a 60/40; I knew that I really did prefer the far lower drawdowns of Golden Butterfly. I thought about it for a bit and make three changes to the DMS-4ETF allocation, primarily focused on lowering the equity allocation which lowers the drawdowns.

- The Russell 1000 allocation from reduced 55% to 40%.

- The US Hedged International Equities were swapped out for Aggregate Bonds

- The allocation to the non equity allocations of Gold, Managed Futures, and Aggregate Bonds were increased from 15% to 20% each.

Bamboo PortfoliosWhat was DMS-4ETF becomes the Bamboo Portfolios, with the changes mentioned, I felt the need to name the allocation strategies, so we now remove the placeholder DMS-4ETF and welcome the Bamboo Portfolios into the family.

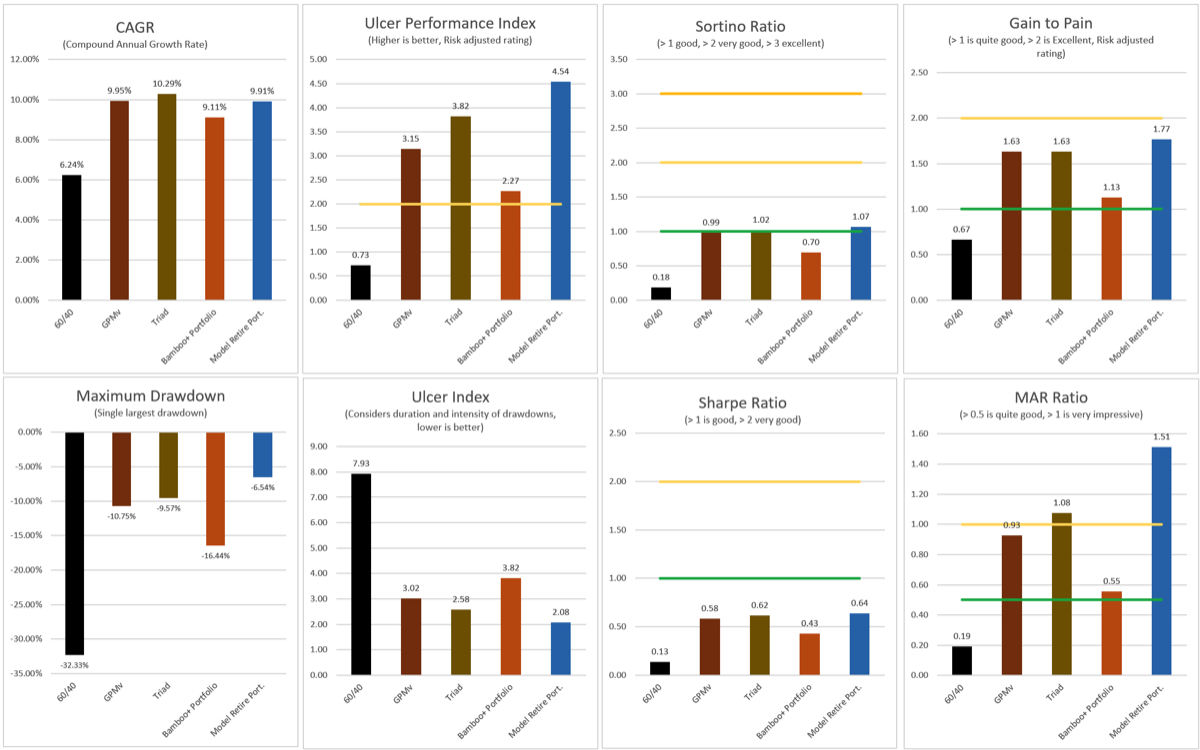

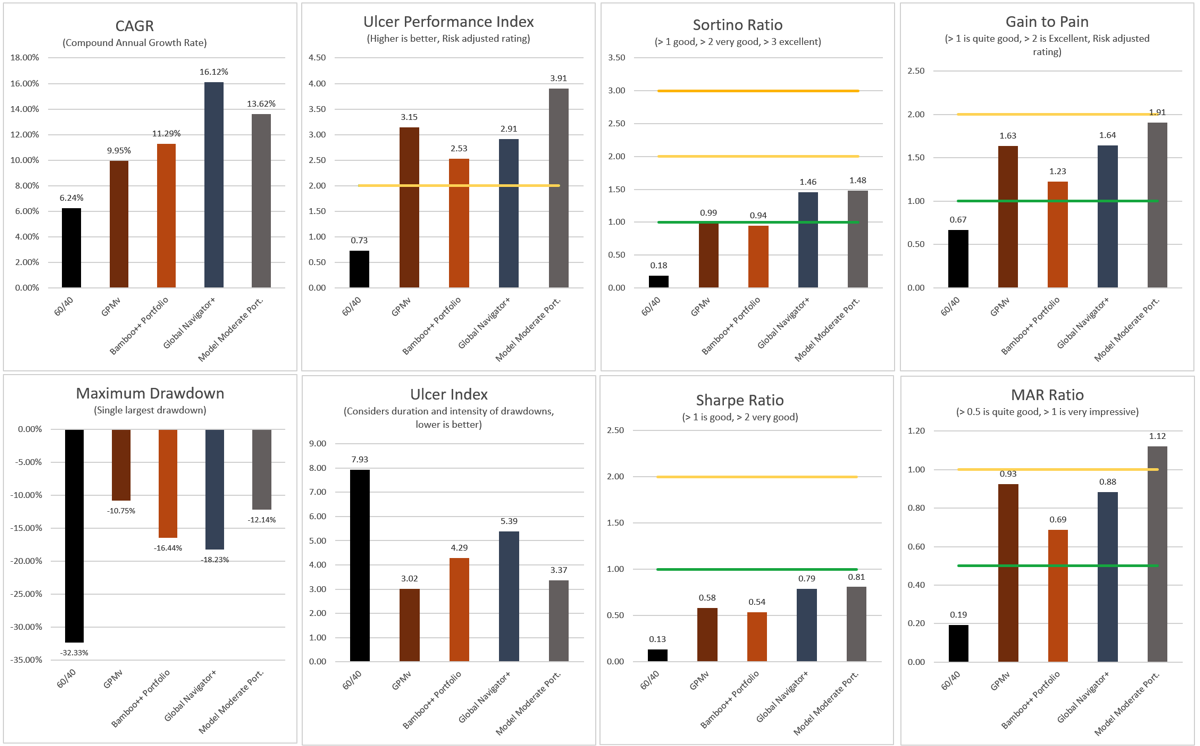

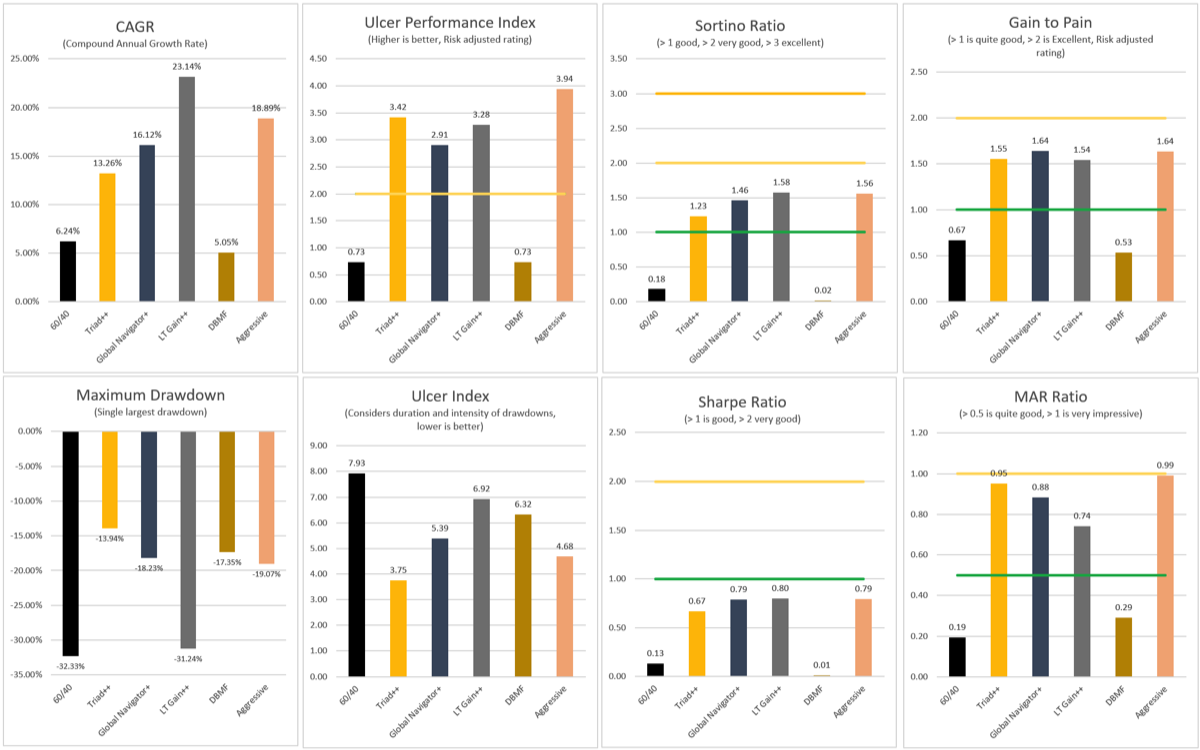

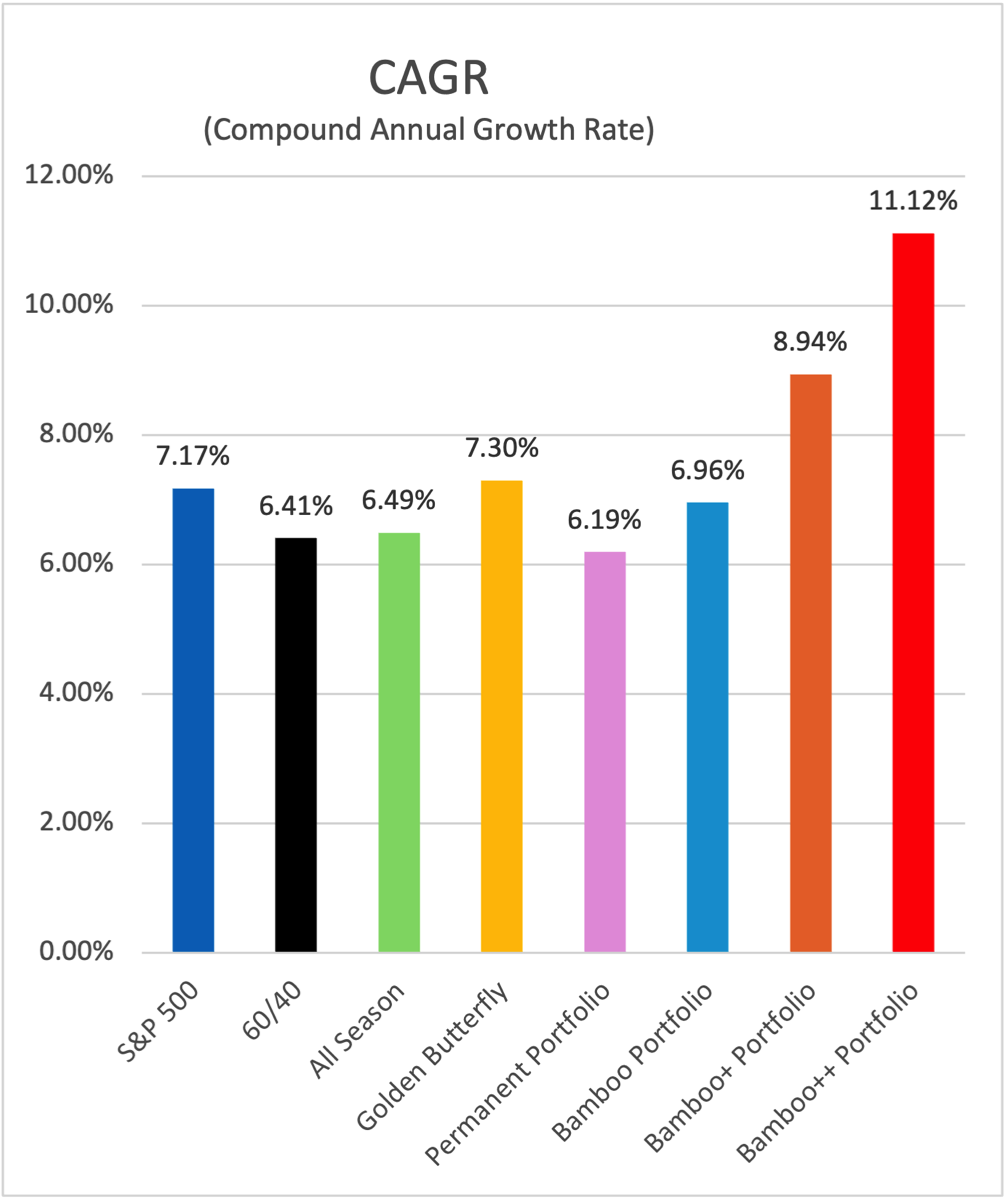

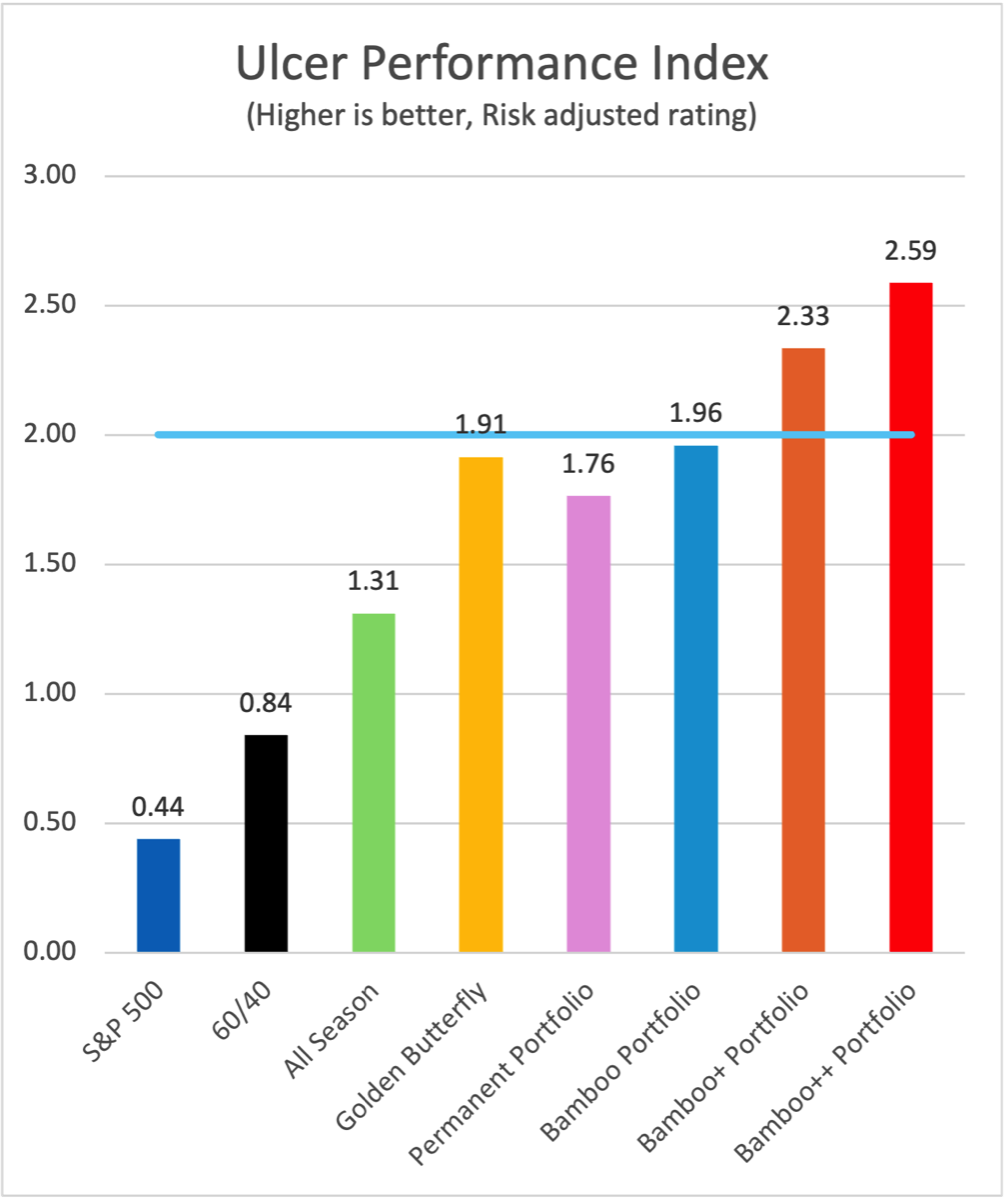

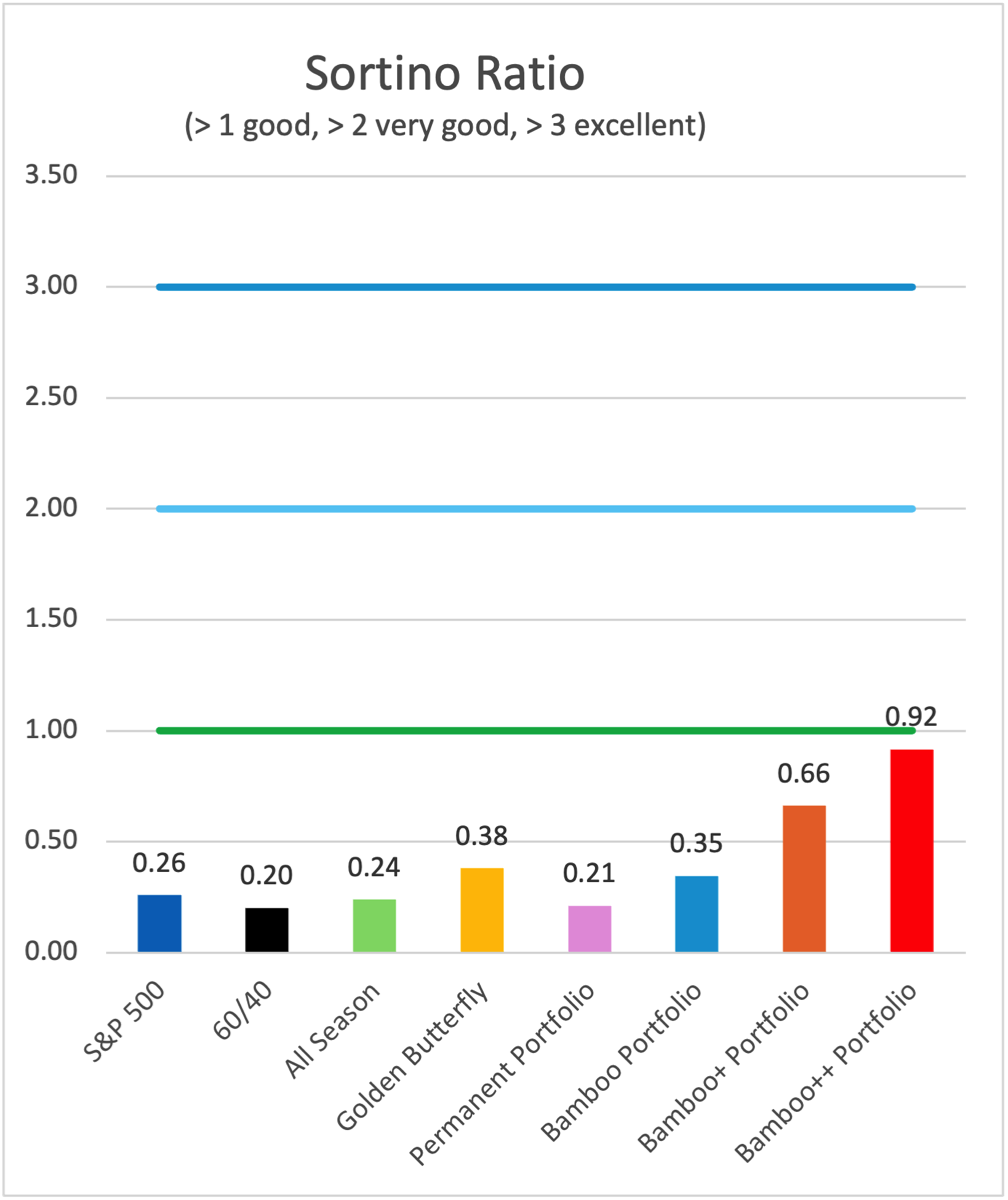

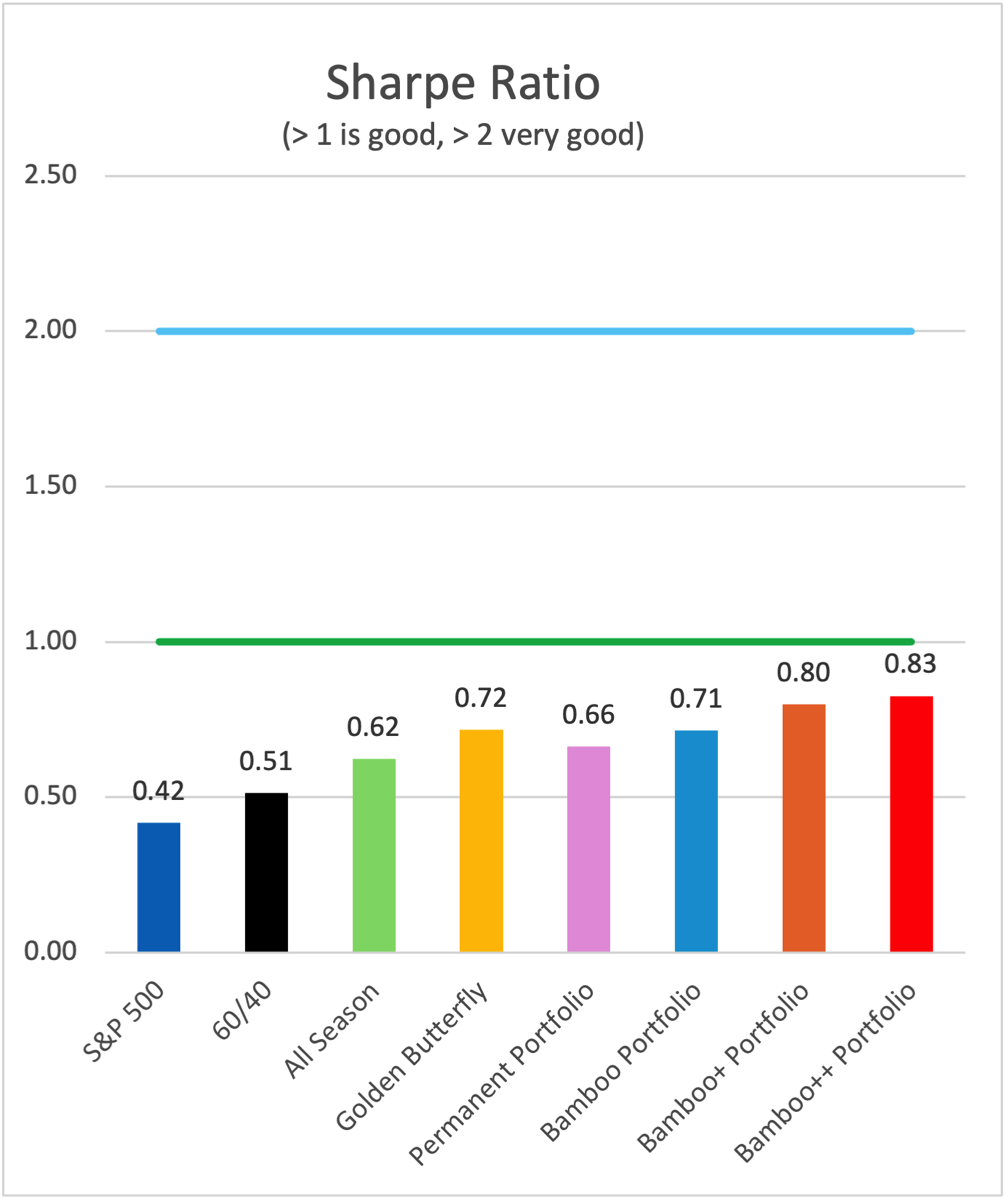

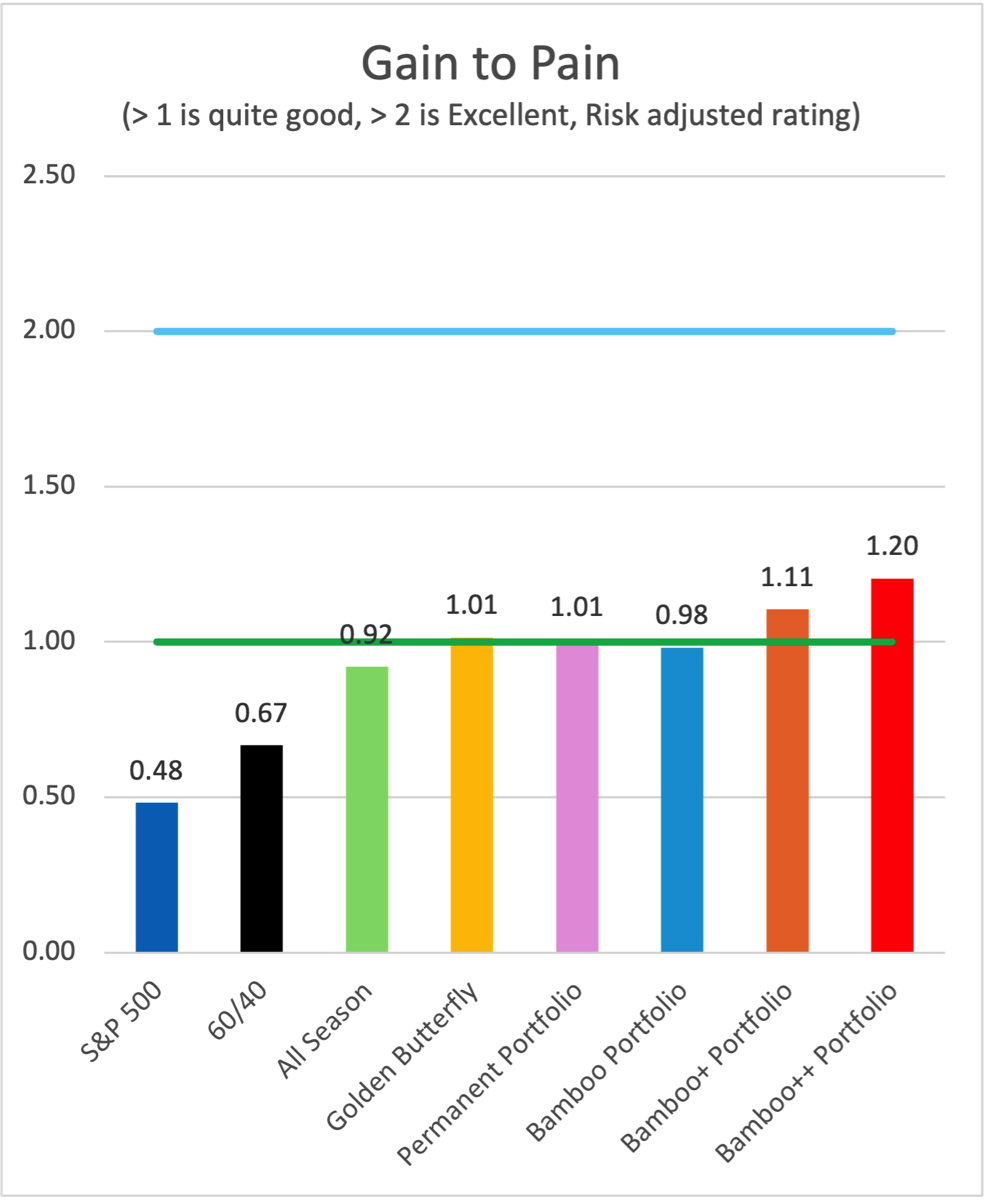

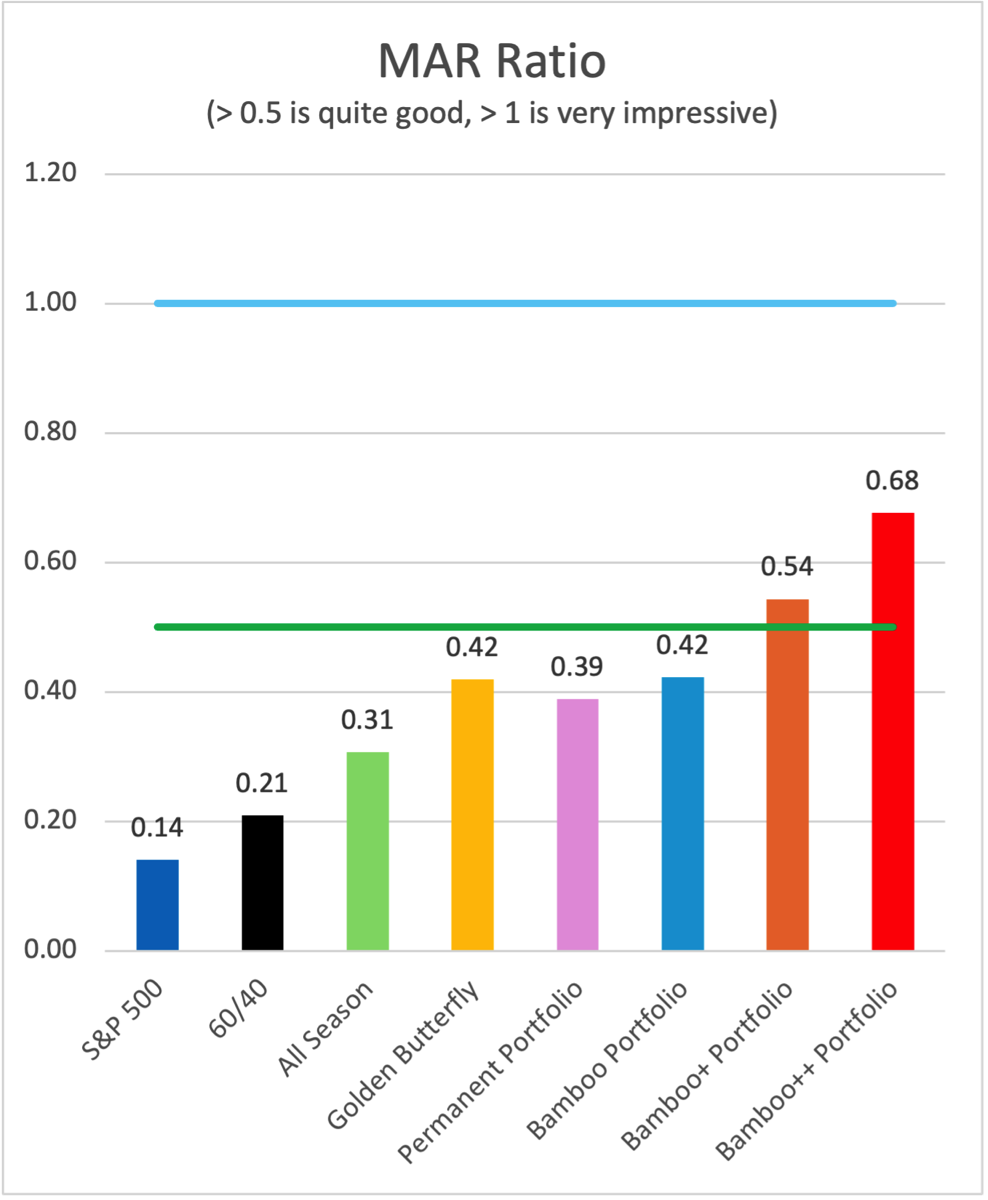

I could not be happier with the results, yes the returns came down a little, but the drawdowns dropped in half, and all the metrics improved tremendously. Mission accomplished. Great returns with far less volatility, and better upside with the versions using Smart Leverage. The allocation is literally world class. The performance metrics are terrific and only improve with the “+” Smart Leverage version, and even more so with the “++” version.

What is Smart Leverage?Smart Leverage is a method to put the US Large Cap portion which is normally unleveraged into a leveraged position. This is triggered with month end to month end drawdown exceeds or equals 15%. This can be over many months, not just one month to the next, drawdowns accumulate over time in a net down market. The allocation will stay in the leveraged position for 1 year maximum, if the dual momentum perspective says to exit the position, then the leveraged Bamboo Portfolios will go back to an unleveraged position. Smart Leverage is a dual momentum metric used in many of the strategies.

Bamboo+ Portfolio will go into 2X [SSO] instead of IWB when Smart Leverage is a go, and Bamboo++ Portfolio will go into 3X [UPRO] instead of IWB when Smart Leverage is a go.

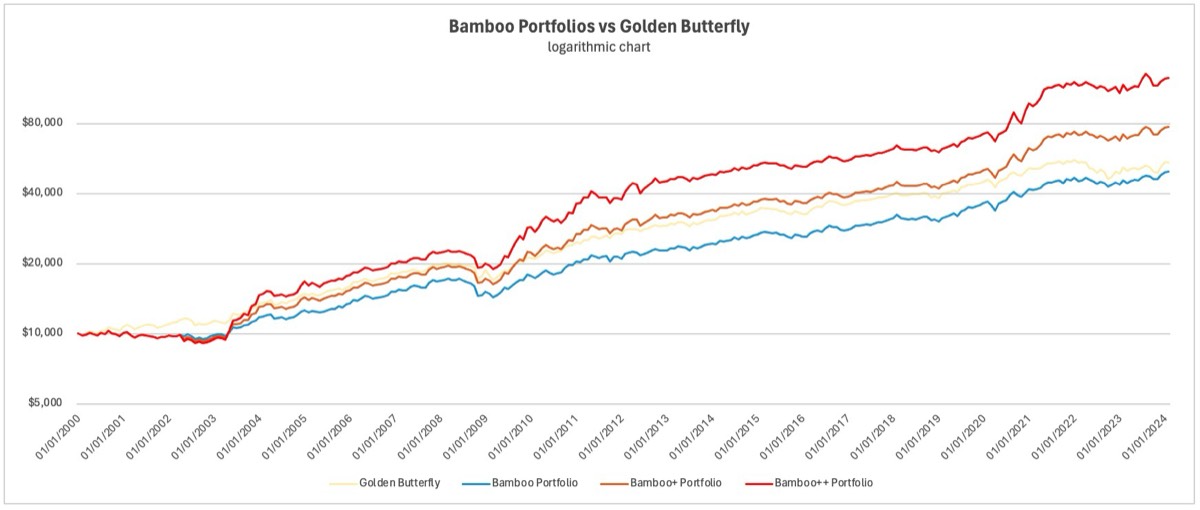

Comparative DataHere are the Equity Charts for the comparative allocations, and then the Bamboo Portfolio allocations against Golden Butterfly. You can see that over this time period, which started off with the Dot Bomb, and also includes the Global Financial Crisis, the S&P 500 in particular, and the 60/40 saw major drawdowns. Golden Butterfly was tops most of this entire period and returned the highest equity from 2000 to now.